Leestat/iStock via Getty Images

Introduction

In September 2021, I wrote a bearish article on a U.S. oil and gas royalty investment vehicle named Chesapeake Granite Wash Trust (OTC:CHKR) as part of my series about double-digit dividend yield stocks and it’s shaping up as one of my biggest misses so far. As of the time of writing, the unit price is up just over 89% since that article came out. So, what went wrong? Well, I was expecting natural gas prices to decline as supplies from Russia normalize and China decreases purchases. However, Russia then invaded Ukraine and all hell broke loose.

Overall, I continue to think that CHKR is overvalued. The trust has a market valuation of $61.5 million as of the time of writing while the present value of estimated future net revenues for its royalty interests stood at just $41.5 million as of December 2021. Let’s review.

Overview of the latest developments

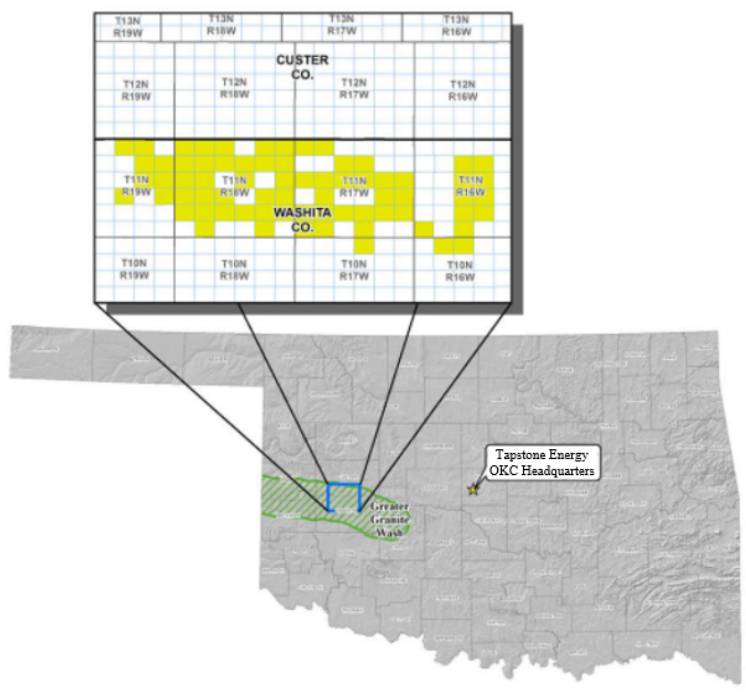

In case you haven’t read my previous article on CHKR, the trust was created in 2011 and it owns royalties on a portfolio of oil and gas properties located in the Granite Wash formation of the Anadarko Basin. The net developed acreage is 26,195 and the drilling unit for each horizontal well comprises 640 acres. No new wells have been drilled over the past several years.

Chesapeake Granite Wash Trust

The reason you are seeing the name Tapstone Energy on the map is because this is the current operator of the wells. In 2020, this company bought the Midcontinent assets of Chesapeake Energy Corp. (NASDAQ: CHK) for $130.5 million. These assets accounted for only 12,000 boe/d of Chesapeake’s production in Q3 2020. In December 2021, Tapstone was bought by London-listed Diversified Energy (OTCQX:DECPF) at a net purchase price of around $181 million.

CHKR is required to make quarterly cash distributions of substantially all of its quarterly cash receipts, after deducting the administrative expenses and any cash reserves. On February 3, the trust announced that it’s distributing $0.0667 per unit, which translates into an annualized yield of 20.21%.

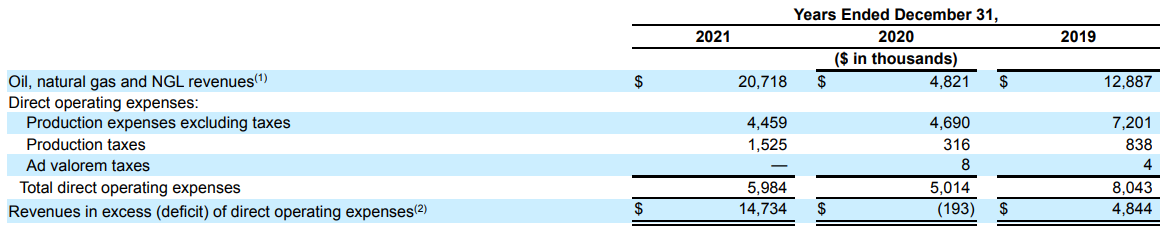

Turning our attention to the financial results, the underlying properties generated revenues of $20.7 million in 2021. However, production has been declining for years and the reason we saw a big jump in revenues last year was because natural gas prices were high.

Chesapeake Granite Wash Trust Chesapeake Granite Wash Trust

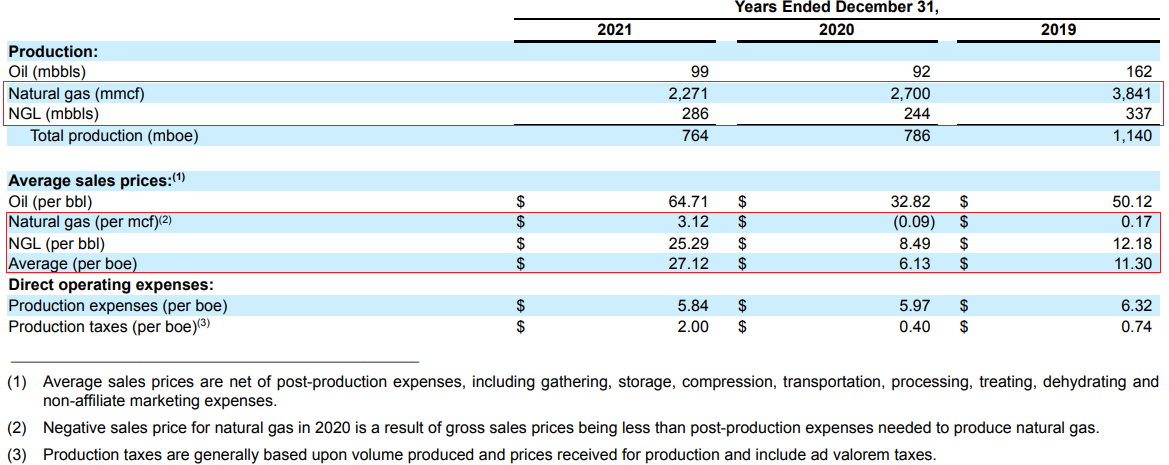

As a result, CHKR booked a royalty income of $8.7 million in 2021, which was over 75% higher compared to 2020. The distributable income came in at $6.54 million, which translates into $0.1399 per unit. The total production attributable to the royalty interests was 417,000 barrels of oil equivalent.

Chesapeake Granite Wash Trust

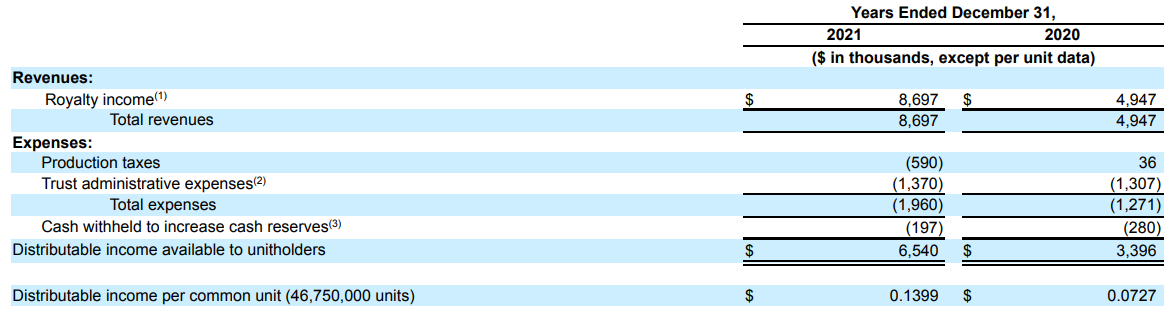

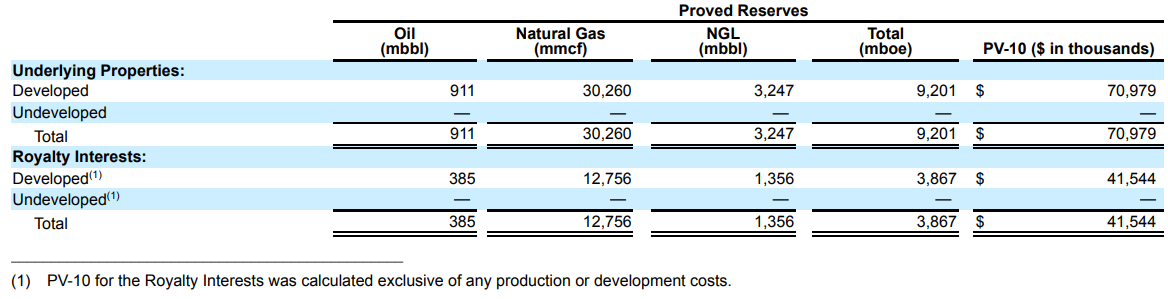

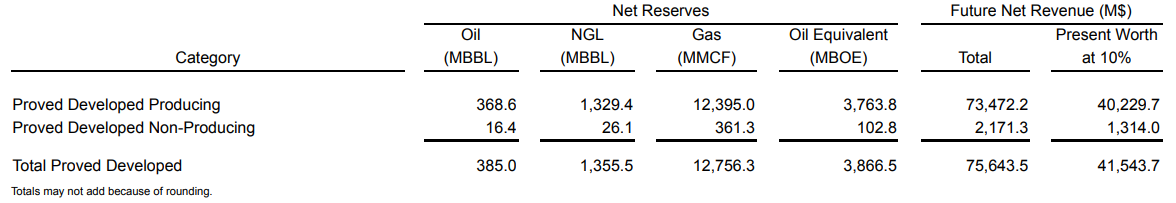

So, the trust has an annualized distribution yield of over 20%, but is this sustainable? In my view, it’s not. The underlying properties had total proved reserves of 9.2 million barrels of oil equivalent as of December 2021. The proved reserves attributable to the royalty interests, in turn, stood at 3.87 million barrels of oil equivalent. This means that the current production rate can be sustained for about 12 years. However, the estimated future net revenues (PV-10) of the underlying properties and the royalties are just $71 million and $41.5 million, respectively. And the PV-10 for the royalties doesn’t even take into account production or development costs.

Chesapeake Granite Wash Trust Chesapeake Granite Wash Trust

Why are the numbers so low? Well, it’s because the estimated future net revenues are calculated applying a 10% discount rate as well as using prices for oil and natural gas that are based on the 12-month unweighted arithmetic average of the first-day-of-the-month price for each month in the period from January through December 2021. This means that the adjusted product prices used were $62.68 per barrel of oil, $25.56 per barrel of NGL, and $1.768 per Mcf of gas. Considering the proved reserves for the royalties are 55% natural gas by volume, natural gas prices have a significant effect on the estimated future net revenues. Back in September, I wrote that the natural gas market was likely to return to normal in the coming few months, but this clearly hasn’t happened as we’re we are at levels that were last seen back in 2008.

Trading Economics

Between my first article and late January, natural gas prices slumped from $5.73 per Mcf to below $4.00 per Mcf by the middle of February. However, Russia then invaded Ukraine and the market has been volatile due to fears that Russian natural gas could stop flowing to Europe. In my view, natural gas prices are likely to remain high until the conflict between Russia and Ukraine is resolved and it’s impossible to forecast when this could happen. However, I doubt it will take more than a year and the only time we had a long period of natural gas prices this high was between 2004 and 2008 when there was a decade-long energy crisis as a result of surging demand from developing economies, stagnant production, financial speculation, and tension in the Middle East. In view of this, I think that CHKR is overvalued at the moment and that its market valuation will fall to levels close to its current PV-10 as natural gas prices eventually come back down to earth. However, opening a short position seems dangerous at the moment as data from Fintel shows that the short borrow fee rate stands at 57.74% as of the time of writing.

Investor takeaway

I view CHKR as a small natural gas trust that has delivered underwhelming returns for the majority of its existence. However, distributions have grown rapidly over the past several months as natural gas prices soared. The key reasons behind this included decreased Russian supplies for Europe as well as strong buying by China.

CHKR currently has an annualized yield of over 20% and H1 2022 is likely to be strong as natural gas prices have increased further following the Russian invasion of Ukraine. However, this conflict can’t continue at this pace for years and I think natural gas prices are likely to return to around $3.00 per Mcf after it ends.

In my view, CHKR’s 20% distribution rate is unsustainable in the long run and I’m bearish. However, the short borrow fee rate is above 50% and I think it’s best for investors to avoid this stock for now.

Be the first to comment