xavierarnau/E+ via Getty Images

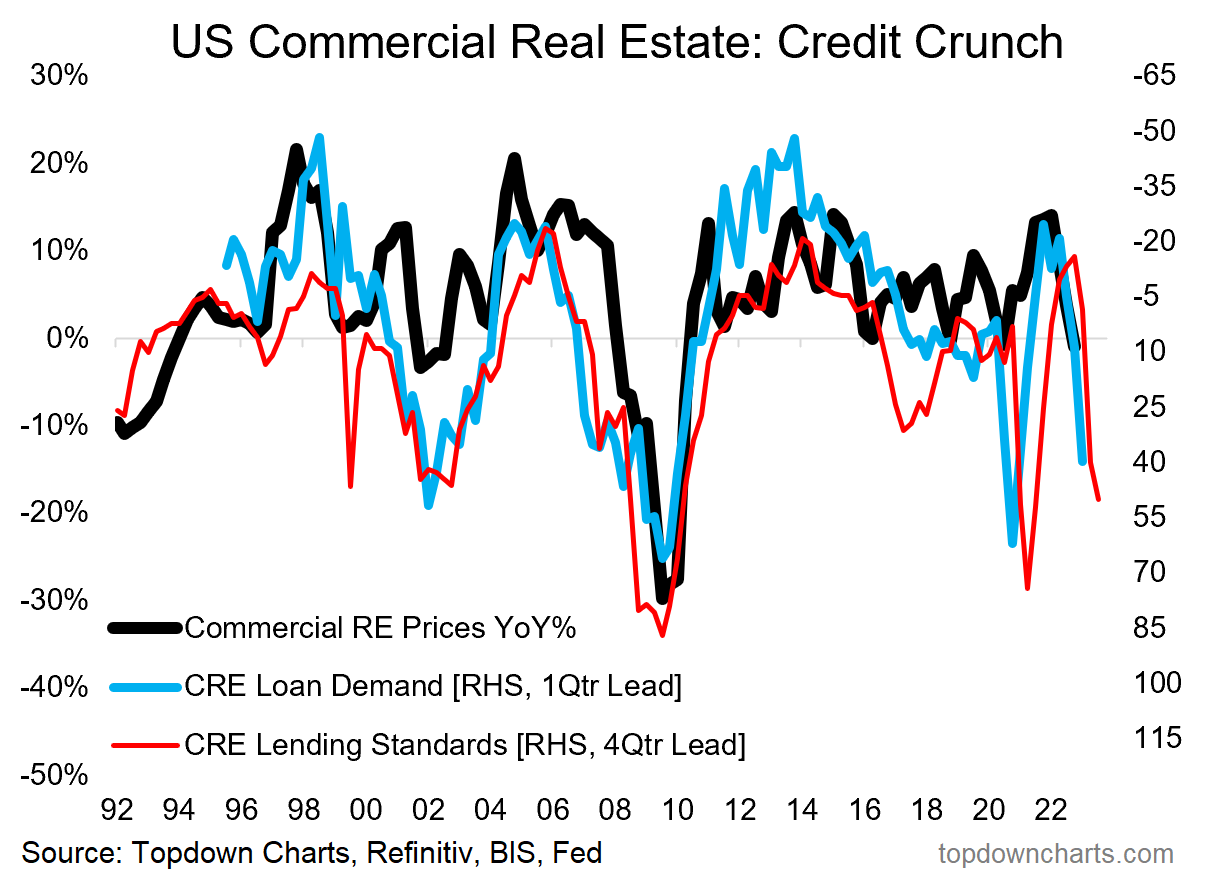

Commercial Real Estate Outlook: I just had a look at the latest Fed Loan Officer survey, and things are not looking good for what is a heavily credit-driven sector…

Banks are tightening up credit criteria, raising loan pricing, and reporting weaker demand for new loans. This appears to be the story across the board (business loans, mortgages, consumer debt), but one sector many overlook stands out to me in particular — Commercial Real Estate.

We saw something similar happen in 2008, but that was a different time, with a different regulatory backdrop, and different way of doing business. This time is different, but not necessarily in a good way.

In 2020 we saw a similar crunch in credit conditions, and some will highlight that instance as a reason to ignore this chart… but of course back then you had the fiscal + monetary emergency super-stimulus coming to save the day, so instead of declining — commercial real estate prices actually jumped that time!

This time around we have a more gradual and pernicious weakening of activity — something that looks and feels more like your traditional recession. We also have an interest rate shock, and globally coordinated (coincident?) monetary policy tightening.

There is also the lingering uncertainty around occupancy in the post-pandemic WFH world, and a shock to expenses on a number of fronts. So I would say there are major looming downside risks for commercial real estate, with few mitigating factors.

Topdown Charts

Key point: The crunch in credit conditions weighs heavy on the CRE outlook.

Be the first to comment