FatCamera/E+ via Getty Images

Intro

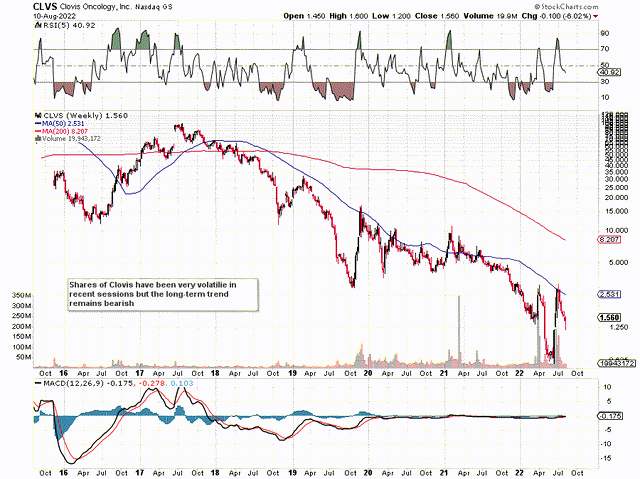

If we look at a long-term chart of Clovis Oncology, Inc. (NASDAQ:CLVS) (Antin Cancer Biotech Company), we see that shares topped out in 2017 and have been making sustained lower lows ever since. Suffice it to say, a lot of shareholders have been burned by this play, and if the present bearish trend continues, shares could easily test the stock’s year-to-date lows of well under $1 a share. If indeed though shares swoop down to their 2022 lows in the not too distant future, the risk/reward play would be heavily skewed to the upside because of what the company still has in its locker in our opinion.

Clovis Technical Chart (Stockcharts.com)

Clovis Needs Capital

Suffice it to say, it then would boil down to how much the company’s assets are worth to a partner if indeed a third party is to enter the scene here, which now looks highly likely. Management announced on its recent quarterly earnings call that raising capital through public or private equity means is not an option at present due to the recent unsuccessful stock split. So, Clovis’ current options with respect to facilitating funding seem to be to either increase the number of shares or enter into some type of licensing agreement. The reason being is that when forward-looking revenue projections and the company´s current cash-burn rate are taken into account, operations will eventually come to a grinding halt in early 2023 if no new funding is found.

Rubraca Sales Are Not Growing

Unfortunately, Rubraca has not performed up to expectations. This means Clovis’ pipeline has literally run out of time. Rubraca sales came in at $32.1 million in the company’s fiscal second quarter, which was a 6% sequential decline as well as a 13% decrease compared to the same period of 12 months prior. Covid-19 has been a clear headwind here due to fewer numbers of people going through the system. This has led to a fall-off in second-line maintenance treatment. Furthermore, recent insider selling demonstrates management’s outlook on how Rubraca is expected to fare going forward, which obviously has been factored in as to when the firm will run out of money.

Pipeline

However, with respect to the pipeline, management was quick to point to the ongoing FAP-2286 (Lead candidate in Radionuclide therapy) LuMiere trial with respect to its recent encouraging results. When we take into account the tumor space, which is a significant area of high unmet need, along with recent evidence regarding Fap-2286’s sound safety and clinical implications, this will be a trial that will be watched very closely going forward by all cohorts in this space.

Then, on the Rubraca side, the ongoing TRITON3 & ATHENA studies offer the opportunity to bring to the market earlier therapy solutions for prostate and ovarian cancer patients. Regarding ovarian cancer, Clovis has plenty of indications in late stages in ATHENA-MONO & ATHENA-COMBO, where we should have updated information in this space in the latter stages of this fiscal year as well as early next year. Remember, the goal here is to widen the net so to speak with respect to patients undergoing therapy in this space. The same goes for specific prostate cancer patients in the TRITON3 trial where we should have an update over the next few months or so.

Worrying Financials

The question then becomes how much is this pipeline worth, notwithstanding Rubraca’s U.S. and international product revenues. Remember, Clovis has well over $600 million of long-term debt on its balance sheet and continues to report negative shareholder equity. Suffice it to say, its bargaining position is not healthy, as the company will most likely have to give up more than it wishes to attract the interests of a funded third party.

From an investor or trader’s standpoint, the play here is to try to put oneself in a scenario where one has significant upside potential but yet small downside risk. This may be achieved through trading the stock´s options, for example, but things could change here rather quickly if both funding and more milestones are met over the near term. In fact, biotech followers will be all too aware that other biotech companies (with much poorer pipelines) many times have doubled if not tripled in price once news of their fresh funding was announced. All is not lost here, especially if the market believes the company’s present late-stage candidates can gain traction.

Conclusion

Therefore to sum up, although it looks like shares of Clovis will continue their pattern of lower lows, shares could easily pop here if funding ensures operations can be sustained for more time to come. We may time an entry in due course if we can set up an excellent risk/reward play to the upside. We look forward to continued coverage.

Be the first to comment