Ridofranz/iStock via Getty Images

Overview

City Holding (CHCO) is WV & KY-based $6 billion community bank. The bank operates in environments that are slow growing and less competitive. The major product lines include retail, commercial and investment management. The bank has recently been successful in expanding into new markets. By deposit contribution, new markets accounted for 24% of total contribution. Currently, the bank has presence in Winchester VA market, Staunton VA market, Beckley tri-state market, Charleston WV market, and Huntington KY markets.

While new market accounts for 24% of the deposit mix, it accounted for a majority of commercial loan portfolio. As of FY21, ~30% of the loan portfolio is C&I oriented. CRE and other real-estate loans account for 50% and 20%, respectively.

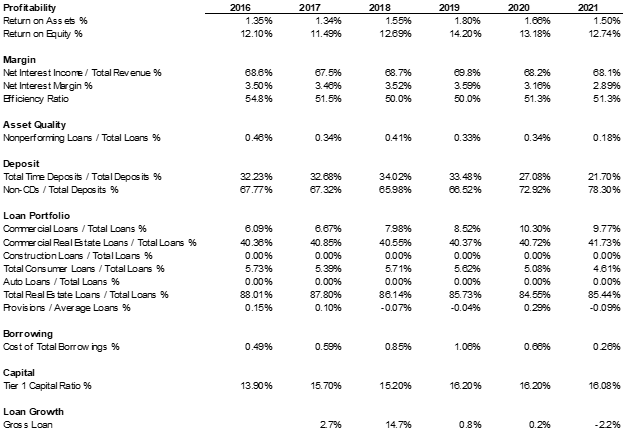

From a deposit perspective, the bank has a significant percentage of high-cost funding, the time deposit. Despite the percentage of time deposits declining over time, it is still a material part of the funding source. DDA’s contribution has increased significantly. At ~22% CD as funding source, it is a significant improvement compared to 5 years ago when CD accounts for 1/3 of the deposit funding.

Inorganic growth was a part of the growth strategy:

Review of Operations

City Holding Company reported net income of $88.1 million for fiscal year 2021 as compared to $89.6 million for the prior year. Earnings per share were $5.66 versus $5.55 for the prior year. Revenues for the year increased to $228.4 million from $226.6 million for fiscal year 2020. During Q4, City Holding Company reported ROA and ROE of 1.6% and 13.8%, respectively. The efficiency Ratio is 48.3% and Net interest income/Revenue is 69.8%. NIM is 2.94 % and Tier 1 Capital Ratio is 16.08%

From a profitability perspective, reported ROA has been consistently above 1% during the past few years, even in FY20 when provisioning increased significantly. That being said, the performance is impressive during FY20, the bank delivered 166 basis points of ROA. The negative provisioning in FY21 indicates a reversal of credit losses in FY20, which is a good sign as the actual loan loss is not as severe.

Credit quality is robust for the bank. Even during the worst year in the pandemic, NPL increased to 34 basis points, which is only on par with historical averages. The bank is very well managed from a credit quality perspective.

The bank’s solid profitability is partially attributable to its efficient management. Efficiency ratio is at a low 50%.

10K

Valuation

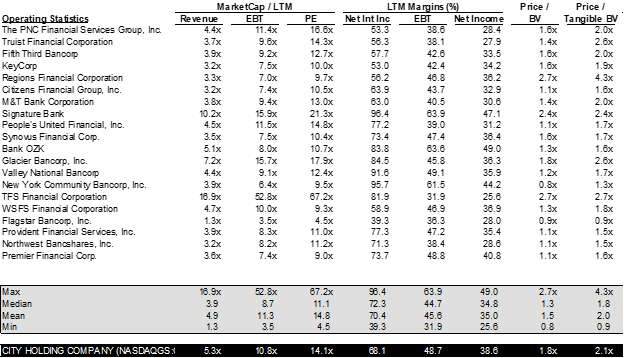

Stock is fairly priced at 14.1x P/E and 2.1x P/TBV.

10K

Risk/Reward

From a risk perspective, the core market is in rural area with HH income lower than the national averages. Despite this factor, the bank has managed the credit quality effectively to lower credit losses.

From a reward perspective, the bank will benefit from a rising rate environment due to its asset sensitive balance sheet. With 100 basis points in rate increase, the bank’s earnings will increase by 12%. The bank has a consistent record of paying out dividends to shareholders and is a good steward of the shareholder capital. From an acquisition perspective, the bank targets small community banks that struggle with lower net interest income, asset quality challenges, lack of scale and limited liquidity.

Conclusion

To sum up, the bank is fairly priced at 14x P/E and 2.1x P/TBV. With the rate rise on the horizon, the P/22 EPS can be more attractive at ~12x. While the 2.1x P/TBV seems unattractive, the bank has a history of successfully acquiring and integrating smaller, sub-scaled banks into its platform. The management team has shown its ability to manage both credit quality and operational efficiency. We believe the market is underpricing City Holding’s earnings potential on a rate hike cycle. We like the risk/reward dynamics for City Holding.

Be the first to comment