Hryhorii Bondar/iStock via Getty Images

Generally speaking, advertising is incredibly important for companies looking to expand their sales. Today, there exist countless businesses dedicated to providing various services aimed at promoting the brands of other enterprises. One such firm that deserves attention from investors is Clear Channel Outdoor Holdings (NYSE:CCO). Despite experiencing significant pain as a result of the COVID-19 pandemic, the company has shown some signs of recovery. Unfortunately, fundamental performance for the business has, historically speaking, been quite volatile. But the tradeoff here is that investors get to buy into a firm that is trading at fairly attractive levels. At the end of the day, these two factors likely balance one another out, making the company cheap but not necessarily great. Ultimately, this leads me to believe that Clear Channel Outdoor, despite being priced as a ‘buy’ prospect, is more likely than not a solid ‘hold’ opportunity instead.

A play on out-of-home advertising

According to the management team at Clear Channel Outdoor, the company operates as one of the largest out-of-home advertising companies in the world. Between the US and Europe, the company operates over 500,000 advertising displays. These are split between 26 different countries. In the US, the company operates in 41 out of the top 50 designated market areas, as well as in all top 20 designated market areas. In Europe, the company operates in 16 countries. Included in this set of operations is also the nation of Singapore. The company’s business also spans four countries in Latin America.

When I say that Clear Channel Outdoor focuses on out-of-home advertising, what I really mean is that the firm provides digital signage that largely consists of its billboards. Customers can pay to put their messages on these billboards, but the business also owns assets that include street furniture displays located largely in urban city centers, airport displays, transit displays that focus largely on the bus and rail markets, and more.

During the company’s 2021 fiscal year, an impressive 75% of revenue associated with its Americas segment for the enterprise came from its billboards. To be more specific, 64% of sales came from the bulletins category of billboards, while 11% came from poster displays. Transit displays made up another 14% of sales in 2021, while street furniture displays made up 3%. This left 4% of revenue coming from spectaculars and wallscapes, while a further 4% was attributable to other activities that included production revenue and other non-advertising revenue. A major trend for billboard operators has been to shift their business to focus largely on digital displays. This is a significant process that involves tremendous costs and time. Even so, by the end of its 2021 fiscal year, the company boasted that 35% of its revenue from the Americas came from digital displays. In all, the Americas segment accounted for 52% of the company’s revenue last year.

The other major segment for investors to focus on is the Europe segment. Its portfolio here includes 430,000 of its displays. This compares to the 69,000 located in the Americas market. Its emphasis in this region is largely centered around major cities like London, Paris, Madrid, and Rome. As I mentioned already, this segment also includes Singapore. Within the segment, 52% of revenue came from street furniture displays. By comparison, only 17% of sales came from billboards. A further 15% of revenue was attributable to retail displays, while transit displays made up 7%. This left other miscellaneous activities like advertising revenue associated with small displays and non-advertising revenue from sales of street furniture equipment, cleaning and maintenance services, and the operation of public bike programs, accounting for 9% of sales. Like in the Americas segment, 35% of revenue associated with the Europe segment came from digital displays. The rest of the company’s business came from its Other segment, which includes Brazil, Chile, Mexico, and Peru. Sales here amounted to 3% of the company’s overall sales for the year. This segment also used to include its operations in China. But the company sold its stake there in 2020.

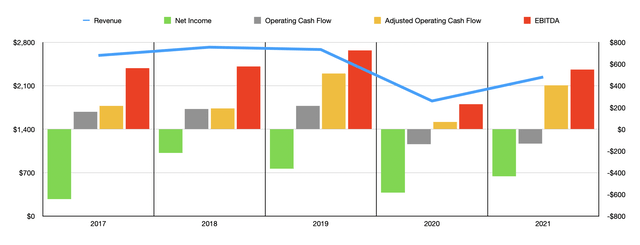

In recent years, fundamental performance achieved by Clear Channel Outdoor has been rather mixed. For instance, revenue increased from $2.59 billion in 2017 to $2.72 billion in 2018. Revenue then dipped modestly to $2.68 billion in 2019 before plunging to $1.86 billion in 2020 as a result of the COVID-19 pandemic. Fortunately for investors, 2021 marked something of a turnaround. Revenue for that year came in at $2.24 billion. Unfortunately, profits for the company have not exactly been great in recent years. In each of the past five years, for instance, the company generated net losses. The loss in 2021 was $433.8 million. That compares to the $582.7 million the company lost in 2020. Even in 2018, when sales peaked, its net loss amounted to $218.2 million.

Although net profits have been troublesome for the company, cash flows have looked a little better. Operating cash flow grew from $160.1 million in 2017 to $214.5 million in 2019. The company’s outflow of cash amounted to $137.8 million in 2020. But in 2021, this metric improved slightly to a net outflow of $133.5 million. If we adjust for changes in working capital, the picture looks more volatile. But the overall numbers are more robust. For instance, adjusted operating cash flow for the company was $403.7 million in 2021. That’s up from the $67.7 million achieved in 2020 but still down from 2019’s $512.3 million. Perhaps most consistent has been EBITDA. This figure increased from $562.4 million in 2017 to $726 million in 2019. In 2020, this metric dropped to $230.3 million. But that decline was short-lived because, in 2021, it rebounded some to $550 million. It is worth noting that some of the company’s troubles appear to relate to the Europe segment the company has. Despite accounting for 45% of revenue last year, the segment was responsible for just 9.1% of the company’s positive segment profits. Recognizing this, management announced, last year, that they were undergoing a strategic review of this segment. Frankly, selling off the unit could be beneficial for shareholders.

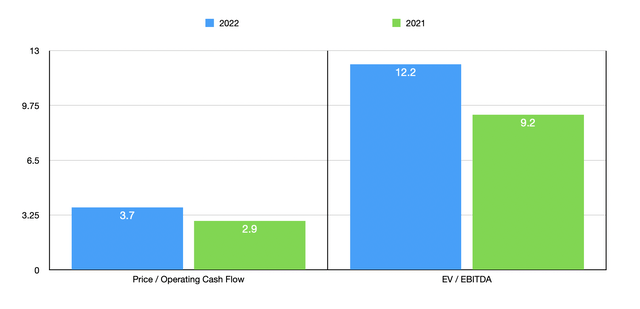

At present, shares of the company do look rather cheap from a cash flow perspective. For instance, using the company’s 2021 results, it is trading at a price to adjusted operating cash flow multiple of 3.7. This compares to the 2.9 the company is trading at if we use 2019 figures. Because of a significant amount of leverage, with net debt as of this writing of $5.19 billion, the firm’s EV to EBITDA multiple is a bit higher, coming in at 12.2 if we rely on 2021 figures and totaling 9.2 if we rely on results from 2019. Debt truly is an issue for this company. For instance, using our 2021 results, the firm has a net leverage ratio of 9.4. This number is a bit lower at 7.2 if we rely on 2019 results.

To put the pricing of the company into perspective, I decided to compare it with five other advertising-oriented businesses. As a note, two of these companies, Lamar Advertising Company (LAMR) and Outfront Media (OUT), focus on signage operations. However, both businesses, unlike Clear Channel Outdoor, happen to be REITs. So they are not exactly comparable in every respect. On a price to operating cash flow basis, these five companies range from a low of 6.5 to a high of 39.6. In this case, Clear Channel Outdoor is definitely the cheapest of the group. If, instead, we use the EV to EBITDA approach, the range would be from 7.1 to 22.6. In this scenario, two of the five companies would be cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Clear Channel Outdoor Holdings | 3.7 | 12.2 |

| Perion Network (PERI) | 13.1 | 14.4 |

| Omnicom Group (OMC) | 8.6 | 7.1 |

| The Interpublic Group of Companies (IPG) | 6.5 | 7.9 |

| Lamar Advertising Company | 15.6 | 18.6 |

| Outfront Media | 39.6 | 22.6 |

Takeaway

At first glance, shares of Clear Channel Outdoor look like they could be a bargain. Certainly, there could be significant value potential if management can do something about its struggling European operations and can use any proceeds from a sale or other restructuring to reduce debt. Overall, net leverage for the company does appear high and it’s disconcerting to see continued significant net losses. All of these factors, combined, weigh against the low trading multiples of the business. So while I would normally be drawn to the company and rate it a ‘buy’, I believe a more appropriate rating for the company would be ‘hold’ until the firm can show signs of improvement.

Be the first to comment