Richard Drury/DigitalVision via Getty Images

Market Overview

Despite a powerful 8.5% rally in the quarter’s final two weeks, the S&P 500 Index finished the first quarter down 4.6%, snapping a run of seven straight quarters of positive returns. We were surprised by: the market’s resiliency late in the quarter given the Ukraine war; a general acceptance the conflict is likely prolonged; high and rising, broad-based inflation; an increasingly hawkish Federal reserve; and a market near the 90th percentile on almost all valuation measures. In addition, signals we consider predictive of future economic activity and equity market opportunity deteriorated: credit spreads widened, parts of the yield curve inverted, and the Fed began to drain liquidity via interest rate increases and stated its intent to reduce its balance sheet.

Market leadership had a decidedly defensive tone in the quarter. Only two sectors produced positive returns. Energy sector shares dominated, rising 39%, essentially in-line with the increase in the price per barrel of oil, while utilities provided investors with safe harbor, adding 4.8%. Financials declined 1.5% (outperforming the S&P 500) but were led by the defensive property and casualty insurance sector (+14%). Importantly, the pro-cyclical banking industry lagged (-7.6%) with underperformance especially pronounced during the late-March rally. Bank underperformance occurred despite the tailwind of higher interest rates, including the first increase in the federal-funds rate since 2018. We believe bank stocks remain a key economic bellwether — especially during a transitioning interest rate regime — and their performance bears monitoring.

Communication services was the notable laggard, declining 12% primarily due to over 30% declines in Netflix (NFLX) and Facebook (FB) (now Meta Platforms), as disappointing 2022 outlooks rattled investors. Despite strong relative performance from behemoths Amazon.com (AMZN) and Tesla (TSLA), the consumer discretionary sector also struggled, declining 9%. Homebuilders and housing-related stocks were hit as rising mortgage rates dampened sentiment despite robust activity levels. In addition, traditional auto manufacturers (ex-Tesla) and suppliers struggled as input cost inflation, supply constraints and higher gasoline prices weighed on 2022 growth expectations.

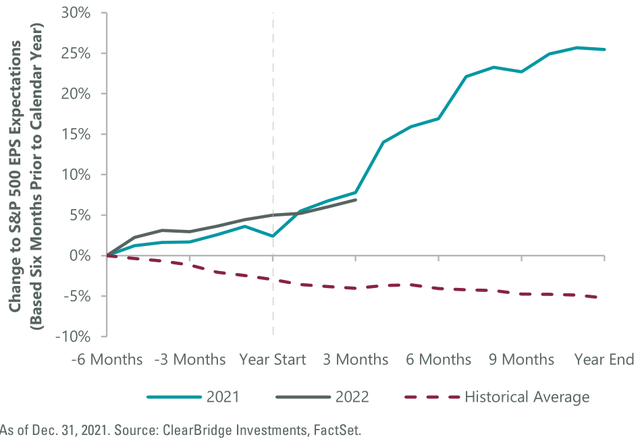

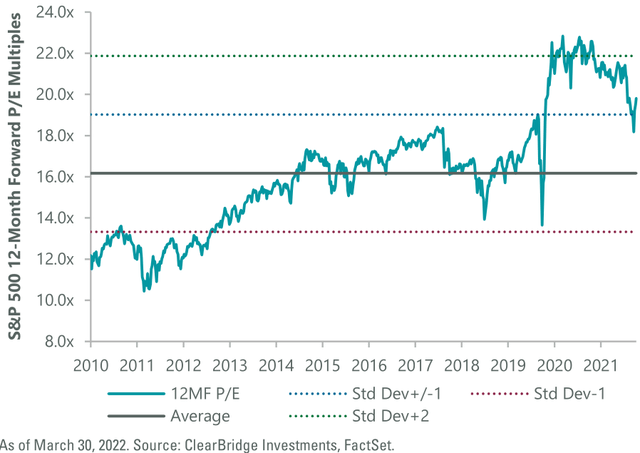

Entering 2022, we viewed outsize positive EPS revisions as support for the elevated market valuation. Year-to-date in 2022, EPS expectations have continued along the same extraordinarily positive path as 2021 (Exhibit 1). 2022 EPS estimates have risen ~7% over the past nine months versus the historical average of a 4% decline in expectations. That said, we believe headwinds to expectations are mounting and 2022 consensus expectations are heavily back-end loaded. We are concerned this unprecedented period of positive earnings revisions is at risk and — along with it — the elevated market valuation (Exhibit 2).

Exhibit 1: Earnings Expectations Extraordinarily Positive

Exhibit 2: Market Valuation is Elevated

Outlook

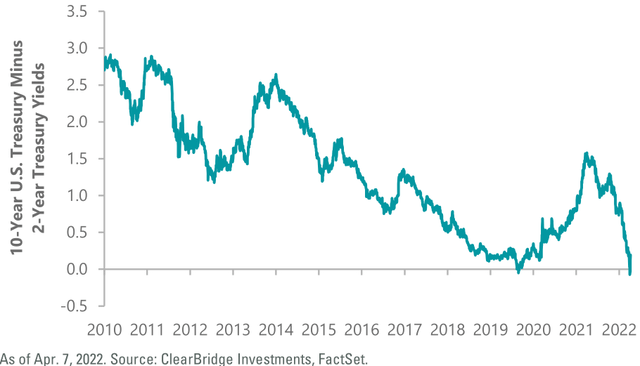

As discussed in our year-end 2021 outlook, we see several important headwinds that temper our expectations for equity market performance. We believe liquidity is a (if not the) primary determinant of equity market performance. The best environment for stocks is one where the Fed is providing liquidity to achieve economic acceleration. Today’s environment is exactly the opposite. The Fed is behind the curve on inflation and says it will remove liquidity, which — if effective — will slow economic growth, increase financing costs and tighten financial conditions. Whenever the Fed tightens there is a risk that it overshoots and puts the economy into recession. Wider credit spreads and the slightly inverted yield curve indicate the bond market is worried about this very issue (Exhibits 3 and 4). The stock market is above the 90th percentile in almost every valuation metric and could be vulnerable to a materially slower U.S. economy, which it does not seem to be discounting.

Exhibit 3: Credit Spreads Widening

Exhibit 4: Yield Curve Near Inversion Point

We continue to assert that inflation remains the primary near- term risk to equities. The war in Ukraine has added fuel to inflation’s already-burning fire. Europe will struggle to replace Russian natural gas and may suffer recession. Ukraine is a massive exporter of wheat and ammonia fertilizer, the loss of which will stress grain inventories that were already low after 2021’s droughts. As we write, inflation continues to climb and at 7.9% is at its highest level in 40 years.

Against this backdrop we continue to prefer companies with strong pricing power or expense pass-throughs, and lower labor intensity, to mitigate the risks posed by a persistent inflationary environment. We also favor commodity-driven sectors like energy and basic materials and are cautious on labor-intensive areas like consumer discretionary. This environment continues to be especially treacherous for hyper growth companies that have yet to produce profits or free cash flow.

Although cautious on hyper growth stocks, we believe technology stocks with high gross margins and pricing power (many software contracts have inflation-based price escalators) can perform relatively well even in a high-inflation environment, on average.

Although we continue to expect near-term cyclical leadership, on a one-year basis we advocate a more balanced approach as growth should continue to do well. Technology is often used as a proxy for growth, but high-quality technology companies that meet or exceed forecasts can continue to perform well despite an increase in interest rates.

We are concerned about semiconductor stocks. They have had an unprecedented upcycle and substantial amounts of new capacity will come on stream over the next several years. The Ukraine war likely creates opportunities in U.S. natural gas producers and exporters. Oil inventories are temporarily short, but supply chains will adjust over the intermediate term. Homebuilding stocks have gotten slammed and even the best companies are trading at or below liquidation value despite a shortage of homes. If we avoid a recession these will be powerful stocks moving forward.

Conclusion

We believe investors should stay the course in equities, though near-term total return expectations should be muted. We continue to recommend a balanced approach to the markets, including both growth and value stocks with an emphasis on quality companies. That said, our portfolio is modestly tilted toward more cyclical sectors that should benefit from a sustained elevated inflation environment. We believe effective Fed policy will reduce inflation over time and will offer patient, long-term investors opportunity to purchase high-growth shares at better prices later this year.

Portfolio Highlights

The ClearBridge Appreciation Strategy outperformed the benchmark in the first quarter. On an absolute basis, the Strategy had gains in four of 11 sectors. The main contributors to performance were the energy and financial sectors. The consumer discretionary, information technology (IT) and materials sectors were the main absolute detractors from performance.

In relative terms, stock selection and sector allocation contributed positively. In particular, stock selection in the IT, communication services, financials and industrials sectors boosted relative returns, while stock selection in the materials and consumer discretionary sectors detracted. An overweight to the energy sector was also beneficial.

On an individual stock basis, the biggest contributors to absolute performance during the quarter were Chevron (CVX), Berkshire Hathaway (BRK.A), (BRK.B), Pioneer Natural Resources (PXD), Travelers Companies (TRV) and Exxon Mobil (XOM). The biggest detractors were Home Depot (HD), Meta Platforms (FB), Microsoft (MSFT), JPMorgan Chase (JPM) and PPG Industries (PPG).

During the quarter, we initiated positions in EQT (EQT) in the energy sector, Truist Financial (TFC) and SVB Financial (SIVB) in the financials sector, Stryker (SYK) in the health care sector and Marriott International (MAR) in the consumer discretionary sector. We closed a position in Otis (OTIS) in the industrials sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment