Igor Kutyaev/iStock via Getty Images

Thesis

Calamos Global Dynamic Income Fund (NASDAQ:CHW) is a closed end fund with a broad allocation mandate. The fund can put capital to work among global equities, convertible bonds, fixed-income securities, and alternative investments as it sees fit. CHW employs an active trading strategy with the annualized portfolio turnover coming in at 133.6%.

The vehicle has a 0.58 Sharpe ratio and an 18 standard deviation (both measured on a 5-year basis). With a 36% leverage the fund experiences deep drawdowns, with the Covid event exposing a -32% maximum draw. The current yield for the vehicle is 9.92%, and it is well covered by its distribution between capital gains and dividend income.

We like CHW and its analytics, especially in light of very robust long-term results, with the 5- and 10-year trailing total returns sitting at 11.7% and 10% respectively. However, despite the fact that CHW has historically traded at a discount to NAV, the fund is now trading at a premium. Coupled with further expected equities weakness on the back of hawkish central banks, we do not feel this is a good entry point for the fund. If you are already long the name then we rate it Hold, while new money is best suited to wait for a more attractive entry point.

Holdings

CHW contains a mix of equities, convertibles and high yield bonds:

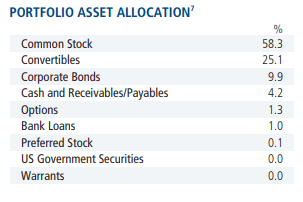

Asset Allocation (Fund Fact Sheet)

Equities currently account for approximately 58% of the portfolio, followed by convertibles and a modest allocation of corporate bonds. To note that, as per the fund’s literature CHW’s management team “has maximum flexibility to dynamically allocate among equities, convertible bonds, fixed-income securities and alternative investments around the world.” This results in a dynamically allocated portfolio that can change the asset allocation mix illustrated above quite abruptly.

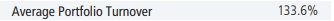

We can see the dynamic allocation/active portfolio trading undertaken by the manager in the annual portfolio turnover figures:

Portfolio Turnover (Fund Fact Sheet)

This fund does not exhibit deep value buy and hold traits but is more of an active portfolio trading vehicle.

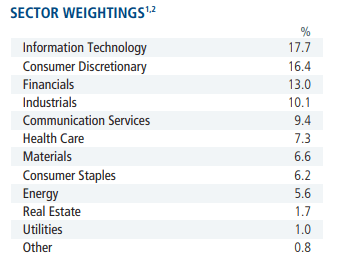

On the equity side of the portfolio asset allocation, the industry sector split is as follows:

Sector Weightings (Fund Fact Sheet)

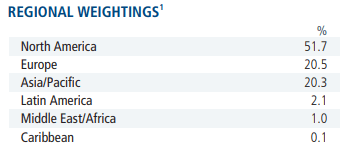

The vehicle has a very high allocation to information technology, closely followed by consumer discretionary stocks and financials. Most of the equities in the portfolio are North American names:

Geographic Distribution (Fund Fact Sheet)

As per the fund’s fact sheet, “By investing at least 40% and up to 100% of managed assets in foreign securities, including emerging markets, the fund blends global securities, endeavoring to maintain an optimum risk/reward profile.” The fund thus has a mandatory global allocation of at least 40%, making it a true global fund.

The current top ten stock holdings are as follows:

Top 10 Holdings (Fund Fact Sheet)

We can see that about 70% of the top holdings are constituted by common stock holdings, while the rest are convertibles.

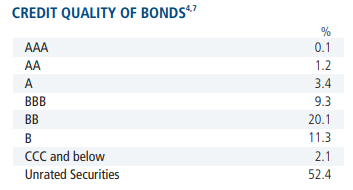

On the fixed income part of the portfolio, the fund invests in high yield bonds:

Credit Quality (Fund Fact Sheet)

Most of the allocation is in the BB bucket and “Unrated” section. Usually, unrated bonds represent smaller private placements that do not garner a rating agency’s interest or have the spending power to cover the rating fees. They do not necessarily represent weaker credits, just names which are not very widely syndicated.

Performance

CHW is down more than -13% year-to-date, underperforming the Vanguard Total World Stock Index Fund (VT):

YTD Total Return (Seeking Alpha)

On a 5-year basis, the fund nonetheless outperforms the index:

5-Year Performance (Seeking Alpha)

We can see that the vehicle not only outperforms the index but has a large time period when it exposed an accelerated positive performance as compared to the chosen benchmark. This speaks quite well to the management team and its ability to source alpha-generating securities.

On a 10-year time frame, the fund and the index expose very similar performances:

10-Year Total Return (Seeking Alpha)

We can clearly see the effect of leverage in the above graph. On the downside move triggered by Covid, CHW lost more than the index, while on the upswing it gained more. Leverage amplifies returns both on the downside and on the upside.

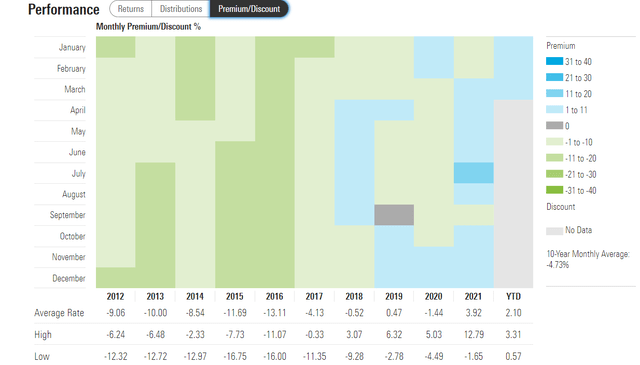

Discount/Premium to NAV

The fund usually trades at a discount to NAV that can be quite substantial:

Premium/Discount (Morningstar)

We can see how up to 2019 the vehicle usually exposed an approximate -10% discount to NAV. With the Fed moving rates to zero post the Covid pandemic and investors looking for yield, CHW moved into the premium to NAV territory.

We are surprised to see that the fund is still at a premium to NAV even now in 2022, despite the massive rise in interest rates. We expect a reversion here.

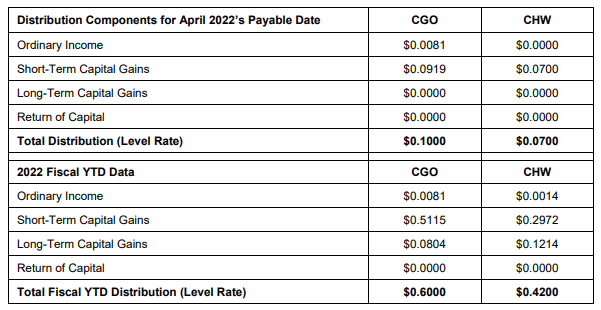

Distributions

The fund does a good job of covering its distributions from either capital gains or dividend income:

2022 Section 19.a Summary (Fund Literature)

We can see from the above table that details the April 2022 distribution composition as well as the 2022 data that the fund covers its dividend well from capital gains (i.e., a good performance) and ordinary income. A high figure for return of capital here would be worrisome.

Conclusion

CHW is a hybrid CEF that has both an equity and fixed income allocation that can vary. The fund has a global mandate with a 40% requirement for foreign securities allocation. The vehicle currently allocates 60% of its funds to equities, followed by convertibles at 25% and high yield bonds at 9%. CHW has very robust long-term results, with the 5- and 10-year trailing total returns sitting at 11.7% and 10%, respectively. The fund experiences deep drawdowns and has a high beta of 1.82.

We like the fund and its analytics, but with CHW still trading at a premium to NAV and the current equity weakness environment not a foregone move we feel the name is only a Hold rating at the moment with much better entry points to be had.

Be the first to comment