Circling The Wagons

Many of us of a certain age remember playing the computer game “Oregon Trail” as kids. In it, you play as a group of settlers traveling West through wild and scarcely populated territory toward the coast. During the journey, you face many hardships, from snake bites to diseases to tornadoes to food spoilage.

In the 1800s, this wasn’t just a game for American settlers. Many thousands of travelers braved the unknown wilderness and its many challenges to create a better life for themselves at their destination. Some of those challenges, such as harsh snowstorms in the Rocky or Sierra Mountains, were impossible to adequately prepare for. Winter claimed the lives of many intrepid pioneers.

But there were some challenges from which the settlers could defend themselves. They often traveled in caravans of covered wagons, and when they paused for rest or sensed oncoming danger, they would arrange the wagons into a circle to create a protective barrier. Bandits or hostile natives often preyed on relatively defenseless colonists with their women, children, and pack animals in tow.

Circling the wagons was a way of mitigating the damage of attacks and changing the odds in their favor. It would prevent the enemy horsemen from penetrating their perimeter and trampling them or creating chaos.

In my judgement, dividend-oriented investors, whether retirees, near-retirees, or long-term compounders, should be “circling the wagons” right now in our investment decisions. By that, I mean that we should be playing defense with our portfolios as much as possible by focusing only on the safest and strongest dividend stocks.

COVID-19 continues to spread rapidly, and the stay-at-home policies resulting from the disease could continue well into May or beyond. Even after these official rules are lifted, the economy will not return to any sort of normalcy until sometime this summer, at the earliest. While we all hope for the infection rate to slow and for the economy to recover quickly thereafter, investors should remain very careful and conservative during this time so as not to waste limited capital. That means preparing for the worst plausible scenario, in which economic normalcy doesn’t return until sometime this Fall. Even when such “normalcy” resumes, it would not be a return to the relatively healthy economy we had before.

With that said, let’s examine some defensive dividend-paying stocks that look unfairly punished during the current bear market. While some of these may be good buys immediately, others could be ones to watch for further price declines. I leave that for you, the reader, to decide.

1. Medical Office Building REITs

Medical office buildings (“MOBs”) are riding the tailwinds of two long-term megatrends: demographics and economics.

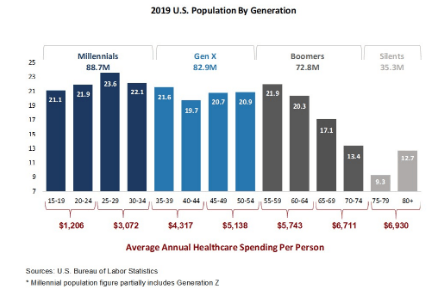

Most people are well aware of the demographics tailwind. The huge Baby Boom generation is aging, moving steadily into their 60s, 70s, and 80s. This is the age at which reliance on the healthcare system is highest (4x as many physician visits as the younger population).

Source: HTA 2019 10-K

Source: HTA 2019 10-K

Quite simply, the aging of Baby Boomers signifies a wave of steadily elevated demand for healthcare providers in the coming decades.

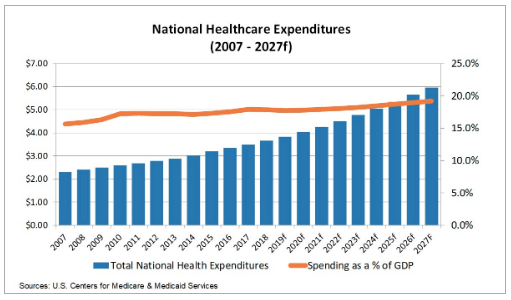

Source: HTA 2019 10-K

Source: HTA 2019 10-K

The economic tailwind pertains to the efforts toward cost-containment. In-patient and hospital services tend to be the most expensive of all forms of healthcare. Hospital operators have largely consolidated in past decades, and regulations on the addition of new hospital beds have restricted the growth of new supply in the hospital space. These factors plus the natural uptick in demand have led to skyrocketing costs. It has also led governments and managed care (insurance) providers to seek out alternatives to hospitals.

This has led to the outsourcing of former hospital services and procedures to outpatient providers in medical office buildings. These include minor surgery centers, ambulatory care facilities, sophisticated imaging services such as MRI and CT scanning, primary care offices, home healthcare offices, dentists’ offices, and blood work laboratories.

And when it comes to medical office building tenants, very few (besides dentists) have seen their core business disrupted by the pandemic. On-campus healthcare providers in particular, which are closely associated with hospitals, have likely seen their traffic increase as hospital beds dwindle and more patients are pushed out to outpatient facilities. Medical offices, naturally, are considered an essential business and are thus allowed to remain open and in business during this time.

Let’s look, then, at two MOB REITs.

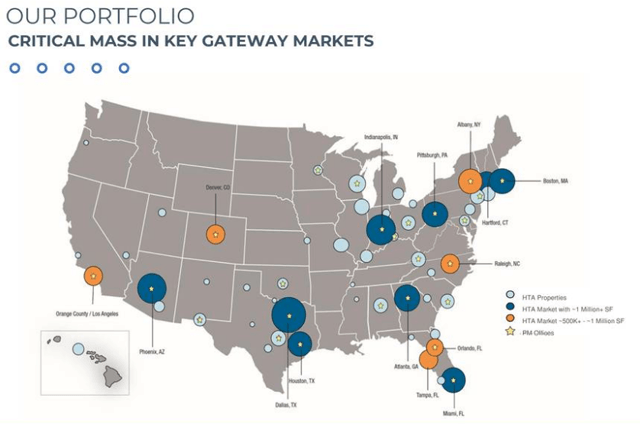

Healthcare Trust of America (HTA) is the largest owner and operator of medical office buildings in the United States. The REIT has invested almost $7 billion over the past decade in on-campus (68% of GLA) and core off-campus MOBs (32% of GLA) in 15 primary metro markets. Dallas (12.5%), Houston (6.4%), Boston (5.9%), Tampa (5.2%), and Atlanta (4.8%) make up the top five markets.

Source: Q4 Presentation

Source: Q4 Presentation

HTA also enjoys a diversified tenant base, with the top 15 tenants accounting for only 30% of annual base rent and the top five only 14.9%. Only two of the top 15 tenants have a credit rating of BB or lower, and another two are unrated. While 9.1% of leases (by ABR) are ending in 2020, it is unlikely that those spaces will be vacant for long with healthcare in such high demand. The REIT’s total leased rate was 90.8% as of the end of 2019. Overall, HTA enjoys 5.6 years on average remaining on its lease terms.

Leasing spreads have been rising in recent quarters, and many of HTA’s leases also come with built-in lease escalators. In 2019, same-property NOI rose 2.7%.

HTA has an investment grade (BBB) rated balance sheet, with $1.2 billion of liquidity and net debt to EBITDA of 6.5x at the end of 2019. In 2019, HTA paid out 76.6% of operating cash flow and 81.5% of FFO. As of this writing, HTA offers a dividend yield of 5.74% and trades at a price to 2020 FFO of 12.8x. The dividend has been growing at an average pace of around 1.6% in recent years, a growth rate that would result in a yield-on-cost of 6.73% in ten years, based on the current price. That may not be a terribly exciting YoC projection, but keep in mind that HTA is an extraordinarily safe investment at this time.

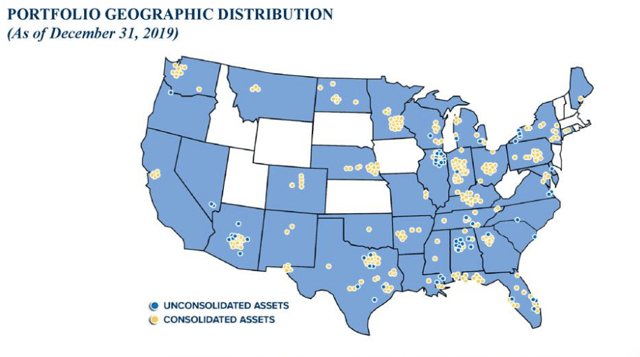

And then there’s Physicians Realty Trust (DOC), which is an MOB REIT very similar to HTA but with a few slight differences. Occupancy is a little higher for DOC, with 95.9% of GLA leased, and only 2.4% of leases are expiring in 2020 for DOC. Also, DOC has an average of over 7 years remaining on its lease terms. DOC is also slightly more geographically diversified than its peer.

Source: Q4 2019 Presentation

Source: Q4 2019 Presentation

As of March 19, DOC enjoyed total credit facility capacity of $850 million. At the end of 2019, DOC’s debt was slightly lower than that of HTA at 6.12x net debt to EBITDA, and it has very little debt maturing in 2020 and 2021. The REIT offers a dividend yield of 7.17% and trades at a price to 2020 FFO of 11.89x. If the REIT does not engage in any acquisitions this year and FFO remains flat YoY, the price to FFO would be 13x, and the payout ratio would be 92.9%.

The dividend, however, has not grown over the course of DOC’s 6.5-year existence as a public company, so investors should not expect much growth as far as the dividend is concerned. That said, I view the 7%+ dividend yield as safe, so long as we do not get news of financial weakness from one of its tenants. The large percentage (almost 60%) of investment-grade tenants is a comfort, especially considering the lack of margin of error in the FFO payout ratio.

2. Other Healthcare Stocks

While not every healthcare company is immune from the coronavirus or its impact on the economy, the sector as a whole is more insulated than most businesses. That makes it a good place to look for stocks that have sold off with the market but should prove resilient to the pandemic. The following two stocks don’t share much in common other than being generally healthcare-related and have strong records of dividend payments.

Healthcare Services Group (HCSG) provides a number of non-healthcare related services to healthcare providers like nursing homes, retirement communities, hospitals, and rehab centers. It is the quintessential “boring-but-necessary” business, providing housekeeping, facility maintenance, food services, and laundry/linen cleaning to the healthcare industry. Revenues are split roughly evenly between services deemed “housekeeping” and those labeled “dietary.”

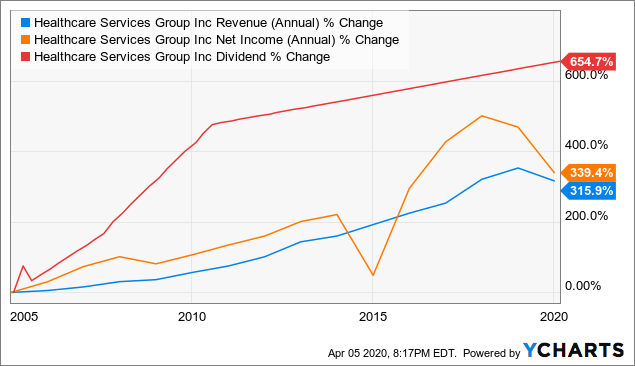

Aside from a dip in the last year or so, revenue and net income growth have been remarkably steady. And the dividend has grown faster than either, having been initiated in 2002.

Data by YCharts

Data by YCharts

What happened in the past year? In Q4 2019, revenue dropped 10% YoY, while net income was down 40% and EPS down 42%. Providing basic services to medical clients is by necessity a low margin business. If HCSG was able to charge more in order to enjoy higher margins, then they would not be competitive enough to earn business or prevent their customers from handling those services in-house. What happened for HCSG in 2019 was that a customer had trouble making their payments on time, and much of that money owed still hasn’t been paid. In 2020, at least prior to the COVID-19 outbreak, management expected earnings to bounce back from $0.87 to $1.12.

It’s useful to remember that many of HCSG’s customers are nursing home and retirement community operators, many of which have extremely thin margins and fixed charge coverage metrics themselves.

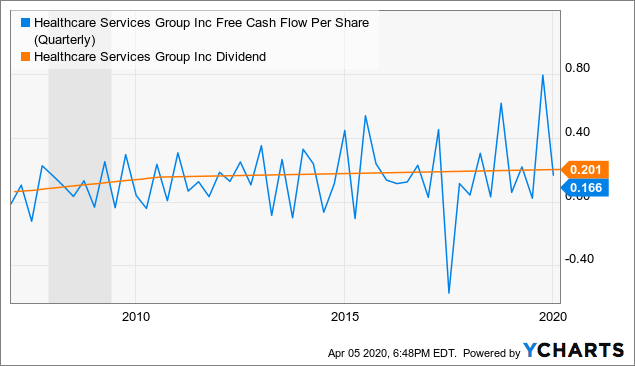

The good news is that HCSG has been able to manage cash flows well, with operating cash flow rising 16% YoY from 2018 to 2019. FCFs have tended to cover the dividend in the past, and that continues today.

Data by YCharts

Data by YCharts

In the last twelve months, HCSG has paid out 66.2% of FCF and 92.1% of EPS. And the dividend has risen every quarter for 16 years. That dividend growth rate, however, has slowed to around 2.5% per year. Given the relatively low starting yield of 3.85%, I would like to wait for the stock price to fall a bit more before seriously buying HCSG.

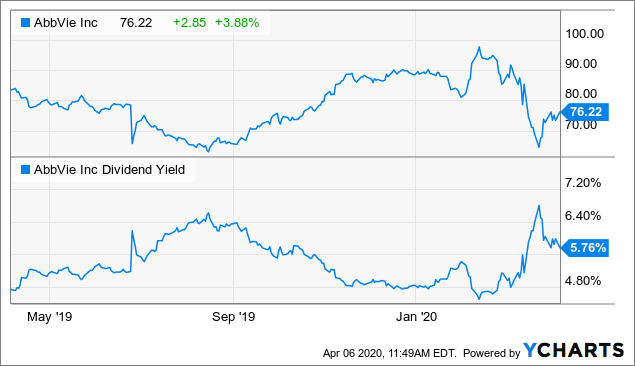

AbbVie (ABBV) is a biopharmaceutical company that develops and produces oncology, immunology, and other drugs for critical illnesses. ABBV suffered a sharp pullback in 2019 after announcing the expensive, $63 billion acquisition of Allergan (AGN), the pharmaceutical company most well known for being the maker of BOTOX. The 2012 spin-off of Dividend Aristocrat, Abbott Labs (ABT), has now returned to 2019’s good value range and offers a 6%+ yield.

Data by YCharts

Data by YCharts

But ABBV’s fundamentals have not changed. The Allergan acquisition, as well as the company’s robust development pipeline, should provide ample cash flow to pay down debt and fund continued R&D while supporting the generous dividend before the key US patent expiration of Humira in 2023. ABBV’s free cash flow yield sits at 12.5%. Plus, whatever short-term pain is brought on by the current crisis, if any, the company can handle with its enormous cash pile of $10 billion+.

I find it doubtful, however, that ABBV will suffer any material downside from the coronavirus pandemic, as the majority of its revenue is derived from insurance companies or the government. Investors at the current price, then, can simply enjoy collecting the 6%+ yield while they wait for the market to reprice ABBV higher.

*** I regularly offer dividend stock ideas like these. If you find this information valuable, please follow me by clicking the orange “Follow” button at the top of the page.

Disclosure: I am/we are long HTA, DOC, HCSG, ABBV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment