Steve Jennings/Getty Images Entertainment

Introduction

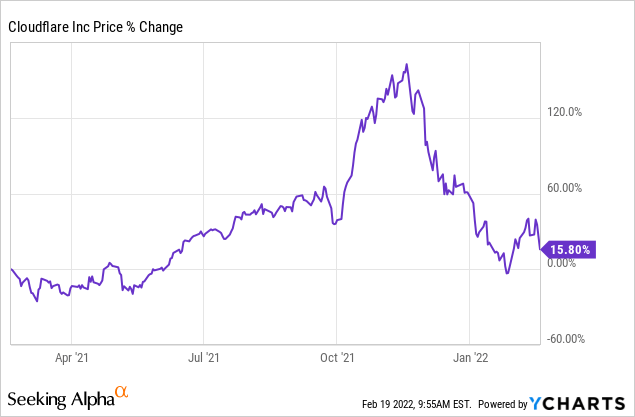

Cloudflare (NET) has been on a wild ride recently. I picked it as a Potential Multibagger at $39 and I still hold it firmly, despite the rollercoaster price moves. This is the last year, for example.

Last week, Cloudflare announced its earnings. Cloudflare inked another impressive quarter and announced an exciting acquisition. Let’s go into more detail.

How were Cloudflare’s earnings?

Revenue came in at $193.6M, up 53.8% YoY and a beat of $8.73M. For the year, revenue came in at $656M, up 52% YoY, marking the fifth consecutive year of growth higher than 50%. Impressive, as usual. Revenue is expected to come down with growth. As founder and CEO Matthew Prince said on the conference call:

Our growth has been relentlessly consistent. We have dialed in our business. We understand and we are in control of its levers.

He immediately couples a competitive advantage to that situation.

You can see that in metrics like our gross margin. While talk across the industry is about increasing cost and pricing pressure, we achieved a gross margin of 79%. That remains above our long-term target gross margin range of 75% to 77% and creates some opportunities. We expect to use this exceptional gross margin as a weapon to take business from competitors more vulnerable than we are to pricing and cost pressures. It also allows us to bundle together products into an overall platform no competitor can match.

Indeed, Cloudflare’s non-GAAP gross profit was $153.3M or 79.2% gross margin, up from 78.1% in Q4 of 2020.

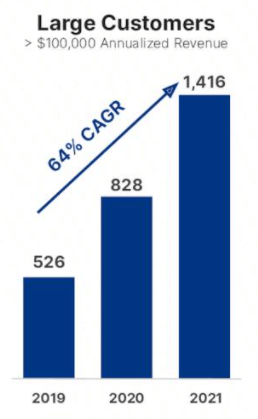

The main growth factor for Cloudflare remains big customers. The company added 156 new large customers (spending more than $100K). That brings the total number of large customers to 1,416, up 71%. This is an acceleration from the past few years.

Big customers Cloudflare (Cloudflare earnings call presentation)

(Source)

And the largest of the large customers even grow faster. Matthew Prince on the conference call:

For the full year, we are also breaking out our large customers into cohorts of those with spend greater than $500,000 and $1 million. We ended the year with 121 customers that spend over $500,000 with us, a 70% increase year-over-year. We ended the year with 56 customers that spend over $1 million with us, a 75% increase year-over-year.

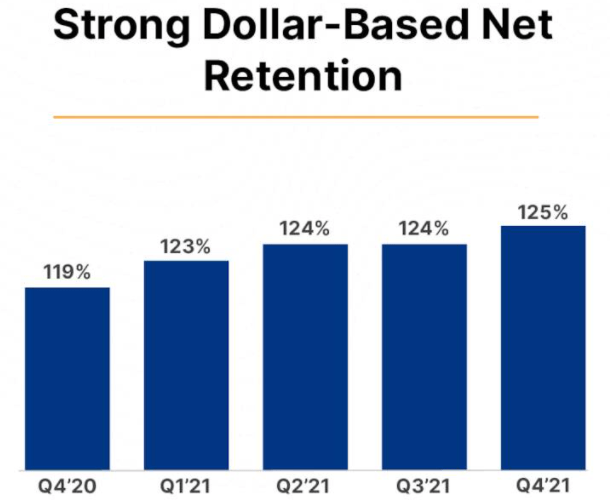

Another element contributing to the high growth is dollar-based net retention, which ticked up to a record 125%, up 6% compared to Q4 2020.

Cloudflare’s DBNRR (Cloudflare’s Q4 2021 earnings call deck)

There are two things to shortly explain here. Some companies use dollar-based net expansion rates, others dollar-based net retention rates, as Cloudflare does. The difference is that net expansion rates take the customers who have stayed on the platform and look at how much more they spent. So, suppose you start with 100 customers who all spend $1,000 in year 1. In the second year, 10 customers leave and the other customers spend $1,250 in year 2. Then the net expansion rate is 125%. But the net retention also takes churn into account. Net retention rate would just be 112.5% because of this: (90x$1,250)/(100*1,000).

The second important element is that companies with more SMBs (small and medium-sized businesses) as their customers will usually have lower dollar-based net retention rates because smaller businesses more often fail than big enterprises. Cloudflare started with smaller customers, but now just above 50% of the revenue comes from the big customers (+$100K). In this context, in which still almost half of the revenue comes from SMBs, I think a 125% DBNRR is very impressive. Because of the high growth of the biggest customers and Cloudflare’s continuous additions of new products, I expect the DBNRR to continue growing slowly, even though it’s high already.

Geographically, EMEA (Europe-Middle-East-Africa) was the biggest grower again, growing by 60% YoY. Cloudflare benefits from the increasing focus on GDPR and data privacy in Europe. EMEA now represents 27% of revenue. APAC (Asia-Pacific) grew 29% YoY, an acceleration but still not at the same pace of the other markets Cloudflare operates in. It accounts for 14% of the revenue. The US represents 52% of revenue and grew 52% YoY.

The company was free cash flow positive for the first time but the next two quarters, it will invest more. Matthew Prince on the conference call:

In the short-term, we expect we will see negative cash flows for the next two quarters as we invest in our network and redesign our physical offices for a post-COVID world. But by the second half of the year, we forecast we will be free cash flow positive. We admire and seek to emulate other companies that came before us and had significant cash flows while holding operating margins at breakeven.

This is what I call the Amazon model because Amazon was the first major company working like this. It shows what we can expect from Cloudflare for the future as well. I think Cloudflare is a good money allocator. There was a question about the increased capex that is projected and CFO Thomas Seifert stressed that Cloudflare invested only in the capacity that it needed. It needed to upgrade its network for bigger clients. Therefore there will be a slight uptick from 11% to 12% of revenue to 12% to 14% over the next two quarters.

We don’t invest free in idle capacity and hope that we fill it over time. So, we follow demand expansion with existing customers as you heard Matthew is the first priority. So, there is little investment in this guidance that is ahead of demand that we hope we generate. There is very little at this point in – for R2 and Offices because we can follow demand.

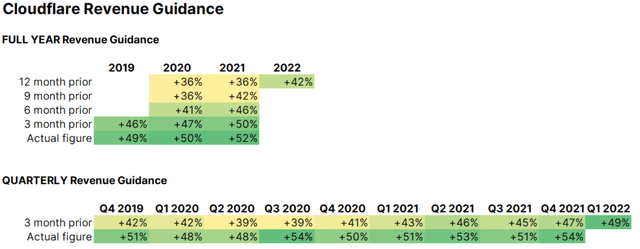

For 2022, the company guides for $927M to $931M in revenue. That’s 42% revenue growth. But Cloudflare is a very conservative guider. It guided for $591M for FY 2021 and revenue came in at $656M, 11% higher. I see no reason why this would be different this time. This tweet gives an excellent overview of Cloudflare’s guidance history:

Cloudflare guidance vs results (Twitter)

As you can see, the guidance is going up, both for the year and for the quarter. And the best thing is that revenue also goes up if you look year over year. So that’s great to see.

So, to summarize, a great quarter with accelerating growth and great guidance.

Updates on Cloudflare’s products

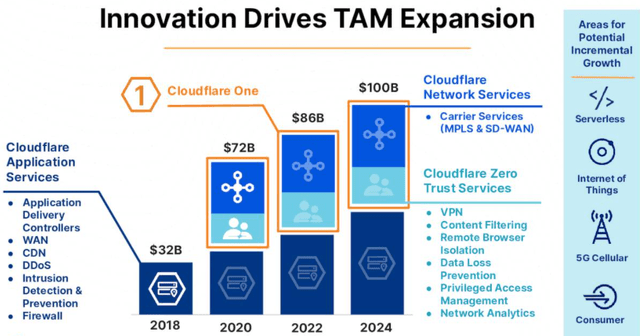

Cloudflare is always innovating and adding new products, which makes their TAM (total addressable market) bigger and bigger.

Cloudflare’s TAM (Q4 2021 Earnings slide deck)

Matthew Prince sees three stages of growth for Cloudflare.

I think something that we think of as sort of Act 1 was the CDN, WAF, DDoS, DNS, those types of products. Act 2 is our zero trust product, which I think we are square in the middle of and where a lot of our growth is coming from. I think Act 3 is Workers, and that’s still, I don’t think has hit really the hockey stick sort of point in the growth curve.

And yes, act two is growing very fast. Three examples of the several that Matthew Prince gave on the conference call:

Let me highlight some great wins we have at Zero Trust and other products over the quarter. A global Fortune 500 telecommunications company signed a $1 million annual contract for over 100,000 Zero Trust seats. This customer initially started on a self-service plan with fewer than 500 seats two years ago.

(…)

For instance, a Fortune 500 financial services company expanded their use of our platform by signing a $900,000 3-year expansion deal, bringing their annual contract value to over $1.5 million. They described us as “future proof.” It’s an example of us bundling our platform to give them access to a broad set of our features while minimizing procurement friction.

A Fortune 1000 shipping and logistics company signed a similar platform bundled deal, which more than doubles their 3-year contract value to $3 million. They specifically appreciated how Cloudflare was a single vendor they could turn to, to deliver the future of their corporate network.

As you see, Prince highlights the factors here why customers choose Cloudflare: one platform, future-proof, a broad set of features…

Workers is indeed very important for the future of Cloudflare. It’s a serverless application platform. Developers can execute and make their applications on Cloudflare’s edge network. Code can be deployed across the globe and it runs as close as possible to the end user. It’s an alternative to AWS Lambda or Lambda@Edge but quite a bit cheaper.

Matthew Prince is very excited about Workers and he sees a ‘clear path’ for one million developers on Workers in 2022. If you look at the above chart (Innovation drives TAM expansion), you see that Workers is not even included. It’s on the right hand side in the blue box, serverless. You have to see Workers in combination with R2 (Cloudflare’s cheaper alternative to AWS’s S3, and Pages (to develop and deploy sites), . It’s the start of Cloudflare as a competitor to become the ‘the fourth cloud’ as they called it (next to AWS, GCP and Azure). And there is a lot of excitement about R2, it seems. Matthew Prince on the conference call:

R2, our zero egress office store, has had more than 9,000 sign-ups for its closed beta, including some incredible logos. It represents hundreds of petabytes of storage and demonstrates the palpable excitement around our workers’ developer platform. We are on track for R2 to progress to open beta in Q2 and then be generally available in the second half of 2022.

And also:

I am looking forward to the day that I can share the logos of who, talking about bringing data over, but we have hundreds of petabytes of data that we are confident will, as R2 goes GA be able to move over to our platform. And I think that again, it’s exciting for the revenue that, that will generate.

R2 will not only make Workers a more logical choice, cementing its position even more, but it will also unlock the cloud, Matthew Prince says.

… it’s going to help unlock the cloud, because I think that other cloud providers will have to respond to this and it is a win for the entire industry if we are able to drive what are egregious egress fees down. And what we want to make sure is that customers can choose products based on whoever is the best out there, and we are confident that we have got a platform that can win on the performance, security, reliability and cost side.

R2 is expected to be in open beta in Q2 and generally available in Q4.

Workers is already a part of 20% of the enterprise deals, so it’s scaling fast, but it will be even more powerful in combination with R2.

I really like that Cloudflare evolves so fast. While it’s in act 2, zero trust, and growing very fast there, it’s act 3 is already completely visible and ready to rock!

Cloudflare’s acquisition of Vectrix

Cloudflare also announced the acquisition of Vectrix. As far as I know, the price was not disclosed. Cloudflare sometimes makes these small acquisitions if they think they see something they can use and it’s faster and better to buy the solution than to make it from scratch. This is how Matthew Prince talked about the acquisition of Vectrix on the earnings call:

We have acquired Vectrix, a startup that has built the easiest to use, most powerful CASB we have seen. CASBs, cloud access security brokers, are a category of services that give visibility and control over data stored in SaaS applications. They can be powerful tools, but their Achilles’ heel has always been their complex setup.

The Vectrix team impressed us with how quickly they could onboard any new customer regardless of size and instantly gives them visibility into all the service providers where the customers’ data was stored. As such, their product is a natural add-on to every current Cloudflare customer. They remind me of Cloudflare and our philosophy since our earliest days. The Vectrix team and technology further rounds out our Zero Trust platform, giving visibility not only for data flowing across the network, but now also data at rest in service providers. We believe it makes Cloudflare Zero Trust a no-brainer, comprehensive security solution for any company and we are thrilled to have the Vectrix team onboard.

The founder and CEO of Vectrix explains in a post on Cloudflare’s blog what problem Vectrix addresses:

We built Vectrix to solve a problem that terrified us as security engineers ourselves: how do we know if the SaaS apps we use have the right controls in place? Is our company data protected? SaaS tools make it easy to work with data and collaborate across organizations of any size, but that also makes them vulnerable.

For more technical details, you can also go to the blog post.

Is Cloudflare’s Stock a long-term buy?

With $656M in revenue in 2021 and a market cap of $31B, Cloudflare has a P/S of 45, which is still very expensive, of course. But with its reliable high growth, the company could grow into its valuation nevertheless. It’s forward P/S is 33, still not cheap, of course, but it shows that the valuation can look better over time.

Cloudflare has high gross margins and if you look at the EV/GM (enterprise value/gross margins), you see that it’s also still expensive with an EV/GM of 65. But with the assumption of gross margins of 77% and $1B in revenue (above the guidance because the company is always very conservative), you go to an EV/GM of 42.8. Still expensive, yes, but again falling fast. Another example can be seen in the price to operating cash flow per share ratio. Just three months ago, it was at 4,200, it’s at 463 now. The same here again: still expensive, but getting better fast.

I’m a long-term investor and my personal investment horizon is 20 years, which means that valuations play less of a role in my investments. But even if it’s ‘just’ five years, high-quality revenue growth (not bought revenue growth that costs the company more than it generates) will be more important for the stock price appreciation than pure valuation.

I always dollar-cost average and when a stock is expensive, I just add slower over time. But I don’t want to miss investing in the best companies of our time because of the valuation alone. And Cloudflare is for me one of those rare birds with a very long runway to come. If it keeps executing as it does now, I can still see this as a tenbagger or more over the next 10 years.

In the meantime, keep growing!

Be the first to comment