Justin Sullivan/Getty Images News

Price Action Thesis

We present our detailed price action analysis on Chevron Corporation (NYSE:CVX) stock, following our recent articles (see here and here) on Occidental (OXY) and Exxon (XOM).

We believe the oil majors are set for a steep mean reversion fallback, given their well-extended price action structures. Notably, CVX stock looks increasingly stretched, as it formed a double top bull trap in early June.

As a result, the recent rapid liquidation in CVX positions should not stun investors as the market digested its rapid gains from its 2020 COVID bottom bear trap. However, we are not convinced that the massive sell-off is over, even though CVX is likely at a near-term bottom.

Given the recent decline, a short-term rally should occur, and investors are urged to use such potential rallies to cut exposure and rotate out of CVX. Double top bull traps are potent price action structures giving investors early warning signals of a potentially significant reversal in trend.

Our reverse cash flow model also indicates that CVX stock is overvalued at the current levels. Therefore, price action and fundamental valuation are singing the same tune highlighting that investors must be cautious here. Cutting exposure/taking profits is an appropriate risk control measure. We also implore investors sitting on massive gains to set up automated trailing stops to protect gains and take your emotion out of the game.

As such, we rate CVX as a Sell.

Chevron Stock – A Double Top Bull Trap Formed In Early June

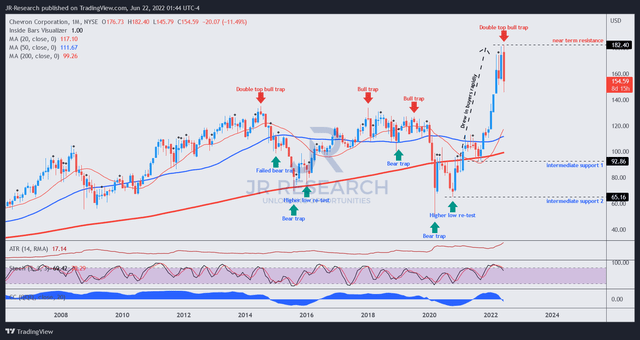

CVX price chart (monthly) (TradingView)

CVX stock has a long-term uptrend, as seen above. As a result, it has helped CVX outperform (5Y CAGR: 7.34%) the SPDR Energy Select ETF (XLE) (5Y CAGR: 2.88%) and its leading peer XOM stock (5Y CAGR: 1.88%) over the past five years.

However, after its previous double top in 2014, CVX stock failed to stage a higher high until it broke its all-time highs in February 2022. Therefore, investors must be wary if they observe a double top, which likely forebodes a potentially significant reversal in bullish momentum.

The 2020 COVID bottom bear trap helped stage its reversal in bearish momentum, as seen in the higher lows subsequently.

However, we believe the COVID bear trap has been resolved with its double top formation in early June, as seen above.

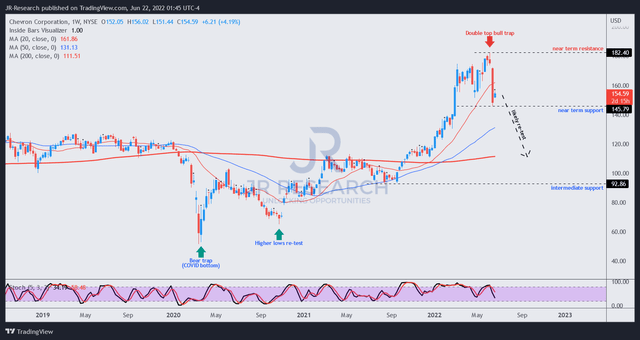

CVX price chart (weekly) (TradingView)

The series of consecutive mark-up bars represented a rapid “flush-up” in price action parlance, drawing in buyers rapidly over the past six to seven months. As a result, it helped CVX notch a market-beating 31.73% YTD gain, despite the recent retracement.

However, we think the party has ended with June’s double top bull trap. The recent steep sell-off occurred after the completion of its distribution phase (from March to June). Its price action dynamics suggest that CVX is likely at a near-term bottom, undergirded by its near-term support, as seen above.

However, given the precedence of its double top, we are not convinced that we have seen the worst of the sell-off. Instead, the market looks likely to stage a short-term rally to draw in dip buyers before forcing another rapid liquidation moving ahead.

We believe the eventual bottom could be found in the gap between its near-term and intermediate support, as presented above. Therefore, we urge investors to use potential rallies to layer out/cut exposure and wait for a better opportunity to add exposure.

CVX Stock Is Overvalued

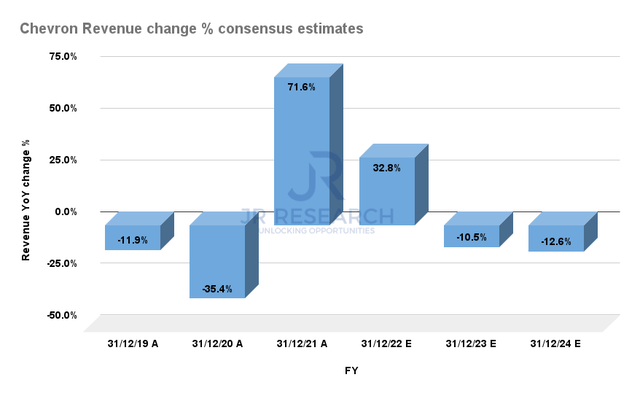

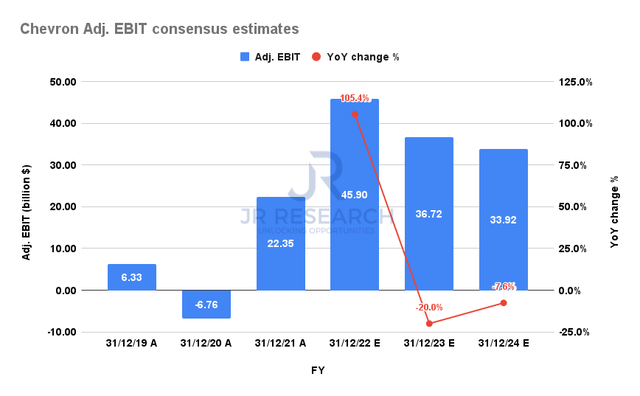

Chevron revenue change % consensus estimates (S&P Cap IQ) Chevron adjusted EBIT consensus estimates (S&P Cap IQ)

We believe it’s critical for investors to ask how much more they expect Chevron stock to rise from here to assess its risk/reward profile. Also, whether the fundamental drivers (revenue and profitability growth) are sufficient to help them meet their expectations.

Notably, the consensus estimates (and the Street is generally bullish) indicate that Chevron’s revenue growth is projected to peak in FY22 before falling precipitously through FY24. It’s also expected to impact its adjusted EBIT profitability as growth continues to slow and eventually decline through FY24.

Therefore, despite the optimism in the market currently, investors are urged to use these estimates, coupled with our price action warning to assess their positions in CVX. The market is always forward-looking.

| Stock | CVX |

| Current market cap | $303.74B |

| Hurdle rate (CAGR) | 7.5% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 7.5% |

| Assumed TTM FCF margin in CQ2’26 | 14.4% |

| Implied TTM revenue by CQ2’26 | $211.27B |

CVX stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Furthermore, our reverse cash flow model indicates that CVX is overvalued at the current levels. Using a hurdle rate and FCF yield of 7.5% (broadly in line with its 5Y mean metrics), we derived a TTM revenue requirement of $211.27B by CQ2’26.

The bullish consensus suggests that Chevron’s revenue could decline through FY24, reaching $168.76B. Therefore, it’s clear that Chevron is unlikely to meet our revenue targets implied in our valuation model and could significantly underperform at the current levels.

If long-term investors are keen to add CVX at the right price, our model suggests the $110-$120 level as a reasonable price to consider. There’s also a potential support zone implied in its price action structure, thus further undergirding our thesis.

Using the same parameters above, adding at that level could help Chevron maintain its 7.5% hurdle rate while modeling a potential revenue decline. Therefore, investors would have built a reasonable margin of safety for themselves.

Is CVX Stock A Buy, Sell, Or Hold?

We rate CVX stock as a Sell. Its price action and fundamental valuation sing the same tune and suggest that investors should consider layering out/cutting exposure.

Long-term investors can consider adding exposure close to the $110-$120 level. Therefore, investors are urged to be patient and adopt a forward-looking perspective when looking at overly optimistic stocks like CVX right now.

Be the first to comment