Catalin Rusnac/iStock via Getty Images

Investment Summary

The threshold question on every market pundit’s mind right now is if equity markets are in the midst of a paradigm shift or not. A background of looming recession, surging rates and record inflation has markets off to their worst start to the year in decades. Underlining the calamity is the pandemic, and all of the symptoms it brought over to financial markets and the real economy. The debate centers on no company more than Co-Diagnostics, Inc. (NASDAQ:CODX), a name that benefitted immensely from Covid-19 tailwinds on the top and bottom line.

Exhibit 1. CODX 12-month price action

Data & Image: Bloomberg

Our previous findings show there is the possibility that CODX’s long-term pipeline will unlock long-term value into the coming years. However, probabilities show the stock will have a difficult time in re-rating and that management’s full year guidance may not be fully de-risked. Tilting the risk/reward calculus back to the upside is a price objective of $11–$13.80 per share, with long-term value to be seen in the company’s vertical assay menu. On the culmination of these factors, we rate CODX neutral.

Macro-pressures add bearish tilt

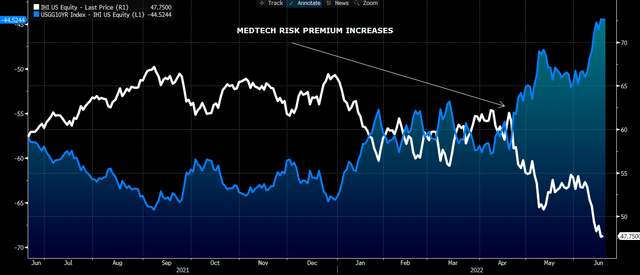

Investors have begun to reposition to absorb specific macro-headwinds looming on the horizon. Namely, surging inflation, rising cost of capital and supply shortages. Similarly, the high-beta and growth trade has completely unwound in 2022 and investors are no longer prioritising top-line growth. One can only lose money for so long before the belief about unprofitable companies starts to dwindle. As much has been the case in medical technology (“medtech”). The sector has incurred substantial losses in 2022. The equity risk premium it commands has also been clamped as the long-end of the treasury yield curve steepens onto 30yr and 10yr rates.

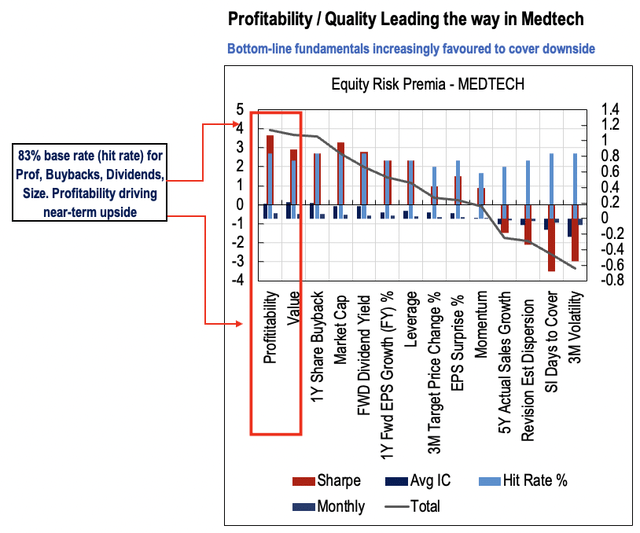

Predicting precisely when or how far the Fed will shoot with its rates plans is a fool’s game and full of assumptions, by estimate. What isn’t full of assumptions though, is the fact that cheap stocks, presenting with fundamental momentum and quality cash flow, may de-risk investor portfolios against these impeding challenges.

In medical devices and healthcare, there’s been equally as sizeable shift away from top-line growth, with a focus onto bottom-line fundamentals. Medtech companies are no longer focused on growing top-line revenues, instead are shifting to lifting margins and growing organic earnings and free cash flow. The shift is likely to absorb cost headwinds down the P&L. On the investor side, the appetite for long-duration equities has also unwound and this has exacerbated directional moves and capital flows in equity markets.

Exhibit 2. Loss of equity premium in MedTech

Data & Image: Bloomberg

For CODX, this presents with material upside and downside risks to the investment debate. Firstly, CODX is profitable, having lifted gross margins from ~69% in Q1 FY20 to ~85.5% in Q1 FY22. Operating margin has followed suit screaming from a loss of 69% to print a positive 43% in operating margin for Q1 FY22. Each of these results are well above its 3-year averages and also above the GICS Industry peer median. This carried through to a $9.1 million net profit last quarter and fed $7.4 million below the bottom line in FCF and $0.27 in EPS. CODX also printed a 35% T12M FCF margin and investors enjoy a 23% FCF yield on this. It also generated a 32% ROA and 32% ROIC in the last print, in line with 3-year averages and both ahead of the peer median. It also has a number of vertical offerings on its testing menu, distributing its revenue across a number of assay segments.

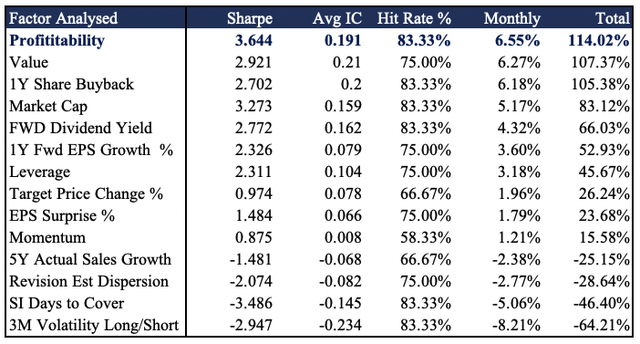

Exhibit 3. HB Insights Equity Risk Premia Model YTD 2022

Data: CODX SEC Filings. Image: HB Insights

Data & Image: HB Insights

The downside risk stems from the source of this income and earnings. Covid-19 provided CODX with superb earnings power, expanding tests throughout the course of the pandemic to a wide-reaching audience. On face value, this might seem as a catalyst to move the needle – the company has focused on producing testing regimes that work on most PCR devices and other extraction modalities. Moreover, there’s a good chance Covid-19 testing will be with us for some time. Specific employment and logistics arenas will continue employing Covid-19 testing protocols for the foreseeable future, and that’s likely to extend out to all branches on the tree of life – sport, schooling, workplace, and so on. The key differential is that there’s no gold standard in distinguishing between symptoms of influenza and Covid-19. The total addressable market (“TAM”) is therefore wide and expands further given tests can be administered from anywhere.

The seasonal incidence of influenza is approximated at 5%–20% in the US with supplementary evidence indicating one billion cases of common cold per year into the coming decade. Epidemiological data illustrates children and the elderly are more susceptible. Important to note is, as mentioned, Covid-19 and influenza present with remarkably similar, often indistinguishable symptoms.

In other words, testing will still be required to distinguish between Covid-19 and influenza into the foreseeable future, we estimate. Moreover, the questionable efficacy on rapid antigen testing (“RATs”) compared to reverse transcriptase polymerase chain reaction (“PCR”) testing remains. It’s the reason why some jurisdictions won’t accept RATs as gold standard to confirm or negate Covid-19 infection. Clinical data shows that RATs for influenza have a 50–70% sensitivity, with a lower-upper limit of 10–70% respectively. Due to the mechanics of RATs many subjects receive false-positives or negatives, meaning logically, RATs don’t provide an accurate negative result. On this basis, there is fundamental value in Covid-19 tailwinds for CODX still.

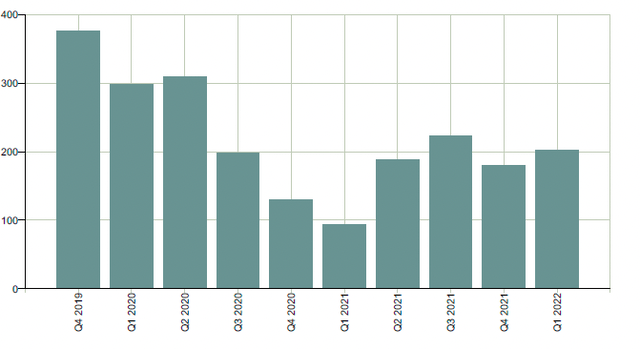

Catalysts to move the needle

The question then turns to what’s tangible for shareholders ex-Covid. In its Q1 FY22 filing, it printed ~$23 million at the top, a 13% YoY growth schedule that came in ahead of consensus. Gross margin came in ~200bps lower from Q4 FY21 but up ~190bps YoY. Net margins were down ~100bps YoY and this carried through to $0.27 in EPS, well ahead of the Street’s $0.17 estimate. Deconstructing CODX’s earnings, there are surprising trends. More than 50% of EPS was derived from non-operating income, with the remainder derived from margin gains and lower operating costs.

Moreover, liquidity is well managed with more than 9x cover over short-term obligations from liquid assets, and ~7.5x from cash alone. CFO as a function of average liabilities is just 4%, whereas equity holders have claim to most of the balance sheet. Each of these figures has held tight over the past two years. Working capital management has been equally as sound such that the cash conversion cycle has reduced by around 96 days to 202 days in Q1 FY22 from Q1 FY20, whereas inventory to cash days has tightened by 95 days to 236 days in the same time. The company therefore has less cash tied up in working capital, and can ratchet up earnings and FCF conversion as a result.

Exhibit 4. Cash conversion cycle creeping lower

Data: Bloomberg. Image: HB Insights

CODX also mentioned its CoDx diagnostic platform is also on track according to plans. It has accelerated its lower cost, multiplex-able POC unit along with the at-home PCR cartridge based platform for a wide testing menu, Covid-19 included. It uses the CoPrimer technology, and can be activated through a mobile phone app, with results displayed to patients within 30 minutes on the app. News on this segment is a major catalyst for share price appreciation, in our estimation. We can’t rule out the possibility of CODX integrating other multiplex assays into the app as well, potentially scaling up revenue. The system is intended for trials this year, with emergency use authorisation scheduled for the FDA’s approval as well. Clinical trials on the segment are therefore paramount for investors to pay close attention too, as we reckon there’s still more to be priced into the stock from this new venture, should results be positive.

Moreover, CODX continues to advance on its PCR test for monkeypox. It announced last month it had completed principal design work on its test. Under the scenario where monkeypox becomes a ‘pandemic’ of its own, then CODX is extremely well positioned with first mover advantage here. The test is said to integrate CoPrimer technology. If the Logix Covid-19 test is anything to go by, the probability of CODX commercialising an affordable, accurate molecular testing unit for monkeypox is quite high, by estimate.

Demand for monkeypox testing would be quite similar to what Covid-19 was in its early days, we reckon. That’s because serology testing isn’t recommended for monkeypox due to its long incubation period. It also has a close resemblance to other surface-level antigens. Hence, molecular diagnostics immediately become the gold standard of testing for monkeypox. Per CEO, Dwight Egan on the test:

One of the most important lessons the world learned following the COVID-19 pandemic is the importance of quick, decisive action in the face of any potential outbreak of transmissible viruses. This means being prepared for every scenario. Co-Dx was founded with the mission to increase the accessibility of affordable, high-quality molecular testing products around the world, and we look forward to eventually making this test available in affected regions as needed to help slow the spread of the virus through early and accurate detection.

Valuation

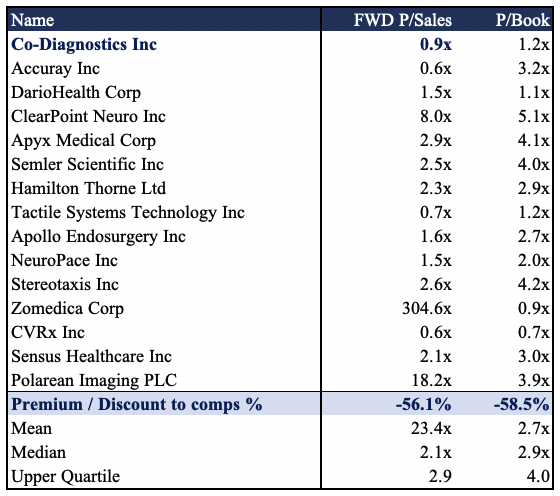

Shares are trading at just 4.2x P/E, well below the 4-year normalised P/E of 14.6x. CODX also fetches ~1.2x book value and is priced at 4.3x FCF, below its 4-year normalised P/FCF of 16x. The rates argument implies that higher interest rates benefit those companies whose cash flows of shorter duration and with greater predictability. CODX’s cash flow metrics put it ahead of peers, although it is trading at a respectable discount to key multiples within the peer group. The stock trades at an average ~57% discount on forward sales and to book value. These figures were used due to lack of profitability within the peer group. On that basis, the question is if the discount is justified.

Exhibit 5. Multiples & Comps

Data & Image: HB Insights

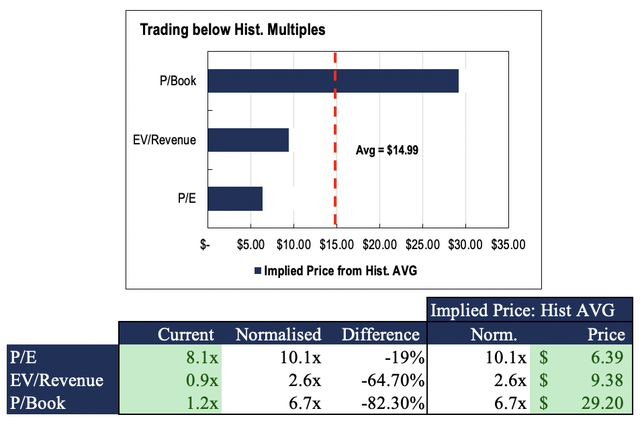

We argue the stock should be priced more towards its historical values, and that it remains unfairly punished to the degree it has been in 2022. There’s a solid case to be made from CODX’s fundamental momentum and FCF conversion, in light of our macro observations. However, we’ve also forecasted a ~17% YoY decrease in revenue, leading to a 30% decline in net income. This should lead to FCF conversion of $36.5 million in our model, an 8.65% decrease from FY21. We’ve mentioned earlier the market has turned towards rewarding bottom-line fundamentals. With headwinds to earnings, we feel this needs to be adequately priced into the stock as well.

With that in mind, we’re going to use normalised multiples in our projections. It’s also not unusual to use normalised values as a cleaner forecasting tool. Doing so in CODX’s case, sees us value the stock at ~16x FY22 FCF and ~14.6x FY22 P/E estimates. This gives us price objectives of $16.70 and $9.30 respectively. Using historical values on earnings and book value implies the shares should be trading up ~$6.40 and $29.20 respectively, and forming a composite from all historical multiples suggests CODX should be priced at ~$15.

Exhibit 6. Historical vs. Current implied valuation

Data & Image: HB Insights

Blending all three inputs on an equal weighted basis sees us value the stock at $13.60 per share in the upside case. Applying a risk-adjustment for an additional 15% downside in equities, sets a price target of $11.80. The upside potential on offer from these two objectives is more than 100% in each case, adding a heavily bullish tilt to the investment debate, and keeping us from rating this name a sell.

How to position CODX

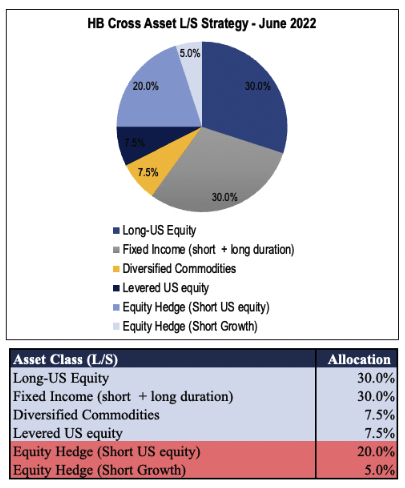

With all angles of the debate now covered, the question then turns to how to position CODX in an equity focused or cross-asset portfolio. Our views on this are quite simple, and relate to recommendations made to our clients on the same topic. We firmly believe that investors should position their portfolios to mimic the distribution of probable outcomes in the global economy. For reference, there’s a wide ranging probability of recession in the next 2-3 years, data from various economists and firms show.

Therefore, investors should position around 30–40% of equity and fixed income weightings that offer a margin of safety above a 20% threshold. This provides adequate downside cover in another 15–20% dip in equities. With that in mind, CODX slots into our thesis well here. Offering substantial return potential with our price objectives, CODX warrants its inclusion on this basis. CODX’s valuation might therefore still be attractive if this were to happen.

The remaining risk should be budgeted throughout equity holdings with the view rates and the Fed will eventually complete a soft landing for the real economy. The market is already paying a slight premium for quality, and CODX doesn’t necessarily fail the litmus test here. In that regard, CODX fits as well, seeing as its value proposition looks to be realised into the coming years.

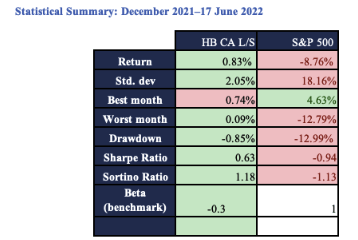

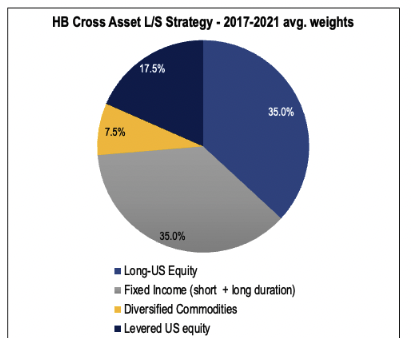

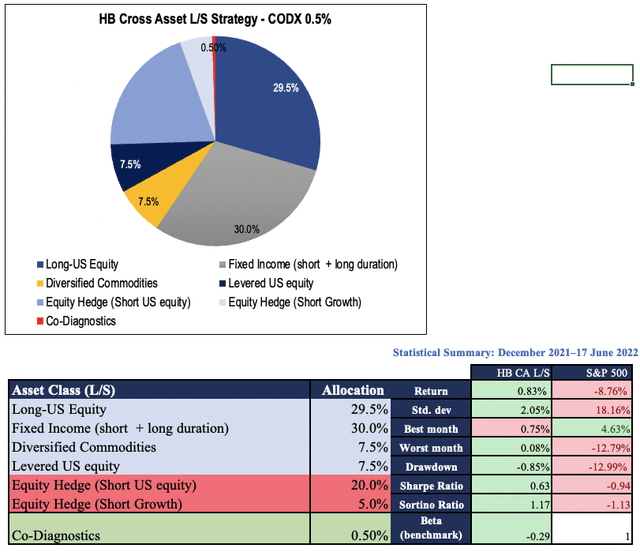

On a multi-directional basis, our cross asset setup is shown below demonstrating that CODX has the propensity to tuck into an equity long/short portfolio on a 0.5% weighting, without adjusting the high-sharpe or high-sortino strategy. Results from the tactical-allocation are shown in the series below.

Moreover, we have been chasing buyback yield in 2021/2022 and CODX’s recent $30 million authorised buyback offers potential upside as well. Arguably, investors are discounting stocks with buybacks in 2022 and our quant research reveals buybacks are in fact driving equity returns in the medtech space this year as well. Indeed, this combination means CODX could tuck nicely into an equity-focused, long-only portfolio as a risk-on holding to reflect our strategies outlined above.

Exhibit 7. HB Cross asset strategy summary

Data & Image: HB Insights

Data & Image: HB Insights

Data & Image: HB Insights

Exhibit 8. CODX tactical inclusion testing

Data & Image: HB Insights

The results above indicate CODX can be tactically included into a strategic asset allocation both in an equity focused and cross-asset portfolio strategy. Note, the above portfolio rotates between 26–72 stocks and has no constraints on short selling, transactional costs or rebalancing parameters.

In short

CODX has the economic pillars that would see it hold up well in the current macro climate. There has been a slowdown in Covid-19 tailwinds, however, this looks to have been priced in by the market. What hasn’t been fully priced in, however, is the ongoing systematic risks currently plaguing the markets. With that in mind, there are impeding risks that cloud the investment debate.

Keeping us in the neutral camp is sizeable price objectives that offer exquisite return potential if they were to manifest. Profitability metrics are therefore paramount for CODX and serve as an adequate litmus test moving forward. We price CODX at $11–$13.80. Rate neutral.

Be the first to comment