Kwarkot

Investment Thesis

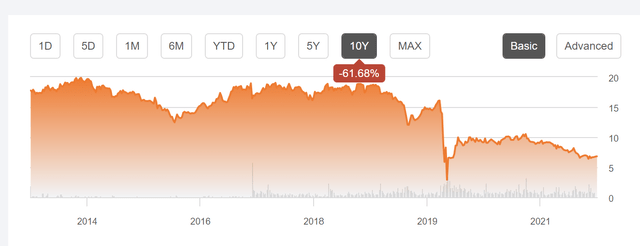

Cherry Hill Mortgage Investment Corporation (NYSE:CHMI) is a micro-REIT (real estate investment trust) that offers its investors an attractive dividend yield of 16.07% at the current share price. Due to the Covid-19 impact and current volatility in the market, the company’s share price has decreased significantly, creating a perfect entry point for the investors to earn stable and high returns by making a new position in CHMI at the current price levels.

Company Overview

Cherry Hill Mortgage Investment is a residential real estate company focusing on acquiring, investing, and operating residential mortgage properties in the USA. The company operates intending to generate attractive dividend yield and capital appreciation returns. The company generates its revenue through three segments: investments in Residential Mortgage-Backed Security (RMBS), investments in Servicing Related Assets, and Other Services. Assets under RMBS consist of Agency RMBS, residential mortgage pass-through certificates, Collateralized Mortgage Obligations (CMOS), and To Be Announced (TBA) bonds. The company’s current portfolio consists of MSRs, RMBS with maturities of 30 years, and RMBS with maturities of less than 20 years. The servicing-related assets consist of Mortgage Servicing Rights (MSRs) and Excess MSRs. The revenue for FY2021 was $49.75 million.

The company has a gross profit margin of 72.39% and a net income margin of 39.37%, which indicates substantial operational and financial leverage, respectively. The company currently has a current ratio of 0.22x and a quick ratio of 0.17x, which are considered low. In the last year, the company has grown its earnings by 46.7%, while the industry earnings have grown only by 5.4%. It has given a return on equity of 7.7%, marginally lower than the industry average of 8%. The company has significant long-term debt on its balance sheet that is not concerning as it is operating in the real estate business, which is known as a capital-intensive business.

Anyway, most of the debt is backed by real estate property which mitigates the risk of rising debt. The company is qualified as REIT under taxation as it has maintained its capital distribution policy of distributing at least 90% of its taxable net income to its shareholder. The company has one of the highest dividend yields in the industry. Currently, it has a dividend yield of 16.07%, with an average payout ratio of 90.76%.

Strong Dividend Yield of 16.07%

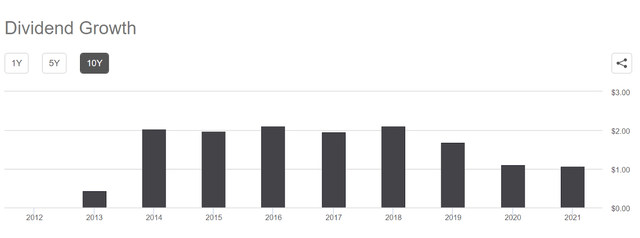

The company has recently announced a quarterly dividend payment of $0.27, which is an annualized dividend payment of $1.08. If we divide the annualized dividend payment by the current share price of $6.78, it will give a dividend yield of 16.07%.

The company has a stable and robust dividend policy, but during FY2019, the dividend payment decreased significantly due to the Covid-19 crisis. I believe the dividend payment will show significant improvement in the short term because the company has shown improvement in profit margins and revenue in Q1 2022 and is expected to continue this growth even in the coming quarters. I think the current dividend yield of 16.07% is very attractive for those investors who want to earn fixed returns with limited risk exposure.

The company is a micro-REIT. Before FY2019, the company used to trade in the price range of $17-$18. With an average annualized dividend payment of $2.00, the dividend yield used to be in the range of 10%-12%. I think that at the current price levels, investors have the best entry point to earn stable returns of 16.07% on their investments.

Key Risk Factor

Increase in the interest rate: Due to the increased cost of borrowing, rising interest rates typically result in a decrease in the demand for mortgage loans. The amount of target assets available to the company may change if fewer mortgage loans are originated, which might negatively impact its capacity to acquire assets that meet its investment goals. The company’s target assets that were issued before an increase in interest rates may likewise offer yields that are lower than those of the current market. The company mitigates this risk through interest rate hedging activities, but these hedging contracts can be expensive depending on the volatility level in the market. Thus, the rising interest is a cause of concern for the company.

Valuation

CHMI has a market cap of $126 billion and is currently trading at a share price of $6.78. The company has witnessed a YTD decline of 19.29% in the share price. The company is trading at a P/E multiple of 5.72x with FY22 EPS estimates of $1.20 (this REIT reports EPS and not FFO). I believe the company is trading at an attractive valuation at the current price level. The solid 16.07% dividend makes it an even more attractive investment opportunity. Going ahead, I believe the company can trade at a P/E multiple of 6.5x, which is close to the industrial P/E average. This gives us a target price of $7.80, a 16% upside from current price levels.

Conclusion

CHMI has a strong dividend yield of 15.86%, with a 16% upside potential in the share price. The company has shown improvement in the profit margins in Q1 2022, and I believe the profit margins will remain strong throughout FY22. The company has witnessed a significant decline in the share price in the past six months, and I believe the stock is undervalued at current price levels. I assign a buy rating for CHMI on the basis of its strong dividend yield and significant upside potential in the stock price.

Be the first to comment