FactoryTh/iStock via Getty Images

Investment thesis

Cisco Systems (NASDAQ:CSCO) operates a solid business with high profitability and free cash flow generation. However, this becomes a problem when there are limited growth prospects and potentially mismanaging market expectations over shareholder returns. We do not see a positive risk-reward balance for the shares offering a dividend yield of 2.8% and rate the shares as a sell.

Quick primer

Cisco Systems designs and sells a broad range of technologies from routers to security software that has been powering the internet since 1984. In 2017 the company set a goal to transform its revenue mix to have 50% as software and services, and this was achieved in 2020 via organic and inorganic revenue streams.

Cisco is no longer seen as a technology leader, but its key competitive strengths are: 1) a very broad end-to-end product portfolio making them ideal as a partner, and 2) highly reputable and best-in-class customer service and relations. Its key peers include Huawei, Fujitsu (OTCPK:FJTSF), Juniper (JNPR), HP (HPE), Extreme Networks (EXTR), and Dell/EMC (DELL).

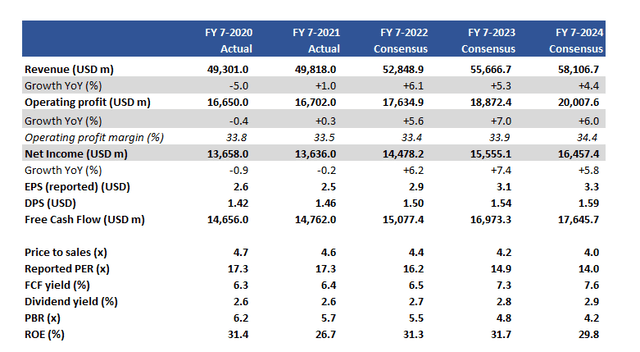

Key financials including consensus forecasts

Key financials (Company, Refinitiv, prepared by Karreta Advisors)

Our objectives

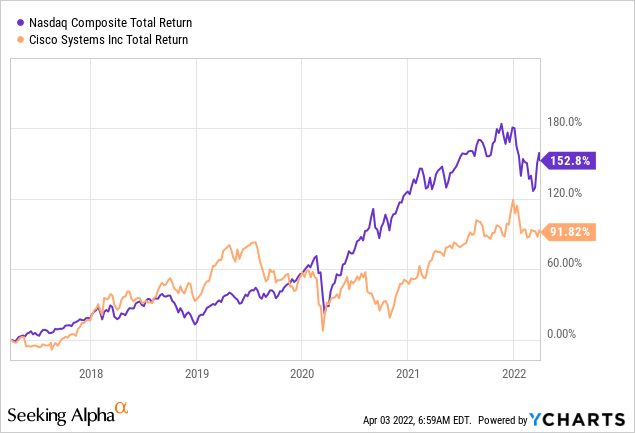

Cisco screens well with double-digit operating margins, high ROE, good free cash flow generation and consistently returning cash to shareholders. Despite these credentials, over the last 5 years, Cisco’s total return has underperformed the NASDAQ Composite by 61%. This highlights that any investment in the company had a relatively high opportunity cost.

There appears to be an expectation gap between what Cisco is perceived to deliver and how the market values the shares. In this piece, we want to assess how sustainable free cash flow generation is at the company, and how this capital is being allocated for shareholder returns and future growth.

Spending more than generating

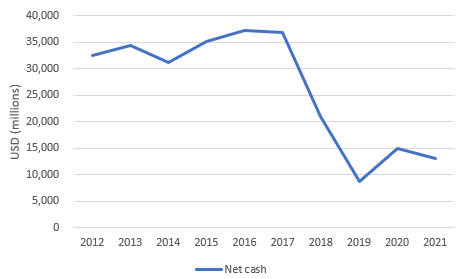

Cisco’s net cash balance of USD13.0 billion in FY7/2021 accounts for only 5.6% of current market capitalization. The net cash balance has been steadily falling since FY7/2018, which implies that there are more cash-outs as opposed to cash being generated.

Net cash balance trend at year-end

Net cash balance trend at year-end (Company)

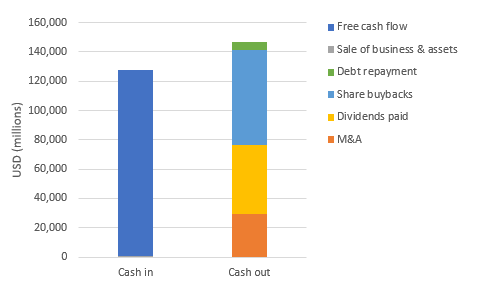

When looking at how capital has been allocated over the last 10 years, we see that the company has allocated more capital than it has been able to generate organically (even if we ignore debt repayments).

Cumulative capital generation and allocation over the last 10 years

Cumulative capital generation and allocation over the last 10 years (Company, prepared by Karreta Advisors)

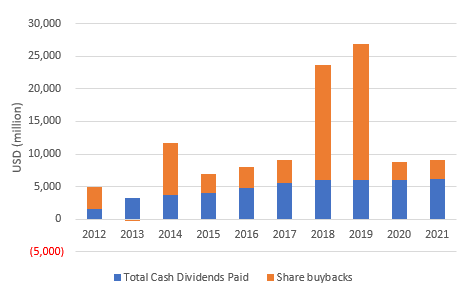

It is good to see a business put capital to use to generate growth via M&A as well as return cash to shareholders. However, we see a couple of red flags. Firstly, if Cisco was to maintain historical levels of spending then it will fall into a net debt position in the short to medium term. With that, shareholder returns may have to be financed externally which is a negative optic. Secondly, there is a risk that shareholder returns that were perceived to be sustainable becoming more volatile which would be negative for the shares. Historically, Cisco’s dividends have been stable with greater volatility in share buybacks.

Despite management’s focus on shareholder returns, the total cash distributed in FY7/2021 was actually below the level seen back in FY7/2017.

Annual cash spent on dividends and buybacks

Annual cash spent on dividends and buybacks (Company)

The key question is whether free cash flow can be sustainably generated and whether there will be much growth in the future. We believe Cisco will remain free cash flow generative with a strong track record in free cash flow conversion (consistently around 120% plus), but in terms of growth we are less positive as 1) conversion rates are unlikely to increase much from here and 2) earnings forecasts are not expecting much elevation in either sales or earnings.

We surmise that Cisco has a fundamentally good business, but is at risk of rising market expectations over its ability to consistently allocate more cash to shareholder returns.

Valuation

On current consensus forecasts the shares are trading on a free cash flow yield of 7.3% for FY7/2023. This is an attractive valuation, but we believe this estimate is too optimistic given there is little evidence to demonstrate why free cash flow will grow 13% YoY with only 5% topline growth, 7% OP growth YoY and consensus Capex forecasting an increase of 16% YoY. The prospective dividend of 2.8% is not very high.

Risks

Upside risk stems from Cisco performing well and gaining more market share, given Huawei’s lowered status in Western markets. Cisco can capitalize on its global sales and services network to drive growth.

With the market currently favoring stable businesses with high recurring revenues at cheaper valuations, Cisco shares may look comparatively attractive as an investment versus other tech peers.

Downside risk emerges when the market perceives that the company has been allocating capital to shareholder returns in an unsustainable manner, given future limitations over increasing its free cash flow.

With pressure to grow the company may embark on more M&A activity, which could have mixed results as well as placing limitations on cash for shareholder returns.

Conclusion

Cisco operates a good business with high profitability and free cash flow generation. However, where this becomes a problem is when there are limited growth prospects and potential mismanagement of market expectations over shareholder returns. Total cash distributed to shareholders in FY7/2021 has fallen compared to FY7/2017, and consensus forecasts for dividends per share show low single-digit growth in the future. We do not see a positive risk-reward balance for the shares offering a dividend yield of 2.8% and rate the shares as a sell.

Be the first to comment