JHVEPhoto/iStock Editorial via Getty Images

Shares of The Charles Schwab Corporation (NYSE:SCHW) have held in quite well this year considering all of the market turmoil, flat over the last twelve months, though they are down 20% from their high. Considering the performance of many bank stocks, insurers, and other brokerages like Robinhood (HOOD), SCHW stands out as a relatively strong performer. While this has left the stock with a somewhat higher multiple, SCHW is well positioned to benefit from rising interest rates, driving material earnings upside. I would recommend continuing to own the stock.

In the company’s second quarter, net revenue rose by 13% to $5.1 billion while net income excluding one-time items rose 34% to $1.98 billion. EPS growth was even faster at 39% to $0.97 from $0.70 last year. The company earned a fantastic 19% return on equity. The company successfully integrated the TD Ameritrade business into its own, and that is translating into top-line growth and bottom-line margin expansion. Importantly, the growth is set to continue while shareholder returns are set for a significant increase.

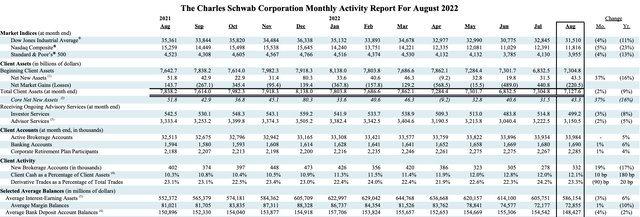

Now as a brokerage firm, there are things the company can control and things it cannot. It cannot control what the stock market does, which in turn impacts the value of client assets. It can however control its customer service, product offerings, and marketing to bring new clients onto the platform. As we can see from its August monthly report, the company is controlling what it can well.

Client assets are lower than a year ago by 9% because equity markets have fallen double-digits. There is nothing Schwab can do about that. However, if you look at core client flows, clients have added assets 12 of 13 months. Plus, that April decline is seasonally normal because people need to make their tax payments by April 15. If Schwab keeps bringing new assets onto their platform, its earnings potential will rise.

In addition to existing clients depositing more money into their Schwab accounts, Schwab has added brokerage accounts every single month, and at 33.984 million, that total is up 5% from last year. Even as firms like Robinhood have seen declining client demand, Schwab low-cost but high-quality offerings have helped it attract new business. Further, derivatives trading, which is more profitable, remains steady at 23% of total transactions

Schwab’s business model is unique and perhaps not what you expect. 54% of its revenue last quarter was from interest at $2.7 billion. The $550 million year over year increase accounted for all of the company’s revenue gains. Trading revenue is just $885 million by contrast. Many of us enjoy free trades now in our brokerage accounts, but the reason they are free is that those fees have never been the primary way Schwab makes money.

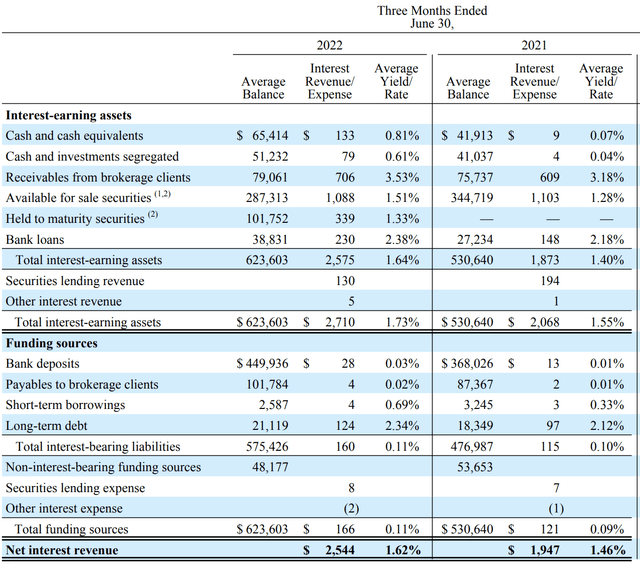

Essentially, Schwab primarily wants to onboard more accounts and more assets because it uses the cash it sweeps from client accounts to invest and earn interest. Yes, the firm makes some revenue on trading and on managing assets in mutual and money market funds, but the core engine like a bank is borrowing the cash and investing it elsewhere. As you can see from the above table, there are $586 billion of such assets, $72 billion from stocks bought on margin by clients and the rest from cash.

Now while interest revenue rose by $550 million last quarter, interest expense rose just $45 million to $166 million. That is because Schwab does pay some interest on the cash in client accounts, but those rates they pay have risen far more slowly than rates it invests in the bond market as the Fed has increased interest rates dramatically. Now, management tracks what it calls “cash sorting” where clients buy money markets or treasury bills with their cash to earn a higher yield than what Schwab pays. While the company is seeing some increase in “cash sorting,” management still expects it to remain at or below levels seen during past rate hiking cycles.

If cash sorting increases, Schwab would likely raise the interest it pays on cash to retain more cash. Schwab tends to see smaller client be lazier with your cash. If you have $5,000 in cash, 3% is just $150 a year-that may not be worth the time of managing where you invest your cash. If you have $5 million, 3% is $150,000 and you will be much more proactive. With Schwab growing its exposure to smaller clients, it expects cash sorting to stay manageable.

The table below shows how Schwab earns its interest margin, which last quarter expanded to 1.62% from 1.46% a year ago.

At the start of the second quarter, the effective Fed funds rate was just 0.2% from 0.08% last year. In June, the Fed did its first 75bp hike to finish the quarter at 1.58% for a quarterly average of about 0.89%. After two 75bp hikes in Q3, the effective Fed funds rate is now 3.08% for a Q3 average of about 2.3%. You can see the yield Schwab earns on its cash and cash equivalents it holds as assets closely track the Fed funds rate. Securities it holds for sale earn a higher yield and those have risen less dramatically as many are fixed rate. As these securities mature and are reinvested in higher yield assets today, they will provide further upside.

Conversely, its funding sources have barely budged, rising just 2 basis points to 0.11% as Schwab is still just paying 0.03% on its cash deposits. I do expect this figure to rise somewhat. The higher Fed fund goes, the more incentive there is for clients to cash sort if Schwab doesn’t raise rates at all. But it’s clear that they do not have to pass on most of higher rates.

Management estimates that every 100bp in interest rates should increase interest income by at least 6%, which is likely conservative given the 20% gain seen over the past year. At their September meeting, the Federal Reserve disclosed that its members expected the fed funds rate to finish this year at 4.4% and next year at 4.6%. Given the Fed’s planned policy path, Schwab could earn 4% on its assets, and if we assume they raised deposits to 1%, at August’s $586 billion in interest earning assets, net interest revenue would rise to a $17 billion annualized run-rate by mid-2023 from $10.5 billion last quarter. Holding the rest of the business constant, that will drive another ~$2.30-2.50 in EPS from the $3.50 this year. With increased client growth and moderating integration expenses from its Ameritrade acquisition, I am looking for Schwab to $5.75-$6 next year.

Given the strength of its results, the company announced a $15 billion buyback authorization and boosted its dividend by 10% to $0.22 in July. This led CFO Peter Crawford to say, “We are nearing the point in which we could accelerate capital returns.” With this amount of earnings power, Schwab is positioned to do about half of that buyback in a year. This is particularly true because capital is quite elevated with Tier 1 Capital of 28.2% up from 26.7% last year. Schwab has the capital flexibility to pay out more than it earns in buybacks and dividends if it chose.

While we all think of Schwab as a platform to trade stocks, the primary risk and benefit to its business comes from Fed policy. So if you believe the Fed will not hike as much or reverse course very quickly, then my anticipated earnings power may not materialize and the stock is more expensive. But given its business model, Schwab is one of the few companies that is a genuine winner from tight monetary policy. Given where inflation is, I believe the Fed will need to hike at least as much as forecast.

With its quality franchise, stellar balance sheet, and unique growth potential, I believe SCHW should trade at least 15x or about $90, representing 20% upside from here. While the stock has held in well, shares remain attractive, and I would be a buyer here.

Be the first to comment