hapabapa/iStock Editorial via Getty Images

Cintas is the leader in the industry of uniform rental and facilities services. It’s the very definition of a high-quality business that can continue to compound its value year over year. It ticks most of the boxes for those looking exclusively for compounders. The qualitative aspects of the business are fairly priced in as we will see.

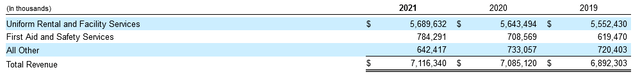

Below is a revenue breakdown of NASDAQ:CTAS by segment. They operate primarily in the US but also in Canada.

Below are the return metrics with peers:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

10-Year EPS CAGR |

10-Year FCF CAGR |

|

CTAS |

28.7% |

15.1% |

17.8% |

15.4% |

|

10.8% |

10.2% |

7.5% |

13.4% |

|

|

13.6% |

3.1% |

n/a |

27.4% |

Source

Returns on capital and capital allocation

Whenever a study is done on the best performing stocks of any previous 20+ year period, the top performers inevitably have far above average returns on capital. The absolute best stocks at the very top will inevitably have not just the highest returns on capital, but a combination of the highest returns and the highest plowback ratio. A company that can generate 60% returns on invested capital but pays out 90% of its earnings in dividends every year is mathematically less valuable than a company which retains 100% of its earnings and makes 30% returns on capital.

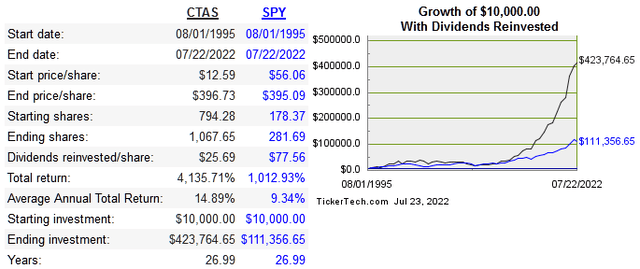

CTAS has been a public company since 1983, they first began paying a dividend in 1990 and began regular buybacks in 2005. We can see with CTAS how much value we can place on the company’s ability to compound.

Median 17-Year Retention Ratio=74.7%

Median 17-Year ROIC=10.8%

This a higher retention rate than a blue-chip CPG company like PG for instance. Their ROIC has also been trending upwards more recently and currently is a very healthy 23%, but the ability to never go below that level again is what will define CTAS as an outperforming stock over the next few years. Mean reversion of ROIC/ROE is one of the biggest risks for those seeking long term compounders.

Most companies with legitimate moats end up being in the same position of limited reinvestment opportunities, and they inevitably have to return capital to shareholders with excess earnings. Shareholder yield like this is an informal admission that the incremental returns on invested capital aren’t very high. As an investor you simply have to recognize that even though a company is high quality, the best days of intrinsic value growth are behind you. So even for the longer-term investor, price matters more at this point of the company’s life cycle than in years past.

To see CTAS’s high returns on capital and simply buy and hold for the long would be a mistake if the price isn’t reasonably discounted. To buy any stock as a higher multiple takes a big leap of faith on business quality. The business quality would have to be your margin of safety, since none exists in the price you’re paying today. This means if you are wrong about the growth, you have no margin of safety whatsoever and can get badly burned.

The qualitative strength of CTAS can’t be denied, but the lack of reinvestment opportunities likewise can’t be ignored. They have a strong position in the US and Canadian markets, but international opportunities aren’t easily available. The nature of the business limits what even a strong brand like CTAS can do in international markets. Consumer brands like KO and YUM rely heavily on exporting these brands all over the world. This kind of brand power simply doesn’t translate into a services business like CTAS.

Acquisitions have been a regular occurrence, but there is a limit to what can be done horizontally since there are few competitors at the top. Management is notoriously quiet on M&A specifics, they are looking for targets of some kind is all we are left with. There have been recent rumors of CTAS potentially acquiring UNF, but I wouldn’t bet on FTC allowing this one easily.

The same goes for ARMK’s plan to spinoff their uniform business. I’m not willing to bank on that being the most significant factor for adding value.

Valuation

|

Company |

EV/Sales |

EV/EBIDTA |

EV/FCF |

P/B |

|

CTAS |

5.4 |

21.5 |

33 |

12.2 |

|

UNF |

1.8 |

12.3 |

-151 |

1.9 |

|

ARMK |

1.1 |

15.1 |

-192 |

2.8 |

There is absolutely a premium placed on these shares now. Focusing on shareholder yield will be vital going forward. EPS growth will be driven largely by reduced share count. Share count has decreased 38% since 2006. This isn’t as much as I would like to see from a legacy moat business that returns capital, but the stock has traded at a high multiple quite often in recent years, and this isn’t good for buying back shares.

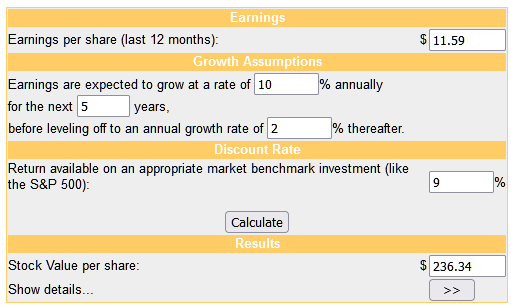

Below is a very conservative DCF, showing overvaluation on this basis as well:

moneychimp

Conclusion

CTAS is undoubtedly one of the higher quality businesses in the world. It’s also quite clear that this level of quality is basically priced in at this point. Even on a long-term basis, you are making a huge bet on EPS growth with almost no multiple expansion at all to drive your returns. Especially when considering the current dividend yield is only around 1%.

My own sort of framework for a legacy moat business like this is to focus on timing the price to give you a significant dividend yield. The exact yield isn’t so important as making sure its higher than a) the yield of the index and b) higher than lesser quality blue chip companies. Buying a high-quality business at an above average dividend yield sets you up for success far more than buying when the yield is low and depending purely on growth.

I would hold CTAS right now and wait for better opportunities but keeping in mind that it can still grow faster than much bigger blue-chip stocks and seeing if ROIC levels revert back to the mean.

Be the first to comment