zorazhuang/E+ via Getty Images

BlackRock’s iShares ETF CNYA (BlackRock)

Chinese companies delisting from the U.S.

For those that want to gain exposure to China’s large state-owned companies, the importance of BlackRock’s iShares MSCI China A Shares ETF (BATS:CNYA) will, in my personal opinion, grow as more and more large Chinese state-owned companies exit the stock markets of the NYSE and Nasdaq. I have covered this ETF for some time, with my last article here.

Investors will likely still want exposure to the second-largest economy in the world.

Five large Chinese companies are in the process of delisting from the U.S. They are:

- China Life Insurance Company (OTCPK:LFCHY)

- PetroChina Company Ltd. (OTCPK:PTRCY)

- China Petroleum & Chemical Corporation (OTCPK:SNPTY)

- Aluminum Corporation of China Ltd. (OTCPK:ACHHY)

- Sinopec Shanghai Petrochemical Company Ltd. (OTCPK:SHIIY)

I have covered LFCHY, ACHHY, and SHIIY recently.

According to the Atlantic Council GeoEconomics Center, the capital that these five companies raised from their IPOs at the NYSE was only USD 7.1 billion, which is a tiny fraction of their combined market capitalization of USD 414 billion.

For these five companies mentioned above, which are all controlled by China’s government, they took the decision that they do not need to be listed in the U.S.

China wants to develop its own financial market, and the liquidity impact of delisting for those five companies is minimal.

There are still about 300 companies based in China or Hong Kong that are trading as an ADR in the U.S. Together they have a market capitalization of USD 2.4 trillion. Some might want to voluntarily delist and choose to be listed in Hong Kong. However, even if we assume that all of them were to delist, it is not a big deal for the capital markets of the U. S. either in my opinion, as I think the market capitalization of USD 2.4 trillion is negligible compared to its USD 48.2 trillion combined market cap. The profits of the exchanges would obviously see some reduction.

International investors can still invest and trade in those companies’ shares in China and/or Hong Kong. For those who either do not have a broker who can execute an order in China or for those that prefer to buy an ETF to gain exposure to China, CNYA might gain more interest.

Currency and interest rate environment

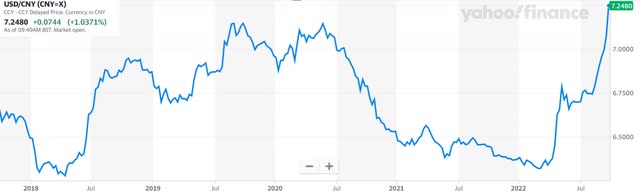

The Chinese currency and most other currencies are falling as a result of the strengthening USD.

A weaker RMB (Yahoo Finance 28 Sep 2022)

When a country is exporting a lot more than they are importing, this becomes a net positive as it gives them a free boost to their export. Both these two factors, a lower interest rate environment and a lower currency will likely boost the earnings of many Chinese companies in the near term.

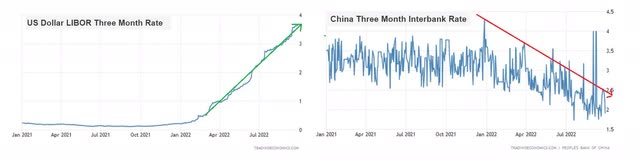

To fight inflation, almost all central banks are increasing their interest rates. The exceptions, that I know of, are Japan and China. That China wants to lower its interest rate is understandable as they are seeing considerably lower economic growth and have had a much higher interest rate than the rest of the world.

Interest rate direction of China and the U.S. (Market Economics)

Earnings from a lower cost of capital and a lower currency should improve for many Chinese companies.

Capital flow

When we see as much volatility as what we now are witnessing, it is natural that capital will flow rapidly between continents.

The volatility is not just a phenomenon taking place in the U.S. The financial world is entwined and capital will flow as a result of it.

Throughout this year, up to August, foreign investors have reduced their holdings of Chinese bonds by more than RMB 520 billion to RMB 3.48 trillion, according to China’s central bank. This move can be explained by the large divergence we pointed to above with regard to the changes in interest rates and the currencies.

However, figures from the Chinese stock regulator showed that a total of RMB 63.2 billion in foreign capital flowed into the A-share market through the Stock Connect schemes during the first eight months of 2022. But they might have conveniently omitted to state the outflow. The story for 2022, so far, has been of a net portfolio outflow from the Chinese market, with a marginal gain in inflows offset by increasingly bigger capital outflows, according to Agatha Kratz, a director at the Rhodium Group.

Thoughts and conclusion

During this last summer, CNYA fell less than the SPDR S&P 500 Trust ETF (SPY) but has since reversed the course.

CNYA versus SPY as of 28 September 2022 (SA)

Despite some investors stating that China is not investable, the bigger picture is that domestic Chinese financial assets owned by foreign investors have, in fact, increased substantially from USD 459 billion in 2016 to USD 1.2 trillion in 2020.

I keep reminding my readers that there are only three ways you as an investor can get remunerated from you parting with your money for some time.

It is either through an appreciation of the value of the asset or through the net income it generates while you own it, or both.

We all know that there is more unpredictability surrounding the price of the asset than the income it produces. It may also require a longer time than what you had foreseen.

We are all impatient and want fairly instant gratification.

As an investor, I think it is important that you do get paid something while you wait for the value to increase. Generally speaking, individual stock picks give you a higher yield, as you have more choice than when you invest in an ETF which consists of a basket of many companies. Some are good and some are not.

Therefore, in order to obtain diversification and some exposure to a certain market, you may have to forego some yield. Theoretically, you should beat the market as alpha is hard to find in the game of stock picking.

When we compare the yield of CNYA with that of the S&P500 ETF SPY, we see that there is little difference.

5-year dividend yields of CNYA and SPY (SA)

I think what many investors are missing is the different trajectories taking place within the economies in Europe and the U.S., and that which will take place in China.

A recession has already started in the West, but I think China will eventually get on top of its Covid pandemic and to some extent abandon its Zero Covid Policy. This will result in opening up their economy more and much-improved consumer confidence.

They will also likely use more stimulus packages to boost economic activity.

Hence, I keep my Buy call on CNYA.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment