JHVEPhoto/iStock Editorial via Getty Images

Dear readers,

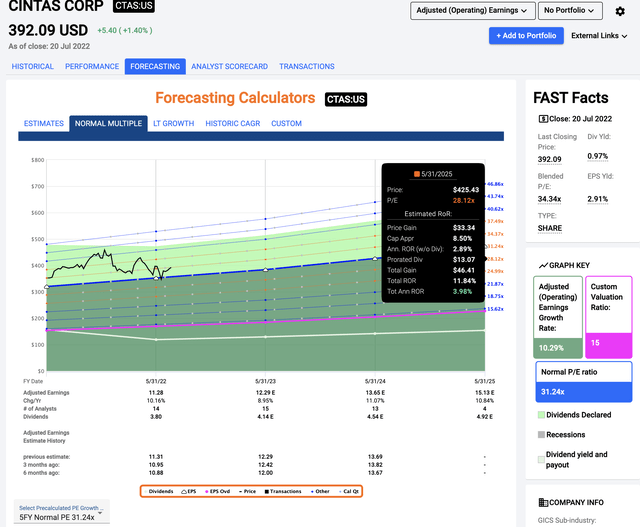

In this article, I’m giving you my unfiltered opinion on the Cintas Corporation (NASDAQ:CTAS). I’ve gone on record calling this company overvalued, and it’s been an up and down development for around a year now, with highs of $450 and lows close to $350 for the company. In this article, I’m looking at what a valuation of $393 per share gives us, as this is the price we’re seeing for the company today.

Cintas – Updating on this conservative stalwart

So, why would you want to own Cintas anyway?

A few reasons – and most of them are easily understood. I’ve written about Cintas Corporation a few times. This is a very conservative business in a segment that’s required virtually everywhere in the modern business world.

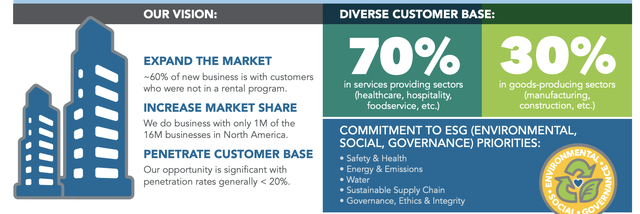

This is a business with over one million individual customers across Latin America and North America, with a two-segmented operating structure that came through the global pandemic relatively unscathed. It’s also very unlikely that Cintas sees any sort of major impact or effect from the Russian situation currently wreaking havoc on the markets. Their direct exposure to the geographies is zero, leaving only indirect effects for the company.

On the surface, it seems like what the company does should be possible to be done by just about any company out there, maybe even by a company’s own operations where they run a cleaning and clothing department. Still, this is quite often the case with simple business ideas. They seem simple – but when you get into it, they’re not. This is where the economics of scale come into the equation – as well as a few other things.

Cintas provides services including uniforms, mats, mops, cleaning and restroom supplies, first aid & safety products as well as testing and safety courses.

Sounds really simple, doesn’t it? How does this business idea grow to over $7 billion in annual revenues, with a net income of closing on $1 billion? Well, Cintas is obviously doing a good job. Because earning $1B from a $7B in revenues from supplying what boils down to day-to-day commodities is very impressive.

Cintas operations are, as of 2Q22, split into the following segments.

- The Uniform Rental And Facility Services segment

- First aid and Safety Services

The activities in the segments are fairly self-explanatory, including all manner of uniforms and flame-resistant clothing, as well as more common cleaning products such as mats, mops, shop towels, and similar items. Cintas also performs cleaning services and other supply sales.

The latest results for the company that we have to go by are the 4Q22 fiscal results, which came in strong at a significant revenue increase of 13%, coming to an annual run rate of over $8.2B. Despite massive inflation issues, the company’s operating margin actually increased, once again showcasing this company’s fundamental strength in the face of a very troubled market. EPS increased almost in lock-step by 13.8% to a $2.81 level for the quarter.

Company sales saw no issues adding new clients, using its 1M+ client portfolio to cross-sell and over-penetrate their respective markets. Because COVID-19 is still a thing, and the pandemic has brought cleanliness to everyone’s mind, the company has zero issues selling its cleaning and management services to customers in today’s market.

Cintas’ outperformance is a product of both existing customers buying new services, as well as new customers adding new contracts from Cintas. The company also saw a 15% increase in overall free cash flow, and the company used close to half a billion dollars to buy back company shares on the open market.

This quarter closes the book on the 2022 fiscal, and this was a very good year for the company. It saw revenue improvements of over 10% organically, and the company was, again despite overall massive global pressures, able to increase its overall margins by 50 bps to 19.7% – for selling cleaning services, clothing, and the like.

I want to emphasize how impressive an accomplishment I believe this to be. The company is also focusing more and more on shareholder returns.

We allocated capital to improve shareholder return. Acquisition spend was $164.2 million. In fiscal 2022 and up until today, we repurchased 4.3 million shares of Cintas stock for a total of $1.62 billion. Also, we increased the dividend 26.7%. We have increased the dividend every year since going public, which is 38 consecutive years. We made significant progress on our digital transformation journey.

(Source: Cintas 4Q22 Earnings Call)

So while this company isn’t seeing any sort of yield records, it’s still seeing a very impressive growth, and shareholders, especially very long-term ones, can still be somewhat happy with the overall performance.

There is very little negative to be said about Cintas fundamentals. The company has been able to grow its adjusted EPS 51 out of 53 years. The track record here is, as I see it, nothing short of amazing. Tens of billions of dollars of work-specific clothing are sold by retailers each year to workers in every sector of a modern economy, where Cintas is active. There are millions of people in healthcare alone, hospitals, urgent care, doctors’ office, dentists’ offices, and long-term care going to work every day in wear purchased from retailers – and in turn, from Cintas.

60% of the company’s new customers are converted from a retail to a rental program. This speaks to the fact that the company’s approach is seeing amazing success.

Every business that has a door, floor, wall, bathroom, and employees is a sales prospect. Our organic revenue growth rates are indicative of our compelling value proposition and tremendous market size. We grow revenue in multiples of GDP and jobs growth because of ample supply and demand for our products and services. Our growth in revenue is profitable growth and our operating margins have a long runway for expansion.

(Source: Cintas 4Q22 Earnings Call)

I cannot help but agree with this. Cintas has an extremely diversified revenue base in terms of customers. Not one customer accounts for more than one percent of the company’s total revenue. The loss of even the company’s biggest customer is therefore really a non-issue, compared to some other companies and the effects the loss of their biggest customer would have on the business.

The company operates 13 distribution centers, 460 operational facilities, and 11,000 delivery routes for its products. Margins for the various segments are surprisingly similar, with COGS of around 53-57% for all segments, and gross margins of around 43-47%. Cintas manages in the end to garner an impressive, double-digit 18-20% pre-tax operating income margin from its operations, which is impressive when you consider what they do is (extremely simplified) rent out uniforms and clean spaces.

The one issue with this company remains its dividend.

Even during the financial crisis, the yield never rose above 2.1%, and today, it stands at 0.98%.

When we look at Cintas, we need to look heavily at total RoR, not necessarily yields or current dividends. The company has been able to average a 20-year annual growth rate of around 10.8% per year and is set to see similar trends going forward.

Cintas – The price

It all comes down to the valuation of a company. And unfortunately with Cintas, this is sort of where things, in my opinion, start to break apart a little.

Cintas warrants a 30X+ P/E premium by the market. But the company, today, trades at close to 34.5X. Even for this company, that premium is extremely high here, even if it’s not at record levels. The company is set to continue growing its (adjusted) earnings by around 10.3% for the next few years to the 2025E fiscal, which on a 31.24X P/E ratio gives us an annualized RoR of just south of 8%.

That is not enough for me.

When I look for investing, I want at least 15-20% these days, and such a conservative potential return isn’t hard to find in today’s market – even A-rated such returns.

Furthermore, if the company were to drop down to sub-30X P/E, that RoR quickly goes down south to below 5-6% annually. There’s a downside risk to the investment that shouldn’t be underestimated here, because thanks to the low dividend, it’s really easy for your returns from Cintas to go into flat territory here – and you don’t even have a dividend to comfort you during that time.

All it would take would be for Cintas to average a 26-28X P/E until 2025E, and your returns annually would be below 4%, and just below 12% total for 3 years.

Cintas Upside (F.A.S.T Graphs)

Unfortunately, Cintas is one of those businesses that just sort of grew in valuation after COVID-19 crashed. And it kept growing. And in terms of valuation, it hasn’t stopped.

At this point, we’re looking at dot-com valuations. Let me put this into perspective for you.

If you had bought the company at peak valuations in 2001-2002, your annual RoR until 2014 would have been 1.6%. Any time earlier and it would have been negative. That’s a whole lot of market growth you’re missing out on investing like that.

On the other hand, if you had paced yourself and focused on establishing a conservative fair valuation, and only bought when the company dipped below that 20X P/E line, your returns could have been market-beating.

This company is a good example of why quality should be your first consideration – but why no investment should be made without first considering what you’re paying for what you’re buying. The best company in the world will not matter if you’re paying such an excessive premium that it could take more than a decade to generate decent returns.

Forecasting Cintas on a forward basis of above 34X means that your returns are too low to interest me. P/E normalization to 10-year or 20-year averages will destroy your returns here if they occur. The company needs to hit a 2025 P/E of 32X to simply generate acceptable amounts of return here. Those sort of circumstances is enough for me to back off.

Cintas has traded to a premium relative to its price target for a long time at this point. The current average is $436/share, around a 10% undervaluation here (Source: S&P Global). I still don’t see a defensible, long-term upside at this valuation, so I’m staying conservative and saying “No” here.

Based on a peer comparison, it cannot be said that Cintas is excessively premiumized here, but paying 34X P/E for cleaning or service companies such as this even with an estimated 10% or above EPS growth isn’t something I’d do.

To my mind, the 20-year average premium of 25X P/E is the most that should be paid. Including 2024, which I view as relevant based on analyst accuracy and outperformance, the highest I would go would be $290/share. This is well above the S&P Global low target stock price of $250/share, though I view this particular target as actually quite valid compared to the $500/share current high.

Thesis

My current thesis for Cintas is:

- The company is a fundamentally excellent services company with a high premium – and is better bought, as proven by history, at cheap valuations.

- With cheap prices and fear, this company can easily generate triple-digit returns, even if the dividend is comparatively low.

- At current valuations, even a forward premium of 30X+ results in potential market underperformance, or a bare-bone upside close to the market. This is a no-go in terms of what you “should” invest in at this particular time.

- Given current trends, I consider Cintas a “HOLD”. It’s not as dangerous to invest in as a few months back at peak valuations, but it’s nowhere near where I’d want to buy the business.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Cintas is currently a “HOLD”.

Thank you for reading.

Be the first to comment