MarsYu

Energy Transition a Key Tailwind in Europe

Market Overview

International equities were dragged lower in the second quarter by steadily rising global inflation, threats to global growth from China’s COVID-19 lockdowns and the ongoing conflict in Ukraine. The benchmark MSCI EAFE Index tumbled 14.51% for the quarter and is down 19.57% year to date. The MSCI Emerging Markets Index held up better, boosted by a rebound in China, but still declined 11.45% over the last three months and is down 17.63% in 2022. Large cap equities were more resilient than small caps in the second quarter with the MSCI EAFE Small Cap Index retreating 17.69%.

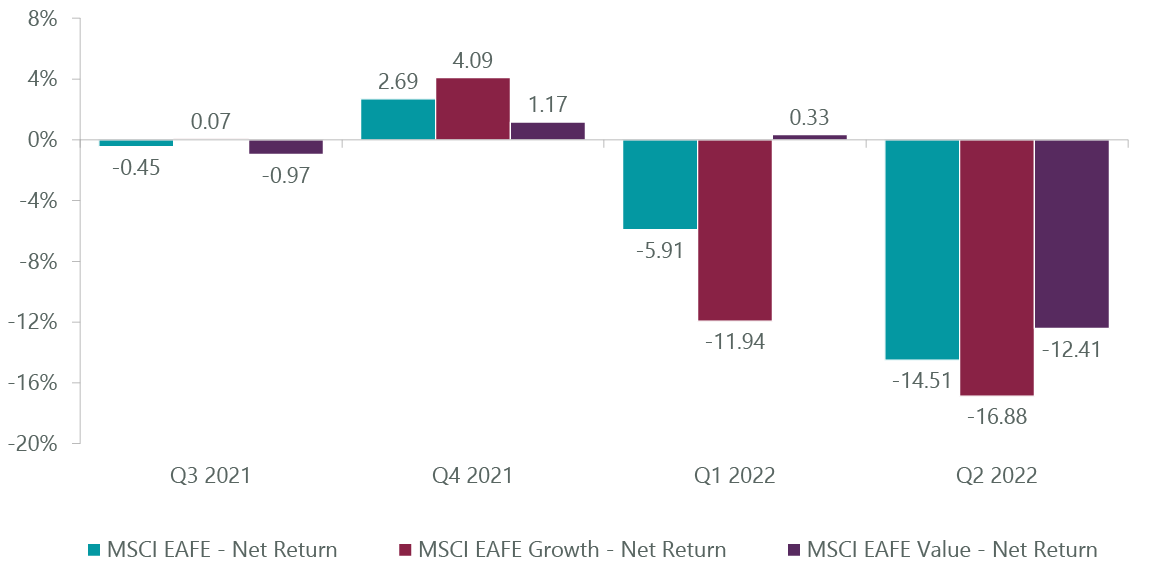

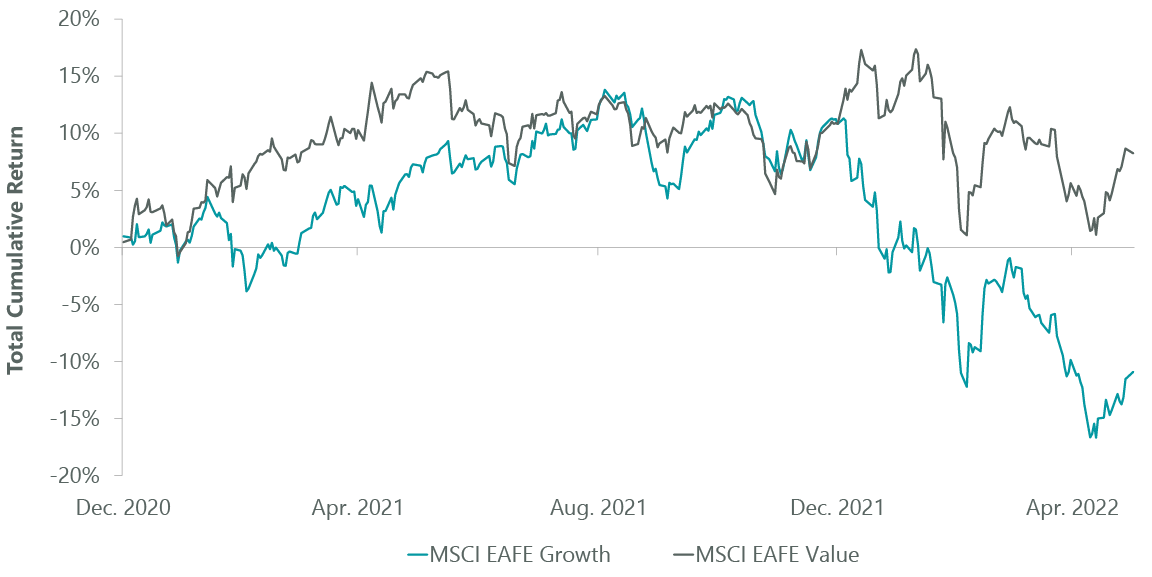

Growth stocks continued to trail value but the magnitude of underperformance has been narrowing (Exhibit 1) with growth outperforming marginally in June. The MSCI EAFE Growth Index was down 16.88% for the quarter and the MSCI EAFE Value Index off by 12.41%. Year to date, growth lags value by over 1,450 basis points — a historically wide disparity (Exhibit 2).

Exhibit 1: MSCI Growth vs. Value Performance

As of June 30, 2022. Source: FactSet.

Exhibit 2: Growth/Value Cap Continues to Widen

As of May 31, 2022. Source: FactSet.

We have discussed in recent commentaries the negative impacts of rising bond yields on growth companies. While German 10-year yields climbed nearly 80 bps during the quarter, similar to the rise in the U.S. 10-year Treasury, rates retreated from multiyear highs in mid-June over rising fears of global recession. This action helped growth stocks top value in June and illustrated the appeal of owning quality growth businesses in periods where economic growth could be challenged. We have been carefully positioning the ClearBridge International Growth ADR Strategy for such conditions, which contributed to our outperforming the benchmark in the second quarter.

Financial conditions continued to tighten over the last three months as regions like Europe faced a difficult balancing act in trying to address surging inflation while supporting economies directly impacted by fallout from war in Ukraine. Russia continues to make progress in the east of Ukraine with little hope that the war will end anytime soon. Instead, Europe is consolidating its defenses with plans to admit Sweden and Finland to NATO. Even with a ceasefire agreement, there will be little room for sanctions to be lifted. Oil, natural gas and gasoline prices continued to move up in the quarter due to Russian shipments falling meaningfully. The increase in energy costs for EU members is around €1.4 trillion or 10% of Eurozone GDP. Governments are assisting lower-income households with subsidies. Eurozone inflation hit a second straight record high of 8.6% in June. The higher-than-expected inflation print has convinced the European Central Bank (ECB) to raise interest rates at its next meeting in late July and likely again in September.

The hawkish moves by the ECB, now falling in line with the Fed and the Bank of England, leave Japan and China as the largest international markets with no immediate plans to tighten policy. Inflation reached 2.5% in Japan during the quarter but fears that higher rates would stall a nascent recovery have caused the Bank of Japan to stick with its current accommodation. Given that Japan has just emerged from its most serious COVID-19 lockdowns and is reopening travel, we suspect its ultra-easy policy will be harder to continue as it is also importing serious inflation from abroad. China lowered a key interest rate as it struggles with ongoing lockdowns to enforce its zero-COVID policy and works to keep real estate market risks under control.

In the U.K., high energy prices are having a meaningful impact on consumption trends and Boris Johnson’s Brexit strategy has caused structural inflation pressures that are unlikely to moderate with the EU in no mood to be helpful. Meaningful rate increases from the Bank of England and a warning from the Treasury about their impacts on the budget are noteworthy. Canada continues to show modest inflation and only recently emerged from fairly strict COVID-19 lockdowns of the past two years. Still, they too have moved three times this year to raise rates to handle inflationary pressures there.

Initial details of the REPowerEU plan to improve energy security and hasten the transition to renewable energy sources were presented in May. These included faster permitting, higher capacity targets and EU grants or loans. The package could support renewable installations of up to 5x current installations, which should offer a lasting tailwind to renewable energy. We increased our exposure to the energy transition during the quarter with a new position in Iberdrola (OTCPK:IBDSF), a Spanish-based integrated utility that is also one of the leading renewable energy developers in the world. The war has opened the eyes of the world that energy independence is critical. Renewables are for many countries the only way to get to the target. It is expected that existing renewable project pipelines will be executed faster, and more projects added to existing pipelines. The energy transition would be extremely helpful for climate change and Iberdrola ranks well on our ESG matrix.

We are well-positioned to participate in the accelerating energy transition. The home sector in Europe accounts for roughly 40% of natural gas usage, so replacing gas in the home with electricity, electric pumps and heating, is also on the agenda. The electrification of transport will come into play with more tax incentives on charging infrastructure and electric vehicles (EV) likely. French industrial manufacturer Legrand (OTCPK:LGRVF) is a significant beneficiary of energy efficiency and electrification trends. Its low-voltage products, sensors and smart thermostats are essential to reducing energy use in commercial and residential buildings. Legrand products also support the growth in EV charging stations infrastructure.

High and rising utility costs combined with policy support are also driving increased penetration of home solar plus storage systems in Europe. Israel-based SolarEdge Technologies (SEDG) expects to see significant growth in solar installations in this market led by Germany and Italy, among others, where consumers are not only demanding solar on the roof but a complete system solution including batteries. This phenomenon is accelerating revenue growth for these companies.

The replacement of demand for Russian gas with green hydrogen positions British industrial gas provider Linde (LIN) well. Green hydrogen, made by using renewable energy to split water into its basic elements, hydrogen and oxygen, and subsequently cleanly burn the hydrogen as fuel, is seen as key to lowering emissions in hard-to-decarbonize industries such as steel and cement, as well as transport. In 2021 Linde announced a long-term agreement to provide European semiconductor maker Infineon (OTCQX:IFNNY) with onsite production and storage of green hydrogen for the company’s site in Villach, Austria. Securing a clean, domestic source of energy for semiconductor manufacturing appears strategic today amid heightened concerns of reliable supply from Taiwan.

Portfolio Positioning

While we cannot position for every possible outcome related to inflation, economic growth and geopolitics, we continue to rely on secular and structural growth companies with strong balance sheets and good business models. We remain tilted toward growth but are much more balanced than in the recent past with our higher-multiple emerging growth exposure now at less than 3% of assets. While we did intentionally lower that number — 5% has been a longer-term average weight — the recent size of this group reflects better performance of other parts of our portfolio such as secular holdings Olympus (OTCPK:OCPNF) in health care and Inditex in consumer discretionary and structural holdings in energy and financials, two areas we have been adding to selectively.

In addition to Iberdrola, new purchases among structural growers during the quarter included Canadian mining company Barrick Gold (GOLD), which is seeing operating improvements in its business. The company has aggressively delevered its balance sheet and reduced capex spending to a lower level, directing its healthy free cash flow to dividends and buybacks.

Japan is an area that we have historically been underweight, given the lack of growth stocks in that market. We initiated a new structural position in Daiichi Sankyo (OTCPK:DSKYF), a pharmaceutical company on the forefront of cancer treatment with antibody drug conjugates (ADXS) targeting breast and other hard to treat cancers. Its partnership with AstraZeneca (AZN) for Enhertu offers meaningful upside for the company.

Disciplined selling is a key component of our risk-based approach, especially among companies with cyclical growth drivers. We have seen good success over the last several years from our semiconductor exposure but have been taking profits in companies such as Tokyo Electron (OTCPK:TOELF) earlier in the year and this quarter in Taiwan Semiconductor (TSM) to reduce overall industry exposure. Given the exceptional sets of circumstances of semi shortages, double ordering and good growth in end market products including personal electronics and even data centers, we believe a neutral market position to this industry within the tech sector is appropriate.

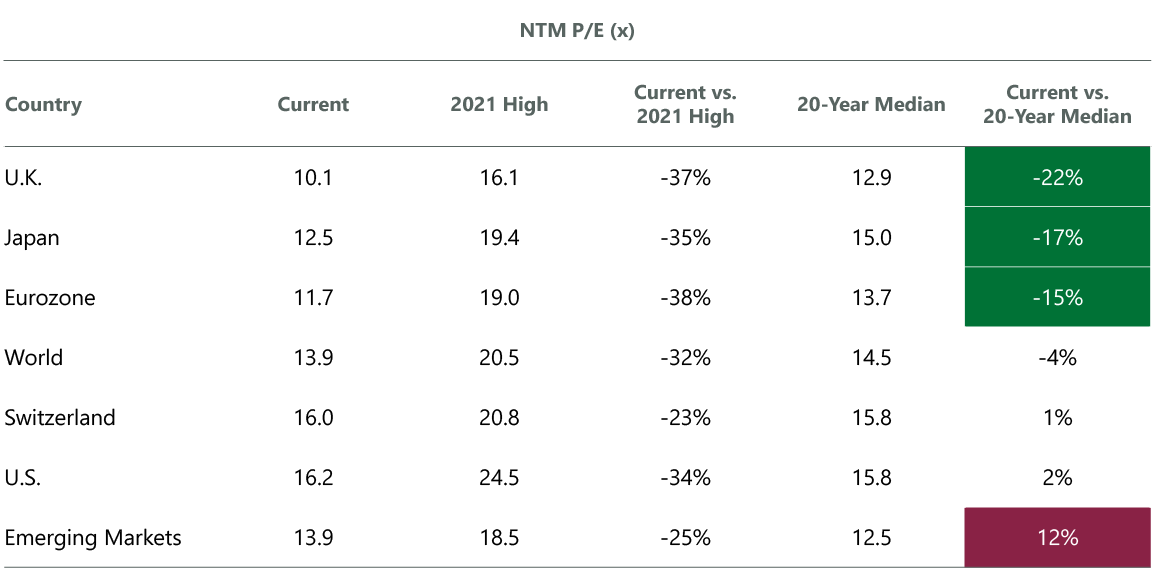

We also closed a position in digital payments and processing provider Worldline (OTCPK:WWLNF) in favor of Adyen (OTCPK:ADYEY), which we see as a long-term category winner in digital payments with a higher growth rate. We have already seen significant multiple compression in technology and, while software tends to be more resilient than other parts of tech during recessions, it also did very well during the 2020–2021 period. We trimmed software makers Atlassian (TEAM) and Elastic (ESTC), while both remain fundamentally sound, to manage overall emerging growth exposure. Despite the current headwinds facing the highest-growth areas of international markets, we continue to see compelling valuations that can act as a complement to higher-priced U.S. growth stocks (Exhibit 3).

Exhibit 3: Global Valuations Attractive

Data as of June 30, 2022. Source: FactSet.

Outlook

What has concerned us recently is that good news on earnings and revenue numbers has been heavily discounted by the market. In other words, good results have been expected and we worry that could change this quarter as earnings will be more challenging. Equities have seen a 25%–35% derating of P/E ratios from the highs in the market in 2021. While there are known headwinds in the next quarterly earnings season, how companies guide on earnings in a highly volatile market exposed to the impacts of the war and increasing commodity prices will set the tone for the quarter. We believe it will be challenging, but the market seems to have anticipated at least some of this already.

One of the main headwinds is supply chain constraints in China that started in mid-March with COVID-19 lockdowns and that will be felt fully in second-quarter earnings. China emerged somewhat from its zero-COVID policy, though another flare-up could spur another round of lockdowns. We believe the Chinese will need to stimulate their economy again, one of the few central banks in that position.

Given the aggressive deratings among Chinese equities and the stimulus potential, what could cause us to move back into this market? In order to gain confidence in the market, resolution of the long-standing audit issues need to be resolved with the U.S. There is some movement, but nothing formalized for now. The very large real estate crisis needs resolution, but the Chinese bond market has been struggling with real estate developers defaults and still has the potential to create a systemic crisis. Falling technology sector earnings need to stabilize and establish credible growth rates. Lastly, we await the news from the 20th National Congress of the Chinese Communist Party as to how the party views private enterprises and whether there are means to redistribute wealth. At some point there is a bounce coming in Chinese equities, but we are unsure if it will be sustainable.

In Japan, inflation rose above 2% for the first time since 2015. The Bank of Japan is holding the line on potential rate hikes, communicating that prices are unlikely to spike without wage growth. GDP contracted 0.2% in the first quarter but the slowdown was less severe than feared, with polls suggesting the lifting of COVID-19 lockdowns should lead to a growth rebound for the second quarter.

Portfolio Highlights

During the second quarter, the ClearBridge International Growth ADR Strategy outperformed its MSCI EAFE Index benchmark. The Strategy had losses across the 10 sectors in which it was invested (out of 11 total). The information technology (IT) and industrials sectors were the primary detractors.

On a relative basis, overall stock selection contributed to performance. In particular, stock selection in the financials, materials, consumer discretionary and IT sectors aided results. Conversely, an overweight to the IT sector, an underweight to the communication services sector and stock selection in the consumer staples, industrials and health care sectors hurt relative returns.

On a regional basis, an overweight to North America and stock selection in Europe Ex U.K. contributed to performance while stock selection in North America and Japan were detrimental.

On an individual stock basis, the largest contributors to absolute returns in the quarter included AIA Group (OTCPK:AAGIY) in the financials sector, Olympus and Daiichi Sankyo in the health care sector, Suncor Energy in the energy sector and Inditex in the consumer discretionary sector. The greatest detractors from absolute returns included positions in ASML (ASML) and Atlassian in the IT sector, Recruit Holdings (OTCPK:RCRRF) and Atlas Copco (OTCPK:ATLKY) in the industrials sector as well as Roche (OTCQX:RHHBY) in the health care sector.

In addition to the transactions mentioned above, we exited a position in Fanuc (OTCPK:FANUY) in the industrials sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment