Roman Barkov

Investment Thesis

Chesapeake Energy (NASDAQ:CHK) exited bankruptcy a few quarters ago, and for now, continues to have some stigma around its operations.

By my estimates, CHK is likely to return to shareholders 17% of its market cap over the next twelve months, via dividends and buybacks.

What’s more, CHK is very well positioned for high natural gas prices. In fact, as its hedged book improves early in 2023, even at lower natural gas prices, CHK’s free cash flows will remain high.

Chesapeake’s Hedged Book Will Improve

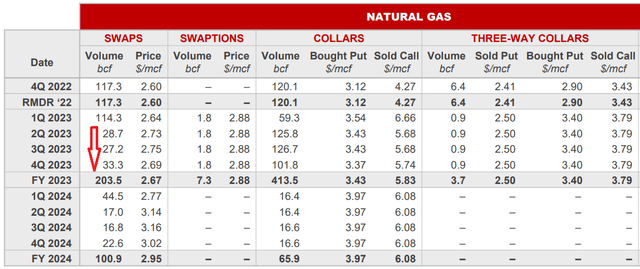

In my prior article, I noted that CHK’s hedge book should improve in the early parts of 2023.

CHK Q3 2022

Along these lines, it’s great to see that this is still the case, as CHK updates investors with its Q3 results.

CHK will see its natural gas production go from approximately 70% hedged at approximately $2.86 mmbtu in 2022, to approximately 40% hedged at $3.19 in 2023.

That means that somewhere close to 60% of its operations are unhedged. If one assumes that Henry Hub natural gas prices remain around $5 mmbtu in 2023, then, CHK will be oozing strong free cash flows in 2023, even if natural gas prices go lower than the current price of approximately $6.20 mmbtu.

Put simply, for investors that are bullish on US-based natural gas, CHK’s 2023 performance will be materially more exposed to the strong natural gas market, even if prices come down. One way or another, all else equal, CHK will print equally strong or higher free cash flow in 2023.

With that in mind, we’ll next turn our focus to CHK’s capital return program.

Capital Returns Program, Around 17% Total Yield

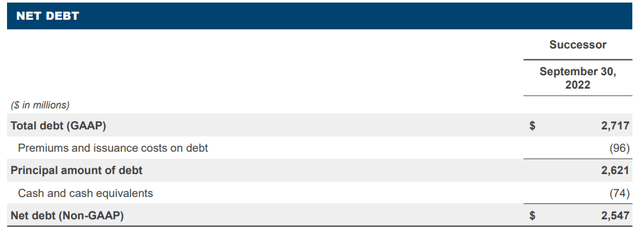

Before getting into CHK’s capital return program, I’ll momentarily shine a light on CHK’s financial position.

CHK Q3 2022

What you see above is a reminder that CHK still carries a fair amount of debt. It’s clearly not crippling. Not when you consider that in Q3 alone, CHK’s free cash flow reached approximately $775 million, a figure that annualizes at approximately $3 billion of free cash flow.

Indeed, this implies that at the current rates, CHK could repay all its debt and operate debt free in less than 12 months.

However, that being said, it’s still some time until CHK’s free cash flows can chip away at its balance sheet.

On the other hand, we should keep in mind that CHK doesn’t have to operate debt free. It can ramp up its capital return to shareholders much sooner than when its debt-free. This is despite the stigma that recently this was a bankrupt company.

With that in mind, this is how CHK’s CEO Domenic Dell’Osso addressed the capital return program on the call,

We will make sure that as we sell off [Eagle Ford] asset that has a lot of EBITDA, we make sure our balance sheet stays in great shape.

So we expect to look at the proceeds that come in, think about what the right balance sheet impact is to reduce leverage and then think about the best way to pursue a return of some of that capital to shareholders through a buyback.

Accordingly, there’s a reiteration that the bulk of the proceeds from the asset sale will go toward paying down debt. And after that, there’s going to be a wait-and-see period, before further ramping up its shareholder program.

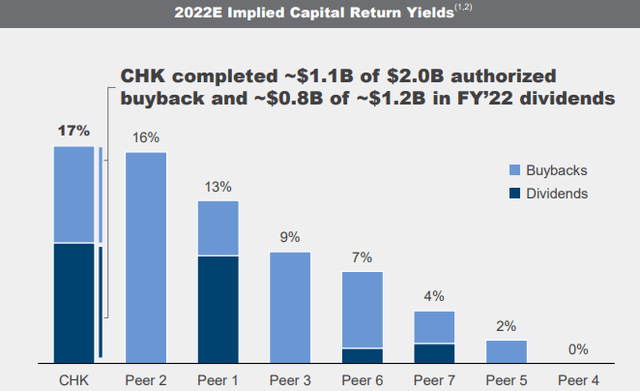

That being said, to be clear, CHK already has a very compelling capital return yield.

In fact, consider what CHK’s CFO Mohit Singh said on the call,

[W]e’ve been very pleased with our ability to be able to do about $1.1 billion of buybacks and well ahead of schedule, and we still have about $900 million and until the end of 2023 to prosecute the rest of the program.

This implies that over the coming year, CHK could be in place to return around 6.9% of its market cap to shareholders.

Altogether, to view this capital return program graphically, see below.

CHK Q3 2022

For Q3 2022, CHK’s base dividend plus special dividend amounts to $3.16 per share, which annualizes at $12.64. Hence, its annualized total dividend payout reaches 12.8%.

With that in mind, perhaps, I’m a little too hopeful in wanting even more capital returns. However, keep in mind that CHK left bankruptcy a few quarters ago.

Consequently, I don’t believe that being too aggressive with its capital return policy at this juncture is the right strategy either.

The Bottom Line

This is the one-line summary. Chesapeake Energy is a cheaply valued natural gas company.

To elaborate on this, consider that CHK has a 3-pronged approach to returning capital. It has a base dividend, plus 50% of its free cash flows making up a variable dividend, plus approximately $900 million authorized to be deployed over the next twelve months via share buybacks.

Altogether, this works out as approximately 17% combined return in 2022, and more likely than not sustainable in 2023. For investors that are bullish on natural gas prospects over the next few years, I believe that CHK is very compelling. Even now.

Be the first to comment