Evkaz

Chimera Investment Corporation (NYSE:CIM) now has a dividend yield of 15.9%, which could be a red flag given that the mortgage real estate investment trust could not cover its dividend with distributable earnings in the most recent quarter.

A solid labor market and, as a result, another large interest rate hike might further stress the company’s valuation in the coming weeks.

Despite the fact that Chimera Investment is already trading at a significant discount to book value, it appears that the market, and not without cause, anticipates a change in dividend policy. The stock of Chimera Investment is a hold.

Chimera Investment Portfolio

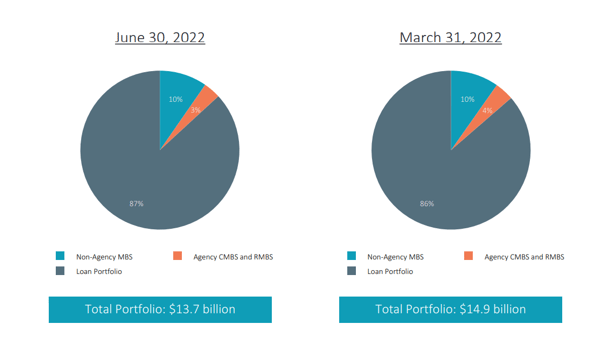

Chimera Investment’s portfolio was valued at $13.7 billion at the end of the second quarter, with the majority of its investments consisting of Residential Mortgage Loans.

Chimera Investment’s portfolio as of June 30, 2022 consisted of Residential Mortgage Loans (87% of the portfolio), Non-Agency Mortgage Backed Securities (10% of the portfolio), and Agency Commercial and Residential Mortgage Backed Securities (3% of the portfolio).

Portfolio Overview (Chimera Investment Corp)

Robust Net Interest Spread, But Interest Costs Are Rising

Chimera Investment, as a mortgage real estate investment trust with a big investment portfolio, generates profits exactly like any other mREIT. It purchases credit-financed mortgage assets with high yields and profits from the difference between the yield on those assets and its borrowing costs. Typically, this business works only if mortgage trusts take on a significant amount of debt.

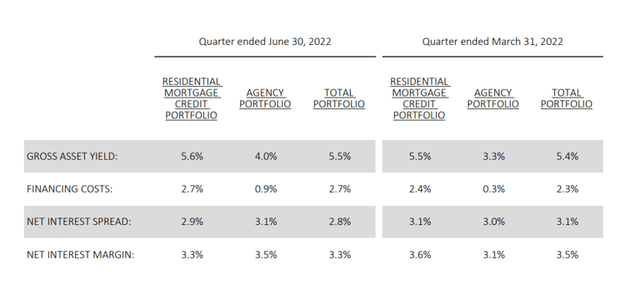

Chimera Investment generated a healthy net interest spread from its operations of buying, holding, and selling mortgage assets in the second quarter.

Chimera Investment’s total portfolio gross asset yield was 5.5%, up 0.1 percentage point from the previous quarter. Having said that, the mortgage trust’s financing expenses climbed from 2.3% in 1Q-22 to 2.7% in 2Q-22 as a response to the central bank’s recent interest rate hikes. As a result, Chimera Investment’s net interest spread declined 0.3 percentage points QoQ to 2.8% in 2Q-22.

Net Interest Spread (Chimera Investment Corp)

However, threats to Chimera Investment’s interest rate spread are rising as the central bank continues to raise interest rates. Indeed, given the moderate labor market strength in August and sustained inflation, the central bank is expected to approve the third super-sized interest rate hike at the end of September.

The central bank has already raised interest rates by 225 basis points this year, to a range of 2.25% to 2.50%, and the Fed is expected to raise interest rates by 75 basis points later this month, lowering Chimera Investment’s net interest spread in the future.

Deteriorating Dividend Coverage

Mortgage real estate investment trusts’ portfolio and book values have been smashed in 2022 as credit spreads have widened, and interest rate volatility has increased at the short end of the yield curve.

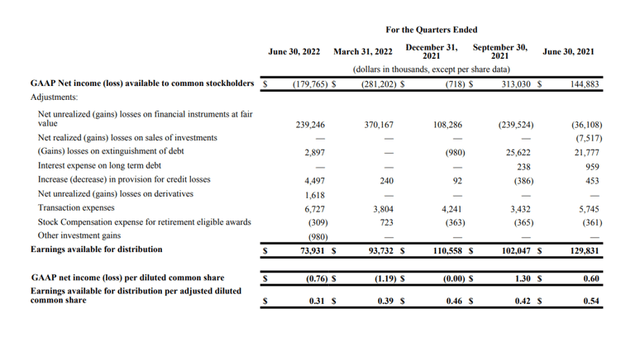

As a result, Chimera Investment’s earnings available for distribution have consolidated over the last year, falling to $0.31 per share in 2Q-22. Chimera Investment’s earnings available for distribution, which are important in establishing the trust’s dividend safety, declined 43% YoY.

Earnings Available For Distribution (Chimera Investment Corp)

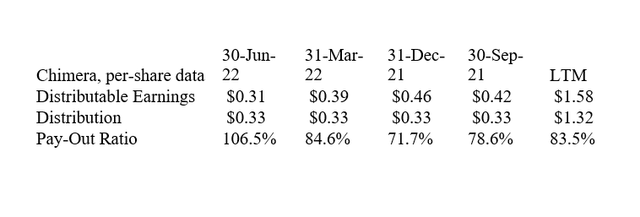

Unfortunately for Chimera Investment, the trust’s distributable earnings fell below the $0.33 per share quarterly payment in the second quarter, implying that the business paid out more than it earned. The pay-out ratio fell to 106.5% in the most recent quarter, implying that the trust will likely reduce its dividend payout in the future.

Pay-Out Ratio (Author Created Table Using Trust Information)

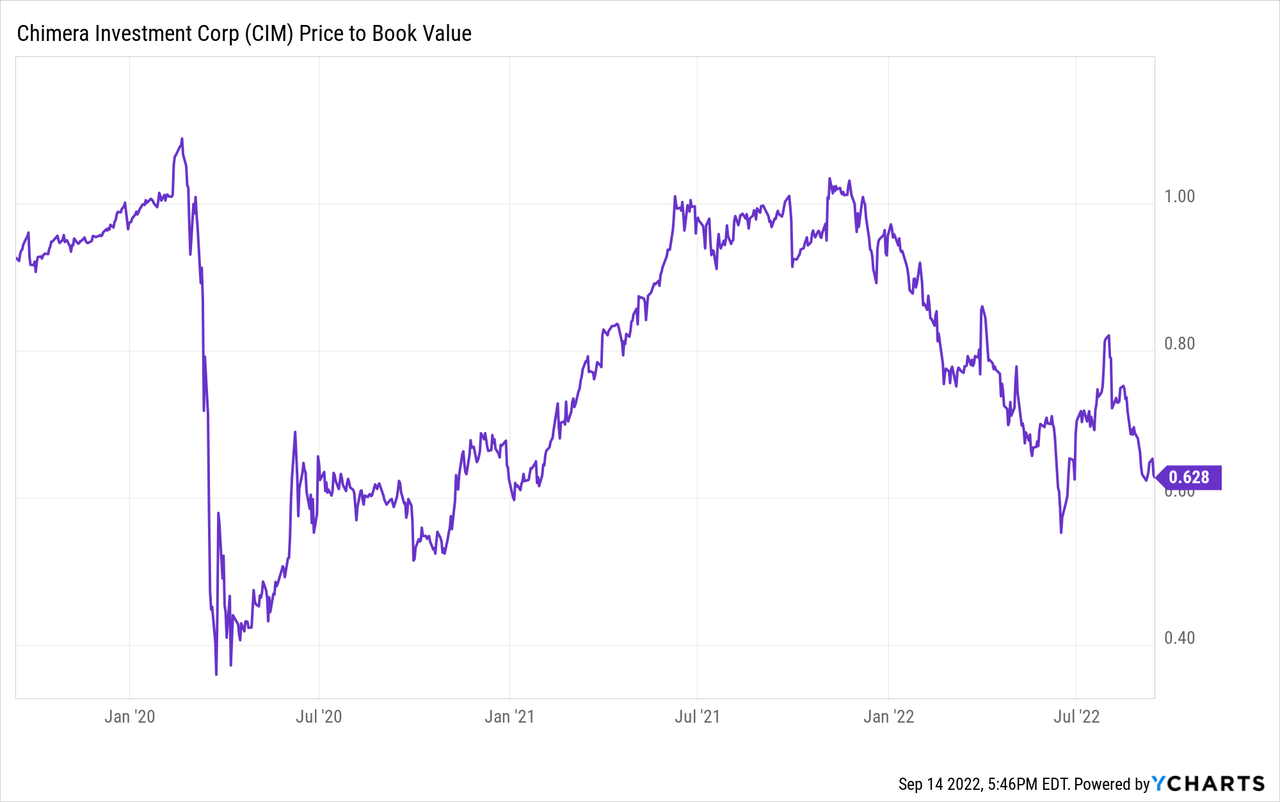

P/B-Multiple

As credit spreads widened and interest rate volatility grew, mortgage real estate investment trusts began to trade at (greater) discounts to book value again, owing to investors’ expectations of severe drops in book value.

Chimera Investment’s stock is currently trading at a 37% discount to book value, implying that the market expects large book value losses and a dividend decrease.

Why Chimera Investment Could See A Higher Valuation

A reduction in interest rate volatility, particularly at the short end of the yield curve, would contribute to less uncertainty in the mREIT market.

Borrowing costs for leveraged mREITs will rise as central banks continue to raise rates, putting pressure on their net interest spreads.

Having said that, a deteriorating labor market, lower inflation, and slower rate hikes would relieve stress on the mortgage trust sector.

My Conclusion

Chimera Investment’s pay-out criteria based on earnings available for distribution deteriorated in the second quarter, raising the likelihood that the trust may realign its dividend with its (lower) earnings.

Furthermore, the substantial discount to book value, as well as the high dividend yield, indicates that the market has become much more wary of Chimera Investment in recent months.

Be the first to comment