Love Employee/iStock via Getty Images

A great deal has happened since my previous Clovis Oncology (NASDAQ:CLVS) article including data updates, shareholder news, as well as buyout rumors. These events have had a positive impact on the share price and injected some bullish sentiment into the ticker. First and foremost, the company reported positive data from Rubraca in the first-line maintenance of ovarian cancer. The data supported the use of Rubraca in first-line patients regardless of their biomarker status. Secondly, the company announced initial data from their Phase I/II LuMIERE investigating the dosing, PK, safety, and initial antitumor activity of the leading targeted radiotherapy candidate, FAP-2286. Overall, one out of nine subjects in the first two dose cohorts showed a confirmed RECIST partial response. These results could support the use of FAP-2286 as a theranostic agent and validate the company’s efforts to pursue these targeted radionuclide therapy programs. Thirdly, there have been rumors that Sanofi (SNY) is potentially in the process of acquiring Clovis, which would make considering their supposed interest in another PARP-inhibitor company, Tesaro, before they were acquired by GSK (GSK). Lastly, the shareholder voted against the company’s proposed 1-7 reverse stock split, which generated a huge spike in the share price. Together, these updates have helped the share price rally from $0.65 to around $2.65 in less than a month. I took advantage of the overblown sell-off and was able to average down to under $1 per share. Now, I am struggling to decide whether to book some profits and reestablish a “house money” status, or do I trust the company is ready to go on a winning streak to hit my current sell targets in the Compounding Healthcare “Bio Boom” portfolio.

I intend to review the recent updates and how they will impact the company going forward. In addition, I will go over some of the looming downside risks that CLVS investors should be cognizant of. Furthermore, I make a decision about my CLVS position and will discuss my game plan for the second half of 2022.

New Rubraca Data

Clovis recently presented Phase III ATHENA-MONO data at ASCO highlighting Rubraca’s benefits as a first-line maintenance treatment in “advanced ovarian cancer who previously responded to platinum-based chemotherapy” regardless of BRCA mutation or homologous recombination deficiency “HRD” status. The data demonstrates that Rubraca’s progression-free survival “PFS” for all patients randomized was 20.2 months verse 9.2 months for placebo. In terms of overall response rate “ORR”, 48.8% of Rubraca ITT patients had a confirmed ORR verse one patient in the placebo arm (9.1%). The median duration of response for the ITT population was 22.1 months verse 5.5 months in the placebo arm.

According to Clovis, Rubraca hit its primary endpoint and demonstrated a similar safety profile seen in previous trials. The overall survival “OS” was immature at the time of data cut-off. The company believes this data will support the use of Rubraca in the frontline maintenance setting. It is important to note that AstraZeneca’s (AZN) LYNPARZA and GSK’s ZEJULA (both PARP Inhibitors) have had solid results in frontline maintenance, however, both have shown mixed results depending on their BRCA mutations or HRD status. So, it is possible the final data will reveal that Rubraca is competitive if not superior to other approved PARP inhibitors. Clovis is currently working on a planned sNDA submission in Q3 of this year, however, the company mentioned that the FDA is requesting more mature OS data, so we don’t have a clear timeline for potential approval.

First Look At FAP-2286

Shortly after reporting the Rubraca data, the company reported initial data from FAP-2286, FAP-2286 is Clovis Oncology’s flagship targeted radionuclide therapy “TRT” program. The Phase I portion of the Lumiere study is assessing the safety of FAP-2286 and to ascertain the dose to be used in Phase II as well as the dosing schedule.

In terms of early efficacy indications, organ dosimetry revealed tumor uptake in a variety of tumor types with sustained tumor retention of 177Lu-FAP-2286. The company reported a partial response in a “heavily pre-treated” pseudomyxoma peritonei of appendiceal patient in the 3.7 GBq dose cohort who completed six rounds of 177Lu-FAP-2286. In addition, Clovis revealed that there was a drop in serum tumor marker carcinoembryonic antigen “CEA”.

The reported initial safety grades established that treatment-emergent adverse events were “generally mild to moderate” and there were no dose-limiting toxicities witnessed in the 3.7 GBq or 5.55 GBq cohorts.

The company is recruiting for the 7.4 GBq third dose cohort and expects to present supplementary clinical data at a nuclear medicine meeting later this year. Clovis plans to initiate a Phase II with expansion cohorts for multiple tumor types in Q4 of this year.

Looking at the data above, it looks as if FAP is a legitimate theranostic target in multiple solid tumors. The data from the first two dose cohorts established an acceptable safety profile, with some early indications of activity. I believe this initial data validates the company’s decision to take on this new endeavor, which could ultimately lead to Clovis becoming a leader in targeted radiotherapy.

Buyout Rumors… Again

Following the Rubraca and FAP-2286 data, rumors began to spread that Sanofi is contemplating acquiring Clovis. This would not be the first time Sanofi has been rumored about making a bid for a PARP-inhibitor company. Sanofi was whispered to have had their eyes set on Tesaro a few years ago before they were acquired by GSK, so a story about a potential Sanofi buyout seems like it has some legitimacy.

It is important to note that Clovis has had numerous buyout rumors over the past decade with valuations around $3B and buyout prices at $179 per share. However, the frequency of the buyout rumors began to slow and the potency of the rumors began to fade despite the story appearing credible.

This time, I suspect the Sanofi rumor to have a prolonged influence on the share price considering the current M&A environment, the company’s recent data, and Sanofi’s lack of deal-making in 2022.

Indeed, we don’t know if a buyout will occur and if Sanofi will be the potential buyer. However, rumors can be true… and if not, they at least bring the spotlight onto oversold tickers such as CLVS.

No Reverse Split

Recently, Clovis publicized the results of their annual stockholder meeting which revealed that the investors did not approve the proposed 1-for-7 reverse stock split. Reverse stock splits typically have a negative impact on the share price in the subsequent trading days as investors anticipate dilution in the form of a secondary offering or the company utilizing an ATM offering. So, the no reverse split news might have eased these fears for the immediate term allowing the share price to rocket and hit prices we haven’t seen since April of this year.

Heavy Downside Risks Remain

My biggest concern is the company’s cash position, which was $122.2M in cash and cash equivalents at the end of Q1. The company had a -$60.2M net income and -$58.5M in cash from operations in Q1, so we can’t expect that cash position to last into 2023. What is more, the company has $653.56M in total debt that is looking to be insurmountable when the company is only expected to pull in roughly $155M this year and report a -$1.70 EPS. Indeed, Clovis is projected to report strong growth in the coming years and could have another source of revenue in their TRT programs down the line. Still, a thinning cash position along with a heap of debt should be seen as a major concern and will most likely continue to weigh on the share price until they are addressed.

My Decision

I had set some sizeable buy orders to take advantage of the overblown selloff and was able to get my cost average under $1 per share. Now, I am trying to decide whether to hold that position until the share price hits the Sell Targets set in my Compounding Healthcare “Bio Boom” portfolio or unload a large portion at 200%+ profit. Typically, I would be patient and stick to my Sell Targets, but the ticker’s downside risks could continue to attract short-sellers after the buyout hype begins to fade. On the other hand, the recent data and buyout rumor might continue to buck short-sellers as biotech tickers finally start to catch a bid after nearly a year and a half of selling pressure.

Do I risk losing profits and reclaiming a “house money” position? Or… Do I risk missing out on a major move higher and hit my Sell Targets?

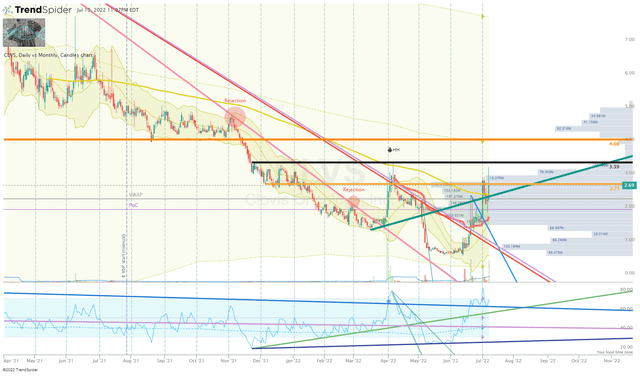

If it was up to the company’s financials and the likelihood of dilution, I would be booking profits and taking a sigh of relief of being back in the “house money” state. However, the CLVS Daily Chart has me leaning towards a more bullish outlook. After nearly a year and a half of sell-off, CLVS was able to break the downtrend after a strong move off the 52-week lows that created a bullish divergence on the Daily RSI.

CLVS Daily Chart (Trendspider)

What is more, we can see the Monthly RSI starting to rise off the bottom, which could an indication that this recent move could turn into a long-term trend.

Accordingly, I have decided to trust my system and my decision to make CLVS a “Top Idea” in my Compounding Healthcare Seeking Alpha Marketplace Service. Therefore, I will hold onto my current position until my Sell Targets are hit.

What will change my mind?

The only thing that really concerns me about CLVS in the near-term is the company’s need to raise cash in order to keep the lights on. As I mentioned above, the company will need to fundraise at some point in the near-term, which could come in the form of dilution. If the company raises cash with an oversized offering below $3.00 per share, I will move my position to “house money” and will wait for the dust to settle before revisiting the position.

My Plan

As I mentioned before, I was able to get my CLVS cost average under $1 per share, and have decided to stick to my Sell Targets with the goal of reacquiring a “House Money” position and holding a core position for a long-term investment.

My strategy is to obtain a house money position by the time the share price hits my second Sell Target, thus, de-risking the position and allowing me to hold a sizeable position long enough to hit Sell 3. However, I will consider reloading the position if the share price drops below my Buy Threshold of $2 per share and will start to aggressively reload if the share price drops below $0.75 per share.

I expect to stick to this strategy for the foreseeable future, which could allow me to generate substantial profit while growing a respectable long-term position that is funded by “House Money”.

Be the first to comment