Justin Sullivan/Getty Images News

There is a certain simplicity to analyzing mature stage companies. While surprises certainly come along, it can be assumed that things are going to keep going as they have been going, more or less. It is in that spirit that I am going to take a look at Coca-Cola (NYSE:KO) today, focused primarily on valuation. Bottom line up front: I don’t see a feasible scenario in which KO is worth what they are trading for on a per share basis currently, at least as it relates their cash generation potential. So why is the market putting a premium on ownership of this legacy beverage manufacturer? I share my thoughts.

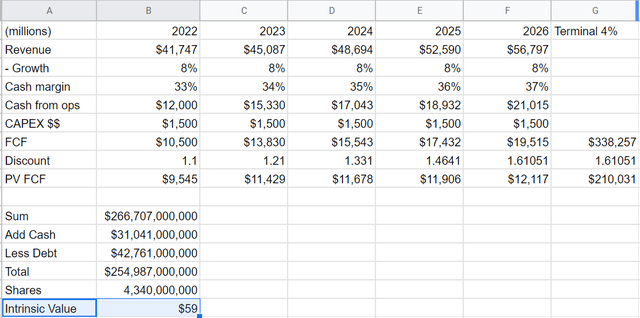

Coca-Cola Stock – Discounted Cash Flow Analysis

It has repeatedly been iterated by many investing greats that the value of a business is dependent on the total cash flows it can generate, summed together and discounted back to the present. Expressed on a per share basis, the arrived-at number or intrinsic value determines whether or not to buy the stock. I did just that with KO. Here is the spreadsheet:

A verbal explanation of the inputs:

– In the most recent conference call management gave exact numbers on what to expect for cash from operations, capital expenditures, and resulting free cash flow in 2022. That is a given and shown in the B column. But they also guided to 7%-8% revenue growth in the year. I took that number and applied it to every year through 2026.

– The margin they achieved on operating cash was 32.6% in 2021. I assumed that they are able to embark on a margin expansive path, going up 100 bps annually to get to 37% in 2026.

– Capital expenditures stay level at $1.5 billion a year.

– Terminal rate of 4%.

– Discount rate of 10%, the long-term return of stock market averages. I assume investors would want a rate of return at least in line with that.

Under these circumstances, intrinsic value comes out to $59 a share, whereas shares are actually trading today around $62. This indicates mild over-valuation. But here is the kicker: I don’t think the above results are remotely feasible.

For starters, 8% revenue growth every year for five years is well beyond what they have achieved historically. Since 2017, the year in which they sold-off their bottling related assets and thereby lost a big chunk of revenue, they have grown revenue by only 2.2% annually. That is well below the long-term average growth they have said they would achieve in the range of 4%-6%. 8% just isn’t going to happen.

Second, margins getting up to 37% is a long shot. The 32.6% they achieved in 2021 was a record high. To keep going up from there and do so every year doesn’t have a basis in reality. Their average in the past five years was 27%.

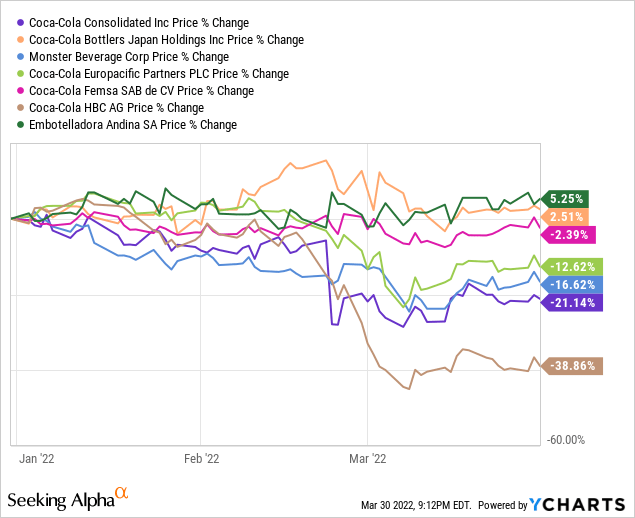

Third, I included in the “add cash” cell not only their cash and equivalents, but also their equity method investments. These are investments made in publicly traded companies like Monster Beverage Co. (MNST), or Coca-Cola Bottlers Japan (OTCPK:CCOJY). Naturally, the share price of these companies goes up and down, and may not be realizable anywhere near the fair value recorded in the 10K as of year-end 2021. In fact, the value of these investment HAS gone down year-to-date. Here they all are:

So the $59 is already impaired. Now, I don’t usually include such things in a DCF analysis. I only use it here to underscore how impossibly over-valued KO is right now, even with the boost.

Finally, a 4% terminal value is extremely generous. That assumes that KO can grow FCF by 4% every year for the rest of forever. Forever is a long time, and ever larger numbers get ever harder to compound at identical rates of return.

To reiterate, even under these fantastically optimistic assumptions regarding future growth, KO is STILL worth less than what they are currently trading for on the public market. Those buying now seem to be accepting a lot of risk.

But I am not the only one that can do a DCF analysis. Either other market participants are using even more optimistic assumptions than mine or a lot of value is being assigned to KO that doesn’t have to do with cash flows.

Intangible Value

What I am about to say is little more that musing, so I will try to keep it brief. The reality is that I can’t know and certainly can’t prove what it is about KO that is impelling the market to so generously value the shares. But I do have some ideas.

First, it’s the dividend. People love dividends. Sometimes to a fault, in my opinion. I even labeled it a false god or akin to idol worship in an article from October of 2018 that was hotly debated, generating over 800 comments. Dividend love has given rise to labels that create a hierarchy for dividend paying companies, some aspiring even to royalty appellations. Based on consecutive years of raising the dividend, the totem pole is as follows:

| Dividend King | 50+ years |

| Dividend Aristocrats | 25+, with other stipulations |

| Dividend Champion | 25+ years |

| Dividend Contender | 10-24 years |

| Dividend Challenger | 5-9 years |

This practice of “knighting” companies to a certain dividend stature amuses me. But I also think it is dangerous. It can lead to dire capital allocation decisions, where management feels pressured into letting the dividend take precedence over other activities that could do much more to increase shareholder value, all to maintain a title or status. I believe this is what happened to AT&T (T), a saga I chronicled some time ago, where debt reduction should have been prioritized over a dividend. T hasn’t done well since that article was published, down 17% vs. a massive 362% surge for the S&P 500. I would be lying if I said I didn’t take significant satisfaction in being right. T recently announced a cut in the dividend. In a puff of smoke, their dividend aristocrat status disappeared.

Veering back, and being sure to iterate that I DON’T think KO is in any similar situation to T, the point is that I do believe that the dividend is part of the reason investors are willing to pay so much for KO. KO is a dividend king, with over 59 years of raising their dividend. Folks have come to love that reliability, and they are apparently willing to pay up for it. So much so in fact that even if the dividend grew 6% every year looking forward it would take 20 years to recoup the initial investment. For context, KO increased their dividend by an average of 5.7% in the last ten years, and the size of increases has slowed in the last five years to grow at only 3.22% annually. I don’t see the rate of dividend growth accelerating from here. At a current payment rate of $1.76 per share annually and based on 2022 expected free cash flow of $1.5 billion, the FCF payout ratio is 72%. While not alarmingly high, it’s getting up there. Room for more dividend growth is shrinking. Current yield is 2.8%, whereas the five-year average is 3.19%, also indicating over-valuation. I would warn folks to not let a dividend cloud good judgment.

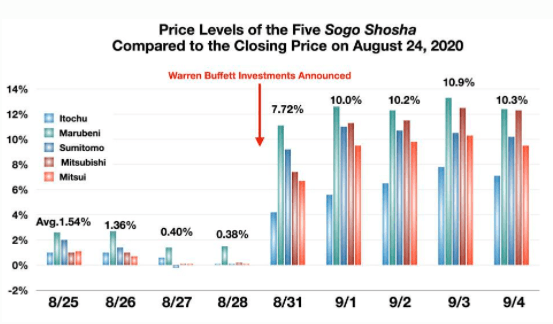

Second, there is always the Warren Buffett effect. Warren Buffett is legendary, and ears perk up when he announces an investment in something. Often, those announcements make the stock of that company go up too. This effect was calculated and tracked by Forbes in the case of Warren Buffett buying five Japanese companies back in September of 2020:

forbes

Any buzz about Buffett being positive a stock exerts upward pressure. While the announcement that Buffet bought KO is long in the past, he has spoken dearly of the investment over many years and has never sold a single share. I imagine that props up the stock price. If Warren Buffett finds it worth owning, many others surely find it worth owning too.

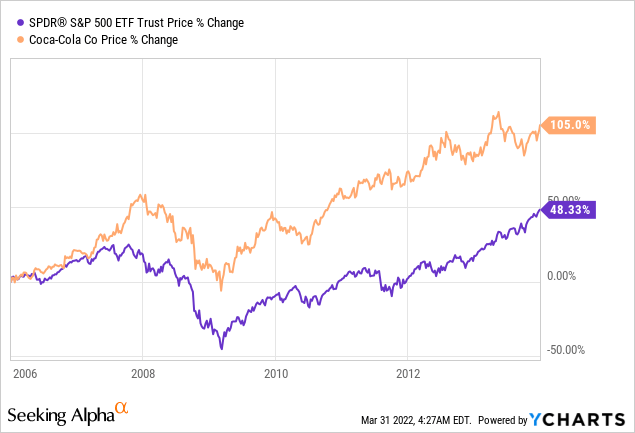

Third and finally, I imagine KO is enjoying a flight to safety surge in light of recent world-wide events and economic conditions. Regardless of what is going on in the world, the logic is that people will still want to drink KO. I know I will. It is a consumer staple and a household name the world over. People may be betting that KO earnings and therefore the stock price will hold up better than most in recessionary environments. And they aren’t wrong. Such was the case in 2008 when measured against the S&P:

There is a certain durability to being a KO owner. That being said, durable earnings and a durable stock price isn’t reason enough to over-pay. At least not for me.

Conclusion

I love Coca-Cola. I drink at least one a day. It is delicious. It is culturally iconic. It sells itself, and the business has boomed for decades. But a booming business can always be overbought. I believe that is the case with KO right now. No reasonable estimate of cash flows can justify so high a stock price. While intangibles exist that support shares, those intangibles can prove fragile and fickle. What if KO gets to the point in a few years where they can no longer raise the dividend? Worse yet, what if they mis-allocate capital such that they have to cut the dividend to pay down debt? You may be thinking “impossible”, but that is what people said about AT&T too. What if Warren Buffett dies and his successor decides to trim the their KO position? What if the climate world-wide settles down and people no longer seek stocks with a safety profile? Any one of these things can happen very quickly, and a multiple contraction will likely follow. The shares will go down severely. I am not willing to incur that kind of risk. However, I am not brave enough to recommend selling KO to those who might now own it, knowing the many factors that prop up the price. For those considering a new position, I would suggest waiting for the shares to come down substantially.

Be the first to comment