We Are/DigitalVision via Getty Images

The Oil Investment Thesis

According to the US Energy Information Administration, the world is consuming approximately 99.82 Mb/d of liquid fuels, with global production projected at 99.93 Mb/d for 2022. While that may seem sufficient, we must highlight the fact that Russia accounts for 10.9 Mb/d of production in FQ3’22, while also exporting 7.7 Mb/d in October 2022. With the country reportedly not accepting the price cap imposed by G7 and preferring to cut some production ahead, it does not take a genius to surmise that global demand will continue to aggressively outstrip supply. Analysts are now projecting a drastic -1.7 Mb/d decline in the Russian output (the equivalent of -1.7% of global demand) by December 2022, due to the worsening geo-political events.

In addition, market analysts predict that the G7 price cap would not have the desired impact on the Russian economy, since more than 100 shadow vessels will be transporting Russian crude oil. By October, up to 6% of loadings are already shadow-operating to the EU, China, India, Turkey, and multiple parts of Asia, according to the IEA. Thereby, circumventing the Russian trade analysis and destination loadings ahead, further upsetting the global oil supply-demand balance. Then again, we expect the EU-led price cap to potentially destabilize pricing in the short term, with the upcoming February 2023 ban triggering more volatility.

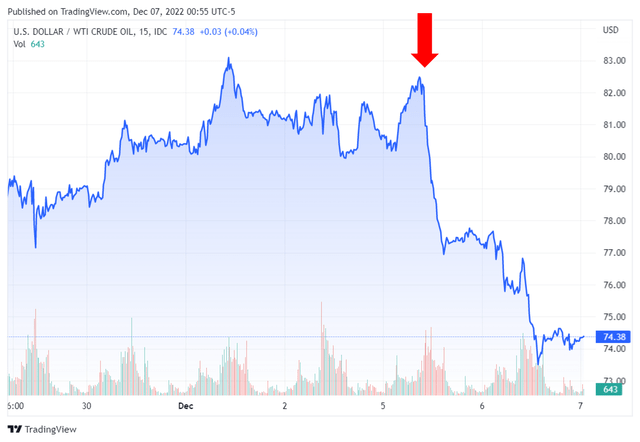

WTI Spot Prices After The Blood Bath on 05 December

Macro Trends

The situation is made significantly worse with OPEC+’s choice to defend the elevated prices by sticking to its 2 Mb/d reductions in oil production through the end of 2023, debunking the rumor of a 0.5 Mb/d increase for OPEC+’s recent meeting. The latter has had a catastrophic impact of crashing the WTI crude oil spot prices by -6.36% on 05 December and by -9.53% by 06 December 2022, indicating the market’s highly volatile nature indeed.

Nonetheless, this untimely plunge will likely be a temporary folly, before crude oil prices rebound to the low $80s. The OPEC has already delivered a 1.36 Mb/d cut in October and another 1 Mb/d cut in November, indicating their commitment towards a price target of $90. There is obviously no destruction here, since it will easily take decades for renewable energy to catch up with the insatiable demand for oil and natural gas.

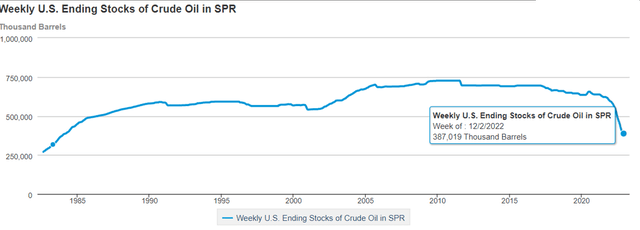

The US Ending Stocks of Crude Oil in SPR

US EIA

With the SPR stockpile plunging fast to 1983-lows, one thing is for sure – supply remains exceedingly tight, with market analysts expecting another 1.4M barrel decline for the week. Even the EIA has this say about the whole situation:

Despite increasing concerns around weakening global economic conditions, we forecast that global oil consumption will outpace global oil production in 2023, which will contribute to increasing oil prices in 2H23. We forecast the Brent crude oil price will rise from an average of $94/b in 1H23 to an average of $98/b in 4Q23, averaging $95/b for all of 2023. [US EIA]

CVX’s Forward Execution Has Been Massively Upgraded Through 2024

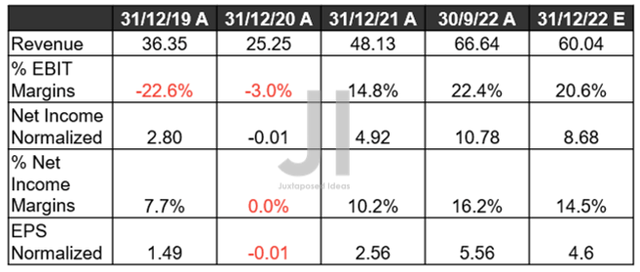

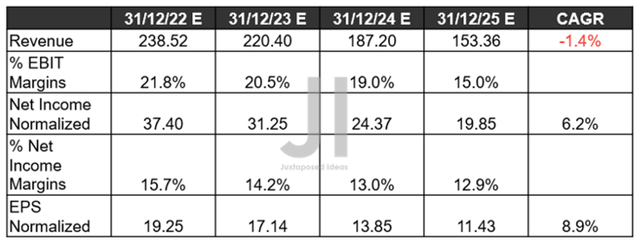

CVX Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

As a result of elevated oil prices, Chevron Corporation (NYSE:CVX) has delivered an exemplary FQ3’22 earnings call, with YoY revenue growth of 49.1% and EPS growth of 87.8%. With crude oil prices still sustaining a 30% premium against pre-pandemic levels, it is no wonder that market analysts expect another excellent FQ4’22, with an impressive YoY revenue expansion by 24.8% and EPS by 79.6%, respectively, despite the tougher YoY comparison.

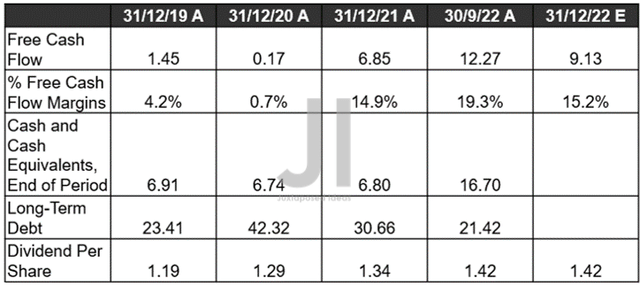

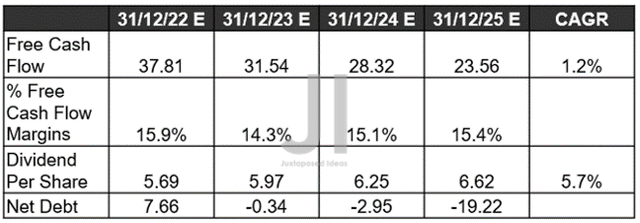

CVX Cash/ Equivalents, FCF ( in billion $ ) %, Debt, and Dividend

S&P Capital IQ

Furthermore, the massive windfall has allowed CVX to strategically deleverage -49.38% or $20.9B of its long-term debts within two years, while increasing its dividends paid out by 12.12% and embarking on $1.75B of stock repurchase programs at the same time. Naturally, this is only possible due to the generous expansion of its Free Cash Flow [FCF] generation by 271.49% and margins by 6.4 percentage points over the last twelve months against FY2019 levels.

Impressive indeed, since CVX continues to report a robust balance sheet by FQ3’22 with $16.7B of cash and equivalents and $22.18B of accounts receivable, against FQ3’19 levels of $11.69B and $12.91B, respectively.

CVX Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

Mr. Market is also highly confident about CVX’s forward execution, due to the immense top and bottom-line upgrades by 14.16% and 13.98%, respectively, since our last analysis in June 2022. Thereby, speculatively pointing to the sustained oil/gas prices through 2024, despite Biden’s and the Feds’ best efforts. Things are only expected to somewhat normalize by 2025, with the company reporting moderated revenue of $153.36B and net incomes of $19.85B.

However, keen-eyed investors may also notice that CVX’s EBIT/ net income margins will remain excellent at 15% and 12.9% in 2025, against 2019 levels of 4.3% and 8.1%, respectively. Therefore, explaining the massive growth in its forward EPS at $11.43, compared to 2019 levels of $6.27.

CVX Projected FCF ( in billion $ ) %, Debt, and Dividend

S&P Capital IQ

Furthermore, despite the projected annual capital expenditure averaged at $13.83B through 2025, CVX is still expected to deliver an impressive FCF generation and margins moving forward, against 2019 levels of 9.4%. Thereby, triggering the continued growth in its dividends paid out to $6.62 by 2025, indicating dividend yields of 3.74% then. Not too bad given the stock’s current baked-in premium, against its 4Y average yield of 4.57% and sector median of 4.32%.

Furthermore, CVX is expected to further deleverage to -$19.22B of net debts by 2025, indicating an excellent reduction from peak levels of $42.59B in 2020. Thereby, speculatively improving its book value per share from $76.62 in 2019 to $85.99 by 2025. In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Chevron: Hold On Tight And Don’t Let Go Of This Aristocrat

So, Is CVX Stock A Buy, Sell, or Hold?

CVX YTD EV/Revenue and P/E Valuations

S&P Capital IQ

CVX is currently trading at an EV/NTM Revenue of 1.47x and NTM P/E of 9.85x, relatively in line with its YTD mean of 1.49x and 10.08x, respectively. Otherwise, massively overvalued based on its 5Y mean of 1.57x and 4.40x, respectively.

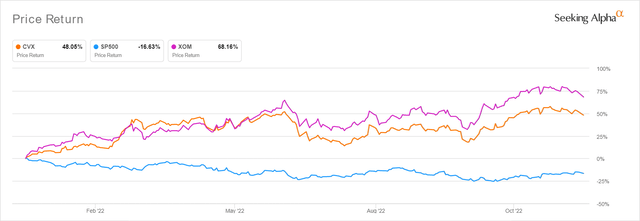

CVX YTD Stock Price

Seeking Alpha

The CVX stock is also trading at $172.01, down -9.31% from its 52 weeks high of $189.68. However, due to the recent 22.02% rally from the September bottom, the stock has consequently maxed out its short-term potential, due to the minimal 11.59% upside from the consensus estimate’s price target of $194.56.

Despite the notable decline in crude oil prices on 05 December, the CVX stock continued to hold on to its baked-in premium thus far, boasting its 44.23% gains YTD against the S&P 500 Index’s decline of -17.83% at the same time. While we believe that oil/gas prices will remain inflated in the foreseeable future, anyone who adds CVX now may also see minimal upsides from current levels.

Depending on the November CPI reports released on 13 December and the Fed’s subsequent hike on 14 December, things will likely remain highly volatile in the short term. This is despite 77% of analysts a Fed pivot with a 50 basis points hike, breaking the trend of a fourth consecutive 75 points hike. Especially since the recent windfall tax in the EU and potentially in the US will discourage forward oil/gas investment/ production while encouraging an accelerated return of capital to investors. Shell (SHEL) is already re-evaluating its £25B investment in the British energy infrastructure, due to the raised windfall tax from 25% to 35%. Thus, there will be more uncertainties in the short term as supply remains tight while government policies continue to suppress prices.

Combined with the likelihood of raised terminal rates to over 6%, we prefer to rate CVX stock as a Hold for now, due to the potential volatility. On the other hand, investors who want to lock in some gains may choose to cash out at these peak levels and come back in during the dips.

Be the first to comment