Boarding1Now/iStock Editorial via Getty Images

Investment thesis

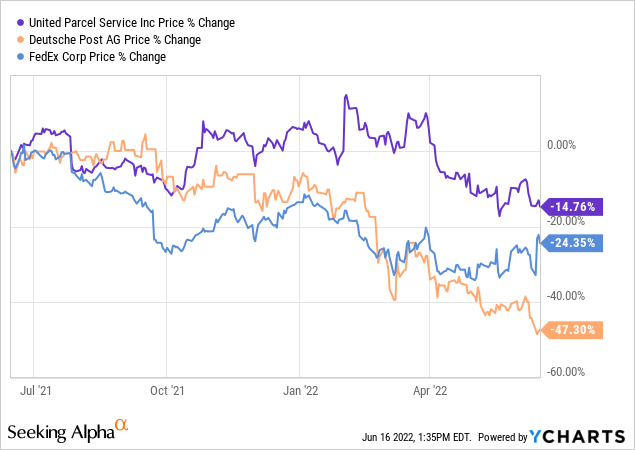

Rising interest rates, high inflation, COVID lockdowns in China, and a war in Europe. The current difficult situation of the global economy pulls the stock market down. Deutsche Post AG (OTCPK:DPSTF) has not been spared, and the stock plunged over 48% from its all-time high in September 2021, although the business remains mainly unaffected by the current situation. Therefore, I believe that the stock is undervalued now and will eventually go back to normal levels.

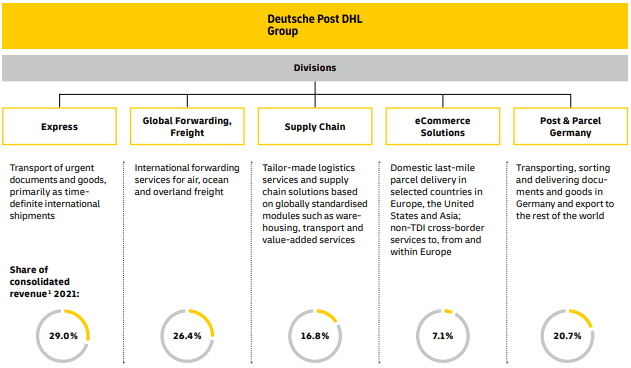

Business model

Deutsche Post divides its business into five separate corporate divisions: Express, Global Forwarding & Freight, Supply Chain, eCommerce Solutions, and P&P Germany. Subsequently, I’ll explain how the different segments will be affected by the current macroeconomic situation.

The “Express” segment could grow its revenue by 15.9% from €5.499 million (Q1 2021) to €6.373 million (Q1 2022). The increase is solely due to price rises (the amount of shipments/day is actually down 7% YoY). As an investor, I like it when companies can remain or even grow their revenues and cash flow in high inflation environments because it means they have a significant pricing power, which allows them to pass inflation over to the customers. Caused by the energy and fuel price hikes, the operating cash flow only grew by 11.7% from €1.441 million (2021 Q1) to €1.609 million (2022 Q1). The management has already announced to hike prices in order to tackle the high inflation.

The “GFF” segment got highly boosted by the current forwarding issues (e.g. jammed ports and as a result higher demand) and could grow revenue by 54.9% from €4.752 million (2021 Q1) to €7.359 million (2022 Q1). This is also primarily due to increased prices, which therefore also elevated the operating cash flow by over 373% from €112 million to about €418 million. The freight volume by air and ocean only increased by 3% and 0.3%. We rarely see a margin increase like this in those types of businesses and in the long-term, the high margin will probably fall back to normal levels. Personally, I am mostly bearish on this segment because the high demand and congestion in the forwarding business have allowed GFF to earn much higher margins. In the near to mid-term future, this situation will relax and go back to normal. This phenomenon can also be observed by looking at the current PE-ratios of forwarding companies like Hapag-Lloyd (OTCPK:HPGLY), which is currently at 3. It seems cheap at first sight but with the economy cooling down and the relaxation of supply chains earnings will drop again.

After vigorous growth in 2021 caused by the extraordinary pandemic-related high volume of deliveries, the segment could not keep the increased revenue for the last quarter. After the strong 2021 Q1, with €4.555 billion, the revenue declined 6.8% to €4.245 billion in 2022 Q1. Nevertheless, the revenue is still up compared to €3.959 billion for 2020 Q1. The operative cash flow fell from €611 million to €479 million. Just recently announced price increases aim to pass the increased costs to the customers in Germany.

Supply Chain and eCommerce Solutions are the two smallest segments. Revenue had a solid growth of 17.7% from €3.241 million (2021 Q1) to €3.815 million (2022 Q1) caused by more customers shifting focus toward a more digital and resilient e-Commerce business. A drop of bitterness is the negative growth in the operating cash flow of €241 million (2021 Q1) to €107 million (2022 Q1) especially due to higher wages and fuel costs. I anticipate this segment to stagnate in growth as less money will be spent in a high interest rate environment.

The “eCommerce Solutions” segment grew strongly over the last two years, from around €996 million (2020 Q1) to €1.454 million (2021 Q1). Obviously, this, with special effects boosted, growth will not last but is expected to at least remain resilient at €1.445 million in this Q1. The operative cash flow fell from €230 million to €170 million. As well as for the “Supply Chain” segment, eCommerce Solutions will also see short-term headwinds in a cooling economy.

DPDHL annual report 2021 (Page 21)

Fundamentals

The overall revenue increased by 19.8% YoY (2021 Q1: €18.860 billion). Still, the operating cash flow fell by 2.6% from €2.490 billion to €2.426 billion. The main reason for this is a typical seasonal decrease in the net working capital (NWC). Meanwhile, the free cash flow fell from €1.183 million to €-197 million in the first quarter of 2022 YoY. Excluding the above-mentioned acquisition of the logistic company “Hillebrand Group”, which cost €1.379 million, the FCF remains on an equal level. (Hillebrand Group is a forwarding company specialized in logistics of beverages, beer, wine, and spirits). Deutsche Post has shown strength in 2021 by utilizing its superior position. The global supply chain and freight forwarding problems have played into the company’s hands. I expect the OCF and the revenue to decrease. According to the management, the slow but steady relaxation of supply chains and the current Covid-19 lockdowns in China will mainly cause this headwind.

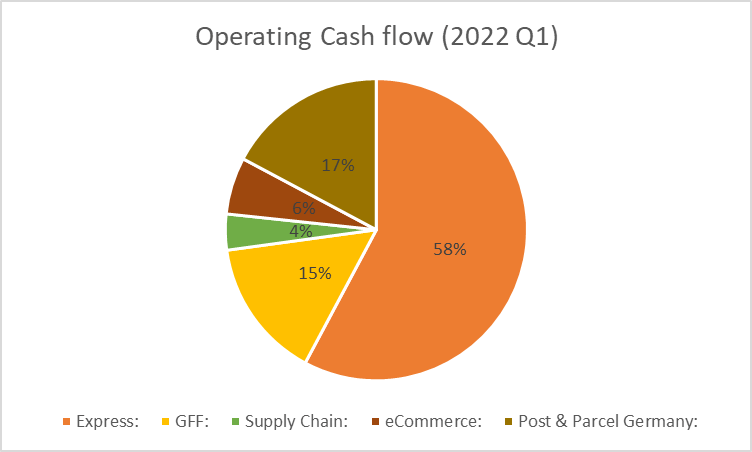

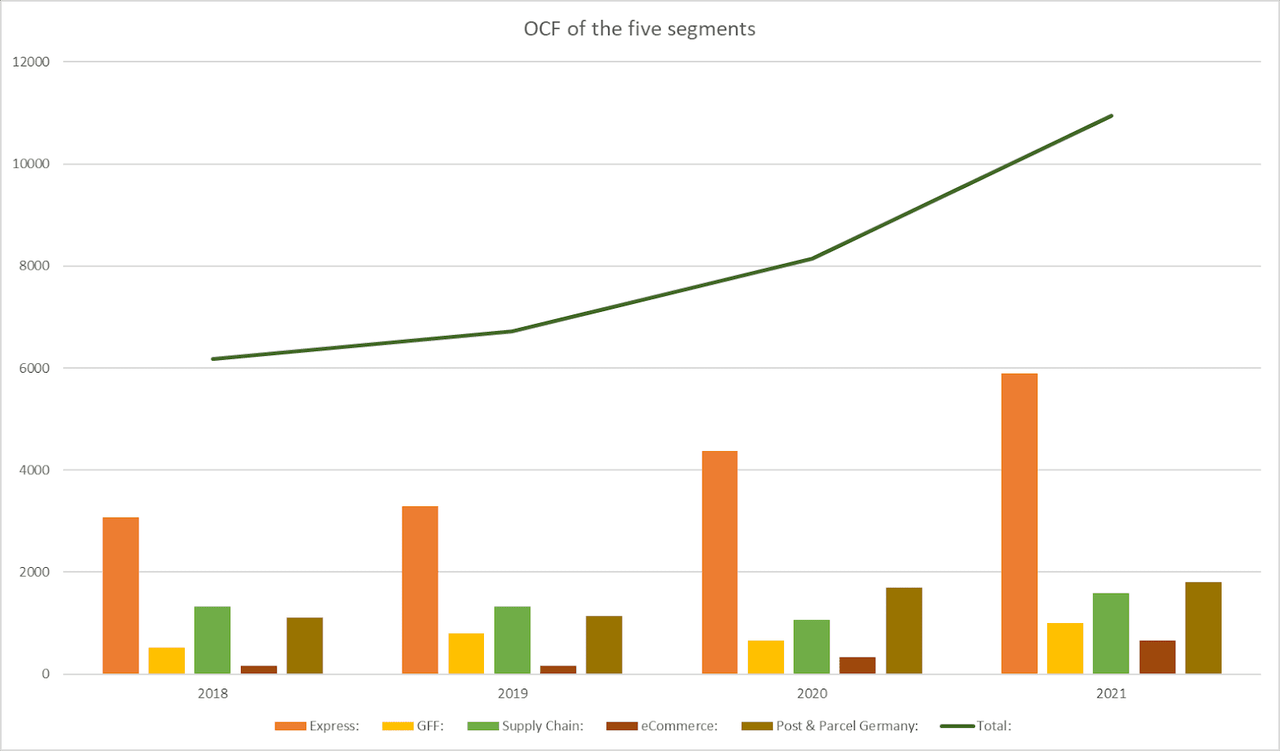

While the Express segment only makes up 29.0% of the revenue, the operating cash flow is around 58.0% of the total OCF. This gives the branch by far the highest margin compared to the other four.

Graphic made by the author using data from the dpdhl quarterly statement: https://reporting-hub.dpdhl.com/downloads/2022/1/DPDHL-Quarterly-Statement-Q1-2022.pdf

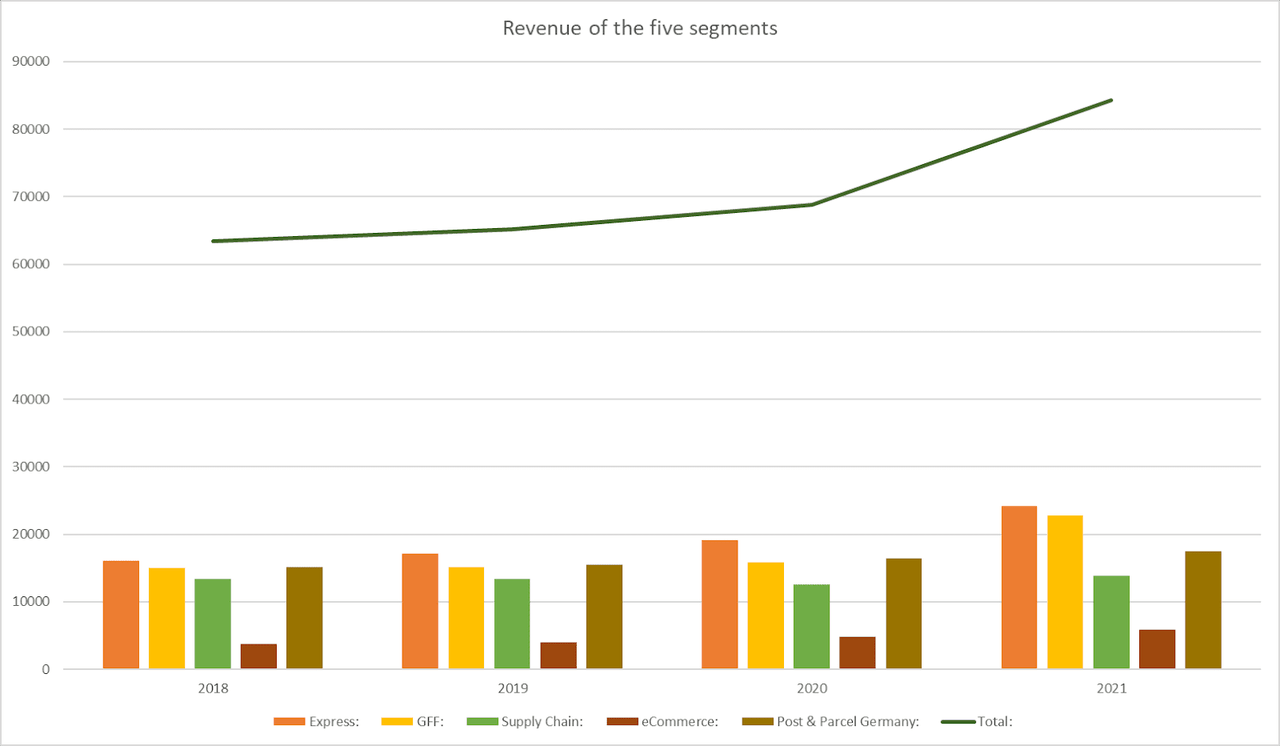

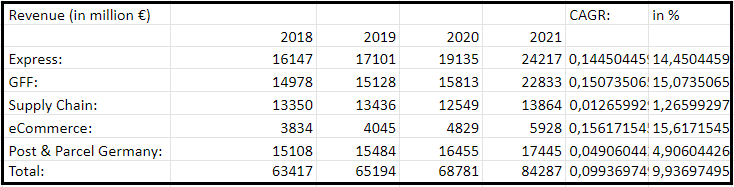

Furthermore, the Express segment is not only a high-margin business but also among the fastest-growing segments, with a CAGR of 14.5% over the last four years. The following graphic shows the growth of all segments and the total revenue over the last four years. I chose this specific time period because the management split up the business in those five branches in 2018 for better comparability.

Graphic made by the author using data from the dpdhl annual report: https://reporting-hub.dpdhl.com/downloads/2021/4/en/DPDHL-2021-Annual-Report.pdf Graphic made by the author using data from the dpdhl annual report: https://reporting-hub.dpdhl.com/downloads/2021/4/en/DPDHL-2021-Annual-Report.pdf

As you can see, the revenue of the four big segments is relatively similar, while the operative margin is exceptionally high for the Express segment. Over the last four years, its average margin has been 21.7%. Meanwhile, the company’s total margin has been at 11.3%. As a potential investor, it is therefore important to keep an eye on the Express segment in particular.

Graphic made by the author using data from the dpdhl annual report: https://reporting-hub.dpdhl.com/downloads/2021/4/en/DPDHL-2021-Annual-Report.pdf Graphic made by the author using data from the dpdhl annual report: https://reporting-hub.dpdhl.com/downloads/2021/4/en/DPDHL-2021-Annual-Report.pdf

How resilient is the Express segment in the current environment? Higher wages, fuel and commodity prices are likely to lower the positive cash flow the company currently generates and therefore decrease the margin. The best option to tackle this struggle is to simply pass this inflation to the customer. In 2018, Express generated a revenue of about €54.9 million per day (divided in €50.3 million from Time Definite International and 4.6 from Time Definite Domestic) and delivered 1.447.000 packages daily (955.000 by TDI and 492000 TDD). By dividing the revenue by the delivered packages, I get an average price of €52.7 per TDI delivery and €9.35 per TDD delivery. In 2021, the average price per delivery was only slightly higher for TDI with €60.8 and the price for TDD even fell to €8.99. Only one quarter later, in Q1 2022, the price drastically increased to €67.6 for TDI and €10.4 for TDD. With volumes only declining slightly, this indicates strong pricing power for Deutsche Post’s strongest business.

The growth over the last years was strong, and the valuation is currently cheap. The stock market expects an upcoming recession and therefore future earnings to fall. In order to properly evaluate this risk, I looked back at the financial crisis of 2008.

2008, the company still partly owned the German “PostBank”, which was in the process of being sold to the “Deutsche Bank”. Therefore, my revenue and cash flow calculations exclude this business.

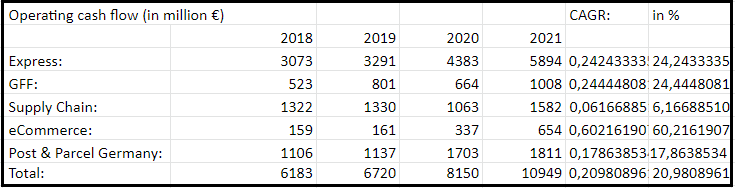

Graphic made by the author using data from dpdhl’s annual reports

As expected, this economic crisis is clearly visible. The revenue in 2008 fell from €54.5 billion to €46.2 billion and it took almost four years to recover back to pre-crisis levels.

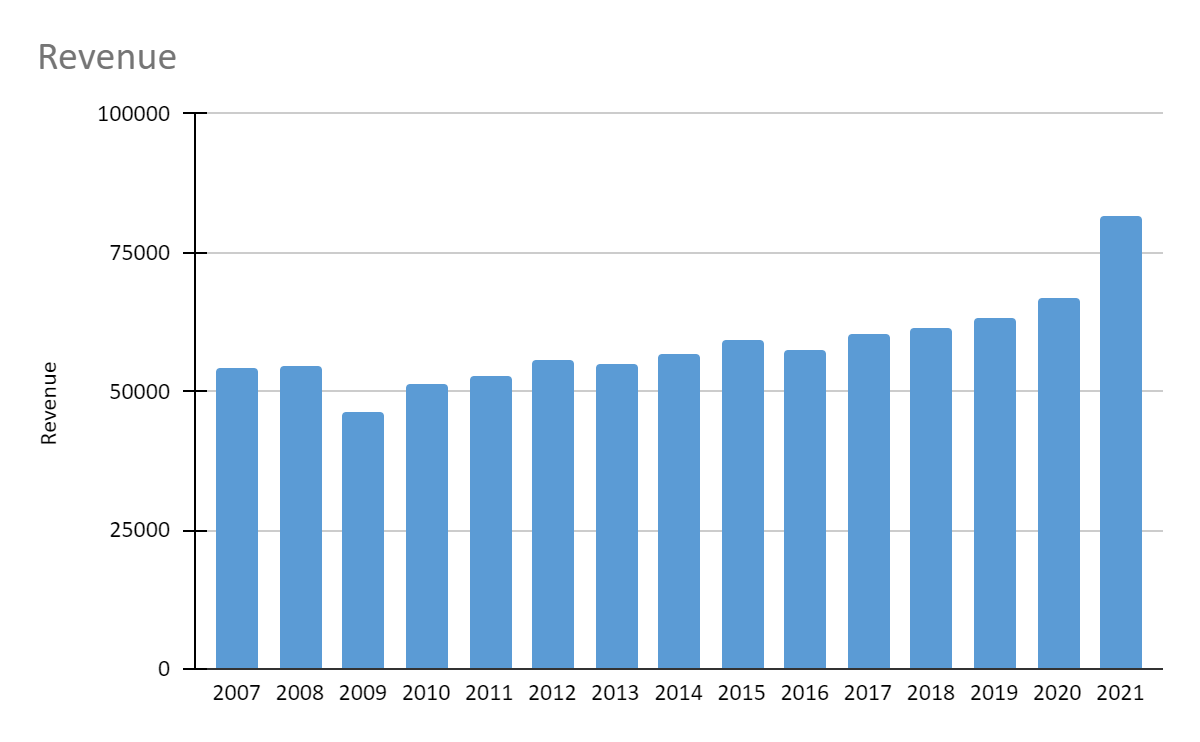

Graphic made by the author using data from dpdhl’s annual reports

While the revenue only fell by 15.2%, the operating cash flow took a heavy hit. It fell from €3.36 billion to €1.24 billion. This is mostly due to a restructuring of the US Express business. Later on in this article, I compare the current situation to 2008, but it is important to understand that a crisis always has to be considered individually. If someone knew it was going to happen and how to handle it, it would not be one. Nevertheless, I have to acknowledge that both revenue and OCF show a clear upward trend. I also like to see the increased margin over the years. While the revenue only had a CAGR of 2.8% the OCF grew annually by a stunning 9.1%.

Competition

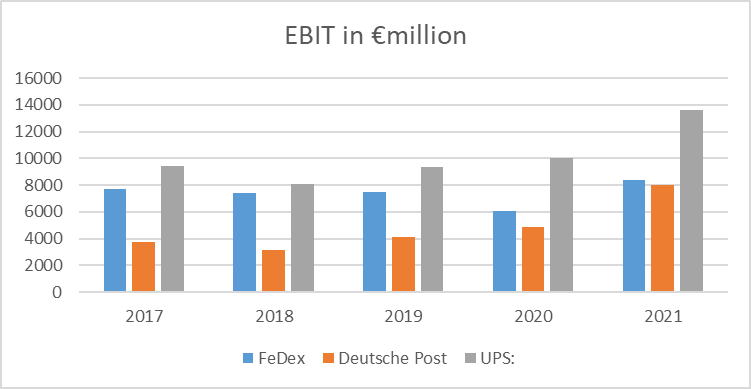

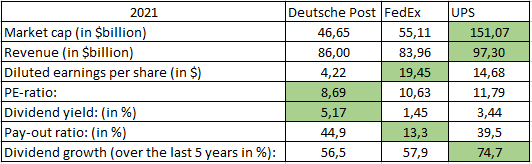

FedEx (FDX) and United Parcel Service (UPS) are both well-established global players and competitors of the Deutsche Post AG. I will take a closer look at their valuation and compare them to each other.

Graphic made by the author using data from dpdhl’s annual reports

United Parcel Service is by revenue, EBIT and market cap, clearly the biggest player among the three.

While being the smallest company by market cap and EBIT, Deutsche Post has been able to accelerate its growth. Additionally, it generates its revenue internationally and is, therefore, less dependent on a single country’s economy. Contrarily, UPS generated $24.4 billion in revenue in Q1 and $15.1 billion of that in the “U.S. Domestic Segment.” Therefore, in this regard, I’d prefer FedEx, which only generated less than a quarter of the Q1 2022 revenue in the United States.

Graphic made by the author using data from Seeking Alpha and the financial reports

My favorite out of the three is still Deutsche Post. United Parcel Service is the clear number one logistics company in the United States and has therefore a high net margin, but this is mainly due to its less diversified revenue income and therefore lower overhead costs. FedEx has almost the same business model as Deutsche Post and therefore I’d not invest in the latter because of its high(er) valuation.

Valuation

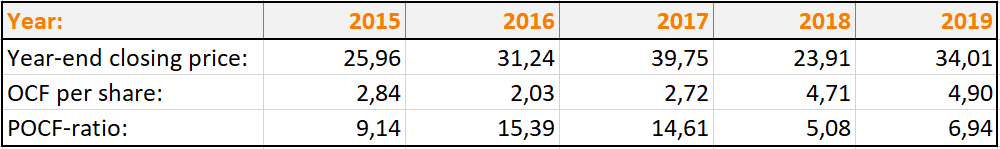

The stock is down 39.1% YTD and this dip could provide a reasonably priced entry for an investment. To properly evaluate my target price, I will look at the historic dividend rate and then the current POCF-ratio, which often indicates an undervaluation.

Like most German companies, Deutsche Post AG distributes its dividend in May. Over the last five years, the average dividend yield was around 3.5%. The forecasted FCF for 2022 is €3.6 billion and €0.5 billion less than the FCF in 2021. Therefore, I expect the dividend for May 2023 to remain at €1.80. At the current valuation, Deutsche Post has a dividend yield of 5.1%.

The current POCF-ratio of around 4.42 is historically cheap. The FCF of the last ten years (excluding 2012 because of special effects in that year) had a CAGR of over 18.5%. The pandemic has extremely boosted the growth and, excluding the last two years, results in a CAGR of only about 2%. An upcoming recession may cause a strong decline in the free cash flow.

As stated above, the 2008 financial crisis caused the cash flow to fall around 63% and took the company several years to recover. I believe that the market has already priced in more of a recession than we are actually going to face. Let me back up this claim with some calculations: The stock price fell from about €21 at the 9. August 2008 to below €8.00 in the following year. That decline in value of over 60% is similar to the decline in cash flow of 63.1% in the same period. By looking at the valuation in the year before the crisis, we can suggest if the stock provides any further downside. In the year 2007, DPDHL generated €4.10 OCF per share and had a POCF of 5.5. In the following year, when the financial crisis had reached its climax, the OCF per share collapsed to €1.60, and because of the crash of the stock, the POCF-ratio increased to only 7.4. Although I highly doubt it, let’s assume that the current year 2022 is the year before a recession as severe as the financial crisis, and aligning to 2008 a decline of 63% in operating cash flow will be imminent in the next year. The stock then has further downside potential with a current POCF-ratio of 4.42. After deducting 63% of the OCF, I get a POCF of 11.4 using a stock price of €34.5. Expecting the company to trade at the same multiple as in 2008, I get a fair value of €22.2 in the bear case (recession). If Deutsche Post is able to remain resilient in this harsh environment and keep the cash flow on its current level, the stock is definitely cheap. In the pre-pandemic years (2014-2019) the share traded at an average POCF-ratio of 10.2.

Graphic made by the author using data from dpdhl’s annual reports

Implying that this average POCF-ratio is fair, I get an undervaluation and a fair target price of €78.9. After applying a margin of safety of 20%, it results in a share price of €63.1.

Conclusion

Logistics companies are cyclical and depend on a strong and growing economy. An upcoming recession will definitely hit the core business and impair its profit. The recent Q1 has shown the ability to pass the risen fuel costs and wages to the customers and to even keep increasing the revenue, even with slightly less sending volume. The management’s goal for 2022 is to be resilient against negative macroeconomic factors and, despite the outbreak of war in Europe, CEO Frank Appel is confident of reaching the forecasted guidance.

At the current stock price, an investment seems tempting, but I have been patient so far. Although the stock definitely is undervalued, I still expect further unjustified short-term exaggeration of the stock market and keep the stock on my watch list until I feel more confident about the prospective world economy. But this is just my opinion and in the long-term one can buy this stock without hesitation.

Be the first to comment