ipopba

A story only matters, I suspect, to the extent that the people in the story change.”― Neil Gaiman

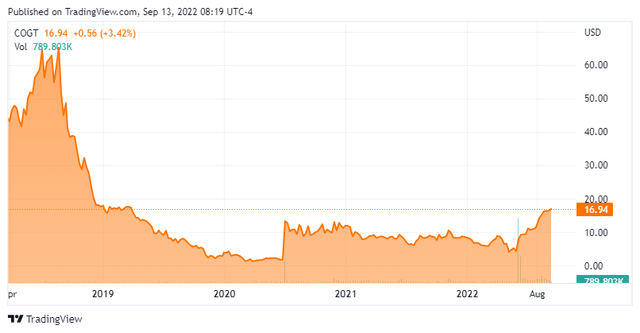

We circle back on Cogent Biosciences, Inc. (NASDAQ:NASDAQ:COGT) today for the first time since our last piece on this company in October of 2020. At the time, the company was called Unum Therapeutics. Through a merger with privately held Kiq Bio soon thereafter, the company was reborn as Cogent Biosciences. So, is this newly born biotech concern a butterfly or a moth in relation to prospects for investors? An analysis follows below.

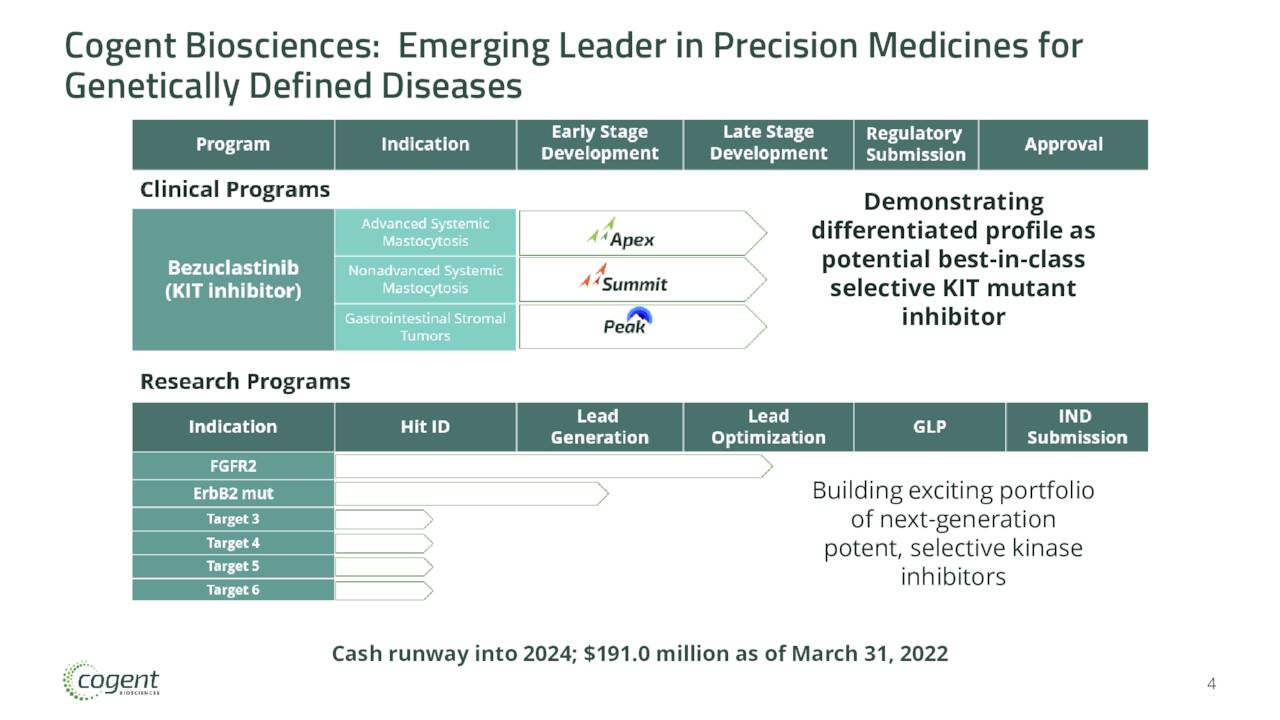

Company Overview:

Cogent Biosciences Inc. is based just outside of Boston in Cambridge, MA. This clinical stage biotech concern is focused on developing precision therapies for genetically defined diseases. Its stock currently trades around $17.00 a share and sports an approximate market capitalization of $1.1 billion.

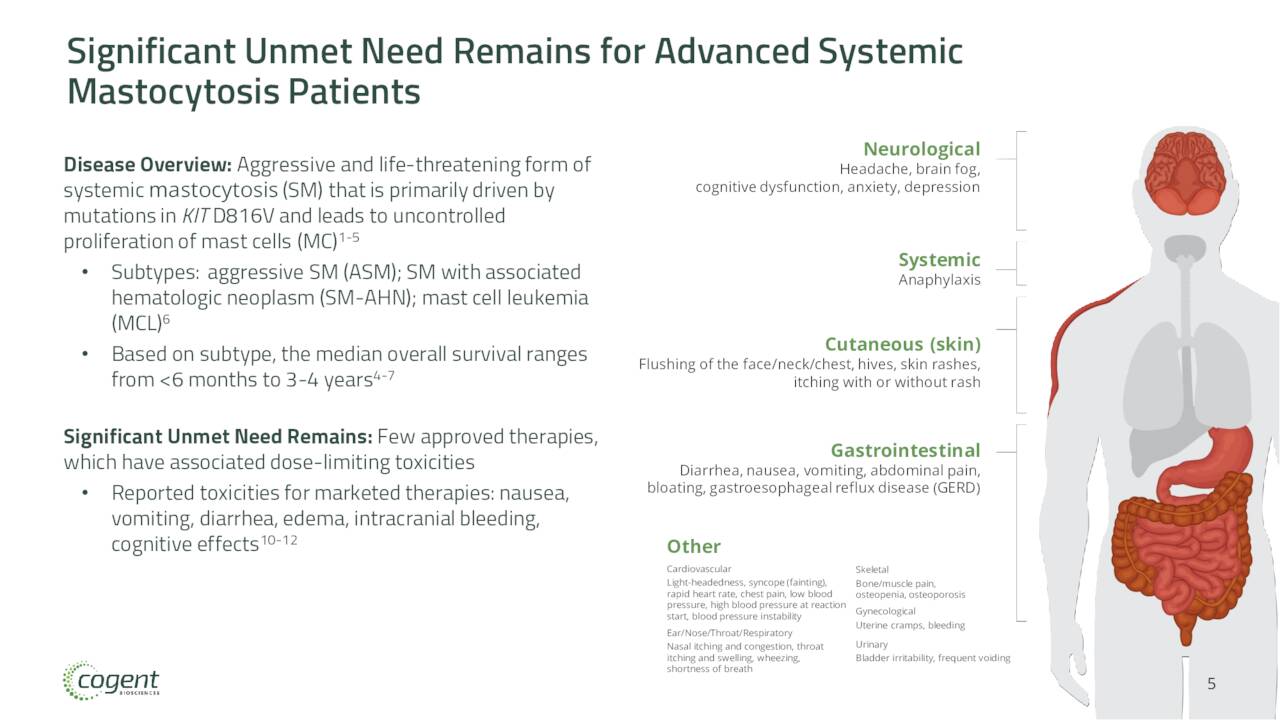

The company lead drug candidate is bezuclastinib. The compound is designed to target exon 17 mutations found within the KIT receptor tyrosine kinase, including KIT D816V. When this mutation remains in a perpetual “on” state, it causes mast cells to accumulate in various internal organs including the bone marrow. This leads to an Orphan Disease called Systemic Mastocytosis.

Other Exon 17 mutations have been found in other afflictions such as advanced Gastrointestinal Stromal Tumors, or GIST. Bezuclastinib is a highly selective and potent KIT inhibitor that eventually could lead to effective treatments for these indications.

June Company Presentation

Bezuclastinib is currently being evaluated in several studies. The company is currently enrolling patients in an ongoing two part Phase 2 trial called “Apex.” This study is evaluating bezuclastinib to treat patients with Advanced Systemic Mastocytosis (AdvSM). This is a rare, very aggressive form of Systemic Mastocytosis. The average lifespan of someone with this rare affliction is 3.5 years. The company posted encouraging interim results from this study on June 10th, which helped ignite a big rally in the stock since then.

June Company Presentation

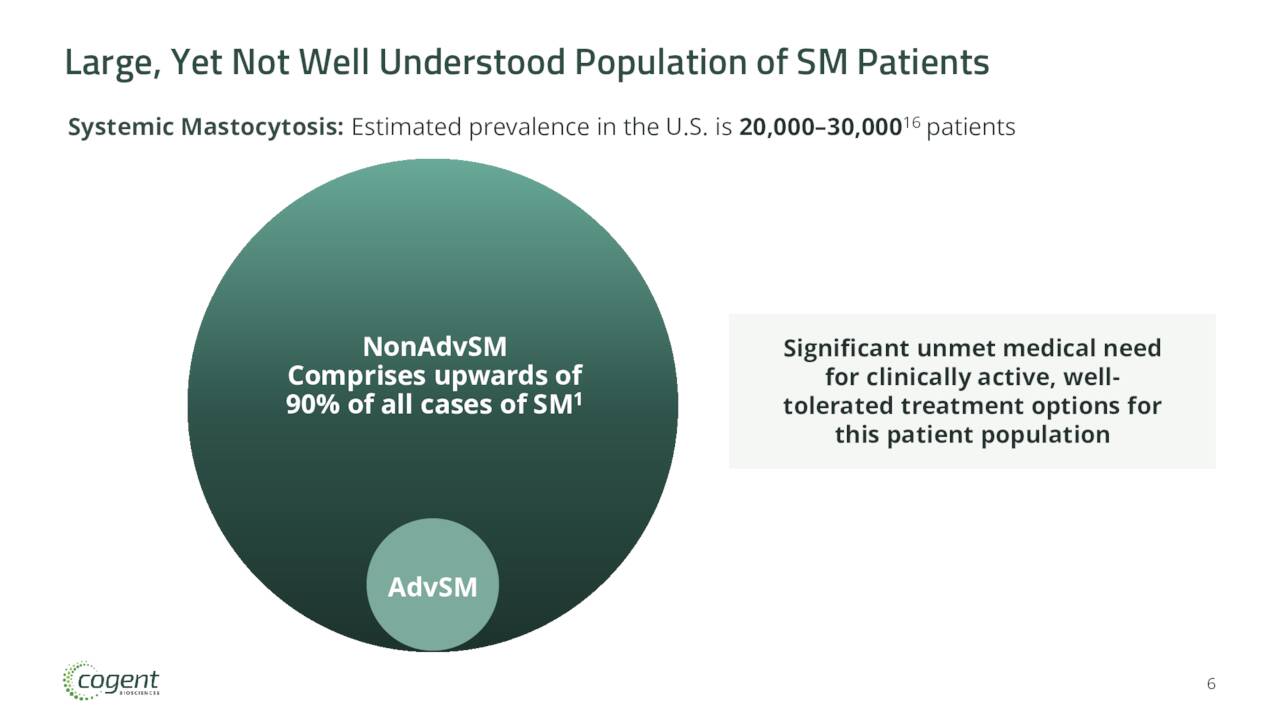

Cogent is also currently enrolling patients in a study called Summit. This is a randomized, double-blind, placebo-controlled Phase 2 clinical trial of bezuclastinib in patients with Nonadvanced Systemic Mastocytosis or NonAdvSM. This is a life-long illness with chronic symptoms that occurs in approximately 90% of the people that have Systemic Mastocytosis.

June Company Presentation

Finally, the company is evaluating bezuclastinib as a potential treatment for GIST. These tumors are categorized by uncontrolled cell growth in the tissues of the gastrointestinal tract. Approximately 80% of GIST patients’ tumors are the result of primary KIT mutations. Bezuclastinib has studied in an 18 person Phase 1/2 trial both as monotherapy as well as part of a combination therapy with sunitinib. Median progression free survival [PFS] reached 11 months with these patients, most of these which were heavily treated previously.

Currently approved therapies currently inhibit a subset of these mutations, but most patients develop resistance due to additional secondary KIT mutations, including mutations in Exon 17. Bezuclastinib is designed to inhibit the primary mutation while sunitinib looks to inhibit additional mutations.

The company is currently enrolling patients in a study called PEAK. This will be a randomized over 400 patient Phase 3 clinical trial of bezuclastinib in combination with sunitinib compared to sunitinib alone in patients with locally advanced, unresectable or metastatic GIST who have received prior treatment with imatinib, which is better known as Gleevec.

Analyst Commentary & Balance Sheet:

Since the company’s last quarterly report, four analyst firms including Wedbush and Piper Sandler have reissued or assigned Buy ratings on COGT. Price targets proffered range from $20 to $28 a share.

Approximately 10% of the outstanding float in this equity is currently held short. After the approximate $150 million secondary offering in June, the company held $325 million worth of cash and marketable securities. Management ‘”believes that Cogent’s cash and cash equivalents will be sufficient to fund its operating expenses and capital expenditure requirements into 2025.” A beneficial owner bought $9.9 million of the June secondary offering. That has been the only insider activity in the shares so far in 2022.

Verdict:

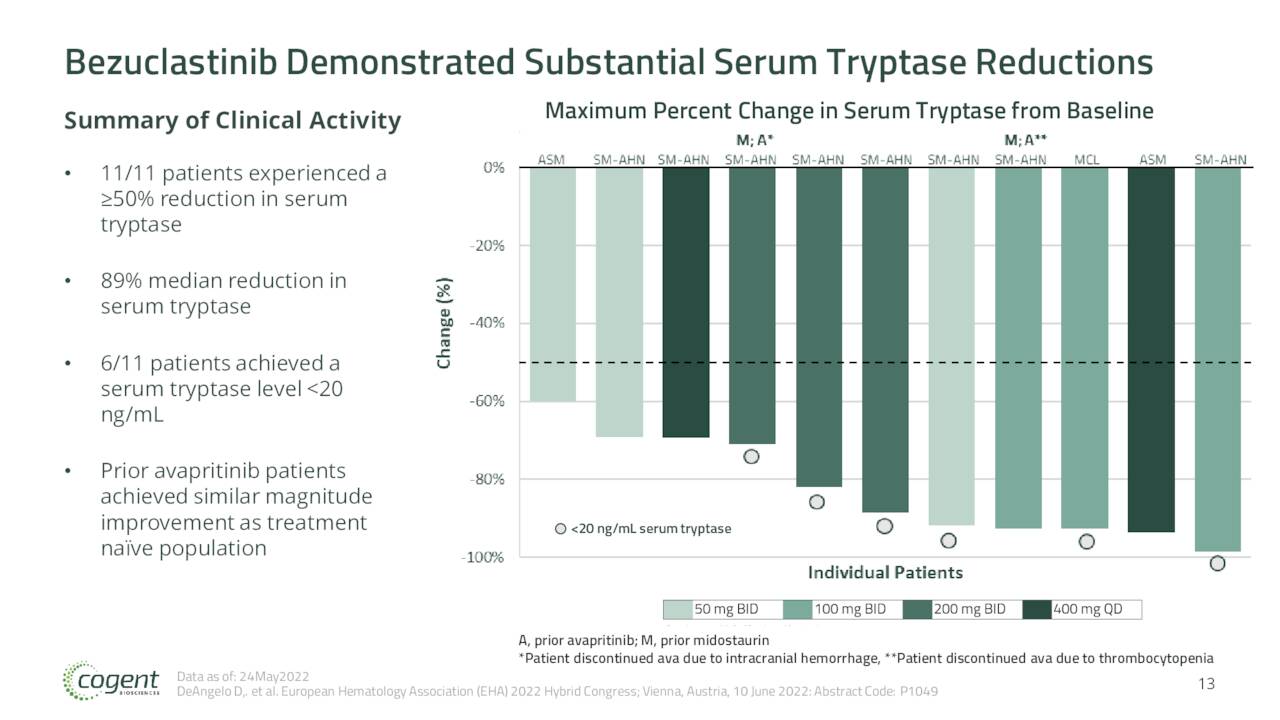

June Company Presentation

The June interim results from the Apex trial showed bezuclastinib has potential to treat patients with Advanced Systemic Mastocytosis. The stock has tripled since that data was posted and the company used the good news to do a capital raise which will fund all activity into 2025. Additional data from this trial should be out before the end of this year. Initial data from the SUMMIT trial as well as lead-in data from the PEAK study should be out in the first half of next year. Topline data from the PEAK trial will not come out until mid-2025.

An article on Seeking Alpha that came out two weeks after trial data was disclosed in June concluded the APEX interim data made a Cogent a name to watch, but while interesting, the name is not quite investable yet. We concur and at best Cogent merits a small “watch item” position while investors wait for more trial data to come out.

Butterflies are not called butterflies overnight. They have to undergo tons of changes in order to acquire that name.”― Michael Bassey Johnson

Be the first to comment