JHVEPhoto

It should come as no surprise that one of the largest regional banks in the country is also one of the oldest. Founded as High Street Bank in 1828 in Providence, Rhode Island, today’s Citizens Financial Group (NYSE:CFG) has over $226 billion in assets and $179 billion in deposits, 1,200 branches and 3,300 ATMs with locations in 14 states. From its early days, the company grew steadily, facing much hardship during the Great Depression and World War II years. By the early 1980s, the bank surpassed $1.0 billion in assets. Later that decade, CFG became a wholly owned subsidiary of the RBS Group. Growth really began to take off following the acquisition by RBS, with the bank making many acquisitions during the great banking consolidation of the 1990s.

Following the Global Financial Crisis, RBS needed to divest its U.S. assets, and Citizens Financial became a standalone, publicly traded company in 2015. While Providence will always be home for CFG, recent acquisitions have expanded the company’s footprint into the competitive New York City metropolitan area. Like many companies that have a long, successful history through various economic cycles, Citizens Financial Group is a strong performer that should be able to manage the current economic backdrop to emerge even stronger.

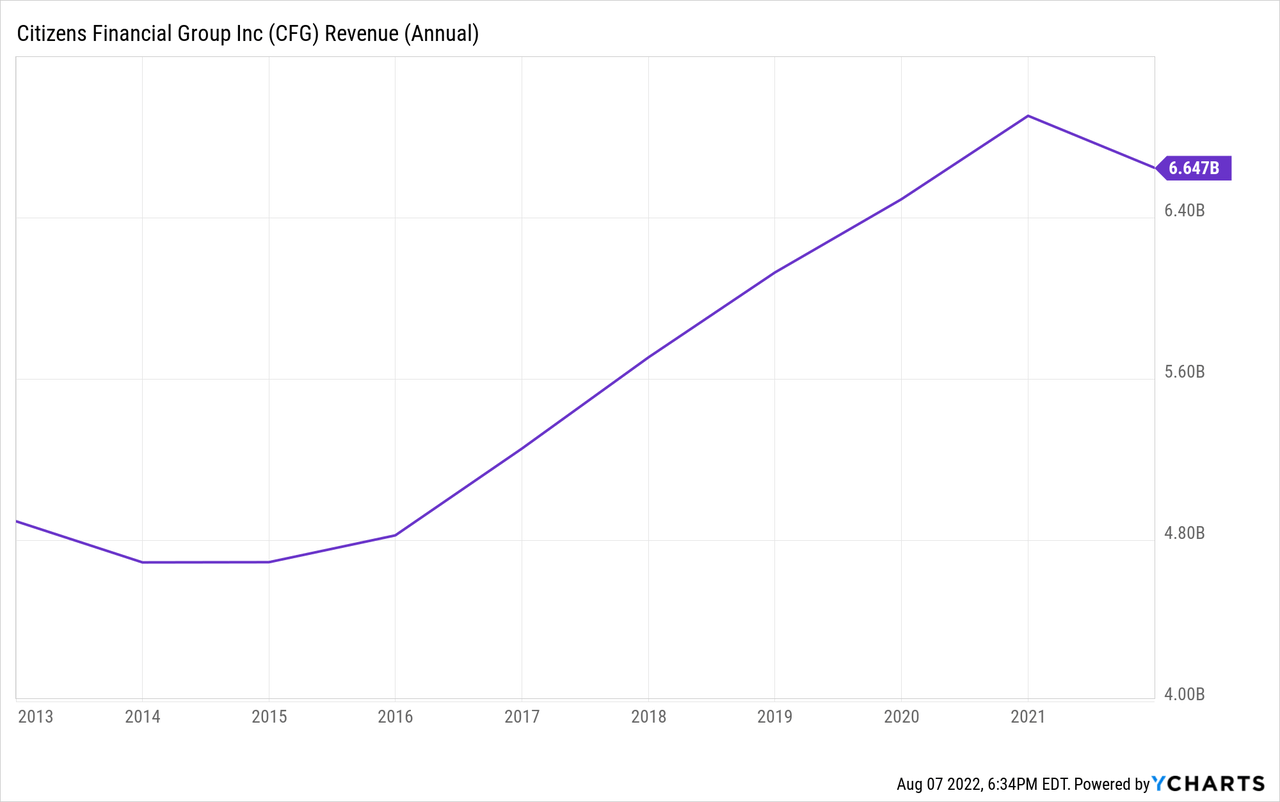

Income Statement

Beginning with net interest income in 2021, interest income actually decreased 9.4%, but interest expense decreased 56%. As a result, net interest income was down about 2% from 2020, mostly due to the lower interest rates and a difficult yield curve environment throughout the year. However, through the first half of 2022, net interest income increased 18% from the first half of 2021, mainly due to higher interest-earning assets and higher net interest margin. Management noted in the Q2 MD&A that the average interest-earning asset yields increased 15 basis points compared to a 4-basis point decrease on the average interest-bearing liabilities. The company did acquire HSBC’s East Coast Branches in February of this year, and CFG also acquired Investors Bancorp in April; these acquisitions have resulted in higher reported loans and net interest income this year, compared to the first half of 2021.

The company has also seen a decline in noninterest revenues when comparing 2021 to 2020. Noninterest revenues declined about 8% compared to the full year 2020. The decline was mainly due to a 53% decrease in the company’s mortgage banking fees due to increased competition in the mortgage space. This decline in mortgage banking continued through the first half of 2022, with mortgage revenues declining 44% compared to the first half of 2021 because of lower margins and production volumes. Total noninterest revenues declined 3% in the first half of 2022 when compared to the first half of 2021. Revenues are a bit of a concern for Citizens Financial as the mortgage business is becoming a drag on total net revenues. The rest of the revenues look good, but because the mortgage business is such a large component of noninterest revenues, the whole number is showing a decline. It is also worth noting that the mortgage banking fees have averaged 5.8% of total net revenues over the past five years. For the first half of 2022, mortgage banking fees were 3.9% of total net revenues.

The activity surrounding the provision for credit losses is interesting. For the full year 2021, the company reported a benefit of $411 million, the first benefit from loan losses since at least 2012. At the time, the company said the benefit was due to “strong credit performance and an improving macroeconomic outlook.” However, in the company’s Q2 10-Q, management reported that the macroeconomic environment had deteriorated slightly, resulting in a provision for loan losses of $219 million, most of which was reported in Q2. Also, the Q2 provision includes some cleanup of provisions from the two acquisitions this year. Excluding those, the company would still have reported a provision for the six months, albeit much smaller. The comment about the deterioration is telling, though, as the macroeconomic environment is becoming more challenging in the face of higher inflation, higher interest rates and continued supply chain impacts.

On the expense side, the company has historically done a fine job managing expenses. Compensation is the largest expense category for financial firms. At CFG, the compensation expense ratio has averaged 0.31 over the past five years, with 2021 coming in at 0.32, a tick higher than average. Through the first half of 2022, the ratio is 0.35, which is quite a bit higher than the historical average. The efficiency ratio, a measure of overall expenses, has averaged 0.60 over the past five years, with 2021 finishing at 0.61. The increase in overall expenses was mainly due to higher equipment and software as the company continues to invest in its technology infrastructure. Outside services similarly increased based on ongoing growth initiatives. Through the first six months of this year, the efficiency ratio was 0.66, which is quite a bit higher than the past. The increases were across all reported categories and include integration-related expenses. This is an area that investors really need to watch. The company hasn’t seen efficiency ratio numbers of this level since 2015. I would expect management to keep these numbers in check over the second half of 2022, particularly with some top line revenue challenges.

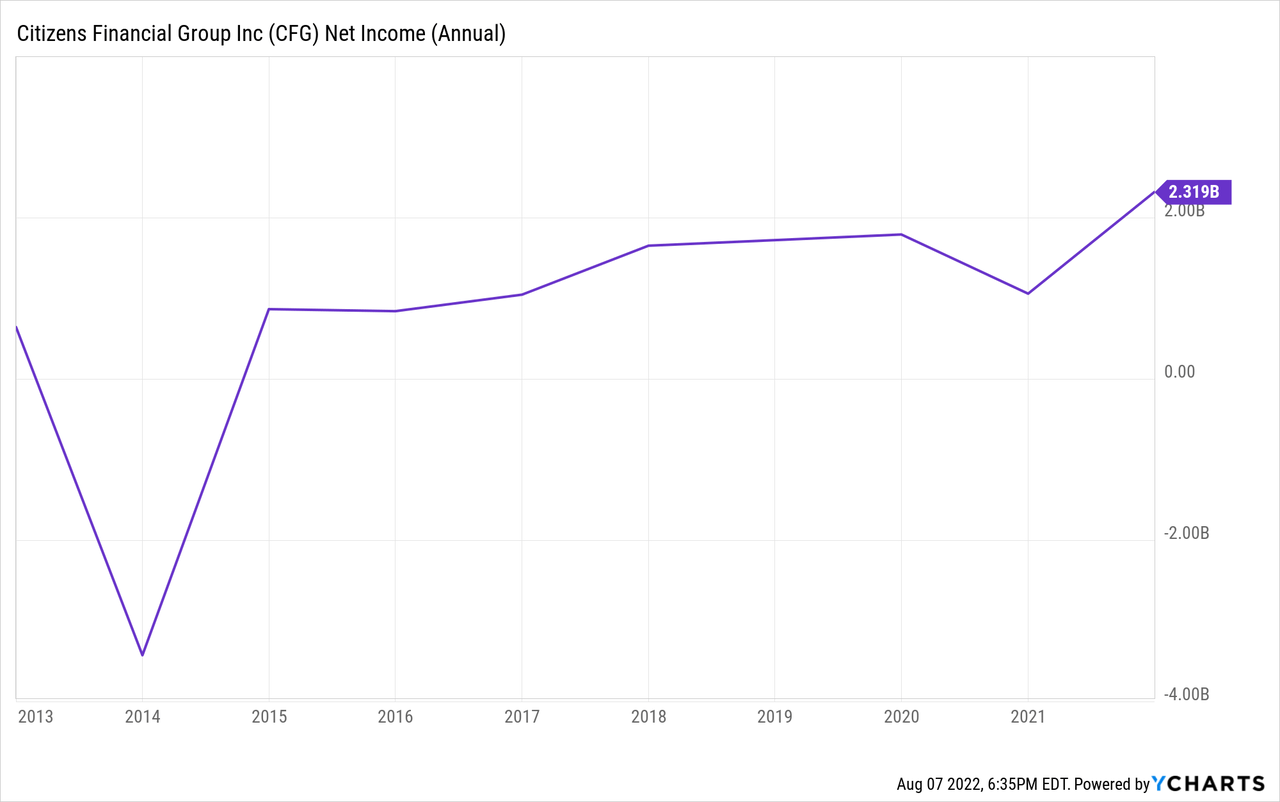

The bottom-line net income numbers have been really strong for CFG. Operating margins have averaged 33% over the past five years, with 2021 coming in at 45%. But keep in mind the loan loss benefit discussed above. Operating margin for the first half of 2022 was 28%, which is good, but well below the pre-pandemic level of 35% in 2019. Five-year net income for common stockholders has increased at 16.4% annually, with EPS increasing at a very strong 21% annually over the same period. In the first half of 2022, net income decreased to 40% to $728 million, while EPS decreased 44% to $1.58 per share. The company has been very aggressive by repurchasing almost 100 million shares, or nearly 20% of outstanding shares, over the past five years. The company is currently authorized to repurchase up to $1 billion worth of outstanding shares under its current authorization.

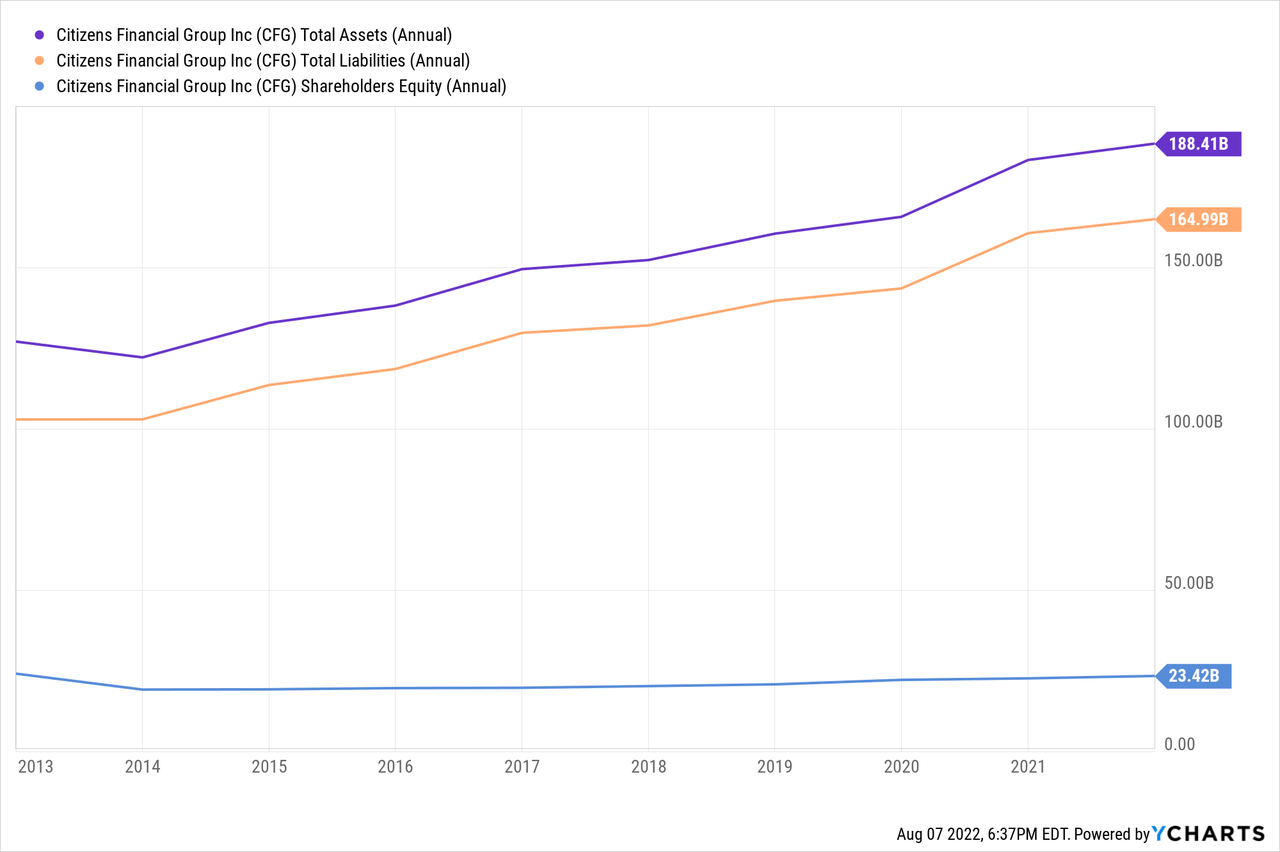

Balance Sheet

Looking at the balance sheet, total assets have increased 4.7% annually over the five-year period ending in 2021. Through the first half of 2022, total assets increased 20%, primarily due to the acquisitions earlier this year. More specifically, commercial loans increased 35% while retail loans increased 10%. Total liabilities have outpaced asset growth, with a 4.9% annual growth rate over the five-year period. Deposit growth has been strong, at 7% annually over this period. The trend continued in the first half of 2022 as total liabilities increased 23%, with deposits increasing 16% since the end of 2021. First half deposit growth excluding the acquisitions was a more modest 2%.

Notably, long-term debt has decreased over 11% annually over the past five years. With the acquisitions earlier in 2022, however, borrowings have increased to $14.4 billion, primarily due to FHLB advances. Actual long-term debt, though, has declined from year end 2021. Finally, equity has increased 3.5% annually, primarily driven by an increased reliance on preferred stock as a source of capital. Additionally, common equity and tangible common equity have both increased 1.9% and 2.5%, respectively, over the past five years.

Ratios

Return on equity was steady in the 8.3% range prior to the 2020 pandemic. After falling by about half in 2020, ROE rebounded to 10.1% in 2021. At the end of Q2, ROE was 8.6%, which is more in line with the historical average. Return on common equity has followed the same trend, declining from a peak of 13.5% in 2018 to 8.3% in 2021. At the end of Q2, ROCE was 6.1%, which is quite a bit lower than historical averages.

Debt to equity has steadily decreased, from a high of 0.87 in 2016 to just 0.30 at the end of 2021. Similarly, debt to total assets has decreased from 0.11 in 2018 to 0.04 in 2021. Interest coverage ratios are strong, with 2021 reporting a 9.8x interest figure. First half 2022 interest coverage was a very healthy 6.4x.

Credit Quality

In terms of credit quality, the company maintains excellent credit. Net charge offs in 2021 were just 0.26% of loans. The allowance for loan losses did tick up slightly from the end of 2021 to the end of Q2. This metric does bear scrutiny as it has increased a fair amount from where it was three or four years ago.

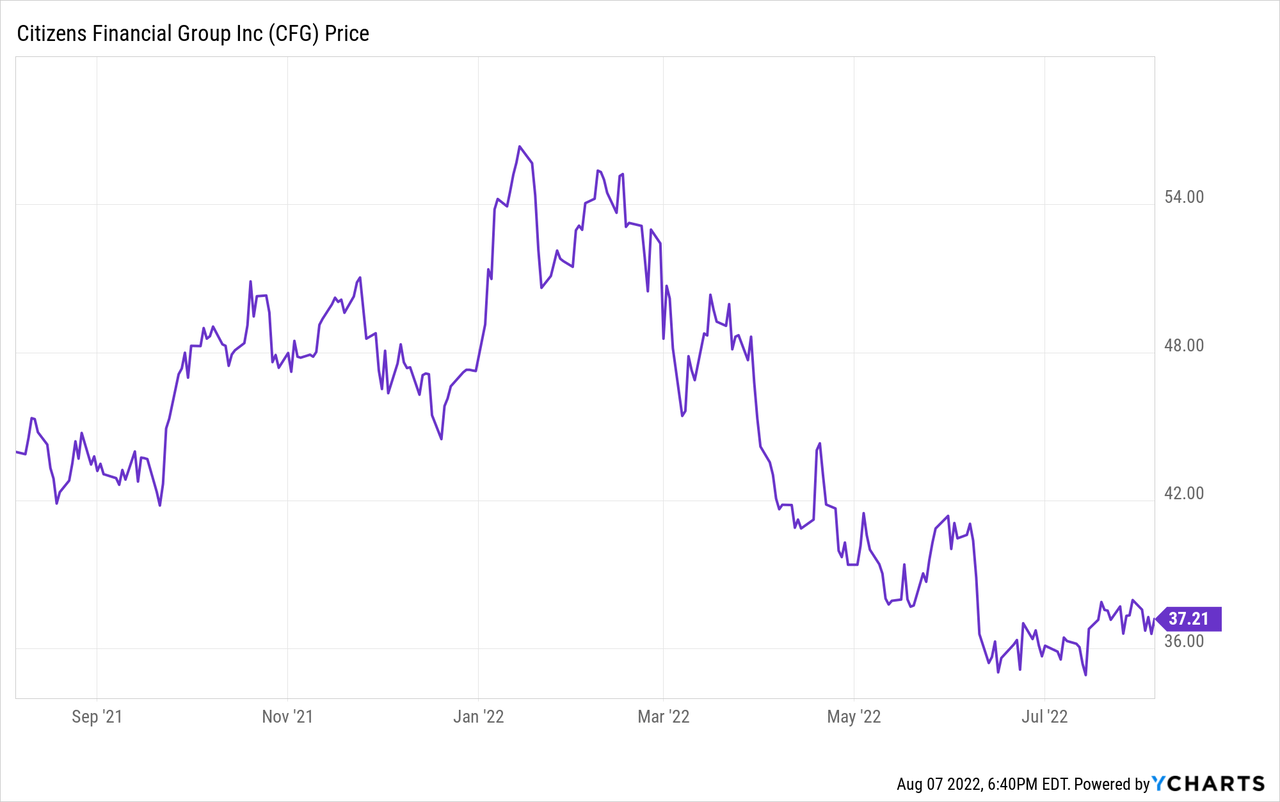

Stock Performance and Valuation

CFG is a good, quality regional bank. Like many stocks this year, CFG is down.

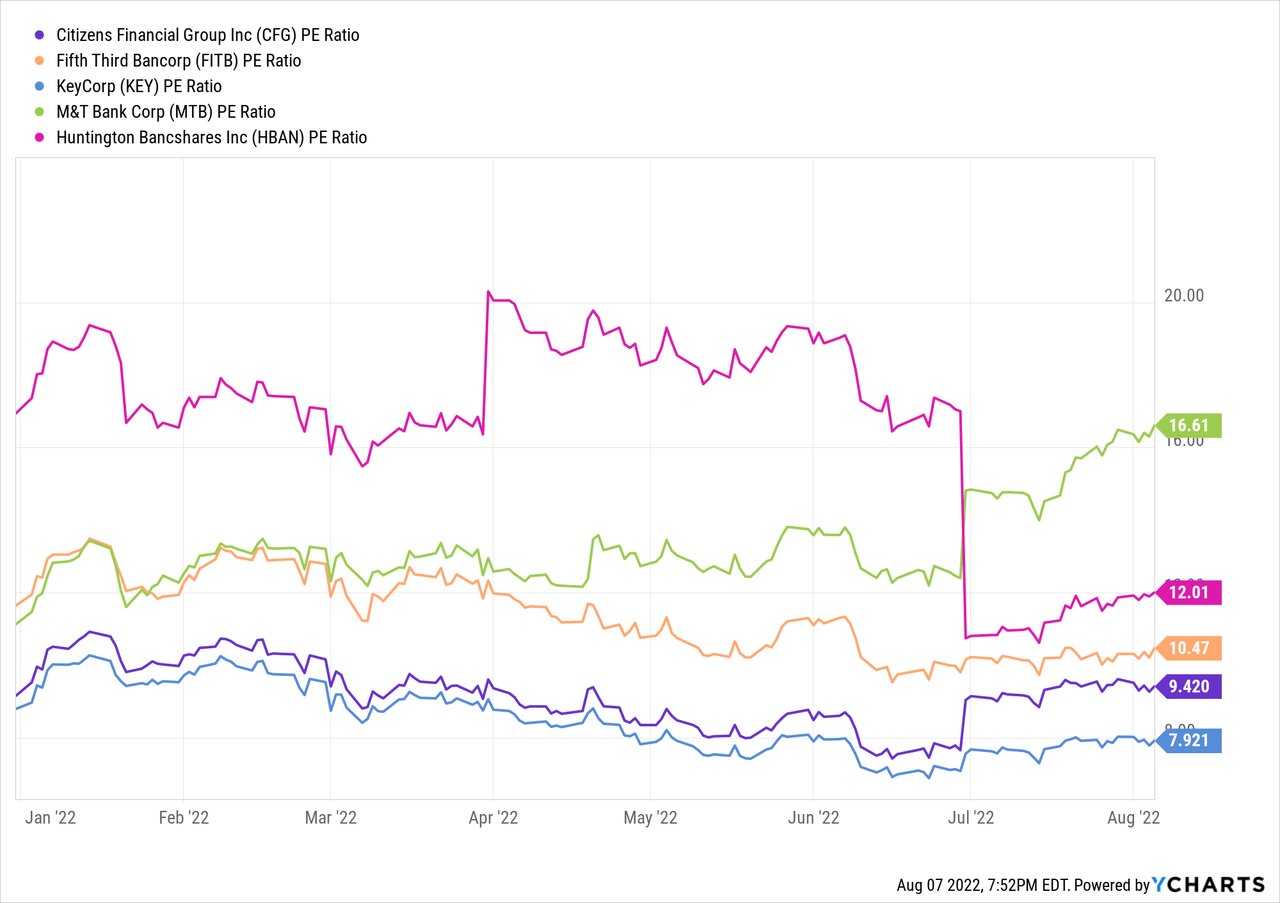

At a recent price of $37.21, the stock is trading at 9.4x last twelve months earnings with a 0.8x book value ratio. Both of these valuation figures are below the stock’s five-year averages, possibly reflecting lower revenue growth, higher expenses over the past six months and a declining economic backdrop. Compared to several of its peers, CFG has a below average P/E ratio.

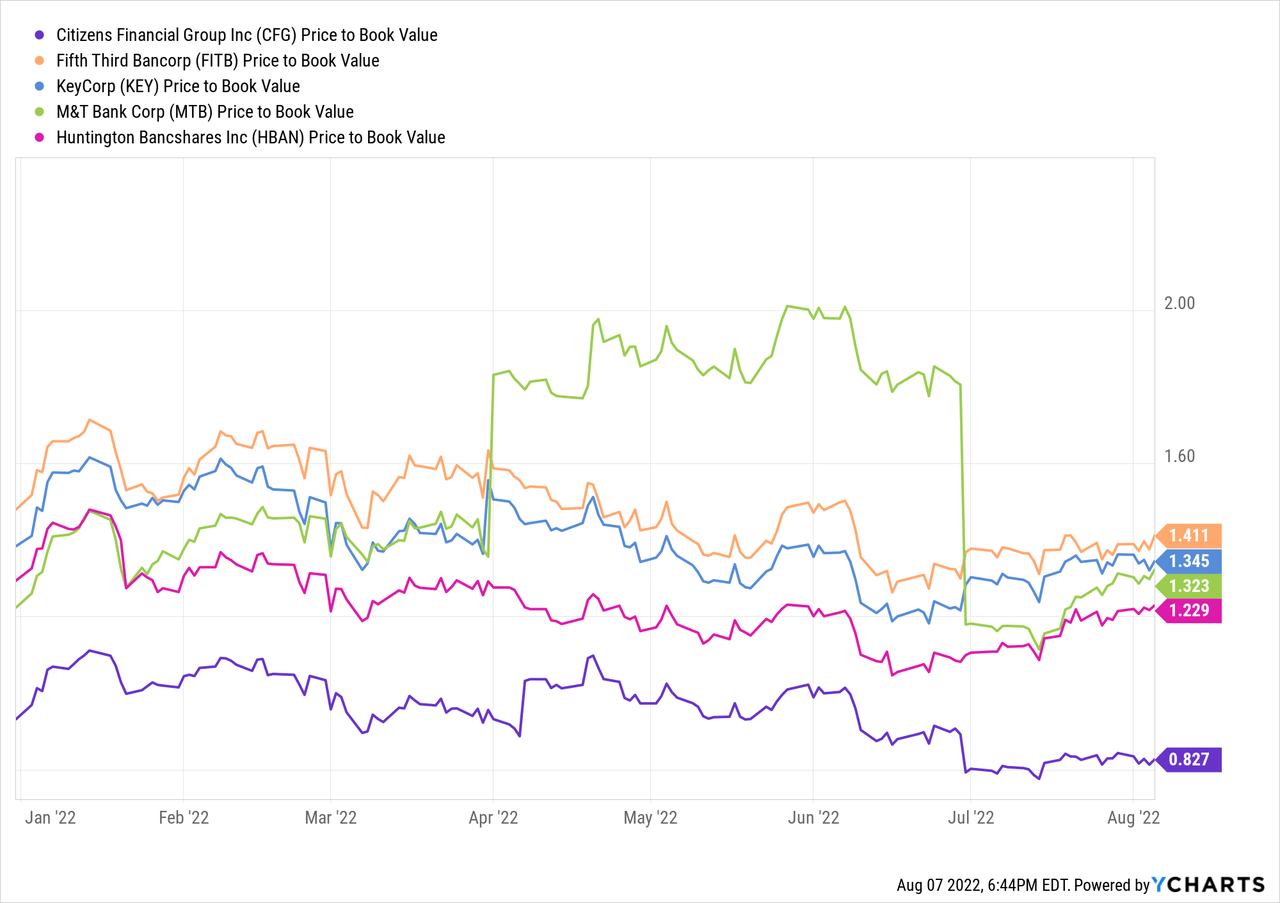

Additionally, the company’s P/B ratio is also below the peer average:

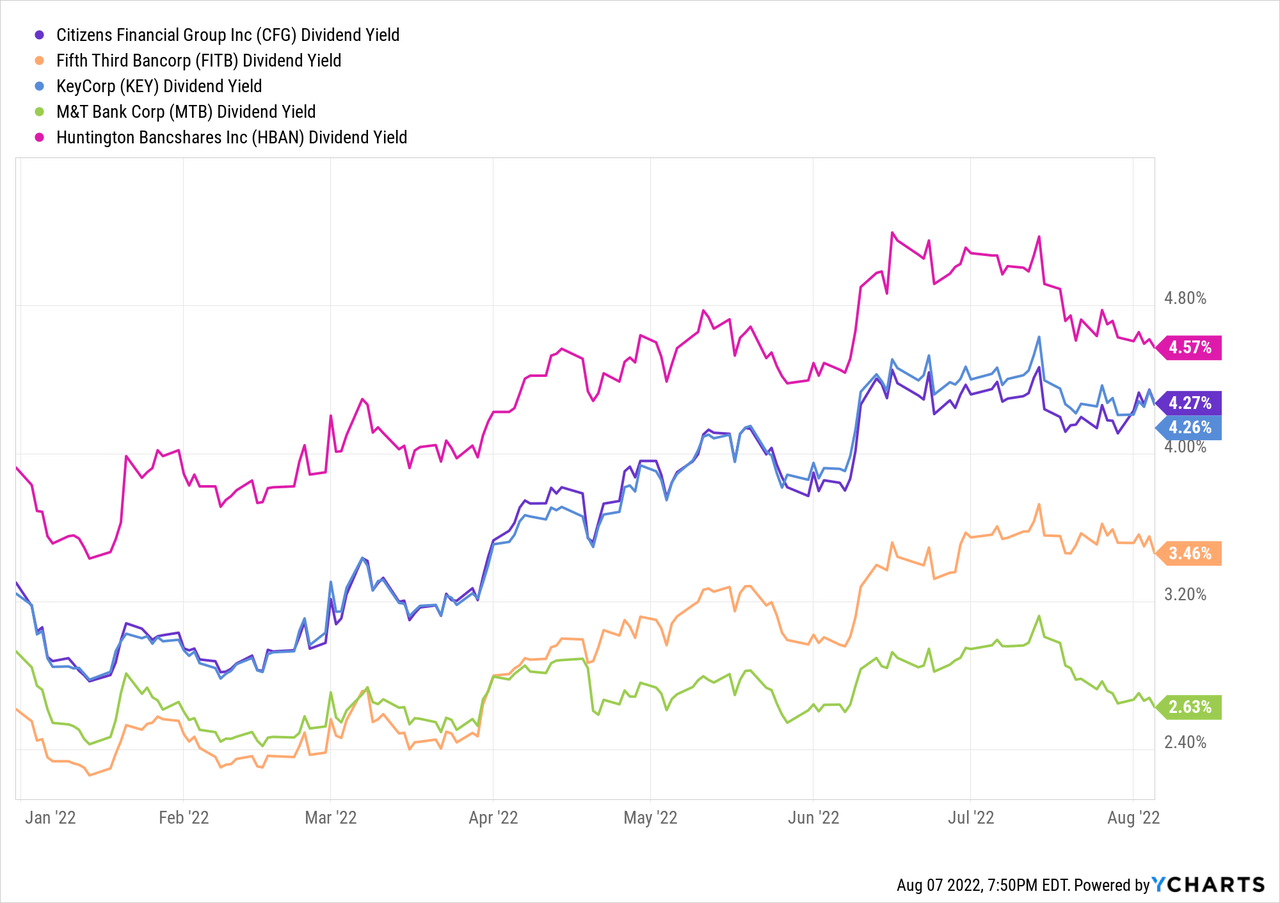

Using a variety of valuation methods, the fair value for this stock is about $40, so the stock is currently slightly underpriced. It does provide an above average yield of 4.27%, compared to the peer average of 3.77%.

As mentioned previously, while EPS has grown at a double-digit clip over the past five years, the stock price does not appear to reflect the ability for the company to generate that type of growth over the near term. As stated above, revenue growth has stalled for the moment, primarily due to the drop in mortgage banking revenues. Also, total expenses have increased during the first half of this year, which has resulted in a fairly significant decrease in net income.

I like the company and it is well positioned for future growth, particularly in the New York City metro area. Also, the yield is really attractive at these levels, and I believe the company has adequate cash flow and earnings to cover the dividend. Stock buybacks have been a large part of historical returns on the stock, and the company is authorized to repurchase up to $1 billion more. Although, they have not repurchased too much over the past two years.

Citizens Financial Group is another good, strong regional bank. For investors looking for solid dividends and earnings growth, it might be worth a look at these levels. There are a couple of warning signs investors should keep their eye on. The stock is currently priced at a slight discount. Like many of its peers, Citizens Financial has seen good times and bad over the many decades of its existence. Despite some short-term headwinds at the moment, it is probably a good bet that CFG will be a sound investment over the long-term as the company approaches nearly 200 years of existence.

Be the first to comment