t_kimura/iStock via Getty Images

2021 was a banner year for the Children’s Place (NASDAQ:PLCE) on the back of stimulus fueled, stay-at-home consumer exuberance. The company earned a whopping $13.40 per share. While most market observers knew 2021 results weren’t sustainable, 2022 has been far worse than expected. After the most recent guidance cut, Children’s Place is now expected to earn just over $4 per share in 2022 (just 3 months ago, the consensus earnings estimate was $8 per share).

While 2022 has turned out to be a very disappointing year (as discussed below), looking out a couple years, there are reasons to believe that Children’s Place can generate $6 per share in ‘normalized’ EPS. Trading at just 6x my estimate of normalized earnings, Children’s Place may be too cheap to ignore.

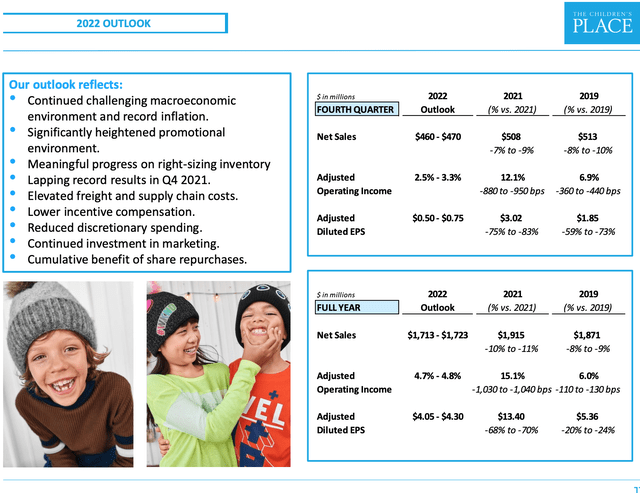

Current Results & Full-Year Outlook

Children’s Place has suffered from many of the same culprits plaguing other retailers, including: rising operating expenses, excess inventories, declining consumer confidence and a heavily promotional environment.

Coming into the year, management was optimistic about 2022 and over-ordered high-cost inventory (high costs due to overseas freight -discussed below). As consumer demand has been weaker than expected in 2022, this has led to heavy discounting, which has negatively impacted revenue, gross margins, and operating margins.

Full Year Outlook (Investor Presentation)

Reasons for Optimism

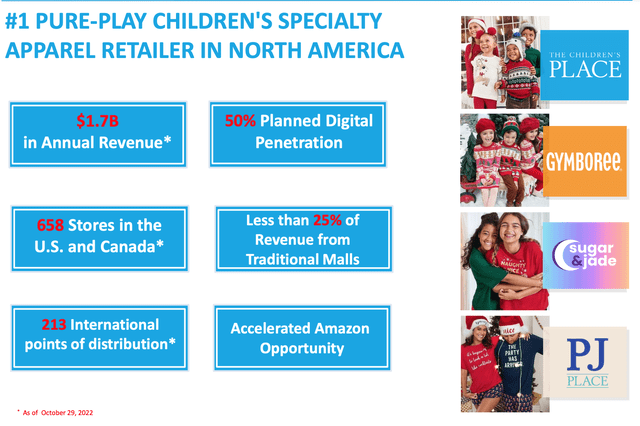

Children’s Place Overview (Investor Presentation)

While apparel retail is a difficult business and current results are challenging, there are some notable positive attributes of the Children’s Place, including:

– Less sensitive to fashion trends – unlike selling to tweens, teens, and young adults who tend to be more fickle in their fashion choices, the Children’s Place is selling inexpensive clothing to less fashion-conscious parents. This reduces the risk of a ‘fashion miss’ and should produce more stable results.

– Nearly 50% Digital Sales Penetration- Over the past several years, the Children’s Place has successfully shifted nearly half of their sales online. Importantly, the company has remained solidly profitable while many e-commerce focused retailers are marginally profitable (or worse).

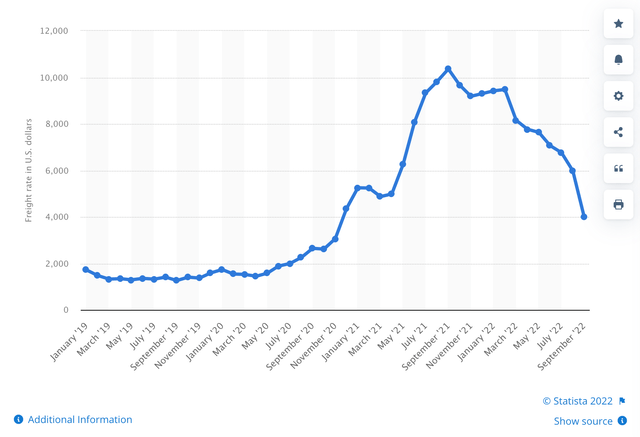

While 2022 is a tough year, as inventories are right-sized and overseas freight expenses fall, 2023 is likely to be a better year (even assuming a recession). The right-sizing of inventory will have two main impacts: 1/ creates a highly promotional current environment pressuring sales and gross margins (leading to the ugly results in 2022) BUT 2/ as inventory position is right-sized this sets 2023 to be a better year as retailers will not be forced to discount as heavily leading to improved gross margins.

While overseas freight expenses have been a massive headwind for most of 2022 (as shown below), rates have plummeted creating a significant tailwind as we move into 2023.

Global Freight Rates (Statista)

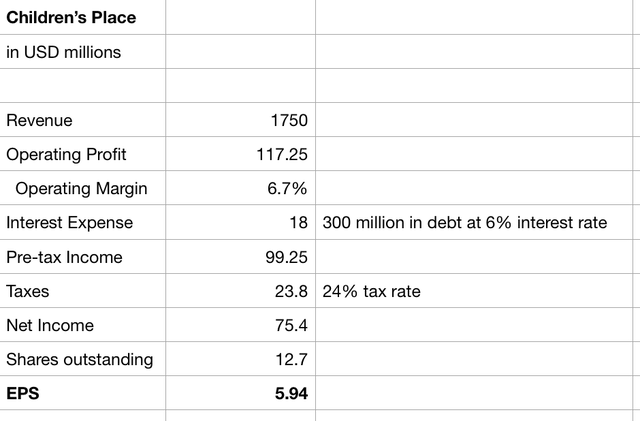

Valuation

Below is my estimate of ‘Normalized EPS’ for the Children’s Place:

Normalized EPS Estimate (Author Estimate)

I assume that sales increase only slightly from depressed 2022 levels (which are below 2019 levels) as a weaker economy offsets the impact of less discounting.

The most important assumption in my estimate is operating margins. Excluding the pandemic year of 2020, the Children’s Place has generated operating margins ranging from 4.5% (current year) to 12% (2021). From 2012-2019, operating margins ranged from 5.3 to 8.5% and averaged 6.7%. I use 6.7% as my normalized EPS estimate – there are puts and takes here. On the one hand, the Children’s Place has shed many underperforming store locations and replaced these sales with e-commerce. On the other hand, e-commerce apparel retail is fiercely competitive.

Applying a 6.7% normalized margin to my sales estimate and deducting interest and taxes gets me to $75 million in net income, which works out to $6 per share.

I think a P/E multiple of 8-10x is appropriate for Children’s Place. This is about a 20-30% discount to the small cap index/ETF (IWM) multiple reflective of a challenging business and Children’s Place experiencing minimal sales growth over many years. This gets me to an estimated fair value of $48-60 which is 35-70% upside.

Conclusion

While the Children’s Place is certainly not a great business, I believe that normalized earnings are significantly above current earnings and that the stock is simply too cheap.

Be the first to comment