Iryna Drozd

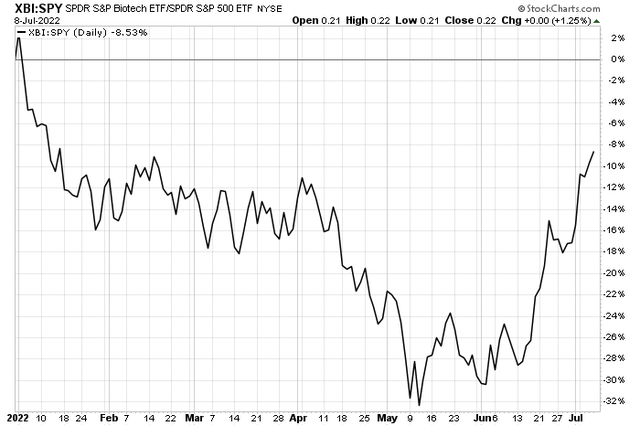

There’s a glimmer of hope for the market bulls. One risk on niche, biotech stocks, has been outperforming for about two months now. The SPDR S&P Biotech ETF (XBI) has beaten the SPDR S&P 500 Trust ETF (SPY) by a whopping 35% since May 12. What’s perhaps most impressive is last week’s continued relative strength in the high-risk space in the face of higher interest rates.

Biotech Stocks: Best Relative Strength Since January

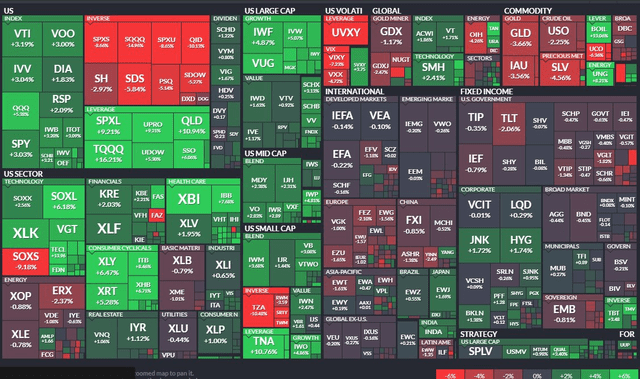

ETF Performance Heat Map Last 5 Days: XBI, IBB Continue To Work

Digging into the industry, we find a biopharma firm – Clovis (NASDAQ:CLVS). According to Bank of America Global Research, Clovis is an oncology-focused biotech company that launched its first drug, Rubraca, in late 2016. The drug is indicated for the treatment of germline and somatic BRCA-induced ovarian cancer after failing two prior lines of chemotherapy, maintenance of recurrent ovarian cancer, and BRCA metastatic castration-resistant prostate cancer.

The Colorado-based $399 million market capitalization company does not pay a dividend and features a remarkably high short float – upwards of 29%, according to Fidelity Investments as of June 15. Recently, the stock has soared, perhaps on some short covering around drug news. Also happening this past week, shareholders rejected a proposal to engage in a reverse stock split.

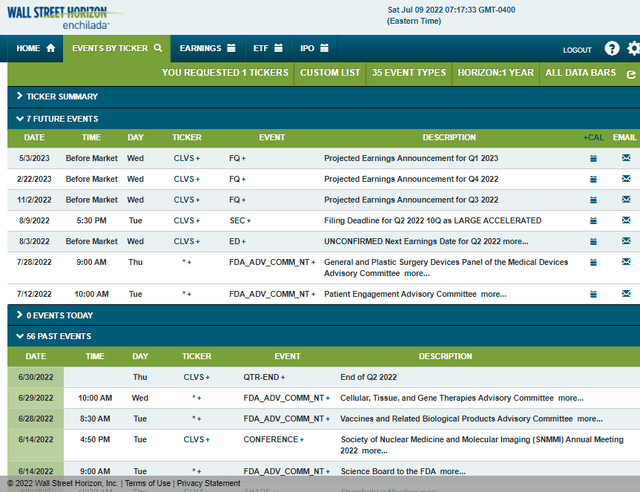

More importantly, earlier this month, the company met with the FDA to discuss its key drug, Rubraca, to treat ovarian and prostate cancers. The FDA eventually recommended that Clovis wait for more survival data before submitting its application. Not surprisingly, the stock has been volatile as key news unfolds around the drug. Corporate events surrounding FDA committee meetings will be critical to watch. As will be its unconfirmed August 3 earnings report, according to data from Wall Street Horizon.

Clovis Corporate Event Calendar

The Technical Take

After bottoming at just $0.58 in June, CLVS shares spiked to $3.25 last Friday before settling at $2.77 for the week. Notice in the chart below that volume came into the stock on its recent surge. But we saw similar price/volume action at the turn of Q1 into early April – and that eventually led to a big stock price plunge.

I see resistance around the $3 mark. Bulls want to see the stock settle above about $3.20 to help confirm a bullish breakout. For now, the stock has risen back up to resistance – both from a key spot dating back to late 2019 and based on a downward trending resistance line off the early 2021 peak above $11 – but that line appears to be giving way to the bulls.

Resistance Near $3, Possible Downtrend Breakout For CLVS

The Bottom Line

Sellers keep emerging above $3 on CLVS. The stock could be coiling ahead of an eventual breakout above important resistance levels, but we want to see more definitive signs that a bullish trend is in place before going long. Trying to predict FDA announcements and drug approvals is a tough game, let’s stick with price action to help find a game plan on CLVS.

Be the first to comment