The Q4 Earnings Season for the Gold Miners Index (GDX) is nearly over, and many producers are busy reporting their year-end Reserve & Resource estimates. One of the first companies to report was Coeur Mining (NYSE:CDE), and it was a satisfactory year for reserve replacement. This was based on the company nearly replacing gold reserves, offset by declining silver reserves and silver reserve grades. However, while the report was satisfactory, I continue to see Coeur as a sector laggard. So, while dips to $4.29 should present buying opportunities from a trading standpoint, I believe there are far better ways to play the sector.

Coeur Mining – Nevada Operations (Company Presentation)

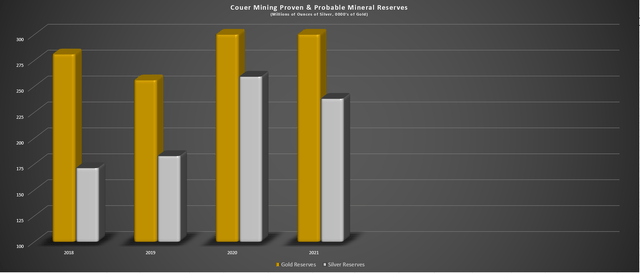

Coeur Mining released its FY2021 Reserve & Resource update earlier this year, reporting total mineral reserves of ~3.08 million ounces of gold, ~238 million ounces of silver, ~296 million pounds of zinc, and ~193 million pounds of lead. This translated to a slight increase in gold reserves on a year-over-year basis (FY2020: ~3.12 million ounces), but silver reserves fell sharply, down from ~259.5 million ounces to ~238.2 million ounces. Unfortunately, it was combined with a slight decline in silver grades to 0.50 ounces per ton. Let’s take a closer look at the report below:

Coeur Mining – Proven & Probable Reserves (Company Filings, Author’s Chart)

As shown in the chart above, Coeur Mining has made progress in replacing its reserve net of depletion over the past few years, with gold reserves climbing from ~2.5 million ounces in 2016 and ~2.8 million ounces in 2018 to ~3.08 million ounces currently. Meanwhile, silver reserves increased by ~153 million ounces in 2016 to ~238 million ounces in 2021, an increase of more than 55%. However, we did see declines on a year-over-year basis in both categories, and while reserves are growing, grades are not keeping up.

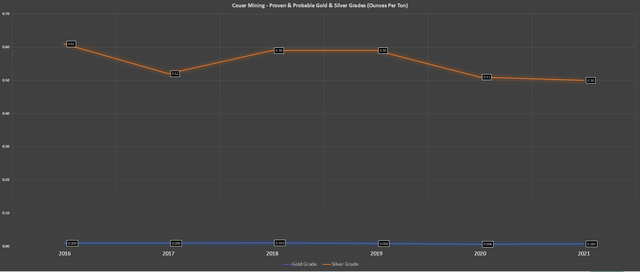

Coeur – Proven & Probable Reserve Grades (Company Filings, Author’s Chart)

This is evidenced by the fact that grades have slid from 0.009 ounces per ton of gold and 0.61 ounces per ton of silver in FY2016 to 0.007 ounces per ton of gold and 0.50 ounces per ton of silver in 2021. I would not call this a huge deal since we’re seeing a trend in declining grades for most producers, and it’s partially due to the divestment of the high-grade San Bartolome Project in Bolivia. However, at the company’s two key assets, Rochester and Palmarejo, it’s quite clear that we’re seeing a steady trend in declining grades even if reserves are being replaced.

This trend of declining grades is the most evident at Rochester, where gold grades have dipped to 0.003 ounces per ton (0.004 ounces per ton in 2016), while silver grades have slid from 0.48 to 0.39 ounces per ton of silver. Meanwhile, at Palmarejo, silver grades have held up and remained mostly in line with 2016 levels, though gold grades have slipped. As of year-end 2021, gold grades are sitting at 0.066 ounces per ton, a more than 15% decline from 2016 levels (0.08 ounces per ton of gold).

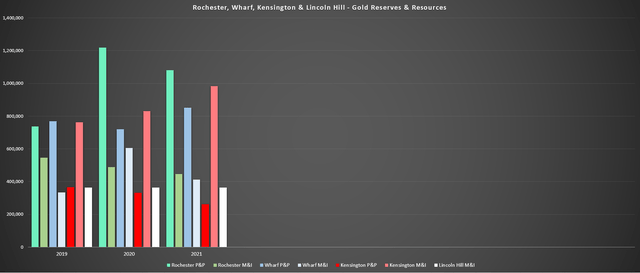

Rochester, Wharf, Kensington

Looking at the individual mines below, we can see that Coeur reported a slight decline in reserves and measured & indicated resources at Rochester (green bars). This was evidenced by reserves dipping to ~1.08 million ounces of gold and ~161.2 million ounces of silver, comparing unfavorably to ~1.22 million ounces of gold and ~185.5 million ounces of silver last year. The company noted that this was related to a higher cut-off grade applied at Rochester due to expectations of increased operating costs. The good news is that Rochester still has a 13-year mine life based on reserves, even if reserves did decline.

Rochester, Wharf, Kensington – Gold Reserves & Resources (Company Filings, Author’s Chart)

Moving to Kensington, reserves slid again at Kensington, declining to a paltry ~260,000 ounces of gold. This translates to barely two years of mine life at the FY2022 production rate of ~115,000 ounces and doesn’t inspire a ton of confidence long-term for this asset. The good news is that measured & indicated resources increased and come in at higher grades, so it’s possible we could see some resource conversion to extend the mine life here at this ~110,000-ounce per annum asset. As it stands, Kensington has nearly 1 million ounces of gold at 0.238 ounces per ton backing up its reserve base, though these resources use a lower cut-off grade of 0.116 – 0.164 ounces per ton (reserve base: 0.143 – 0.201 ounces per ton).

Finally, at the company’s smallest Wharf Mine in South Dakota, reserves increased to ~850,000 ounces, supporting a 10-year mine life assuming an 80,000-ounce per annum production rate. This is good news for this asset, which wasn’t able to replace deletion in 2020. Given the company’s ~$40 million exploration budget in 2022, I imagine adding ounces at Kensington will be a focus. The company also noted that it would target higher-grade zones at West Rochester and continue with its aggressive drilling program at Silvertip. While Silvertip remains a longer-term opportunity, the recent increase in zinc prices is certainly a positive for the project, given its large zinc reserve base (~296 million pounds).

Palmarejo

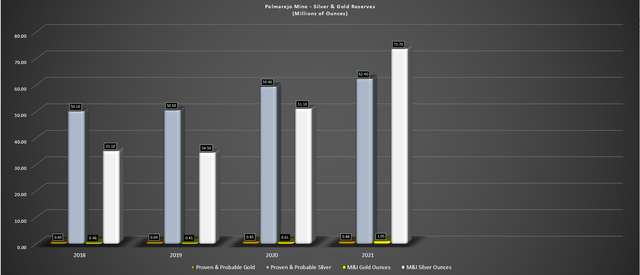

Moving south to Mexico, Palmarejo saw an increase in gold reserves to ~880,000 ounces and an increase in silver reserves to 62.4 million ounces. This was a positive development given that this is a crucial asset for the company with much lower costs than Coeur’s other operations. It’s also worth noting that measured & indicated gold and silver ounces also increased year-over-year, with the mine’s silver base now sitting at ~136 million ounces in the proven/probable and measured/indicated categories, translating to an 8+ year mine life.

Palmarejo — Silver & Gold Reserves & Resources (Company Filings, Author’s Chart)

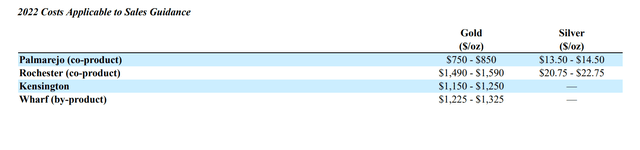

Costs Applicable To Sales Guidance – Coeur (Company Filings)

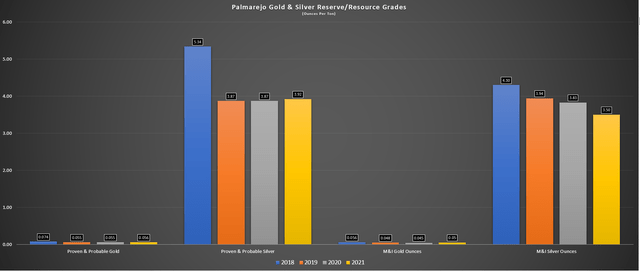

The only negative worth reporting at Palmarejo is that while resources have been increasing, the company has struggled to replace ounces at similar grades. This is evidenced by the chart below, which shows that grades have slid from 5.34 ounces per ton of silver in 2018 to 3.92 ounces per ton of silver this year. Meanwhile, gold grades have dipped from 0.074 ounces per ton three years ago to 0.056 ounces per ton in the same period.

Palmarejo – Reserve/Resource Grades (Company Filings, Author’s Chart)

The decline in grades at Palmarejo is not a huge deal for Coeur, and this continues to be a very profitable asset for the company. However, with inflationary pressures and grades declining, we are seeing an increase in costs at the asset, with costs set to increase sharply on a year-over-year basis to $800/oz gold and $14.00/oz silver at the mid-point. These costs are still well below the company’s average cost profile. Still, it doesn’t help to see its lowest-cost asset seeing a meaningful increase in costs on a year-over-year basis, given that this is the one asset helping Coeur to have a respectable cost profile currently.

Summary

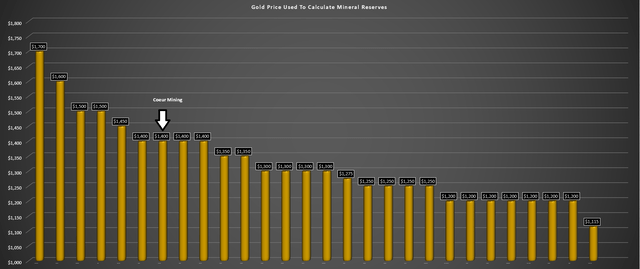

Overall, Coeur has done a satisfactory job replacing reserves to date, and certainly a much better job than it has when it comes to managing share dilution and growing production per share. However, it is worth pointing out that higher metals price assumptions have helped to grow the reserve base. This is based on the company’s gold price assumption sitting at $1,400/oz, above the industry average, and its silver price assumption moving to $20.00/oz, up from $17.00/oz last year. These are much less conservative figures than $1,250/oz gold and $17.50/oz silver in FY2016.

Peer Group – Gold Price Used To Calculate Reserves (Company Filings, Author’s Chart)

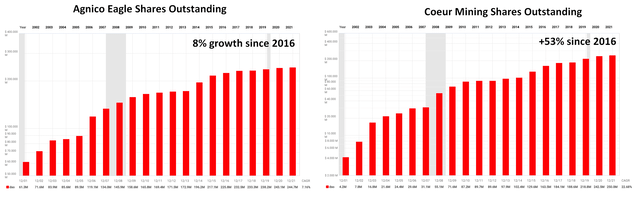

Conversely, companies like Agnico Eagle (AEM) have increased their reserve base over a 5-year period (2021 vs. 2016) from ~19.9 million ounces of gold to ~25.7 million ounces of gold and at slightly higher grades (2.37 grams per tonne vs. 2.31 grams per tonne). This has been achieved despite only a slight increase in the company’s gold price assumption ($1,250/oz vs. $1,150/oz) and maintaining a gold price assumption below the industry average. Most importantly, Agnico has achieved this growth in reserves with minimal share dilution, while Coeur has had one of the worst track records of share dilution sector-wide.

Agnico Eagle vs. Coeur Mining Shares Outstanding (FASTGraphs.com)

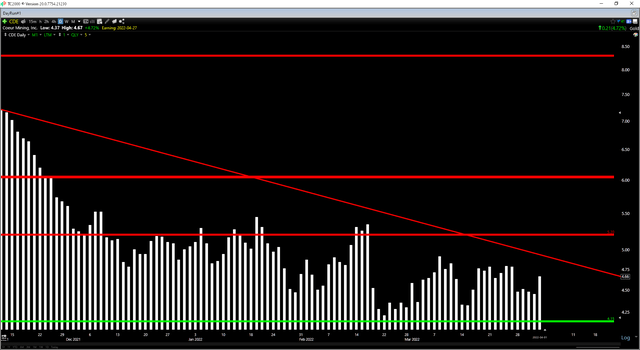

Technical Picture

Looking at the chart below, we can see that Coeur Mining recently bounced off short-term support at $4.15, but the stock has a lower resistance level at $5.20. Given that the stock is currently trading near the middle of this trading range at $4.66, the reward/risk ratio is balanced, with $0.51 in potential downside to support and $0.54 in potential upside to resistance. When buying small-cap sector laggards, I prefer a minimum 6 to 1 reward/risk ratio to justify entering new positions, which is not the case currently. Instead, the reward/risk ratio based on the expected trading range sits at 1.06 to 1.0.

CDE Daily Chart (TC2000.com)

For Coeur Mining to become attractive from a trading standpoint, the stock would need to decline below US$4.30, where it would have $0.90 in potential upside to resistance and $0.15 in potential downside to support. This doesn’t mean that the stock can’t go higher, but with the potential for additional share dilution and given Coeur’s poor track record of production growth per share, I think there are far better bets elsewhere in the sector. So, if I did want to buy the stock from a trading standpoint, I would be looking to enter new positions at or below $4.29.

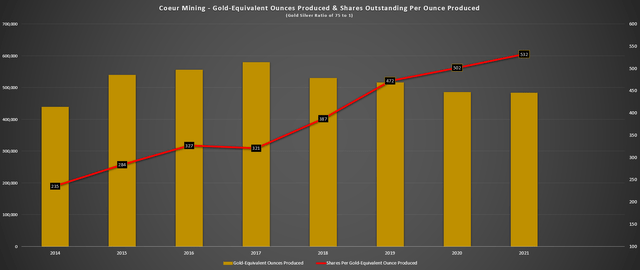

Coeur Mining – Shares Outstanding Per Gold-Equivalent Ounce Produced (Company Filings, Author’s Chart)

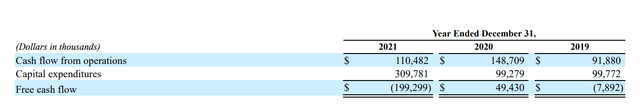

While Coeur had a satisfactory year from a reserve replacement standpoint, it continues to have a relatively weak balance sheet compared to peers, which could lead to additional share dilution in the next 12 months. I don’t see this as a deal-breaker. Still, with many other producers busy returning capital to shareholders (buybacks/dividends), I am much less interested in producers where share dilution could be on the table and those companies that are generating limited free cash flow at current metals prices.

Coeur Mining – Annual Free Cash Flow (Company Filings)

While the culprit for the dip in free cash flow is mostly related to the Rochester Expansion, this combination of potential share dilution and limited free cash flow generation means that Coeur could continue to underperform its peer group. This is not ideal, and certainly not for patient shareholders that are still waiting to see a return to 2016 prices. To summarize, I continue to see far more attractive bets elsewhere in the sector, but if I wanted to own Coeur as a trading vehicle, I would be looking to buy at US$4.29 or lower.

Be the first to comment