ymgerman/iStock Editorial via Getty Images

The Fed just released its annual stress tests also known as CCAR.

CCAR is exceptionally important for the large U.S. banks as it effectively determines their minimum level of capital above which they are allowed to pay dividends and undertake stock buybacks.

For Citigroup (NYSE:C) it is especially important since it currently trades at only 0.6x tangible book value. It recently had to slow down buybacks as well due to increased capital requirements arising from changes in its Global systemically important banks (“GSIB”) score as well as an increase in its Risk-Weighted-Assets (“RWA”) due to methodology changes used to measure its trading book (also known as SS-CCR).

So Citi was forced to increase its target common equity tier 1 (“CET1”) ratio to 12% from 11.5%. And it is now in the process of building up its capital ratio with the expectation of managing to get CET1 of 12% by year-end. Citi’s CET1 ratio as of Q1’2022 is 11.4%.

(Note that all charts are extracted from the Federal Reserve Website)

Citi’s CCAR results are disappointing

The most important outcome from the Fed’s CCAR process is the Stress Capital Buffer (“SCB”) which measures the maximum drawdown in a severely adverse scenario.

For more background on CCAR and SCB, please read my prior article on the topic.

Back in 2020, Citi’s SCB was 2.5% and it inched up to 2.7% in 2021.

In the results released yesterday, Citigroup’s SCB has increased to 3.6% which is disappointing and will likely result in a higher target capital ratio for Citi.

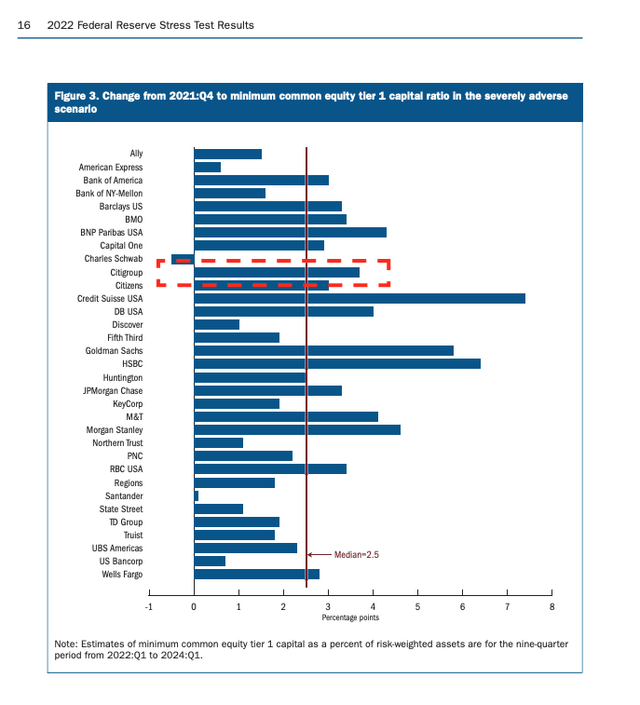

The results for all the banks are depicted below:

As can be seen above, Citi’s maximum drawdown of 3.6% in the latest CCAR results is well above the median for all banks of 2.5%.

What is driving Citi’s underperformance?

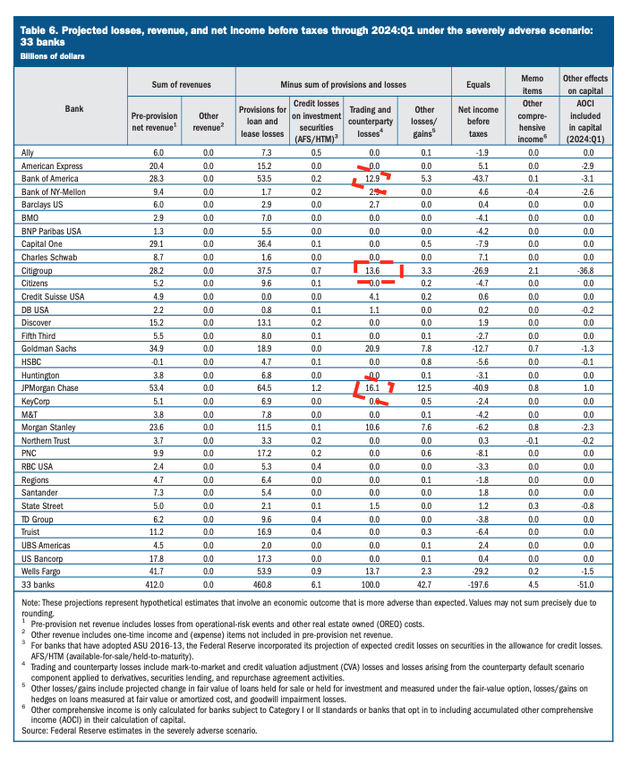

It is predominantly the trading and counterparty losses projection as can be seen below.

Citi projected losses are just a tad higher than Bank of America (BAC) even though its trading operations are much larger. As a point of reference, Citi’s trading and counterparty losses projections were only $6 billion in 2020.

It looks like either the positioning of the book or the specific scenarios and models used by the Fed had an adverse outcome on Citi’s projections.

In any case, I am sure that Citi’s CEO and CFO are bitterly disappointed and I am not surprised by the market reaction today (as I type, Citi’s share price is down more than 2% in an up market).

I suspect that Citi will now need to target a higher CET1 in the near term and I expect it to be 12.5%. This will handicap somewhat its share buyback capacity.

The positive takeaway

Citi is disposing of its global consumer bank including the sizable Mexican franchise. Doing so will not only release capital (~$15 billion), but it will also put downward pressure on both its G-SIB score as well as CCAR stress losses calculation. This should help it in reducing its target CET1 ratio back to ~12% in the medium term.

Final thoughts

I remain very bullish when it comes to Citigroup. It is both a self-help story as well as favorable macro and secular trends. I expect the underlying performance especially in the Investment Bank to be strong.

I see a paradigm shift in FICC trading income due to increased volatility as central banks cease to suppress volatility. Q2 should be exceptionally strong with management guiding to the north of 25% growth in Markets income.

Rising interest rates also favor its accrual business and especially the crown jewel Trade and Treasury Solutions (“TTS”).

Whilst it is certainly disappointing news on the buyback trajectory for 2022, especially as the shares are trading at such a discount to book, I expect Citi to significantly ramp up buybacks in 2023 and beyond.

Be the first to comment