efks/iStock via Getty Images

Investment Thesis

ChargePoint Holdings, Inc. (NYSE:CHPT) has obviously rallied in the past few weeks, due to the $7.5B provision from the Inflation Reduction Act and the company’s stellar FQ2’23 earnings call/ forward guidance. The company has shown excellent supply chain management by delivering a stellar 35.65% QoQ growth in revenues, though strong demand continues to expand its ending backlog by 26% QoQ. CHPT has also shown a robust increase in its future recurring subscription revenue by 7% QoQ and 74.83% YoY. Thereby, pointing to the durability of consumer demand despite the worsening macroeconomics, since new customers also account for over 30% of its FQ2’23 billings. Impressive.

Furthermore, CHPT is growing its global capabilities, with a special focus on the EU, delivering 11% QoQ and 254% YoY growth in sales to $17.3M in the latest quarter, accounting for 16% of its revenues then. With the EU aggressively banning the sale of ICE cars by 2035, we expect to see an immense boom in the region’s charging network through the next decade. As a result, ensuring CHPT’s top and bottom line growth moving forward.

CHPT Continues To Grow-At-All-Costs, Eschewing Profitability For Now

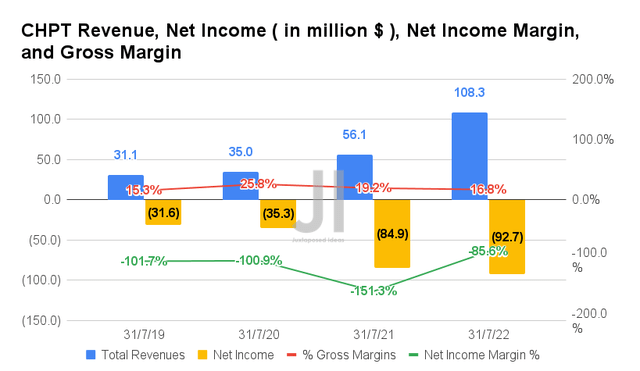

In FQ2’23, CHPT reported revenues of $108.3M and gross margins of 16.8%, representing an increase of 93.04% though a decline of -2.4 percentage points YoY, respectively, with the latter attributed to rising component and logistical costs. The company also reported worsening profitability, with net incomes of -$92.7M and net income margins of -85.6% in the latest quarter. It indicates a YoY decline of -9.18% though a moderation of 65.7 percentage points, respectively.

Impressive Growth Across Segments

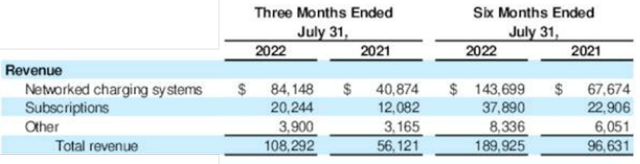

In the meantime, CHPT reported impressive growth across all verticals, with its networked systems recording an increase in revenue by 41.3% QoQ/ 205.87% YoY and subscriptions by 14.72% QoQ/ 67.55% YoY. Commercial billings also improved by an impressive 45% QoQ and 83% YoY, particularly in the EU, with 24% QoQ and 300% YoY growth in the commercial vertical. In addition, residential billings are up 11% QoQ and 125% YoY, despite the supply chain constraints thus far.

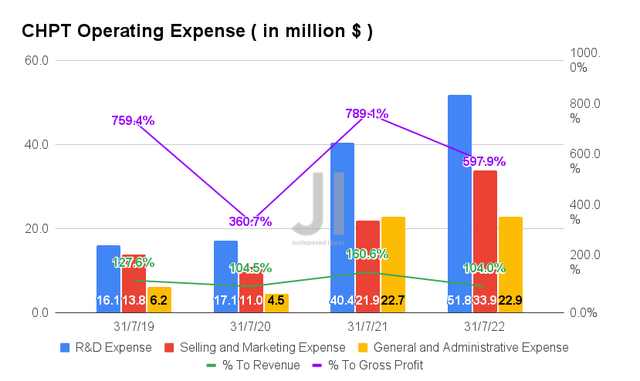

Its unprofitability is, again, attributed to CHPT’s elevated operating expenses of $108.6M in FQ2’23, representing an increase of 27.76% YoY and 300.83% from FQ2’19 levels. Therefore, it is no wonder that the ratio of its expenses to its growing sales remains lacking, accounting for 104% of its revenues and an eye-watering 597.9% of its gross profits by the latest quarter.

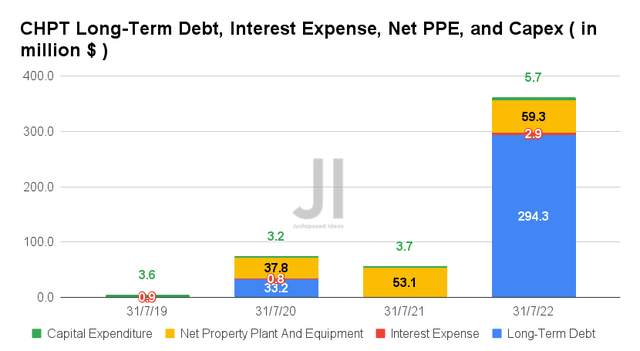

At the moment, CHPT’s long-term debts remain stable from last quarter at $294.3M with interest expenses of $2.9M in FQ2’23. These debts would also only mature by 2027, giving the company more liquidity during the worsening macroeconomics.

In the meantime, CHPT continues to expand its presence by 11.67% YoY to $59.3M of net PPE assets, with a 7% QoQ and 70% YoY growth to 200K of installed base in network ports by FQ2’23. Beyond the 60K managed ports in the EU, the company also partnered with multiple global partners to improve its roaming reach to over 335K ports worldwide by now. Combined with capital expenditure of $5.7M in the latest quarter and the massive boost from Biden’s Inflation Reduction Act, we expect to see accelerated future expansion indeed.

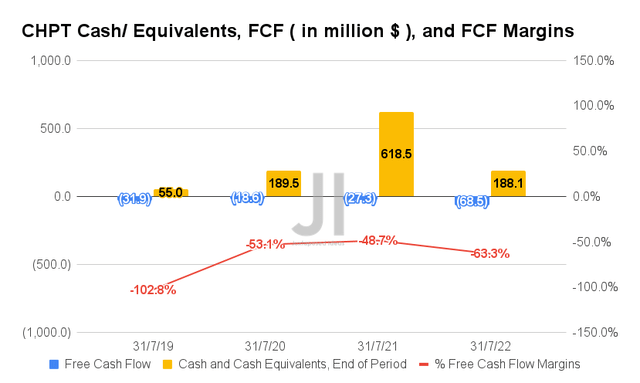

Therefore, it is natural that CHPT has yet to report positive Free Cash Flow (or FCF) generation thus far, with an FCF of -$68.5M and an FCF margin of -63.3% in FQ2’23. It represented a decline of -250.91% and -14.6 percentage points YoY, respectively. Given its dwindling cash and equivalents of $188.1M and lack of profitability, it is likely that the company may further rely on more debts in the short-term. We shall see.

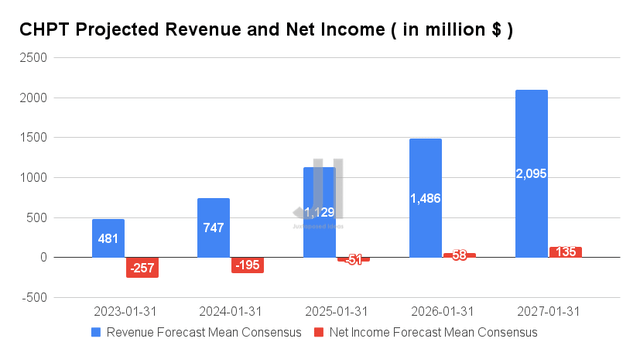

Over the next five years, CHPT is expected to report revenue growth at an impressive CAGR of 55.92% while also reporting net income profitability of $58M by FY2026. The company may also record net income margins of 6.44% by FY2027, representing much improvements from current levels.

For FY2023, consensus estimates that CHPT will report revenues of $481M and net incomes of -$257M, representing tremendous YoY growth of 211.55% though a decline of -94.34%, respectively. Given the massive boost from the new regulations, we expect to see a nice upward rerating in its top-line growth ahead, with the management guiding FQ3’23 revenues of up to $135M, indicating an excellent 24.65% QoQ growth.

For now, the company is still growing at all costs, thereby still justifying its aggressive cash burn over the next few years, significantly aided by the insatiable demand for EVs reported by multiple automakers. Ford (F), General Motors (GM), and Tesla (TSLA) continue to report massive backorders worth billions through 2023, despite the rising inflation and elevated price tags. As a result, signifying the massive growth for EV charging ahead, as the US EV market grows tremendously from $28.04B in 2021 to $137.4B in 2028 at a CAGR of 25.4%.

In the meantime, we encourage you to read our previous article on CHPT, which would help you better understand its position and market opportunities.

- ChargePoint: The Hidden Ace In EV War

So, Is CHPT Stock A Buy, Sell, or Hold?

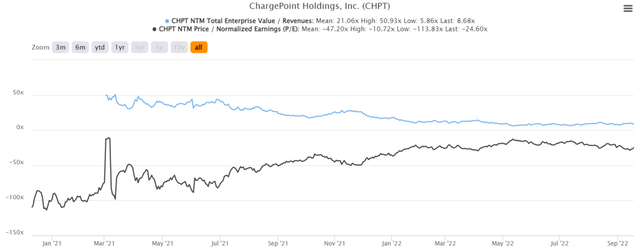

CHPT 2Y EV/Revenue and P/E Valuations

CHPT is currently trading at an EV/NTM Revenue of 8.68x and NTM P/E of -24.60x, lower than its 2Y EV/Revenue mean of 21.06x though massively improved from its 2Y P/E mean of -47.20x. The stock is also trading at $16.21, down -43.55% from its 52 weeks high of $28.72, though at a premium of 90.7% from its 52 weeks low of $8.50. Consensus estimates remain bullish about CHPT’s prospects, given their price target of $28.67 and a 74.39% upside from current prices.

CHPT 2Y Stock Price

Nonetheless, due to its impressive FQ2’23 earnings call, the CHPT stock is also trading at a premium, above its historical 50-day moving average of $15.45. We expect the Fed’s 75 basis point hike in interest rate to moderately digest that rally over the next week, bringing its valuation to a more bite-size level, with the S&P 500 Index already plunging by -20.99% YTD.

We continue to iterate our price target of $10 or $11 as a safer entry point for long-term investing and growth, due to its historical support pattern. It will come as the time of maximum pain is unlikely here yet, with the Feds expected to aggressively hike interest rates through November/ December 2022 and 2023. Patience for now, since we do not expect to see another rally like in the early 2021s, due to minimal positive catalysts in the short term.

Be the first to comment