Natali_Mis/iStock via Getty Images

In my previous article on CION Investment Corporation (NYSE:CION), I wrote about the poor timing for this BDC that went public in October 2021 after nearly a decade as a private company. Now in September, as the Fed gets ready to raise rates again and the market is undergoing yet another downturn that looks to be getting even more severe, CION continues to offer long-term investors a unique opportunity. CION offers a healthy distribution with a 13% annual yield from a dividend that was raised by 10%, from $0.28 to $0.31 quarterly, after the company’s Q2 earnings report. Additionally, there is potential for capital appreciation as the stock trades for under $10 per share, closing at $9.92 on September 16 while the NAV as of June 30, 2022, was $15.89, down slightly from March 31 when it was estimated at $16.20.

When I first wrote about CION back in June during the lowest point of the 2022 market thus far, the discount to NAV was about 40% and the yield was 14%. That was an excellent time to establish a long position in CION and the stock has performed well since then. However, as credit markets begin to deteriorate again, there may be another opportunity soon to establish a position, or to add to an existing one, in this newly public BDC before it resumes its upward trend.

In a recent commentary from CION, the company discussed the current state of the credit markets and what they view as a potential near-term outcome based on the Fed’s actions. CION invests primarily in the debt of private middle market companies through the issuance of 94% senior secured loans which are about 85% floating rate, so this BDC stands to benefit from rising rates. However, the overall economy is expected to continue to deteriorate and thus credit markets may suffer more in the coming months, tamping down the expectations for continued outperformance in the BDC sector.

The July and early August question of whether the markets were recovering or if it was a bear market rally was answered, with the bears remaining firmly in charge. The catalyst was Chairman Powell’s recent remarks, where he made clear that the Fed is committed to getting inflation under control.

Treasury yields rose, almost hitting the June year-to-date peak. After a mostly positive July, most major credit sectors declined in August. The Bloomberg Barclays U.S. Aggregate turned in its sixth month of negative performance, retracing all the gains from July, which was its best month year-to-date.

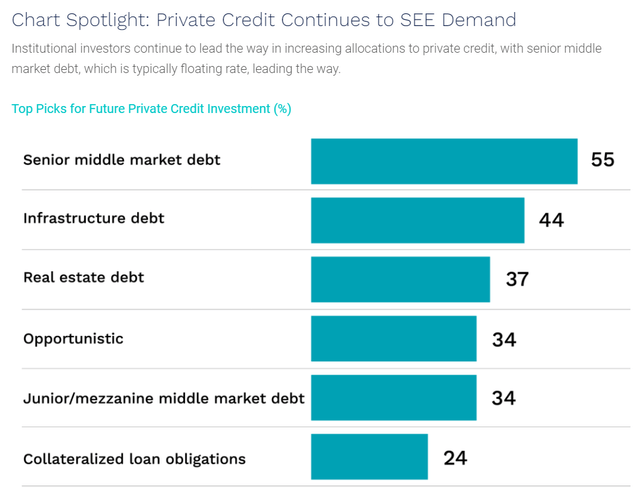

In addition, the commentary notes that future expectations are expected to remain negative with further softening of demand over the next six to twelve months. Price pressures are expected to persist at least through the end of the year. The silver lining in all of this is that opportunities exist to invest more in private credit, which is expected to see continued demand as illustrated in this chart from the article.

CION credit market commentary (CION website)

Investment Management Expertise

One differentiator for CION as an investment includes the external manager’s expertise. CION, the BDC is externally managed by CION Investment Management, LLC, or CIM. CIM is a different breed with unique capabilities of scale and precision based on established relationships and core partnerships in the credit and asset management space. CIM is an affiliate of parent company CION Investments. In addition to CIM the company also holds subsidiary companies CION Securities and CREM Capital. The CIM subsidiary also offers a product that is managed by CION Ares Management, a joint venture with Ares Management (ARES), called CION Ares Diversified Credit Fund.

Portfolio Allocation

According to the fund website, CION invests in companies with a targeted range of EBITDA from $25M to $75M. The average transaction is around $25M. Primary investment types are senior secured loans that are about 93% first lien, some second lien and unitranche, and about 4% equity co-investment. Roughly 85% are floating rate loans, 10% fixed, and about 4% in non-income producing investments.

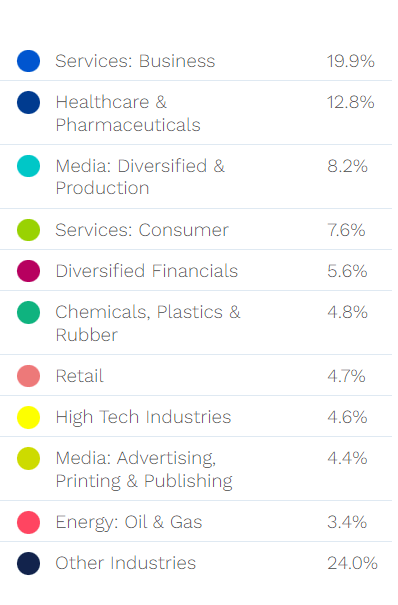

As of June 30, 2022, there were 121 portfolio companies in diversified industries representing a portfolio value of $1.9 billion in total assets.

Portfolio allocation by industry (CION)

Second Quarter Earnings Summary

After a difficult first half of the year for equity and credit markets, CION reported a reasonably good quarter in their Q2 report published August 11. Even though the headline reported by SA was a GAAP EPS loss of $-0.02, net income for the 3 months ending in June was $43.6M or $0.34 per share.

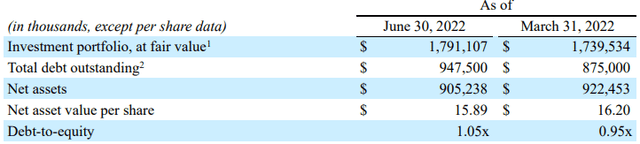

As of June 30, 2022, the Company had $947.5 million of total principal amount of debt outstanding, of which 78% was comprised of senior secured bank debt and 22% was comprised of unsecured debt. The Company’s debt-to-equity ratio was 1.05x as of June 30, 2022, compared to 0.95x as of March 31, 2022.

Debt to Equity (Q2 press release)

Investments on non-accrual status amounted to 1.5% and 3.6% of the total portfolio fair value and amortized cost, respectively.

- On April 27, 2022, the Company entered into a 5-year floating rate unsecured term loan agreement with More Provident Funds and Pension Ltd. under which the Company borrowed $50 million; and

- On June 24, 2022, the Company’s board of directors, including the independent directors, increased the amount of shares of the Company’s common stock that may be repurchased under the Company’s share repurchase policy by $10 million to up to an aggregate of $60 million.

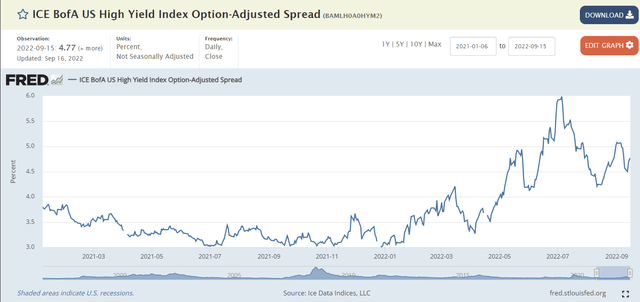

NAV per share declined to $15.89 from $16.20 on March 31. The decrease was due primarily to mark to market adjustments caused by wider credit spreads and price declines. As can be seen in this chart from the St. Louis Fed, the credit spreads really began to widen in June reaching the peak of 5.99% on July 5. Since that time, the spread began to normalize back to around 4.5% before rising again now in September.

High Yield Credit Spread (FRED economic data from St. Louis Fed)

In summarizing the Q2 results, co-CEO Michael Reisner discussed the investment philosophy and portfolio growth despite difficult market conditions:

“The improved second quarter financial and portfolio performance is a result of our prudent, long-term investment strategy which we continued to implement even during these volatile market conditions. We remained focused on the expansion and diversification of our portfolio with solid companies across many industries while seeking to capitalize on new opportunities. As a result, during the quarter we increased our portfolio by $63 million in net funded investments. We believe we are well positioned to provide strong returns to our shareholders. Our stock trades at a significant discount to our net asset value per share of $15.89 at quarter end, which is one of the reasons why our Board recently approved the increase of the total amount to be repurchased under our existing share repurchase policy by $10 million to a total of $60 million. Share repurchases under this policy will be accretive to our net investment income per share, thus provide higher returns to our current shareholders,” said Michael A. Reisner, co-Chief Executive Officer of CION.

Distribution History and Policy

CION also announced that, on August 9, 2022, its co-chief executive officers declared a third quarter 2022 regular distribution of $0.31 per share payable on September 8, 2022, to shareholders of record as of September 1, 2022, which is an increase of $0.03 per share, or 10.7%, from the $0.28 per share regular distribution paid for the second quarter 2022.

Due to the recently public nature of the stock, there is a very short but enlightening distribution history for CION. In December 2021, the fund paid its first public quarterly dividend of $0.2648 and a special dividend of $0.20. Then in March 2022 and in June the company made quarterly distributions of $0.28. The next quarterly dividend to be paid in September will be $0.31. So, in less than a year the dividend has already been increased twice and a supplemental distribution was paid. The total amount of distributions paid in the trailing twelve-month period will be $1.33 for an annual yield of 13.4%.

Summary and Recommendations

Based on recent market conditions the reversal of the bullish trend that began in July but turned negative again last week, I would suggest that current shareholders continue to Hold and reinvest dividends if possible. There may be an opportunity ahead to increase a long position as the credit markets struggle to gain traction. I would be a cautious buyer under $10 if you are new to the stock but do not want to try to time the market. For others who are interested in this ticker, it may be wise to wait and see what happens over the next few months.

The upcoming mid-term elections may have some impact on future market sentiment, which could prove to be a time to “buy the dip” if the market does change course again. Meanwhile, the CION portfolio managers will likely deploy funds to take advantage of the opportunities that may prevail in private credit markets to further increase the portfolio NAV and thereby enabling continued growth in future distributions. CION has a good track record (since 2011) prior to going public with the CION stock in 2021 and this is not their first rodeo. Although if credit markets overall continue to tank in the next 6 to 12 months there may be no safe harbor for investors.

Be the first to comment