Chaz Bharj/iStock Editorial via Getty Images

Cineworld (OTCPK:CNNWF) operates in an industry currently in a COVID-accelerated structural decline amid a shift toward Premium Video on Demand and shorter theatrical windows. Compounding its troubles is the massive (on balance sheet) debt load Cineworld will need to address at a time when cinema attendances remain well below pre-COVID levels. There’s also a C$1.23bn claim to worry about, as the company looks to appeal against the court ruling related to its aborted Cineplex takeover. Given the size of its liabilities relative to the current market cap and cash flow outlook, an equity raise or debt for equity swap seems inevitable to recapitalize the company, and that could leave equity holders with cents on the dollar. Even assuming a 90% dilution scenario (likely optimistic at this point), the current £448m equity value implies a ~£4.5bn post-money valuation, which seems too high given the balance sheet risks.

Results In Line but Well Short of Optimistic Base Case Scenario

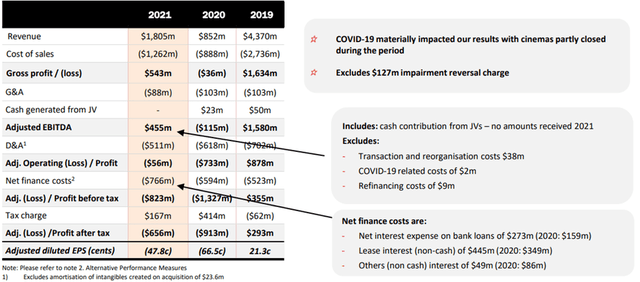

Cineworld’s full-year revenue of $1.8bn was in-line with Street expectations but remained down on pre-COVID numbers as weak box office revenues (-62% from pre-pandemic levels) were accompanied by concession revenue at ~55% below pre-pandemic levels. The cost cuts and site closures (25 closed vs. 10 opened and seven refurbished for the year) did drive a higher EBITDA flow-through at ~$455m. Since then, however, January and February have been difficult months due to the Omicron surge and the lack of major film releases. March should be stronger given the latest Batman release but not quite enough to support the going concern assumptions, in my view. The current base case scenario pegs US admissions at ~85% of pre-COVID levels for 2022, with the UK and the rest of the world reaching ~90% and 95%, respectively. Admissions are subsequently projected to run ~5% below pre-COVID levels in 2023, before reaching parity in 2024. Given the structural headwinds from Video On Demand and a compressed theatrical window (Warner Bros recently reduced its window to 31 days in the UK and 45 in the US), the going concern assumptions strike me as optimistic. Instead, I suspect Cineworld will need to lean on pricing and cost/capex cuts instead for short-term P&L gains, which will likely weigh on attendance numbers going forward.

Cineworld

Source: Cineworld Full-Year 2021 Presentation

High Net Debt Levels Raises the Risk of a Covenant Breach

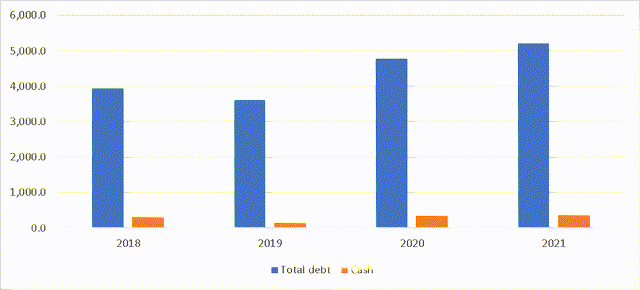

The balance sheet is the key to the Cineworld thesis – worryingly, the company’s debt levels are worsening, ending 2021 with ~$4.8bn of net debt (~$5.2bn gross debt and ~$354m cash), up from ~$4.5bn in 2020 (pre-IFRS 16). While the current liquidity level was not disclosed, the dwindling cash balance indicates Cineworld is likely down from the ~$653m pro-forma liquidity in H1 2021 despite Q4 being cash flow positive. In the near term, the issue is that the $100m minimum liquidity covenant remains in place, and the covenant waiver on the $449m (fully drawn) revolver expires in June. Plus, the Omicron impact in Jan/Feb 2022 means it has likely been burning cash in Q1 2022 as well, which leaves minimal headroom relative to the minimum liquidity covenant. Per the going concern statement, there is “material uncertainty” as to whether Cineworld will be able to pay down the revolver prior to covenant expiry, so another covenant waiver for June 2022 will likely be required. In essence, Cineworld looks set to breach its banking covenants, even in a best-case scenario, leaving few options on the table other than to recapitalize. Whether this takes the form of a debt for equity swap or a straight equity raise, the implication for shareholders is clear: dilution.

Cineworld

Source: Cineworld Disclosures, Author

Potential C$1.23bn Payout Adds to Overall Funding Risks

Having agreed to buy the Canadian chain Cineplex but subsequently pulling out when the pandemic struck, Cineworld could be on the hook for C$1.23bn. The company has already lost the initial judgment, but Cineworld is pushing forward with the appeal process for the Cineplex case. Interestingly, Cineworld recognizes no liability with regard to the judgment, with management reiterating its belief that the liability and damages were calculated in error. The Cineworld case rests on the argument that Cineplex is an unsecured creditor and that the group would not have sufficient liquidity to pay the initially proposed damages. Management also reiterates that the pandemic was a valid reason to pull out, while Cineplex takes the opposite view per the terms of the legal agreement. I take no view on the legalities, but the fact that the Supreme Court in Ontario ruled against Cineworld is a concern. It’s hard to see an appeal resulting in a different outcome, although stretching out the payout timeline probably makes the most sense given its liquidity position. In any case, the equity implication is not great and only further emphasizes how deeply out of the money the equity portion of the capital structure already is.

Bear Case Could Quite Easily Become the Base Case

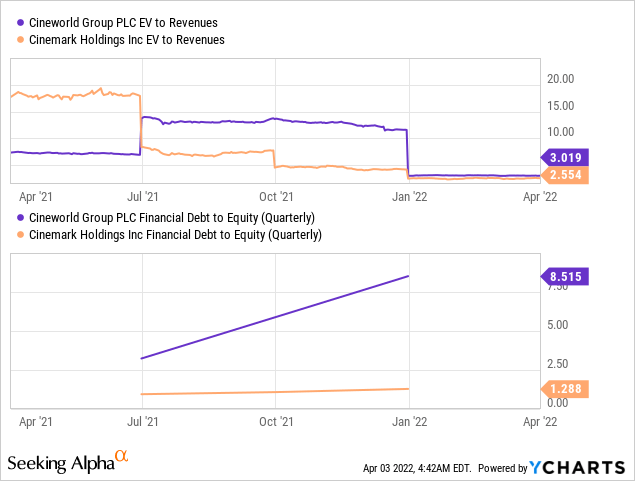

At the core of Cineworld’s troubles is its >$5bn debt load. To make matters worse, a defeat in the Canadian courts looks inevitable, and even with the subsequent appeal, the best scenario Cineworld can hope for is a delayed payment timeline. The coming months will be particularly challenging – a covenant waiver on its revolving facility expires soon, and it looks like breaking covenants will be the only way out. This could entail a sooner-than-expected fundraise, either via a debt for equity swap or a straight equity raise. Both options would entail massive downside for the market cap, which remains surprisingly resilient at ~£450m, while having to pay for Cineplex damages in full could entail an eventual bankruptcy scenario. With Cineworld stock also trading at a premium to closest peer Cinemark (CNK) despite the latter having a stronger balance sheet, it’s hard to see much upside for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment