Investment Thesis

Chunghwa Telecom (CHT) reported another weak quarter in its Q4 2019 with negative top-line and bottom-line growth rates. We think it may be difficult to significantly increase its mobile average revenue per user due to Taiwan’s already saturated mobile market. Similarly, its broadband Internet business is facing intense competition from regional cable operators. The company is also expecting higher capital intensity as it is set to start to build its 5G network in 2020. Given the challenges to grow its business in the near term, we think investors may want to wait on the sidelines.

Recent Developments: Q4 2019 Highlights

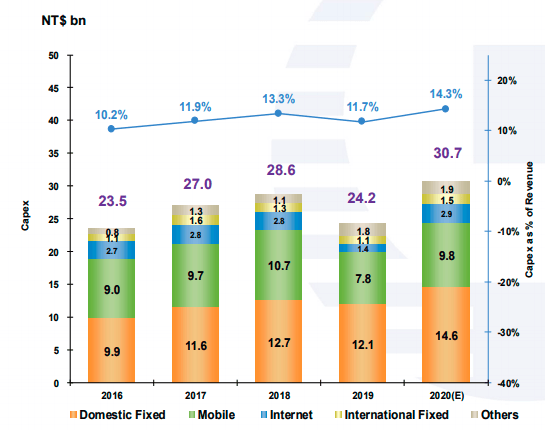

Chunghwa Telecom delivered a weak Q4 2019 as the company saw another quarter of decline in its revenue and net income. As can be seen from the chart below, its revenues declined by 0.5% year over year to NT$55.23 billion. Its net income of NT$7.8 billion was also below its guidance of NT$8.5-9.1 billion. Similarly, its EBITDA of NT$18.80 billion in Q4 2019 was also below its guidance of NT$19.6-20.5 billion.

Source: Q4 2019 Investor Presentation

Growth and Earnings Analysis

Mobile business appears to be stabilizing

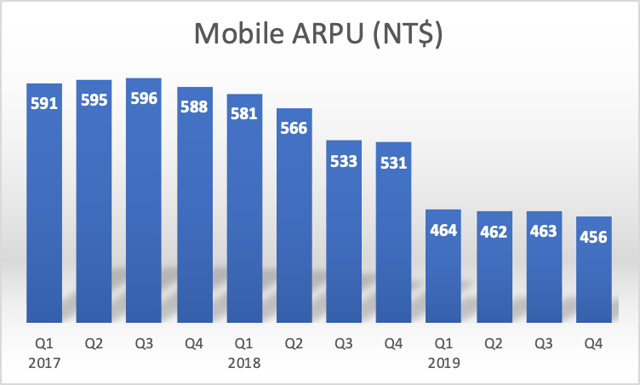

Chunghwa Telecom spent much of its 2018 defending its market share in its mobile business by having heavily discounted mobile plans. This price war went on until the first half of 2019. As a result, its ARPU declined considerably as many subscribers gradually renewed their contracts to lower monthly fee plans. This has resulted in a considerable decline in its mobile average revenue per user. As can be seen from the chart below, its mobile ARPU has declined from the peak of Q3 2017 to NT$456 in Q4 2019. We have noticed that its ARPU appears to be stabilizing in 2019 as competition intensity begins to decline. We have observed far fewer lower cost monthly fee plans from its competitors Taiwan Mobile and FET Telecom. However, we have yet to observe a reversal of the trend in its ARPU decline in the second half of 2019 and the first two months of 2020. Therefore, we think mobile revenue may not return to growth in 2020.

Source: Created by author

Broadband Internet segment should remain flat in 2020

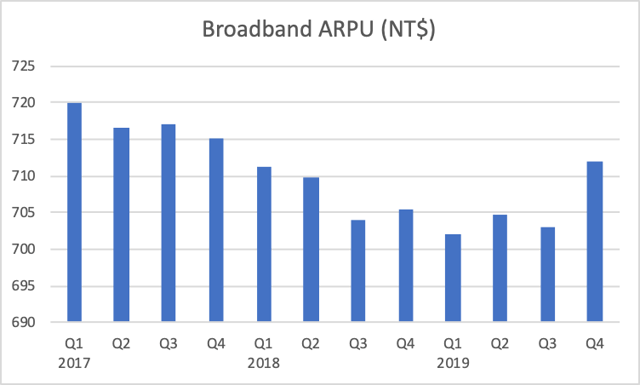

Revenue in Chunghwa Telecom’s broadband Internet segment is expected to remain flat in 2020. Despite the nice ARPU trend we have observed in Q4 2019 and the first two months of 2019 (primarily due to rate increases), the company continues to face the challenge of losing its Internet subscribers. In fact, its broadband subscribers have declined to 8.001 million subscribers in February 2020 from 8.152 million subscribers in February 2019. This was primarily due to competition from cable Internet operators (many regional operators have upgraded their bandwidth to Gbps Internet lately). Therefore, we do not expect a rebound in revenue in this segment yet.

Source: Created by author

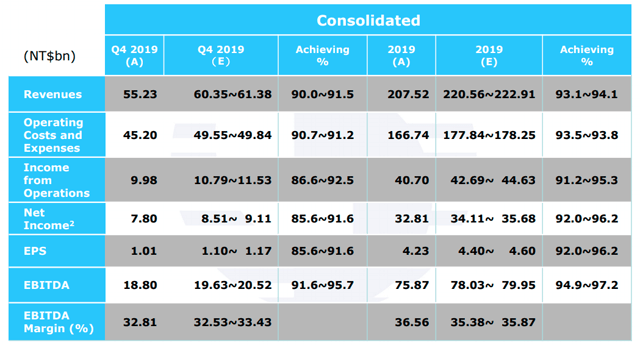

Capital intensity is expected to grow in 2020

Another factor that will likely continue to cause a decline in Chunghwa Telecom’s ability to maintain its free cash flow is the higher capital expenditures expected in 2020 and 2021. The company has recently participated in a bid to secure optimal 5G bandwidth in the latest auction that ended in late February 2020. In this auction, the company has acquired the best spectrum zone by spending NT$48.37 billion. This should allow it to build a superior 5G network as the newly acquired spectrum will have no second-harmonic frequency interference from its existing 4G networks. However, in order to build its 5G network, Chunghwa Telecom will need to invest heavily in 2020 in order to quickly upgrade its mobile network. Therefore, its capital intensity (see chart below) is expected to significantly increase to 14.3% in 2020 from 11.7% in 2019. As can be seen from the chart, capital expenditure in its mobile segment is expected to grow from NT$7.8 billion in 2019 to NT$9.8 billion in 2020.

Source: Q4 2019 Investor Presentation

Valuation Analysis

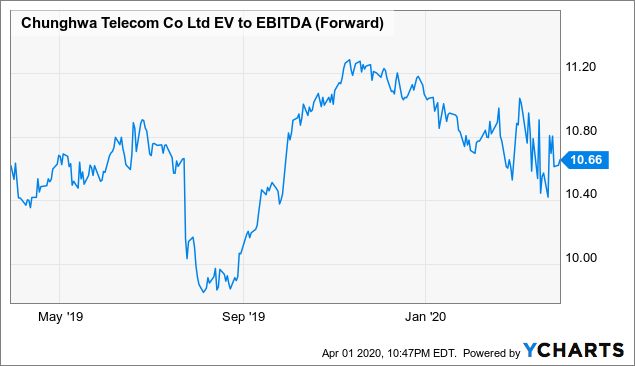

Chunghwa Telecom is currently trading at a trailing EV to EBITDA ratio of 10.66x. This valuation is slightly higher than its 5-year average of 9.89x. Given its weak guidance (EBITDA will likely grow in the range of negative 1.3-0.9%), we do not think there will be much upside in its share price. However, downside will likely be limited also due to its recession-resilient business.

Data by YCharts

Data by YCharts

Dividend Analysis

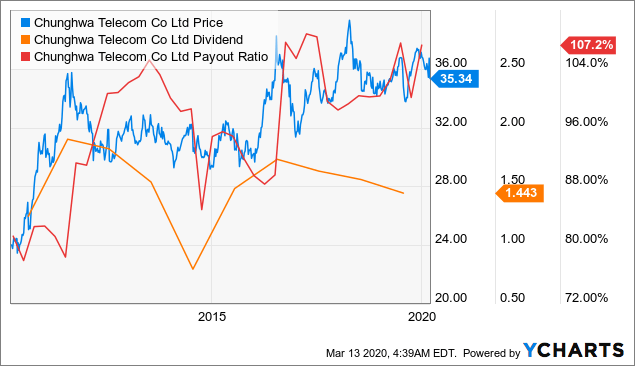

Chunghwa Telecom paid an annual dividend of US$1.443 per share in 2019. This is less than 2018’s US$1.558 per share. As can be seen from the chart below, its dividend has declined for 3 straight years due to its deteriorating bottom line. Its dividend payout ratio has also remained elevated.

Data by YCharts

Data by YCharts

Risks and Challenges

Government and Regulation Risks

Taiwanese government is the largest shareholder of Chunghwa Telecom. The country’s Ministry of Transportation owns about 35.3% of the company. This means that Chunghwa Telecom’s management decisions can be influenced by government policies that generally are set in favor of the public interest. These decisions may not necessarily act on the interest of other shareholders.

Investor Takeaway

We see limited upside for Chunghwa Telecom due to its weak growth outlook. Therefore, we think investors should initiate a position right now. However, we must also note that this stock has historically done relatively well in a market downturn with limited volatility. Therefore, for investors who already own this stock, you should be okay to continue to hold on to your shares.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Be the first to comment