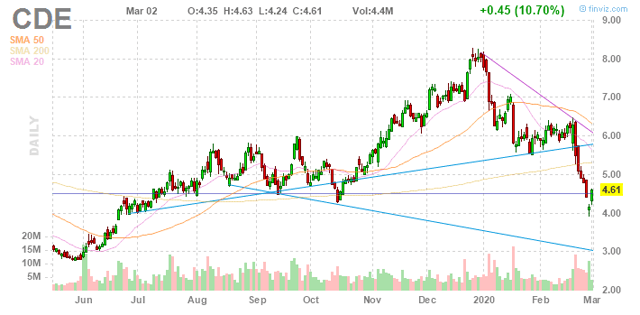

Coeur Mining (CDE) shares had a very good 2019, rising about 80% in value, but the beginning of this year was very rough, and the stock lost more than 40%. In 2020, the stock kept falling regardless of gold, silver, or fellow miners’ performance, and ultimately attracted an analyst upgrade on valuation. Is it time to speculate in the company’s shares?

In 2019, Coeur Mining generated revenues of $711.5 million and a net loss of $342 million. The biggest part of the loss came from a $251 million impairment of the Silvertip mine (more on this later). However, the company would have generated a loss even without this impairment since the revenues were sufficient enough to offset production costs, amortization and G&A costs but failed to offset exploration, reclamation and interest expense costs. On the cash flow side, the company generated $92 million of operating cash flow but spent $100 million on capex. While this picture does not look too good, things were much worse in 2018 (operating cash flow of $17.4 million; capex of $141 million), so expectations of improvement in Coeur’s performance boosted the shares last year. As it turned out, these expectations were set too high for the company.

The impairment of the Silvertip mine was the biggest negative surprise in the fourth-quarter report. Coeur Mining bought the mine back in 2017. The initial consideration of $200 million consisted of $146.5 million of cash, $38.5 million of Coeur shares (4.3 million new shares at that time), and assumption of $15 million of debt. The deal also implied additional potential payments of up to $50 million upon achieving future permitting and exploration milestones at the mine. At that time, Coeur expected to invest $25 million-35 million of incremental capital and reposition the mine for long-term success.

The “long-term success” did not materialize since Coeur decided to suspend mining and processing at Silvertip. As per the company’s annual report, the carrying value of Silvertip is now just $150 million, so the company has written off more than 60% of the mine’s carrying value. Coeur blames weak zinc and lead prices as well as increase in treatment charges for zinc (15%) and lead (35%) concentrates on making the mine uneconomic. The company wants to revive the mine by doubling its exploration investments in 2020 and expanding the mill to improve the mine’s cost structure. Put simply, the plan is to spend more money on the poorly-performing mine roughly two years after its purchase. As per the earnings call, the company anticipates that the earliest possible restart at Silvertip would be in late 2021. Meanwhile, the company will incur quarterly holding costs of about $6 million and one-time costs of $5 million-10 million.

I doubt that the market will easily buy into the “restart Silvertip” narrative since the mine has been showing negative operating cash flow right from the start, quarter after quarter, which puts the initial due diligence under question. On the other hand, Coeur will now operate without this major cash bleed – Silvertip generated negative operating cash flow of -$69.4 in 2019, and the company spent $17.5 million of capex at the mine.

Another source of worry is the Rochester mine, whose 2019 silver and gold production was below expectations. In the earnings call, the company stated: “We view the second half of 2019 as a temporary setback and what we expect will be a long and prosperous future for the mine.” In 2019, the mine generated $15.8 million of operating cash flow, but investments in the mine led to a negative free cash flow of -6.8 million.

Source: Coeur Mining Q4 2019 report

In 2019, the company produced 359,418 ounces of gold, 11.7 million ounces of silver, 17.1 million pounds of zinc and 16.6 million pounds of lead. The production guidance for 2020 offers two materially different scenarios. Using illustrative assumptions of $1600/oz gold and $17/oz silver, the worst-case scenario implies revenues of about $680 million while the best-case scenario implies revenues of about $810 million. Thus, a lot will depend on Coeur Mining’s actual production performance.

At this point, the key question is whether all of Coeur Mining’s misfortunes have been already reflected in its share price. In my opinion, the market will not provide the company with the benefit of the doubt in the near term as Coeur Mining has a history of dilution that sponsors negative free cash flow. As per the annual report, the company sold 16.6 million shares at an average price of $3.00 per share in June 2019 and 14.2 million shares at an average price of $5.27 per share in September 2019. The annual report also states that the company has already issued 0.9 million shares in 2020 to satisfy the resource contingent consideration for Silvertip (a milestone payment of $25 million in the form of $18.8 million in cash and 0.9 million in shares).

Coeur Mining is a “serial diluter”: back on February 19, 2015, the company had 103.3 million shares of common stock, and this number has increased to 243 million as of February 17, 2020. Any longer-term holder of the company will have to accept the risk of never-ending dilution in addition to usual risks like precious metal price volatility and potential mine underperformance. Sustainable upside is challenging under this scenario, and Coeur is likely to remain a volatile, traders’ stock for the time being. Despite the company’s problems, the higher gold price and the decision to stop losing money at Silvertip may lead to improved cash flow situation in the next quarters, so the company’s shares may indeed find buyers at current levels, but I’d watch momentum very closely since any sign of additional problems will lead to another major sell-off.

If you like my work, don’t forget to click on the big orange “Follow” button at the top of the screen and hit the “Like” button at the bottom of this article.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CDE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may trade any of the above-mentioned stocks.

Be the first to comment