JHVEPhoto/iStock Editorial via Getty Images

Cleveland-Cliffs (NYSE:CLF) is managed by one of the finest CEOs I’ve followed, Lourenco Goncalves. Goncalves started off by stabilizing the company, then he improved the efficiency at which it operated, and then he transformed it into the North American steel giant it is now, all while working in shareholders’ best interests. After several years of fantastic business and stock performance, fears of a recession have created an opportunity to buy Cliffs at a compelling value once again. Long-term investors would be wise to accumulate shares via dollar-cost-averaging to benefit from this strong management team and strong competitive position, albeit in a challenging industry.

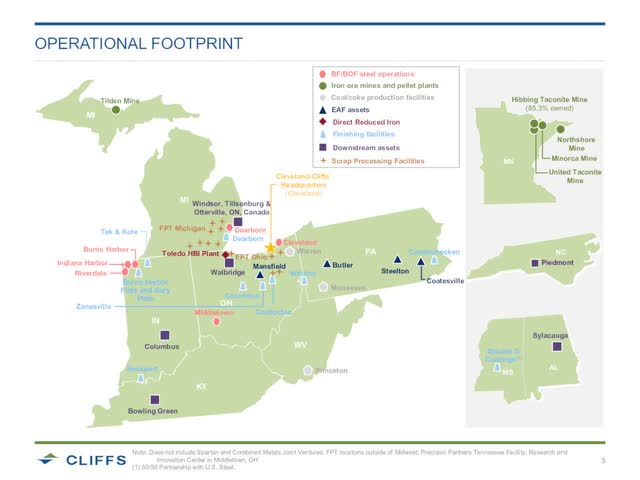

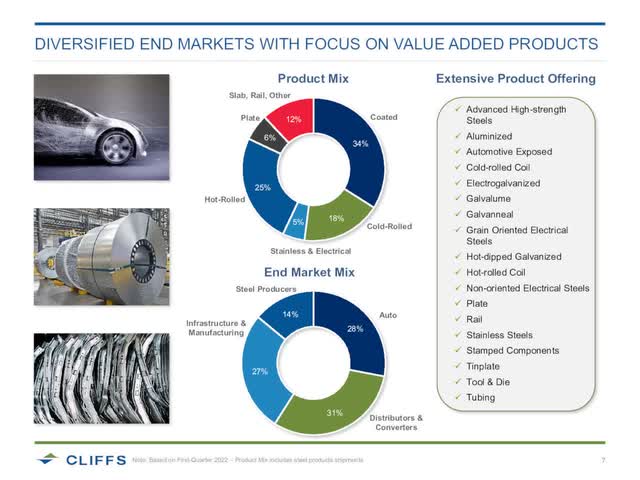

Cleveland-Cliffs is the largest flat-rolled steel producer in North America, and the largest supplier of steel to the automotive industry. The flat-rolled steel industry has seen substantial consolidation over the last 22 years with the big-4 making up 44% of the market in 2000, to now making up 84%. Cleveland-Cliffs is vertically integrated across the whole spectrum of steel production and now scrappage. Cliffs ships approximately 16 million tons of steel per annum, while also being the largest North American minder of iron ore. Value-added steel is an essential ingredient to the movement towards green energy, playing a critical role in electric vehicles/charging stations, wind energy, solar power, and the electric grid. No company is better positioned in the industry to benefit from these key themes than Cleveland-Cliffs.

Source: CLF Investor Presentation

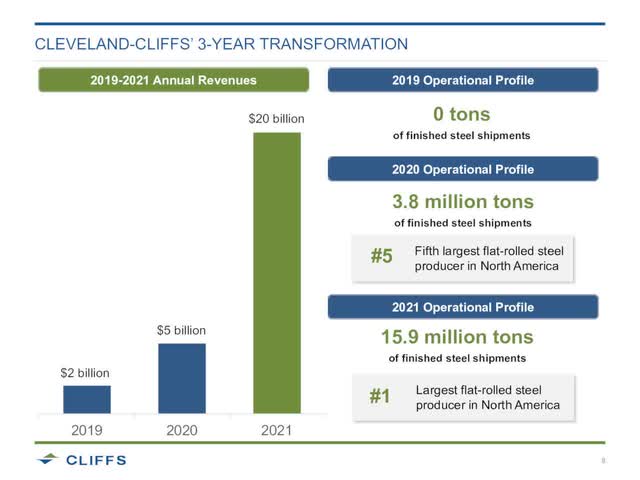

Cleveland-Cliffs’ 3-Year Transformation should be taught at business schools as an example of a strong management team, operating in a challenging industry, and positively transforming the business via strong capital allocation and execution. To set the stage for this transformation the company had to scratch and claw, while many pundits predicted the company’s demise. Goncalves has done a masterful job divesting non-core businesses, improving the safety and efficiency of operations, and making key investments to improve the competitive position. Mixed with this has been stellar capital allocation via stock and debt buybacks at favorable prices.

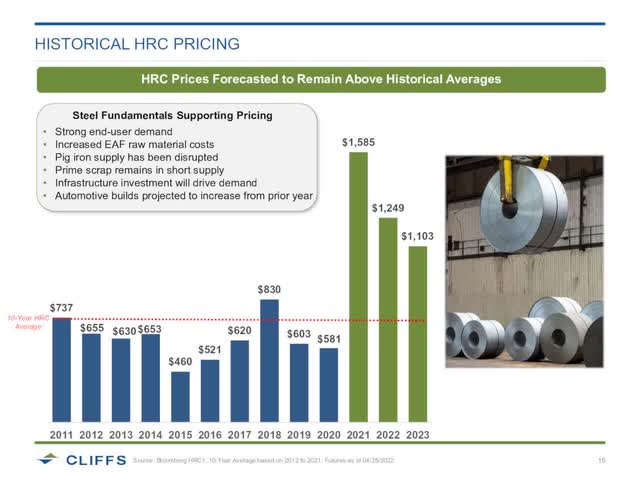

In 1990, 99% of flat-rolled mini-mills were blast furnaces, versus 58% in 2021, with the remainder being EAF. The result of this is that prime scrap demand is up, while prime scrap supply is down, and has been shrinking for the last 50 years due to manufacturing offshoring and improvements in yield. Flat-rolled EAF’s are dependent on prime scrap, pig iron, DRI, and HBI. Cleveland-Cliffs has differentiated itself from its competitors with its self-funded building of an HBI plant in Toledo, Ohio. This made Cliffs the only US flat-rolled steel producer that does not need to rely on pig iron and slabs, much of which comes from Russia and Ukraine, which are not the most reliable suppliers nowadays. They built this plant in a period of extreme pessimism as to the company’s ability to finance the plant without partners, and the overall need for HBI. It was questioned whether Cliffs could find enough customers to make the investment worthwhile. Ultimately, Cliffs made moves that allowed it to fully utilize its production of HBI internally without needing outside customers, but this was the step that set the stage for the following acquisitions, where Cliffs was able to capture more facets of the value chain.

In March 2020, Cleveland-Cliffs announced the successfully completed acquisition of AK Steel Holding Corporation, which integrated the largest producer of iron ore pellets downstream into the production of value-added steel and specialty manufactured parts of the automotive industry. On December 9th 2020, Cliffs completed the acquisition of Arcelor Mittal USA, which formed the largest flat-rolled steel producer in North America. These acquisitions were bought at cheap prices during relatively weak periods for the industry. Analysts were scared about the increased leverage that they put on Cliffs, but management has done a stellar job optimizing the efficiency of the organization, to reduce the fat after each purchase. Cliffs has also taken advantage of periods of weakness in its own bonds to purchase the debt at a discount, reducing the leverage and interest payments. Higher prices on steel have greatly bolstered the bottom line for Cliffs, creating enormous cash flows, which management has prudently deployed to further improve the financial condition of the company to its now enviable position.

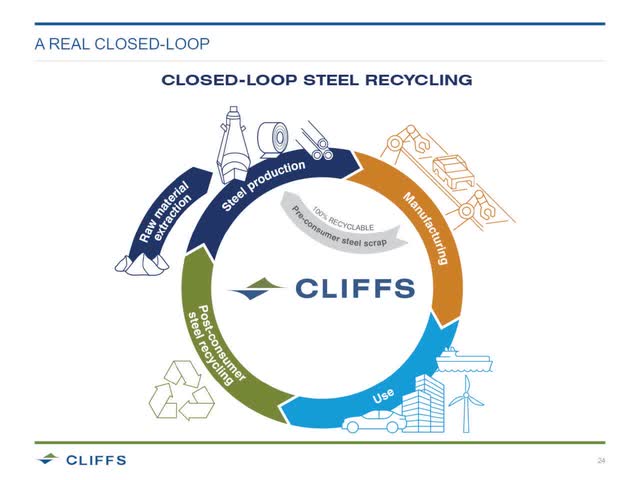

In November 2021, Cleveland-Cliffs completed its acquisition of Ferrous Processing and Trading Company (FPT), entering the scrap business, which really gives Cliffs control over the whole steelmaking and disposition process. Prime scrap is in short supply, so Cliffs’ acquisition keeps with the theme of maintaining independence from other suppliers and becoming indispensable to its customers. FPT is one of the largest processors and distributors of prime ferrous scrap in North America, processing around three million tons per year, with roughly half being prime grade. The rationale of the acquisition is to create a platform where the company can leverage flat-rolled automotive and other customer relationships into closed-loop recycling partnerships to grow its prime scrap presence. Cliffs is the largest source of the steel that generates prime scrap in manufacturing facilities across the country. This also furthers the company’s strategy to commit to environmentally friendly, low carbon intensity steel making, due to the utilization of cleaner materials.

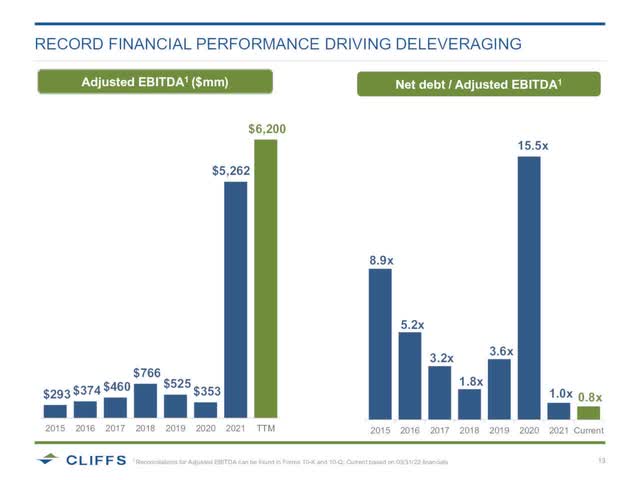

On April 22, Cleveland-Cliffs reported a sensational first quarter, producing $1.5B of adjusted EBITDA, which was more than three times higher than the EBITDA in Q1 2021. Over the last 12 months, Cliffs has generated $6.2B of EBITDA, which is far and away a record for the company. Based on the TTM EBITDA, CLF’s leverage ratio is only 0.8x, putting the company in the soundest financial position it has been in at least the last 12 years. Already this year, Cliffs redeemed its convertible notes and 9.875% secured notes, well ahead of the maturity in 2025. Since the second quarter of 2021, Cliffs has reduced its diluted share count by 9% to 532MM shares. In 2021, Cliffs completed the redemption of all outstanding preferred shares, using $1.3B in cash. Through Q1, the company has announced an additional $1B share repurchase program, so the company can take advantage of the depressed stock price.

Based on a recent share price of $16.27, CLF trades at just 2.4x TTM earnings of $6.83. The Enterprise Value of $14.056B is just 2.26 TTM EBITDA. Cliffs has fixed price contracts, which provide much more stability to earnings, which means that most 2022 revenues are locked-in at this point at even higher prices than what was realized in Q1, despite the recent pullback in steel pricing. Goncalves has a fortress balance sheet, strong cash flows, and a great competitive position to take advantage of weakness if we do indeed go into a recession. Shareholders have seen his track record of prudent capital management, and I’d expect to see buybacks ratcheted up if the share price stays at these levels for long. Even as simple 3x on TTM EBITDA puts the share price about 30% higher than current prices and I think demand is likely to stay above the long-term average for steel with many of the ESG initiatives that are in the works, along with the rebuilding of automotive inventories in the barren dealership networks. While shares could always trade lower, I think there is potential for a lot more to go right than wrong based on the current share price of CLF.

Be the first to comment