JHVEPhoto

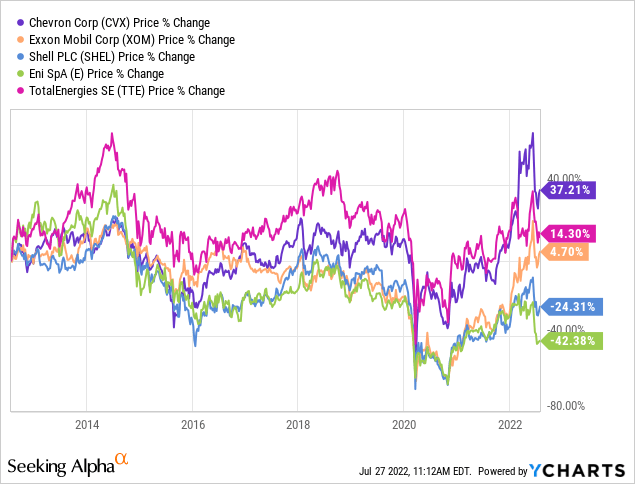

Like many companies in the O&G sector, the stock of Chevron (NYSE:CVX) has declined about 10% over the past 90-days despite the fact that Q2 consensus earnings estimates have risen sharply (~25%) during that same time frame. Over the years, Chevron has kept a very strong balance sheet. That allowed the company to navigate the COVID-19 crisis much better than most of its peers. Indeed, Chevron is the best performing international integrated oil stock price over the past decade (see graphic below), and dividend growth has been strong as well (currently $5.68/share annually – double the 2010 payout). After all, there was a reason the DJIA kicked Exxon (XOM) out, but kept Chevron in the average. Expect a stellar Q2 report on Friday due to the strength of Chevron’s Permian and LNG assets. CVX is generating tons of FCF: $6.1 billion in Q1, or $3.14/share. As a result, investors should expect continued strong shareholders returns going forward. The rally in oil, natural gas, and LNG prices, combined with the recent 10% drop in Chevron’s stock price, leads me to upgrade my rating on Chevron from HOLD to BUY.

Investment Thesis

Most all investors are well aware of the impact that Putin’s horrific war-of-choice on Ukraine and the resulting sanctions placed on Russia by the U.S. and its Democratic and NATO allies have had on global energy markets. Those developments, combined with very disciplined production growth by U.S. shale producers and OPEC have led to very strong pricing for oil, natural gas, and LNG. For a company like Chevron that has a low-cost and low-royalty tier-1 position in the Permian, and strong LNG assets in Australia and Angola, that means soaring profits.

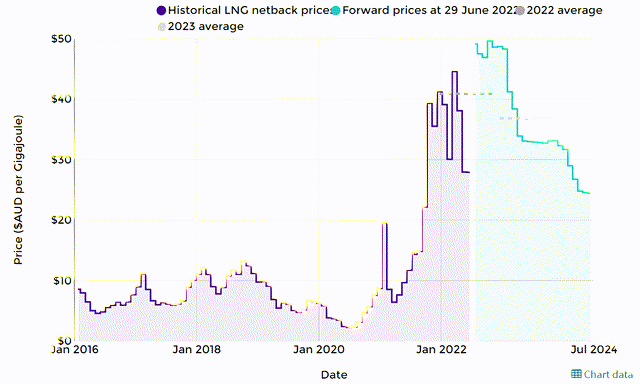

As I mentioned in my recent article on ConocoPhillips (COP), Australian LNG prices were very strong in Q2 (see COP: Shifting Focus To LNG):

On the Q1 conference call, we also got an idea of the strength of Chevron’s Angola LNG asset when Chevron CFO Pierre Breber commented:

I also pointed out that Angola LNG returned $500 million of capital. That’s essentially operating cash. That’s a function of operating an LNG facility and selling it into the European gas markets at TTF prices.

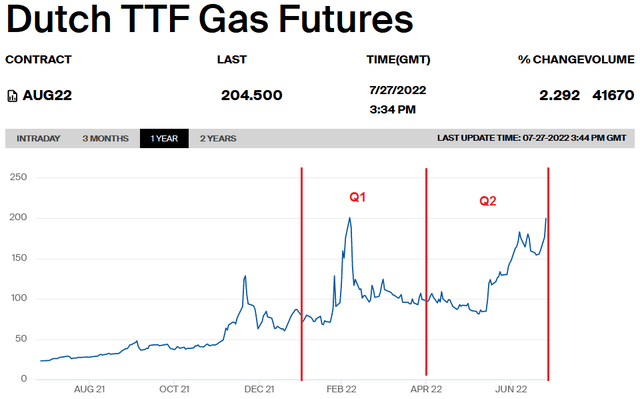

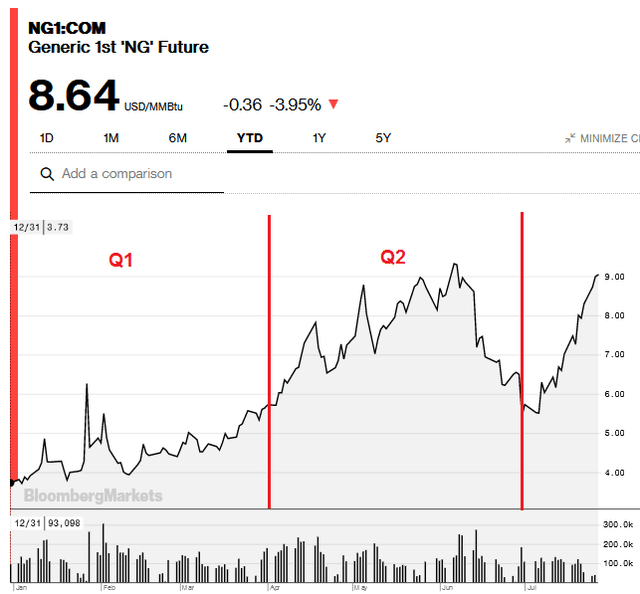

The graphic below shows TTF pricing during Q2 as compared to Q1:

InterContinentalExchange (ICE)

As you can see, the rally in EU gas continues: The area under the curve in Q2 was greater than it was during a very bullish Q1.

Meantime, Chevron is a significant producer of natural gas in the U.S. as well: 1.83 Bcf/d in Q1. That’s mostly due to the company’s associated gas production in the Permian Basin and from the Gulf-of-Mexico offshore platforms. That being the case, Chevron also is a big beneficiary of the very strong pricing of NYMEX gas:

Again, as you can clearly see, NYMEX gas rallied sharply in Q2 as compared to Q1.

Earnings

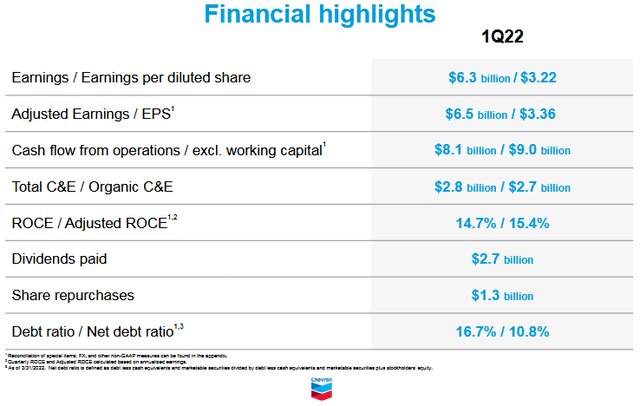

In late April, Chevron released a very strong Q1 EPS report – highlights of which are shown below (from Chevron’s June Investor Presentation):

The company generated $6.1 billion of free cash flow during the quarter ($7 billion excluding working capital). That equates to $3.14/share based on the 1.945 billion fully diluted shares outstanding at the end of the quarter. That obviously bodes well for Chevron shareholders going forward considering the current quarterly dividend is “only” $1.42/share and the total dividend payout in Q1 was only $2.7 billion. Combined with arguably the strongest balance sheet in the industry, that means Chevron has plenty of free cash flow to fund excellent dividend growth, share buybacks, and/or further debt reduction.

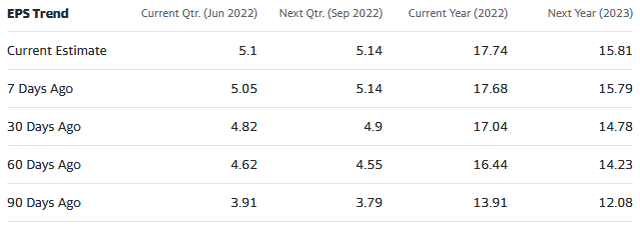

Looking forward to Q2, and as mentioned earlier, EPS estimates have been rising sharply and currently expect $5.10/share in Q2 earnings – up a whopping 58% sequentially from the very strong $3.22/share earned in Q1:

However, I do want to mention that Chevron reported on the Q1 conference call that it expects lower production in Q2 due to planned turnarounds at Wheatstone LNG in Australia and Angola LNG. Note also that Chevron CFO Pierre Breber reported:

We anticipate a return of capital between $250 million and $350 million from Angola LNG in the second quarter. This cash is reported through cash from investing and not cash from operations. In the first quarter, Angola LNG returned over $500 million of capital.

and

I also pointed out that Angola LNG returned $500 million of capital. That’s essentially operating cash. That’s a function of operating an LNG facility and selling it into the European gas markets at TTF prices.

Yet despite Chevron’s planned LNG turnarounds in Q2, and the resulting lower production, the strong commodity price environment has consensus earnings estimates rising significantly. Indeed, analysts now expect Chevron to earn $17.74/share this year. Given the current stock price at pixel time ($148.50), that implies a (six-month) forward P/E of only 8.4x. In my opinion, that’s extremely cheap for a company that’s very shareholder friendly, has a strong balance sheet, is very well positioned globally, and has a strong growth profile moving forward.

Going Forward

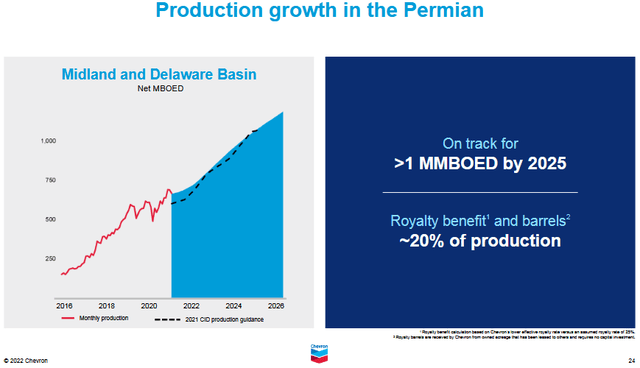

As mentioned in the bullets, Chevron plans to grow production to ~3.5 million boe/d by 2026. That’s up 400,000 boe/d as compared to this year’s expected production of ~3.1 million boe/d. This will largely be as a result of growth in Tengiz expansion programs and, of course, strong growth in the Permian Basin:

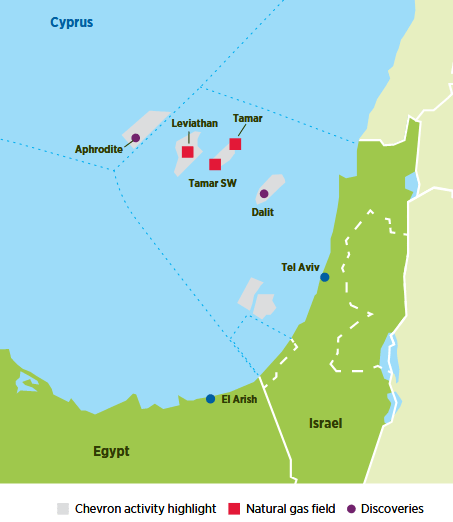

Yet perhaps a more exciting growth area for Chevron is in the Eastern Mediterranean Sea as a result of its acquisition of Noble Energy’s excellent natural gas properties. CEO Mike Wirth commented on this during the previously referenced Q1 conference call:

On the other question, LNG. I addressed earlier a little bit of the – we got a number of options in the Eastern Mediterranean. We’re talking to some people here in the U.S. You may have seen media reports that we have been talking to people in the Middle East about expansion projects there. So we’re evaluating a number of different opportunities. We’d like to grow our LNG position. The world needs it. But similar to my response to Paul, it’s got to compete for capital.

Chevron

Chevron has a 39.66% owned and operated interest in the Leviathan gas field located 80 miles northwest of Haifa. The Leviathan leasehold covers ~49,000 net acres (198 sq km) and is Israel’s largest energy project. In 2020, Leviathan production ramped up to an average of 242 MMcf/d, of which Chevron’s net attributable share was 64 MMcf/d.

Chevron also has a 25% owned and operated interest in the Tamar gas field east of Leviathan. In 2020, net daily production from the Tamar Field averaged 173 MMcf/d (51 MMcf/d net to Chevron).

Considering the current need for additional natural gas supply for the EU, Chevron’s assets in the Mediterranean Sea hold excellent potential for future development given the relatively close proximity to southern Europe.

Summary and Conclusion

Chevron is arguably the best international integrated oil company. It has excellent unconventional assets in the Permian Basin and strong performing LNG assets in Angola and Australia. CVX also has a very strong balance sheet and strength in downstream refining and chemicals through CPChem – a 50/50 JV with Phillips 66 (PSX). Its Noble Energy acquired assets in the Mediterranean Sea have excellent growth potential going forward. Chevron current yields 3.9% and the outlook for future dividend growth is outstanding.

Meantime, expect Chevron to release a stellar earnings report this Friday. Trading at a six-month forward P/E of only 8.4x, and generating tons of FCF that can be directed toward additional shareholder returns in the form of dividends and buybacks, Chevron is a BUY.

Be the first to comment