grandriver/E+ via Getty Images

Investment Thesis

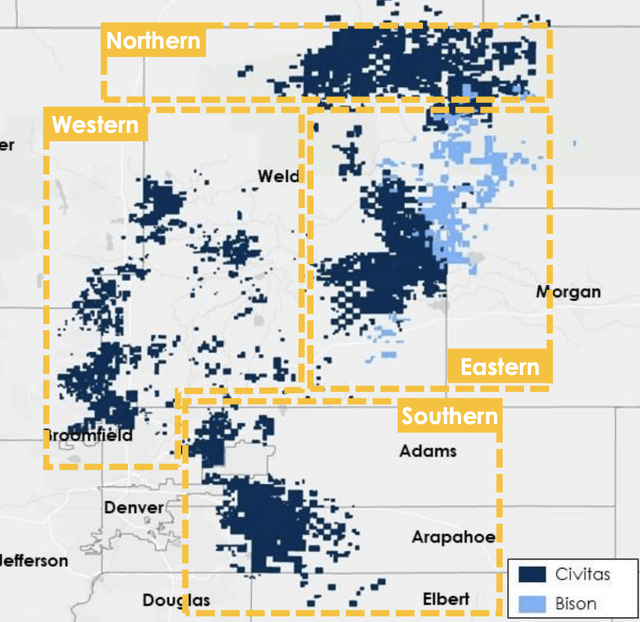

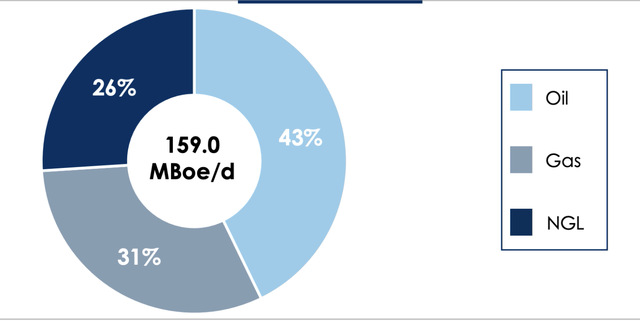

Civitas Resources (NYSE:CIVI) is an oil and gas producer focused on the Denver-Julesburg Basin (DJ) in Colorado. Over approximately 500,000 acres, CIVI produces 160 kboe/d (thousands of barrels of oil equivalent per day).

What sets CIVI apart is its low cost of operations which produces a high FCF yield of 20%. Average cash and lease operating expenses (LOE) cost $5.75/boe. CIVI has a fortress balance sheet with very low leverage of only 0.5 Debt to EBITDA (11.4% debt-to-equity).

On top of all of this, CIVI is a carbon-neutral operator by Colorado standards and has a dividend yield of 8.7% (a base of 3.2%, with 50% of trailing FCF paid out as a variable). For this reason, we believe that CIVI is an excellent choice for dividend yield.

Estimated Fair Value (EFV)

EFV = E2023 EPS of $12.00 times PE of 9 = $12 X 9 = $108

|

Civitas Resources (CIVI) |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

2.1 |

2.0 |

1.9 |

|

Price-to-Earnings |

7.2 |

6.3 |

5.4 |

|

EV/EBITDA |

3.0 |

2.7 |

2.7 |

Business Model

Expenses remain low for the sector, per barrel of oil equivalent: $2.5 going toward leasing, $3.25 going toward extraction, and $0.5 going toward midstream expenses.

These low expenses allow CIVI to spend nearly $1 billion a year on capex, with at least $825 million going toward drilling and completion costs and $70 million going toward land acquisition costs and midstream costs. In 2022 CIVI estimates that they will drill approximately 190 wells, and bring 155 of those to completion.

|

Area Owned |

Total Undeveloped Locations |

Weighted Average IRR (from CIVI) |

|

Southern Basin |

407 |

43% |

|

Western Basin |

301 |

66% |

|

Eastern Basin |

256 |

29% |

Oil and gas tend to be an expensive high leverage industry. However, CIVI remains committed to low operating costs, with a “relentless” focus on keeping operating costs down. This has allowed CIVI to maintain an E2022 FCF yield of >20%, should oil prices remain above $75/bbl. Much of the reinvestment of oil income is going toward the Bison redevelopment program.

CIVI Investor Day Presentation

In March of 2022 CIVI acquired the privately held Bison Oil and Gas, a small producer with 102 potential locations with 38 already permitted to begin drilling immediately. As Bison’s wells are retooled and connected to CIVI’s architecture, it is estimated that an extra 9,000 boe/d will be added to production with a 75% oil mix. CIVI has a total production of 70-75 Mbbl/d.

CIVI owns some of its own midstream infrastructure, which allows lower and more consistent costs in transportation expenses, as opposed to taking inefficient routes. At the present moment, CIVI’s natural gas midstream capacity is roughly 315 MMcf/d with 280 miles of pipe, and crude pipelines of 35 miles with 77 Mbo/d incapacities. Overall the midstream operating expense, including own and leased pipelines is roughly $0.50/Boe.

Risk

Commodity price risk is the biggest risk for any exploration and production company including CIVI. Regulatory risks for drilling and production include permitting for new drilling prospects. In addition, the global objective of reducing carbon-based energy to reduce climate change is a longer-term risk. Oil demand could peak on a worldwide basis over the next few years. We expect the demand for natural gas to continue to grow over the next 5 or 10 years as electricity production moves away from coal.

Should a well rupture, oil spill, or other environmental event be found to be the fault of CIVI, it could damage the firm’s public image and subject them to regulatory actions, fines, and interrupted production. CIVI does attempt maintain a net zero emission standard, through the use of emission target reductions and through carbon offset credits purchased. While this still means that CIVI is a net emitter of carbon credits aside, it provides significant financial incentive for the company to reduce the long-term costs of carbon emission.

CIVI operates exclusively in the DJ basin which is mostly in Colorado. This opens CIVI up to a not-insignificant portion of geographic risk as negative political changes in Colorado could directly and seriously impact the operations of CIVI.

Be the first to comment