Cloudflare could be a tech giant in the making Sundry Photography

Investors will turn to Q2 earnings of Cloudflare, Inc. (NYSE:NET) to see if the company has gotten control over its expenses, as cash flow has become king in a period of high inflation and rising interest rates.

This article will argue that investors should look at the size of the opportunity for Cloudflare before making a judgement on short-term challenges like higher expenses. My view is that any weakness in the stock should be viewed as a positive if the bigger picture remains intact. The current contrast between the opportunity ahead of the company compared to its current market cap is staggering. Add to that the high barriers to entry thanks to the heavy capex, and the stock should at least be worth a look by investors capable of stomaching the volatility

Learning from Railroads

Cloudflare and railroads have a lot in common; both connect people and products, albeit in Cloudflare’s case it does so digitally. Both also began as hyped-up new technologies that rose to prominence in difficult periods. For Cloudflare, it was the pandemic, for the railroads, it was the 1894 strike. This excerpt from the Library of Congress sums up some of the similarities nicely:

The railroad opened the way for the settlement of the West, provided new economic opportunities, stimulated the development of town and communities, and generally tied the country together. When the railroads were shut down during the great railroad strike of 1894, the true importance of the railroads was fully realized.

They also had phenomenal stock returns that eventually fizzled; Cloudflare’s stock gained more than 340% and 70% in 2020 and 2021 respectively before finding itself down more than 70% from the high. The rail industry for its part was more than 50% of the US stock market by 1900.

Cloudflare’s Rail

Cloudflare is the Railroad of the 21st Century (Cloudflare)

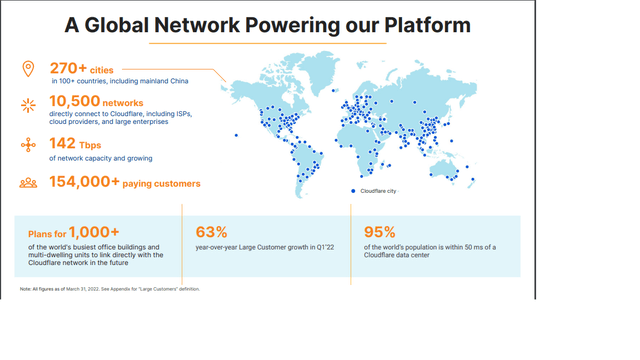

The biggest similarity between Cloudflare and the railroads is what sets the former apart from other SaaS businesses; building more than 10,000 networks in 100 countries including China requires the company to spend 12%-14% of revenue on network capex. It is one of the few software businesses that is capital intensive. And while that may be bad for margins in some respect, it also represents a barrier to entry that other SaaS businesses don’t have. At its core, the company helps websites run smoothly for internet users. And to do so it has to build servers around the world close to users to ensure web traffic runs smoothly. It then complements that with other services like security for example. So not only does the company have a moat in the fixed-costs required to build a similar network, it offers mission-critical software that has inherent switching costs that would make any company think hard before replacing it.

Cloudflare is also very efficient in building out its network. Akamai Technologies, Inc. (AKAM) has a depreciation expense of $555 million that built a network with a capacity of 300 Tbps (Terabytes per second). Cloudflare has almost half that capacity (shown in the slide) while incurring $66 million in depreciation.

Cloudflare is Coming for the Amazon Tax

We are aiming to be the fourth major public cloud.

Cloudflare CEO Mathew Prince was clear about the company’s intentions, it won’t settle for being a railway delivering goods to other consumers, it will leverage its network to offer enterprise solutions at cutthroat prices that are also pure margin for the company. And it will keep expanding the breadth of its software solutions until it is a giant enterprise software company with massive and reliable subscription revenue.

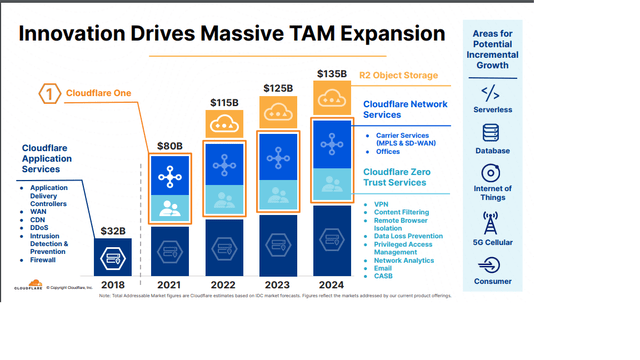

Cloudflare is expanding its solutions sweet to rival public clouds (Cloudflare)

The company is looking to benefit from the big margins of IaaS companies like Amazon.com, Inc. (AMZN) and Microsoft Corporation (MSFT) and grow its products to eventually rival those companies. It used the data servers it initially built for CDNs to offer a wider breadth of services (shown in the picture) that are cheaper than competitors yet simultaneously increase the margins of the business dramatically. Here is CEO Mathew Prince Making that point in more detail:

how we think about products. And again, if we invest behind the resource as opposed to investing in front of it. So we’ve deployed all these servers all around the world and every single quarter, our infrastructure team, our product and our product team get together and they asked the question, where are we running hot, right? Where do we need to deploy more resources and then where do we have excess resources? And one of the things that we realized was we had a whole bunch of access storage that was running around the world. And so we can actually build a product to take advantage of that. And then as we see demand pick up, then invest behind that demand.

In fact, many of its products are free. Yet despite offering free and cheap products, it still manages gross margins above 70%. That gross margin is likely safe given the advantages mentioned in the earlier section. So investors can expect a higher operating margin as the company matures and the pace of building out data servers decreases over time.

The launch of the R2 Object Storage solution (a cloud storage solution) in particular is the first real shot at Amazon and Microsoft. Competing with companies like those two is never easy, and the CEO admitted the company won’t offer a comparable product in terms of quality at first. This is especially true when it comes to providing developers with the ability to apply different analytics tools to their stored data.

But there are some advantages to using Cloudflare’s solution; it is cheaper, and companies won’t have to pay a fee if they decide to transfer its data to a competing service (unlike the case with the major public clouds).

For Cloudflare, the service will also be profitable even though its priced at half what Amazon charges, because it has lower operating and bandwidth costs compared to competitors.

This has been Cloudflare’s strategy from the start; offer a ridiculously cheap product that appeals to smaller companies not served by incumbents, then add higher margin solutions as customers scale and eventually start targeting enterprise customers. Mathew Prince said this about the company’s strategy and bigger competition back in 2010:

I’m really a big fan of Clay Christensen, he was a business school professor of mine, and I like the idea of businesses that come in from below. The big incumbents have an Innovator’s Dilemma trying to come down and deal with a company like ours.

For investors, given both Microsoft and Amazon are valued north of a 100x Cloudflare, any 1% in market share the company gains will be of huge consequence to stock returns.

Risks

While Cloudflare is chasing a massive TAM with a clear moat given its capex-heavy business, there is no guarantee the company is successful in its endeavor. Making matters worse is that the company is unprofitable, so it’s virtually impossible to try and assess a bear-case value for the company. Investors might be better advised to keep an eye on the company to see how it advances towards its goals. as a result, the company is a hold. However, for growth investors who are seeking to put a small percentage of their portfolio across a host of promising companies accepting that only a handful will work out, Cloudflare is among the best options they should consider.

Conclusion

Cloudflare is trading at a tiny market cap compared to the size of the opportunity it has and its importance to the internet. It is one of the few small SaaS companies that has some barriers to entry. Its mission-critical software might also make it less susceptible to a recession. Those advantages are counter-balanced by the fact it is competing with giants like Amazon and Microsoft. Another issue is that its lack of profitability on almost every metric, while somewhat understandable given the size of the opportunity, makes it virtually impossible to value the company.

Be the first to comment