raisbeckfoto

Next Wednesday afternoon, we’ll get fiscal fourth quarter results from technology giant Cisco Systems (NASDAQ:CSCO). The company disappointed investors back in May when it provided much weaker than expected guidance, calling for revenues to decline over the prior year period. Management will have a chance to redeem itself this time around, with investors looking to see if this was just a short-term hiccup in growth or the start of another down cycle.

For the July 2022 quarter, Cisco guided to revenues being down 1% to 5.5% over the year ago period. Analysts were hoping for some growth in the period, and non-GAAP EPS guidance of $0.76 to $0.84 came in well short of the consensus of $0.92. At the time, management said that demand was not an issue, more so that Cisco’s results were still being pressured by the Russia / Ukraine situation and the impact of COVID lockdowns in China. This quarter was only the second miss on the top line in the past five years, although two of those misses were in the past three fiscal quarters.

As you might expect, analysts have cut their numbers since the May report. The current street average calls for revenues of $12.78 billion, which would be a nearly 2.7% decline over last year’s fiscal Q4. The interesting part here is that the US dollar has strengthened a bit since that guidance was given, so holding all else equal, you might expect revenues to come in towards the lower end of the guidance range. On the bottom line, non-GAAP EPS of $0.82 are expected, which would be down more than 2.2% year over year. Cisco has not missed on the adjusted bottom line in the past five years, although it only beat by a penny per share in 10 of those quarters.

As we look forward to the current fiscal Q1, which ends in October, analysts are expecting some sequential improvement in the top line. However, the street still expects about a 0.4% decline in revenue to $12.85 billion. Non-GAAP earnings per share are expected to rise more than 2.3% to $0.84. Revenue growth is expected to accelerate throughout the year, as seen in the graphic below, partly as the company faces easier comps in the back half of the year. Overall, the street is looking for more than 3.2% yearly revenue growth to $52.87 billion, with non-GAAP EPS rising by 5.5% to $3.54.

Quarterly Revenue Estimates (Seeking Alpha)

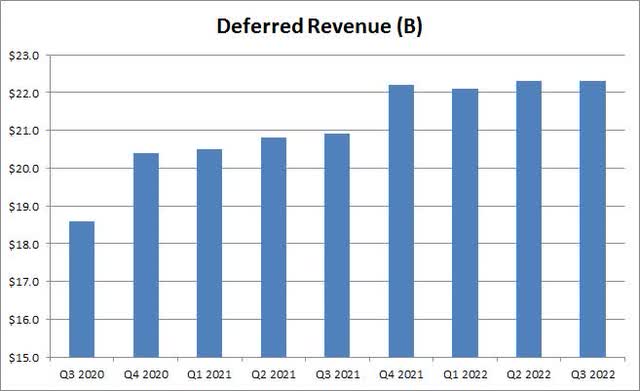

Beyond the headline numbers, I’ll be looking at the update on three key metrics from the company – the deferred revenue balance, remaining performance obligations, and annual recurring revenue (“ARR”). As the chart below shows, Cisco’s deferred revenue balance has been rising nicely in the past two years, so I’ll be looking to see if we get the usual Q3 to Q4 jump. These are revenues that will be recognized moving forward, so this metric can be seen as a measure of future business strength. A rise in your remaining performance obligations also can be seen as a positive, as it shows you are booking more future business.

Cisco Deferred Revenue (Company Earnings Reports)

Perhaps the most important number for investors though will be annual recurring revenues. Cisco is looking to get this percentage up moving forward so the business is more steady and less seasonal, as ARR currently represent less than half of the company’s total. This also is part of the move from Cisco to become more of a service-based business than a hardware focused one, although growth rates for key metrics on the hardware side have been more impressive in recent quarters.

These metrics are key because investors want to see some growth from Cisco in the coming years. While the stock has a nice capital return program, including a more than 3.3% annual dividend yield and a buyback plan, the name is seen as an old, legacy technology name like IBM (IBM). To shed that kind of mantra, it starts with revenues, and guiding to year over year declines doesn’t sit well with investors. That’s why we saw the sharp decline a few months ago, especially as we have rising fears over tech spending slowing down due to sluggish global growth.

As for Cisco shares, they closed just above $46 on Wednesday. Wall street is fairly positive on the name, with the average price target implying almost $8 of upside from current levels. The reason this earnings report is key in my opinion is because the 50-day moving average (purple line) in the chart below has basically leveled off. A good earnings report could send this key technical trend line higher, which would provide support for a new breakout to the upside. However, if Cisco falls below the 50-day, new yearly lows are in play and the line then rolling over would likely mean resistance moving forward.

Cisco Year To Date (Yahoo! Finance)

Investors will be watching Cisco closely next week as it is the last big major tech name to report quarterly results. The hope is that the company is in the midst of just a one or two quarter revenue downturn, partially hurt by the stronger dollar, and that top line numbers will look much better as we move into calendar 2023. With the stock’s 50-day moving average basically flat at the moment, Cisco’s results will likely form the basis for the move over the next couple of months.

Be the first to comment