malerapaso/E+ via Getty Images

Elevator Pitch

My investment rating for Cohen & Steers, Inc. (NYSE:CNS) stock is a Hold.

I previously touched on CNS’ valuations and dividends in my earlier March 25, 2021 update for the company. In the current article, I turn my attention to how Cohen & Steers has been performing in this tough environment for financial markets in general.

CNS has performed above expectations with its earnings beat for Q2 2022 and stable flows in 1H 2022. But such positives are priced into Cohen & Steers’ valuations; CNS trades at 20 times forward P/E which is in line with its historical averages. I continue to assign a Hold rating to Cohen & Steers, as I view its current valuations as fair. I will consider upgrading CNS to a Buy in the future, if the company makes greater-than-expected headway with its new private real estate business.

CNS Achieved Stable Flows And Above-Expectations Financial Results

Cohen & Steers’ AUM declined significantly since the start of 2022, but its flows have been relatively more stable over the same period.

According to its Q2 2022 financial results presentation slides, CNS’ AUM decreased by -4% from $106.6 billion as of the end of last year to $102.1 billion as of end-Q1 2022, before falling by another -14% to $87.9 billion as of June 30, 2022. In aggregate, Cohen & Steers’ AUM has contracted by -18% between the beginning of this year and the end of June.

But it is noteworthy that the -$18.7 billion drop in Cohen & Steers’ AUM in the first six months of the year was mainly attributable to a -$17.1 billion decrease in the market value of its assets in the first half of 2022.

In contrast, CNS’ flows are rather stable, with Q1 2022 net inflows of +$756 million being partially offset by Q2 2022 net outflows of -$717 million.

Cohen & Steers also delivered a good set of results for the second quarter of 2022, which was better than what the market was anticipating.

Revenue for CNS increased by +2% YoY from $144.4 million in Q2 2021 to $147.7 million in Q2 2022. Cohen & Steers’ second-quarter top line turned to be +7% higher than the sell-side’s consensus revenue projection of $138 million.

The company’s non-GAAP adjusted earnings per share rose from $0.94 in the second quarter of last year to $0.96 in the most recent quarter. CNS’ adjusted EPS for Q2 2022 exceeded the market’s consensus estimate by +3%.

Focus On Real Assets Pays Off

At the company’s Q2 2022 earnings call, Cohen & Steers highlighted that its clients are seeking “diversified real asset exposure” to increase “inflation protection.” This has clearly benefited CNS, as evidenced by its stable flows in 1H 2022 and better-than-expected quarterly financial results.

Asset manager Nuveen defines real assets to include real estate, REITs, infrastructure, and commodities, and noted that real assets help to “hedge inflation” on its website.

Definition Of Real Assets

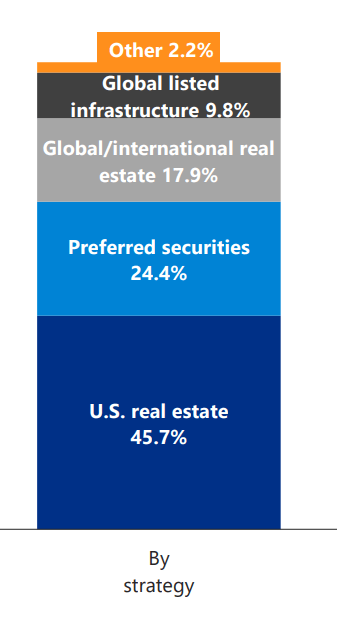

CNS has substantial exposure to real assets, as seen with its strategy mix as of end-Q2 2022 as highlighted below. Strategies relating to real estate and infrastructure accounted for close to three-quarters of Cohen & Steers’ assets under management as of the end of June 2022.

Cohen & Steers’ Strategy Mix As Of June 30, 2022

CNS’ Q2 2022 Earnings Presentation

In summary, Cohen & Steers’ positioning as a niche player with a focus on real assets has paid off in the current market environment, where demand for exposure to real assets to counter inflation has grown substantially.

All Eyes On Private Real Estate

Last year, Cohen & Steers announced “the formation of the Cohen & Steers Private Real Estate Group, a team purpose-built for private real estate investing” as per a press release issued on April 19, 2021. In March 2022, CNS disclosed that Anthony Corriggio has joined the company’s private real estate business as “Senior Vice President and Portfolio Manager.” Cohen & Steers was likely referring to this new hire, when it mentioned at its Q2 2022 investor briefing that “we’ll need to have specialists in private real estate.”

Cohen & Steers’ Current Private Real Estate Team

CNS Company Website

It is worth spending time to understand why Cohen & Steers is venturing into the private real estate space again and ramping up hiring, having previously made an exit from this space in 2013.

In my view, there are both push and pull factors which explain CNS’ renewed focus with respect to private real estate.

The push factor is that investors have been increasing their allocation to private real estate (at the expense of their listed counterparts) in the past couple of years, and Cohen & Steers has to move beyond listed real estate securities if it is to continue to remain relevant in the eyes of its clients. CNS highlighted at its Q2 2022 earnings briefing that “the market share of private real estate allocations has gone from 10% to 35% over the past 3 years” as private real estate took “market share” from “the listed alternatives.” Cohen & Steers has traditionally been more focused on listed real estate strategies, and it is clear that times have changed now which makes it necessary for CNS to increase its exposure in the private real estate space.

The pull factor is that there are new growth opportunities to be exploited with Cohen & Steers stepping into the private real estate market again. CNS stated at its Q2 2022 earnings briefing that “in the planning process for a non-traded REIT” to take advantage of the trend of “accelerating sales of non-traded REIT vehicles.” As a reference, inflows for the non-traded REIT market more than tripled from $10.9 billion in 2020 to $36.5 billion in 2021 based on an analysis done by Robert A. Stanger & Co.

Closing Thoughts For CNS

Cohen & Steers is rated as a Hold. CNS is currently valued by the market at a consensus forward next twelve months’ normalized P/E multiple of 20.0 times as per S&P Capital IQ. This is on par with the stock’s five-year and 10-year mean forward P/E multiples of 20.1 times and 19.7 times. At a time where a lot of stocks are trading close to their historical troughs, Cohen & Steers’ current valuations suggest that the market has already factored in its favorable strategy mix (comprising of a high proportion of real assets) into its valuations to a large degree. Moreover, Cohen & Steers still has to prove to investors that it can achieve success in the private real estate space, just like what it did for the listed real estate market. As such, Cohen & Steers is a Hold now, rather than a Buy.

Be the first to comment