Just_Super

Investment Thesis

In my last article on the Global X Cloud Computing ETF (NASDAQ:CLOU), I highlighted some of the risks associated with investing in high multiple stocks in a rising rate environment. Since then, CLOU has lost ~7% vs a loss of ~3% for the S&P 500. Tech stocks have rebounded sharply since mid-June 2022 in what I consider to be a very aggressive bear market rally fueled by the Fed pivot narrative. While policymakers will probably slow down the pace of rate hikes (and accelerate quantitative tightening), I don’t believe that a pivot is on the table, for now at least. Given where valuations are in the cloud industry, investors continue to face a rude awakening once they realize that liquidity is gradually declining.

What Has Happened Since My Last Article

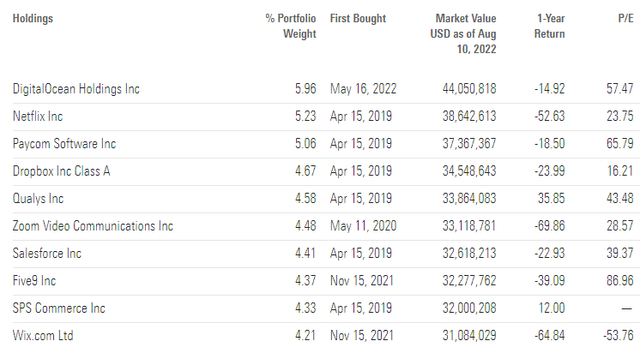

As a reminder, the Global X Cloud Computing ETF invests in companies positioned to benefit from the increased adoption of cloud computing technology, including companies whose principal business is in offering computing Software-as-a-Service, Platform-as-a-Service, and Infrastructure-as-a-Service. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

I concluded my previous article with the following statement:

CLOU gives investors access to a portfolio of fast-growing international firms largely focused on cloud software and services. While I am confident that cloud computing is here to stay, I believe it is difficult to predict today’s winners. Furthermore, cloud stocks trade at high multiples going into a new monetary regime where liquidity will be inadequate to sustain such valuations. All in all, I believe patient investors will be able to pick up CLOU shares cheaper in the next 12 months.

The subsequent price action gave investors multiple opportunities to accumulate shares at a lower price, sometimes at a discount as low as ~24% compared to mid-April. Unsurprisingly, CLOU was more volatile than the Invesco QQQ ETF (QQQ) and had larger drawdowns. For comparison, CLOU lost nearly ~8% compared to a loss of ~3% for QQQ since mid-April 2022.

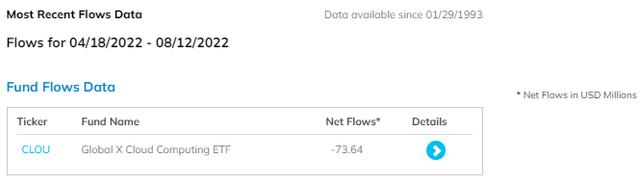

Liquidity is now starting to gradually decrease in financial markets, and equities are no exception. CLOU registered ~$74 million in outflows over the last 3 months, which is in line with the net flow activity of other long-duration cloud strategies such as First Trust Cloud Computing ETF (SKYY).

Focusing On Valuations And Rates

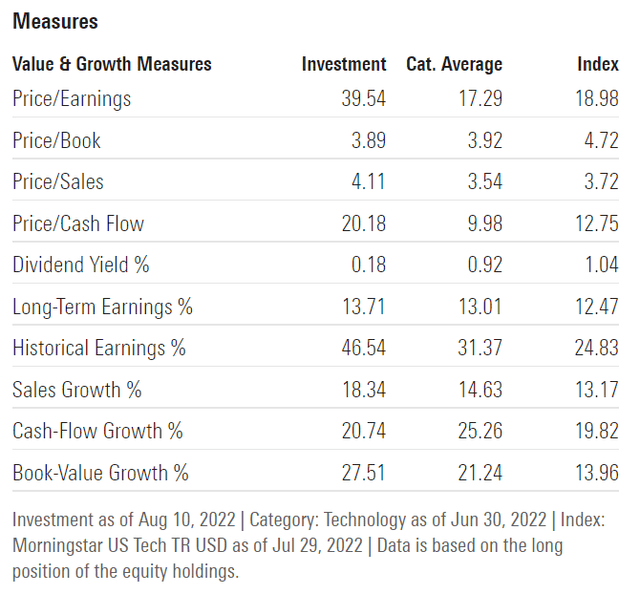

In my previous article on CLOU, I identified valuations to be the main threat to future returns. Despite a sharp pullback in May and June 2022, CLOU and other tech stocks have rebounded sharply in what I believe to be a bear market rally. As a result, valuations are back to a near all-time high. CLOU trades at ~40x earnings and has a price-to-book ratio of ~4 which makes it very expensive in a rising rate environment.

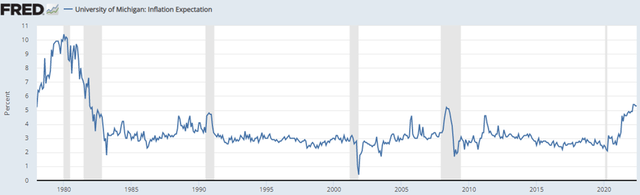

Following the last FOMC meeting, there has been a new debate around a Fed pivot, which should ultimately favor high-multiple stocks. That said, I believe it’s hard to bet on a pivot just yet. Inflation remains sticky, as illustrated by the recent 1-yr forward consumer expectations. A strong labor market and a hot rental market remain key issues to be addressed through higher rates in the coming months. Perhaps the best source of information on the topic is the Fed itself. Last week, President Bullard “said the central bank will continue raising rates until it sees compelling evidence that inflation is falling” and other Presidents have also adopted a hawkish tone in recent weeks. While we might see a slower pace of interest rate hikes, I think it’s premature to anticipate a pivot in 2022.

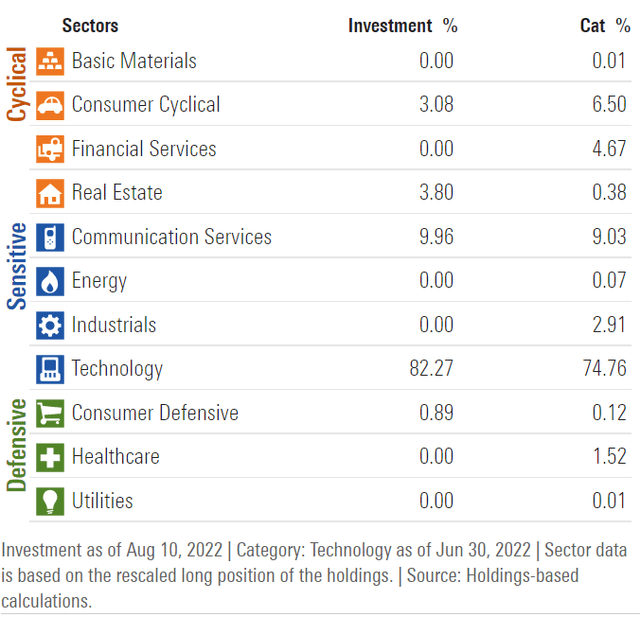

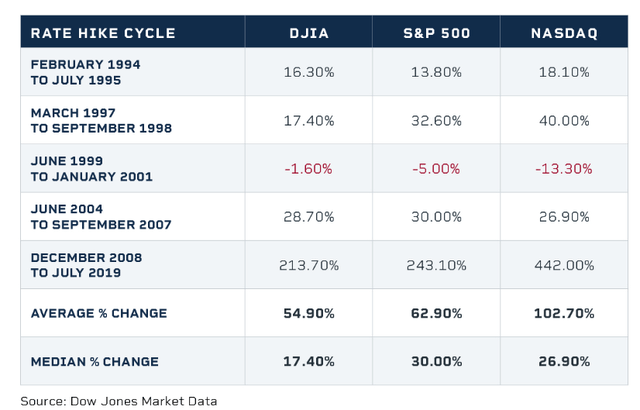

CLOU has over 80% exposure to tech stocks, which makes this strategy very volatile due to changes in interest rate expectations. While some market analysts could argue that tech stocks held up pretty well during previous tightening cycles, I am more worried about the outcome resulting from lower liquidity, which generally translates into a slowing economy and poor stock market returns. Both 2001 and 2008 are good examples of possible outcomes due to higher rates, while the 90s seem to be the exception.

All in all, I think this is a treacherous market for tech investors. “Don’t fight the Fed” was the main theme of the past decade and it worked very well for high beta strategies. However, turning/staying bullish today seems to me like breaking with the past. A pivot is unlikely to happen in the next couple of months, which makes CLOU a risky and volatile play for now. As a result, protecting the portfolio against major drawdowns seems to be a priority. For those who want to get long CLOU, I believe that LEAP call options are the best way to maximize returns while minimizing your losses.

Key Takeaways

CLOU underperformed the Nasdaq 100 since my previous article. This comes as no surprise given the fact that the strategy generally tends to outperform in good times and underperform in bad times. Since mid-June 2022, tech stocks have rallied rapidly powered by the idea of a potential pivot in terms of monetary policy. While policymakers will probably decrease the pace of rate hikes, I don’t believe a pivot is on the table for the time being. As a result, the combination of higher rates for a longer period of time coupled with lofty valuations in the cloud sector remains a major headwind for CLOU’s future returns.

Be the first to comment