iantfoto/E+ via Getty Images

Renewable energy YieldCo Clearway Energy (NYSE:NYSE:CWEN, NYSE:NYSE:CWEN.A) closed out fiscal 2021 achieving many of its stated financial objectives. The company radically expanded its clean energy asset base, improved its CAFD ahead of guidance, and increased the dividend paid to owners of its common shares. It truly was a material year for Clearway with the company closing on roughly $820 million in growth investments as well as the issuance of $1.3 billion in new corporate bonds to bolster its balance sheet. The latter action helped extend its debt maturity profile to 2028 and enabled the company to realize interest rate savings.

Fiscal 2022 looks set to be an even stronger year for asset growth on the back of Clearway’s sale of its Thermal Business. The company expects net proceeds of $1.35 billion to be aggregated with retained growth investment capital of $750 million. This will provide Clearway with the financial capacity to execute its long-term growth objectives. For dividend investors, this includes management’s guidance to achieve the upper range of their 5% to 8% annual dividend growth objective through at least 2026.

This financial outperformance has come against the backdrop of rising energy prices exacerbated by Russia’s invasion of Ukraine. Energy security has suddenly now come back into the national lexicon as the importance to US national security of reduced energy import dependency has been highlighted by the overreliance of other NATO allies on Russia for their energy. This will spark a new world where renewable energy will play an increasingly important role in securing energy independence.

Generating energy from renewable energy sources will hold a vanguard position in the new world that has already seen the US ban imports of Russian oil, liquefied natural gas, and coal.

Clearway’s Fiscal 2021: Asset Growth And Stronger Yield

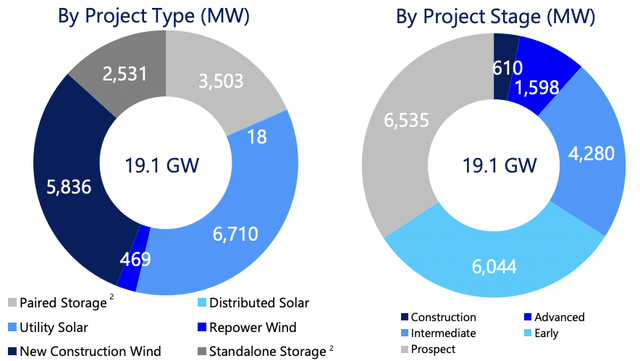

Clearway is one of the largest developers and owner-operators of utility-scale renewable energy projects in the United States. The company continues to expand its clean energy asset base and now owns 5.2 GW of renewable generation assets with an energy pipeline that is set to grow to 19.1 GW. Construction of up to 2 GW of this is expected to commence this year.

Clearway Energy Inc 2021 Financial Results

With a large amount of this pipeline still in the very early stages, Clearway is positioning utility-scale solar to constitute the bulk of its future CAFD and dividend growth at 6.71 GW. This is closely followed by new construction wind and standalone energy storage.

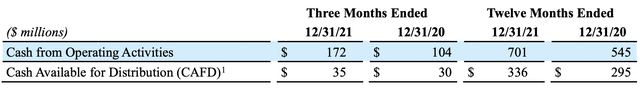

Adjusted EBITDA for the year reached $1.15 billion, a 6.28% increase from the previous year. The company’s cash from operating activities grew to reach $701 million as of the end of its fiscal 2021, this was a 28.6% increase from the previous year. CAFD grew to reach $336 million, a smaller 13.9% increase from the previous year.

Clearway Energy Inc 2021 Financial Results

This provided the backdrop for the company to increase its quarterly dividend by 2% to $0.3468 per share. At $1.3872 annualized, this places the current yield at 4.23%.

Clearway has ample cash and equivalents to maintain this dividend payout and to also conduct continued capital allocation to grow its asset base to fully realize its 19.1 GW clean energy power pipeline. The current dividend is also fully covered by CAFD.

Low-Carbon Infrastructure For The New World

The new world started on February 24, 2022. The most direct consequence for Clearway will be the opening of a strategic scope for renewable energy as a tool to attain energy independence not just to combat climate change. The events of the last few weeks highlight the need for the U.S to make deeper investments into green energy generation and storage capacity in the years ahead. The war has placed energy security in a new light and highlighted the importance of renewable energy in decoupling economies from the vagarities of global geopolitics.

The importance of Clearway’s asset base is even more important with the parallel increase in electric vehicles purchases in the years ahead. The new world is set to see energy demand rise exponentially. Clearway will be a piece required to see production match this demand growth. The overall shift to a low-carbon economy forms a long-term trend that will see tens of billions invested every year in the years coming to decarbonise the North American energy supply. This ambitious effort aims to contain a future where climate change unleashes destructive effects on us all.

Clearway Energy is one of the best public clean energy companies on the basis of its strong balance sheet, high CAFD generation, and ambitious pipeline that the company is well-capitalized enough to realize. With continued financial discipline the company should be able to hit at least the mid-range of its 5% to 8% annual dividend growth objective through at least 2026.

Be the first to comment