PeopleImages/iStock via Getty Images

Clorox (CLX) reported a horrendous quarter for Q2 FY 2022. The company beat revenue estimates, but they still declined in comparable periods. However, Clorox missed non-GAAP earnings per share estimates by a wide margin. The share price was slammed and fell about (-15%) in one day. The culprit was higher input commodity costs and transportation costs resulting in a massive gross margin contraction of 1,240 basis points to ~33% from ~45%. In addition, Clorox cut its non-GAAP EPS estimates to $4.25 – $4.50 from $5.40 – $5.70 for the quarter. As a result, analysts are now bearish on Clorox. The Seeking Alpha ratings summary is Hold from Wall Street and Sell from SA Authors. In fact, the last ten articles have either been a sell or hold by SA authors as of this writing. Clearly, the investor sentiment about Clorox is strongly negative. However, despite the bad news about Clorox, an investor must always ask whether it is time to be contrarian.

Clorox’s stock price is now trading at levels seen before the COVID-19 pandemic in 2018. Investors must ask themselves whether Clorox is worth less than before the pandemic. In addition, Clorox has leading brands with the No. 1 or No. 2 market position for the great majority of them. Furthermore, Clorox is a Dividend Champion and Dividend Aristocrat with 45 years of dividend increases. The dividend yield is now over 3.25%, which is attractive. Lastly, Clorox is not standing still and is working to increase margins, although it may take time.

Hence, below are three reasons to why Clorox is a long-term buy.

Clorox Has Market Share Leadership

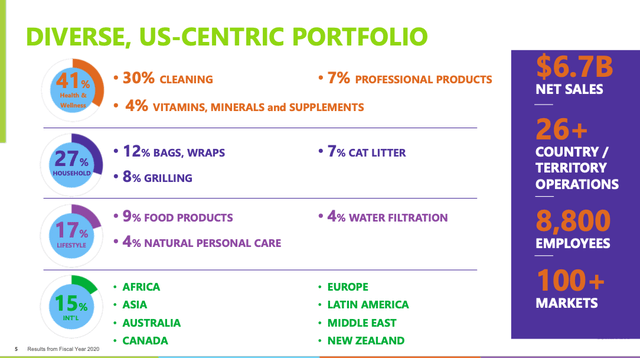

Clorox is a leader in mid-size consumer products. The company operates in three business segments: Health & Wellness (41% of revenue), Household (27% of revenue), and Lifestyle (15% of revenue). Clorox had $7,341 million in revenue in fiscal 2021 from 26 countries. Clorox is known for its cleaning supplies. The company also sells trash bags, kitty litter, grilling charcoal, water filtration systems, and more.

Clorox’s notable brands are well-known to most consumers. They include Clorox, Glad, Burt’s Bees, Kingsford, Scoop Away, Formula 409, Fresh Step, Pine-Sol, Liquid PLUMR, etc. More than 80% of the company’s brands have the No. 1 or No. 2 market share in their categories. The competitors usually have a much smaller market share. For instance, Clorox has nearly 60% market share in bleach, 54% share in charcoal, and 30% market share in trash bags. The company is also No. 1 in wipes, trash bags, water filtration, salad dressing, and lip balm. It is No. 2 in cat litter and collagen.

Clorox maintains its market share through advertising and incremental innovation. In consumer products, innovation typically consists of improvements to packaging and additional features. For instance, Clorox added scent, extra strength, and leak guards to its trash bags.

Clorox’s Dividend Keep Growing

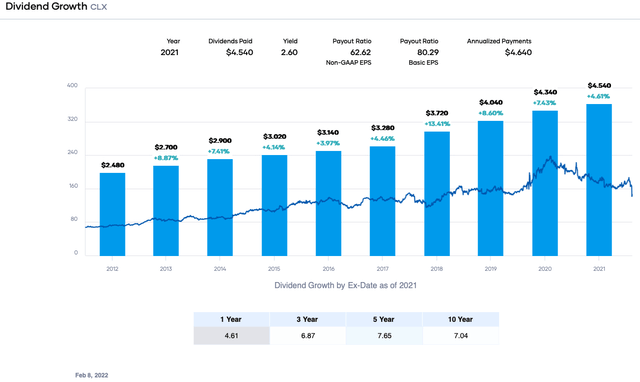

One of the main attractions of Clorox stock is the growing dividend. The company is a Dividend Champion and Dividend Aristocrat. The dividend has been raised for 45 consecutive years. It is unlikely this streak will end due to the current challenges faced by the company. Once a company achieves the 25+ year mark for dividend increases, management tends to resist stopping the increases.

The recent decline in stock price has simultaneously increased Clorox’s dividend yield to about 3.28%. This yield is more than the past 5-year average of ~2.5%. It is also more than double the average dividend yield of the S&P 500 Index.

Clorox’s dividend continues to grow at a decent rate. The past 5-year dividend growth rate is about 7.65%, and the trailing 10-year dividend growth rate is approximately 7.04%.

The dividend safety metrics were acceptable before the current cut to earnings estimates. However, the payout ratio is now over 100% based. This number is based on a forward dividend rate of $4.64 per share and an earnings estimate of $4.40 per share. The payout ratio was about 82% before the cut to earnings estimates. This percentage is still high, but Clorox is a consumer products company and thus viewed as less risky.

From a free cash flow perspective, the dividend is also safe. In the last 12 months, operating cash flow was $869 million. Capital expenditures were $289 million resulting in an FCF of $580 million. The dividend required $563 million, giving a dividend-to-FCF ratio of roughly 97%. This value is above my threshold, but Clorox has taken one-time write-downs and restructuring costs, which have recently impacted the cash flow numbers. In a more typical period and pre-COVID-19, FCF was about $700 – $800 million. This point indicates a dividend-to-FCF ratio of roughly 75% at the mid-point, a more conservative value.

Clorox’s balance sheet has little debt. In the last 12 months, short-term debt was $383 million, the current portion of long-term debt was $600, and long-term debt was $1,886 million. Debt is offset by only ~$216 million in cash and short-term investments. Net debt was about $3,012 million, which is small for a company the size of Clorox. In addition, the leverage ratio was ~2.9X, and interest coverage was around 7.4X. As a result, Clorox can meet its financial obligations, and the dividend is safe from a debt perspective.

Clorox Will Rebuild Margins

Clorox is not standing still regarding margins. Clorox’s management has indicated they have experienced four inflationary cycles in the past decade in the most recent earnings call. The company states,

If I look at our history, this is the fourth inflationary cycle we’ve gone through in the last 10 years. If you look at the 3 previous times we’ve done this, we’ve been able to fully price and drive our cost savings program to offset the cost inflation, rebuild margins. It historically has taken us about 12 to 18 months to do that.

This fact means Clorox will likely raise prices and cut costs to increase margins back to the 43.5% to 45.5% level. However, inflation is the highest in almost four decades. Hence, the time required to rebuild margins will likely be longer.

Clorox plans to raise prices on around 85% of its product portfolio. They are also increasing prices on several brands multiple times. However, pricing increases will probably not benefit Clorox until the H2 FY 2022 and fiscal 2023.

The main point is that lower gross margins are probably a temporary phenomenon for Clorox. Although, rebuilding margins may take two to three years.

Risks to Clorox

Clorox faces several risks for recovering gross margins and restoring momentum for the top and bottom lines. First, Clorox’s products face significant competition from private label brands. For example, bleach has little to no competitive advantage. It is essentially a commodity product with no switching costs-Clorox leverages product extensions, packaging, and marketing to drive sales. If consumers switch to less expensive alternatives during a period of inflation, it will adversely impact Clorox’s sales. However, Clorox has faced private-label competition and has successfully grown sales and earnings.

Next, Clorox is smaller than many of its competitors in household products. Larger companies like Proctor & Gamble (PG), Colgate-Palmolive (CL), Unilever (UL), and privately held SC Johnson & Wax offer significant competition. They have the resources to take market share from Clorox in some markets. That said, Clorox has managed to become the No. 1 and No. 2 company by market share in most of its product lines.

Lastly, Clorox’s input costs are not entirely in their control. Inflation is being driven by higher oil prices, increases in other commodity prices, and higher freight and transportation costs. As a result, inflation was viewed as temporary but more persistent than expected. This point will prevent Clorox from restoring margins.

Final Thoughts on Clorox: Is It Time to Be Contrarian?

Clorox is a stock most dividend growth investors should look at. The company benefitted from the COVID-19 pandemic on the sale of cleaning supplies. However, the tailwind has slowed and turned into a headwind. In addition, inflation is affecting cost inputs for Clorox, lowering margins. This downward movement is probably temporary as the company implements price increases and cuts costs. Investors seeking a decent dividend yield and dividend growth may be interested in Clorox. Granted, the forward price-to-earnings (P/E) ratio is high due to the significant drop in forward earnings estimates, but it should revert to the mean as margins improve. I view Clorox as a long-term buy.

Be the first to comment