Charles Schwab (SCHW) released its quarterly earnings report in line with estimations. Despite the company has experienced a significant drop in revenue and EPS compared to last year, I consider Charles Schwab as a core holding in the financial sector, given its aggressive initiatives to enhance scale and efficiency together with new monetization opportunities.

Q1 2020 Earnings Highlights and Outlook

Net revenue totaled $2.62 billion in the quarter, in line with estimations and down 4% over a year ago. Net interest revenue, which is the biggest revenue component, dropped 6% to $1.57 billion, impacted by the decline in yields at the end of the quarter, despite higher cash and other interest earnings assets over a year ago. On the other hand, asset management and administration fees were up to 10% to $827 million, driven by utilization of advisory solutions and increased balances in purchased money funds, offsetting lower equity market valuation during the period. Total revenue was also affected by a decline of 13% in trading revenues, which totaled $188 million, despite high trading volumes, driven by Charles Schwab’s strategic move in October 2019 to reduce trade commissions to zero.

Overall, under the harsh market circumstances at the end of February and March, in my view, Charles Schwab did well in Q1, not only by reaching estimations during worsened conditions but also due to some relevant achievements. For example, a record 609 thousand new brokerage accounts were opened in the quarter, with over 280 thousand in March alone. As a result, the company ended March with 12.7 million brokerage accounts.

Other initiatives underway are aimed at generating more value to clients, such as the Schwab Intelligent Income, launched at the beginning of the year, designed to be a low-cost tool to generate a predictable paycheck from clients’ investment portfolio, especially during the retirement. Its initial adoption has been positive, as clients are running investment portfolios that are twice as big as the average of other Schwab Intelligent Portfolio Solutions.

On the flip side, expenses increased by 8% to $1.6 billion, driven by compensation and benefits, which historically accounts for roughly 55% of total operational expenses. Of note, while other volume-related costs raised as well, ongoing investments in scale and efficiency are proving to be critical at this juncture, as they have improved the capability to attend an increased level of interactions with clients and elevated trading volumes with basically the same head account.

Finally, bottom line results declined compared to last year, as net income came in down 18% at $757 million and diluted EPS was $0.62, excluding certain items, in line with estimations and down 10% over a year ago.

Meanwhile, Charles Schwab continues to drive new monetization opportunities. Schwab Intelligent Portfolios Solutions have already $47 Billion in AUM since launch near one-year ago and Schwab ETFs family has $164 billion in AUM, ranking number 3 in 2019 in terms of net flows.

In addition, Charles Schwab’s future integration with Ameritrade will generate potential cost savings of around $1.8-2.0 billion and should also provide revenue growth opportunities. For example, improved yields associated with net cash assets are expected to boost interest-earnings revenue. In addition, advisory fees should benefit from a larger client base using Schwab’s investment and advisory solutions.

Financial Analysis and Valuation

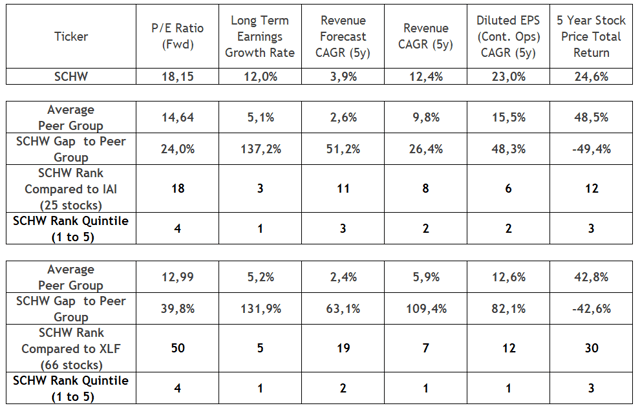

I am going to compare Charles Schwab’s financial and valuation metrics with companies in the peer group using as a reference IAI – iShares US Broker-Dealers & Securities Exchanges ETF. Furthermore, I am also going to compare the company with the broader financial sector using the XLF – Financial Select Sector SPDR ETF as a bench market.

Looking at the earnings quality, we can see that Charles Schwab is a top-tier company compared to IAI peers and the broader financial sector. Charles Schwab’s gross profit and operating margins are high-ranked compared to its two peer groups. Besides, margins growth rates over the past 5 years are also higher than most peers, which is consistent with the revenue growth outperformance over the same period. Finally, other quality indicators such as free cash flow yield and return on invested capital are also well positioned in the second quintile. Basically, the exception was Charles Schwab’s return on equity, which is in the middle of the group and, according to the quarterly news release, was hampered in part by an increase in stockholders’ equity-driven by mark-to-market gains in investment securities.

Source: Data from Finbox, consolidated by the author

Moving to the valuation analysis, looking at the table below, Charles Schwab looks overvalued, as its P/E FWD multiple of 18 is higher than the average of both peer groups. On the other hand, Charles Schwab’s long-term earnings and revenue growth forecasts and historical figures are also higher than peers, which suggests that higher valuation multiples are warranted to the stock.

Source: Data from Finbox, consolidated by the author

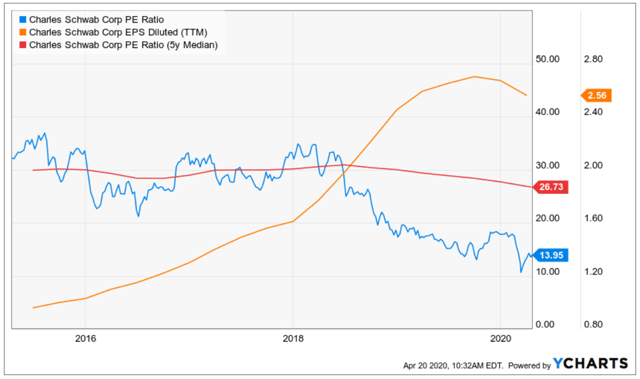

As a remark, according to the chart below, Charles Schwab is currently trading well below historical P/E multiples in the range of 26 since the end of 2018. While competition is fierce in the broker-dealer segment, Charles Schwab has been able to grow EPS, despite the drop in the last two quarters, which is as indicative of a potential long-term opportunity, as multiples tend to return to historical levels over time.

Source: YChart

On the other hand, we should be aware that current low yields environment should continue to affect net interest revenue over the next quarters. Therefore, we can expect that earnings should remain under pressure at least in 2020, which can keep weighing on the sentiment on the stock in the short term.

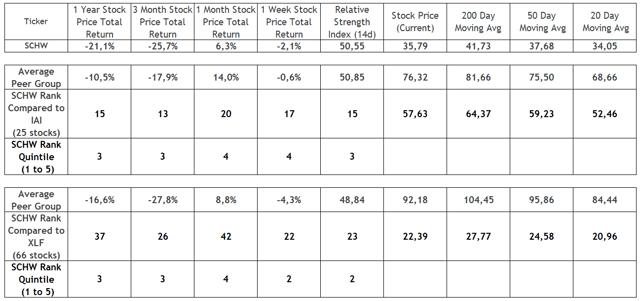

Shifting to the price momentum analysis, shares of Charles Schwab are trading nearly in line with the broader financial sector but has lagged IAI peers over the past year. Short-term momentum has recently recovered for shares of Charles Schwab alongside the broader market, as current prices are already above the 20-day moving average. Nevertheless, longer trend momentum is still weak to Charles Schwab and both bench markets, as prices are still below 50- and 200-day moving averages, as expected after steep price declines experienced last month.

Source: Data from Finbox, consolidated by the author

Takeaway

While Charles Schwab’s earnings profile has been among the best in the financial sector, the current yields environment is expected to be a headwind for interest net revenue and margins for the quarters ahead. In the longer term, however, I think the company is well positioned to boost growth through its monetization and growth initiatives and is likely to outperform the financial segment as P/E multiples return to historical levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment