Sundry Photography

Investment Thesis

Cloudflare (NYSE:NET) continues to put one foot in front of the other and push forward with a plus 50% CAGR. During its earnings call, Cloudflare talks about the challenging macro environment and the importance of focusing on free cash flow to navigate the challenging environment we find ourselves in.

I was previously bearish on this stock, as I believed that too much enthusiasm was being priced in.

Today, I’m bullish on this name. There are still some areas of concern, most notably its valuation, but I believe that with the stock down so significantly in the past year, this is probably the best time to get interested in NET.

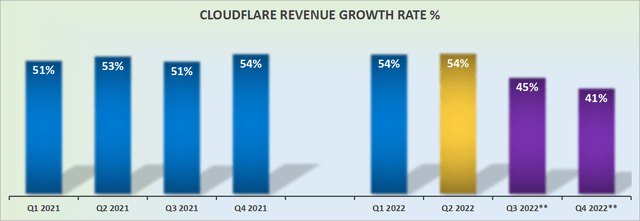

Cloudflare’s Revenue Growth Rates, Still Above 50% CAGR

Cloudflare’s revenue growth rates

Cloudflare’s revenue growth rates have been consistently above 50% for the past 8 quarters. And if we exclude the temporary dip below 50% CAGR during the Covid Q2 2020 quarter, when a lot of the world was in chaos, Cloudflare has actually steadily maintained 50% CAGR for an even longer period than this.

Hence, when Cloudflare guides for just slightly above 40% CAGR for the back end of 2022, I’m thoroughly inclined to believe that Cloudflare will end up upwards revising that guidance on the back of its Q3 2022 results.

What’s more, recall that from Q4 2021 into Q1 2022, Cloudflare added approximately $25 million to the midpoint of its full-year 2022 revenue growth rate guidance.

Then, from Q1 into Q2, Cloudflare added a further $18 million to its full-year 2022 revenue guidance.

Consequently, I believe that the business has enough momentum to end up once again upwards revising its full-year revenue guidance, once it reports its Q3 2022 results.

Essentially, despite everything that’s happening in the world, if Cloudflare can upwards revise its guidance, this can only mean that when the skies brighten up slightly further, Cloudflare can impress even further.

Cloudflare’s Near-Term Prospects

The only notable blemish on Cloudflare’s results was that its total paying customers only grew 20% y/y. This is the slowest pace of customer addition that we’ve seen going back to Q4 2019 when total customers grew by 16% y/y growth and the next quarter was Q1 2020 when total customer growth was 21% y/y.

A lot of investors will rapidly look beyond this business metric and highlight that Cloudflare’s +$100K customers continue to grow at a steady clip. And this too is of course accurate.

However, it’s important at the same time to see a very healthy bottom-of-the-funnel customer addition, and this will be something to keep one’s eye on going forward.

On the other hand, as Cloudflare noted on its earnings call, customers paying more than $100K per year, now account for 60% of its total revenues. This implies that its biggest customers, the biggest enterprises with the deepest pockets and less likely to be impacted by the slowing economic environment, will continue to support Cloudflare’s trajectory.

On yet the third hand, Cloudflare openly discusses that there’s a more challenging environment at play, saying on its Q2 earnings call,

In Q1, our pipeline generation slowed, sales cycles extended, and customers took longer to pay their bills. We watched those metrics closely throughout Q2 and saw them all at least stabilized. They’re not where we throw up hooray yet, but the metrics are trending in the right direction. (Emphasis added)

On balance, I do believe as Cloudflare discusses, that some companies are more “recession-resilient than others” and that Cloudflare will continue to deliver substantially above market growth rates.

NET Stock Valuation – Never Cheap

Cloudflare is not a cheap stock, priced at 24x forward sales. That being said, Cloudflare has never been cheap. It’s a business that openly discusses the fact that it has no plan to maximize profitability. As a reminder, this is what Cloudflare’s CEO and founder previously stated last earnings call,

I think that we’ve been very consistent at saying that we are going to hold as close to breakeven on our operating margin as we can. I said on a previous call that if we showed massively positive earnings per share, that would mean something that we did something wrong because if we can continue to grow at the rates that we’re guiding towards, there’s nowhere else we should be putting that money other than back into the business to grow the business as quickly as possible. (Emphasis added)

That being said, while I fully recognize that the business has what it takes to be both disruptive and growing at breakneck speed, that doesn’t detract from the fact that the stock is not cheap.

Yet, as we go through what has been a truly tumultuous period in the past several months, only the best of the best companies have been able to continue their very strong growth rates. During this earnings season, we’ve seen plenty of high flyers get shot down.

Nevertheless, let’s not forget that the stock is down more than 60% from its former highs, despite the nearly 30% jump on Friday.

To say that a lot of enthusiasm for Cloudflare has now washed out is putting it mildly. The investors that are now still holding onto the stock are only those investors that would not sell at any price.

When you get an absence of sellers, anyone visiting the stock is likely to be a buyer. That’s a very favorable setup for future investors.

The Bottom Line

As I touched on throughout, there are two themes overriding this investment thesis. On the one hand, the stock is not cheap, even today. On the other hand, the business is unquestionably growing at a breakneck speed and showing no near-term slowdown.

However, I believe that everything boils down to the following. There’s really no question that the market has truly smashed to pieces the “growth” sector of the market. With the effect that any investor that bought Cloudflare in the past year is more likely than not to hold losses today. And if they haven’t sold out despite their losses, they are less likely to be selling now, as they hope to return to breakeven, as the stock retraces higher.

All considered, I believe that there’s a positive setup in NET.

Be the first to comment