Galeanu Mihai

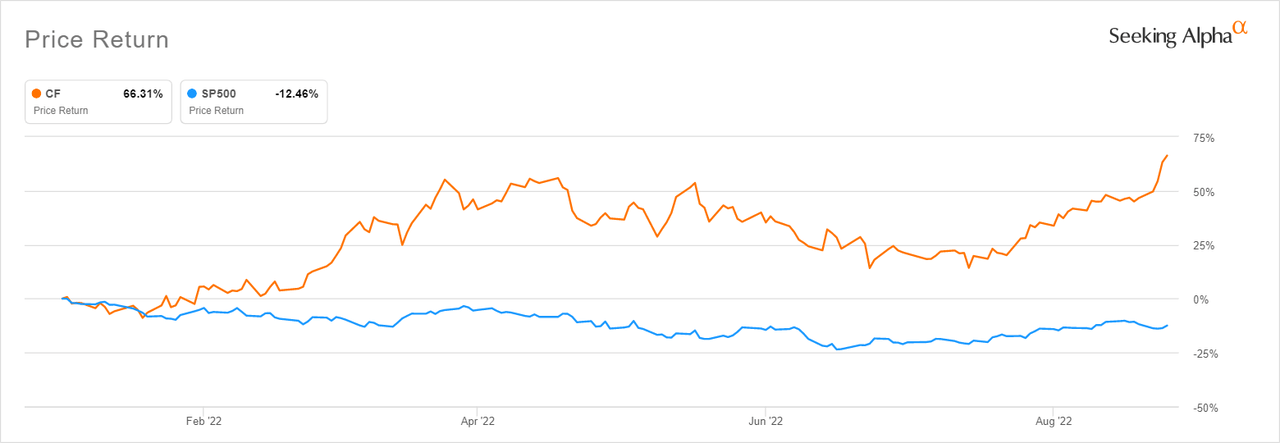

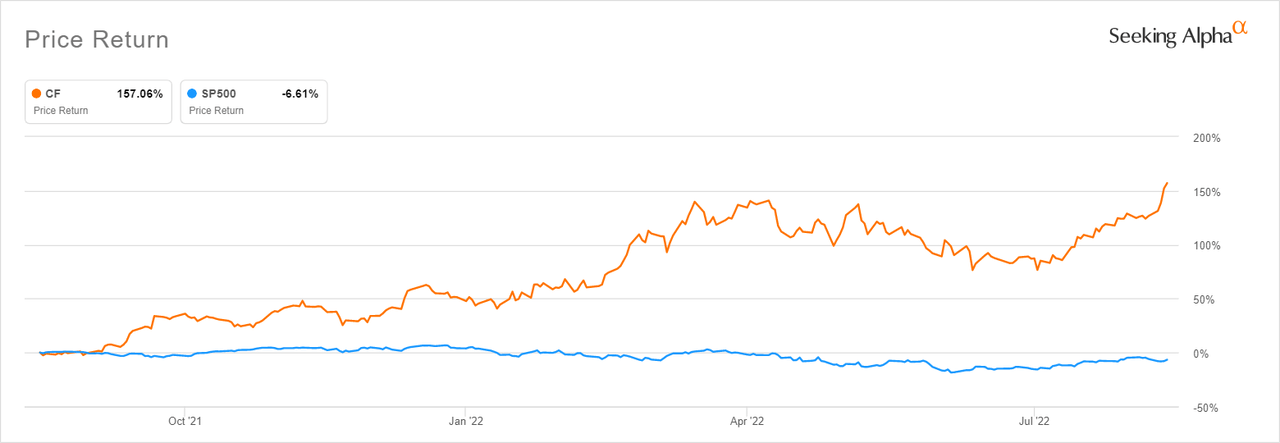

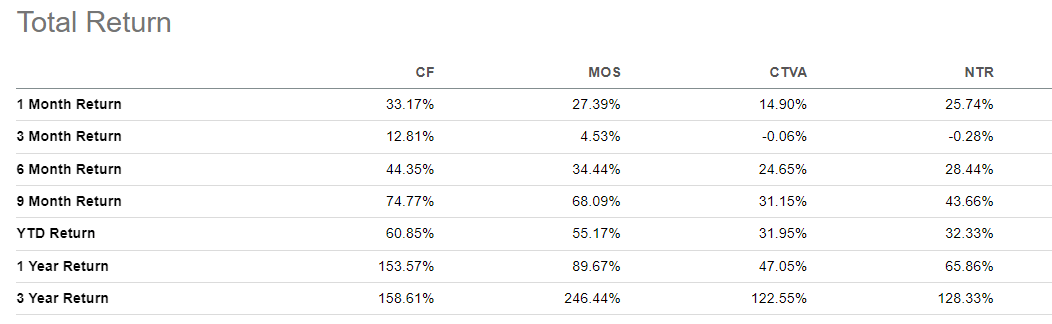

Investors who started a long position in nitrogen fertilizer producer CF Industries (NYSE:CF) at the start of 2022 can currently book a YTD return of up to 66%, a superb performance in comparison to the S&P 500’s 12% decline over this time. If you zoom out to 2021, CF investors who built their positions twelve months ago can currently book a return of up to 157%, a far cry from the S&P 500’s negative 6% return over this period. The bottom line? It’s been a great time holding a long position in CF.

CF Industries YTD performance vs S&P 500 (Seeking Alpha)

CF Industries 1-year performance vs S&P 500 (Seeking Alpha)

With such gains on hand, it’s only natural (and prudent) for CF bulls to investigate whether the trend has run its course or if there’s more life in it. Our assessment shows that there’s still more money to be made with fairly limited downside risk for investors who continue holding their long positions or even those who build a position at current levels.

Fertilizer prices to stay elevated longer

Like other fertilizer names, including The Mosaic Company (MOS), Nutrien (NTR) and Corteva (CTVA), CF is up primarily because of the outsized impact of high fertilizer prices on earnings. MOS is up 55% YTD, CTVA up 31% and CTV up 32% over the same period, underlining the sector-wide bull run that has primarily been driven by elevated fertilizer prices.

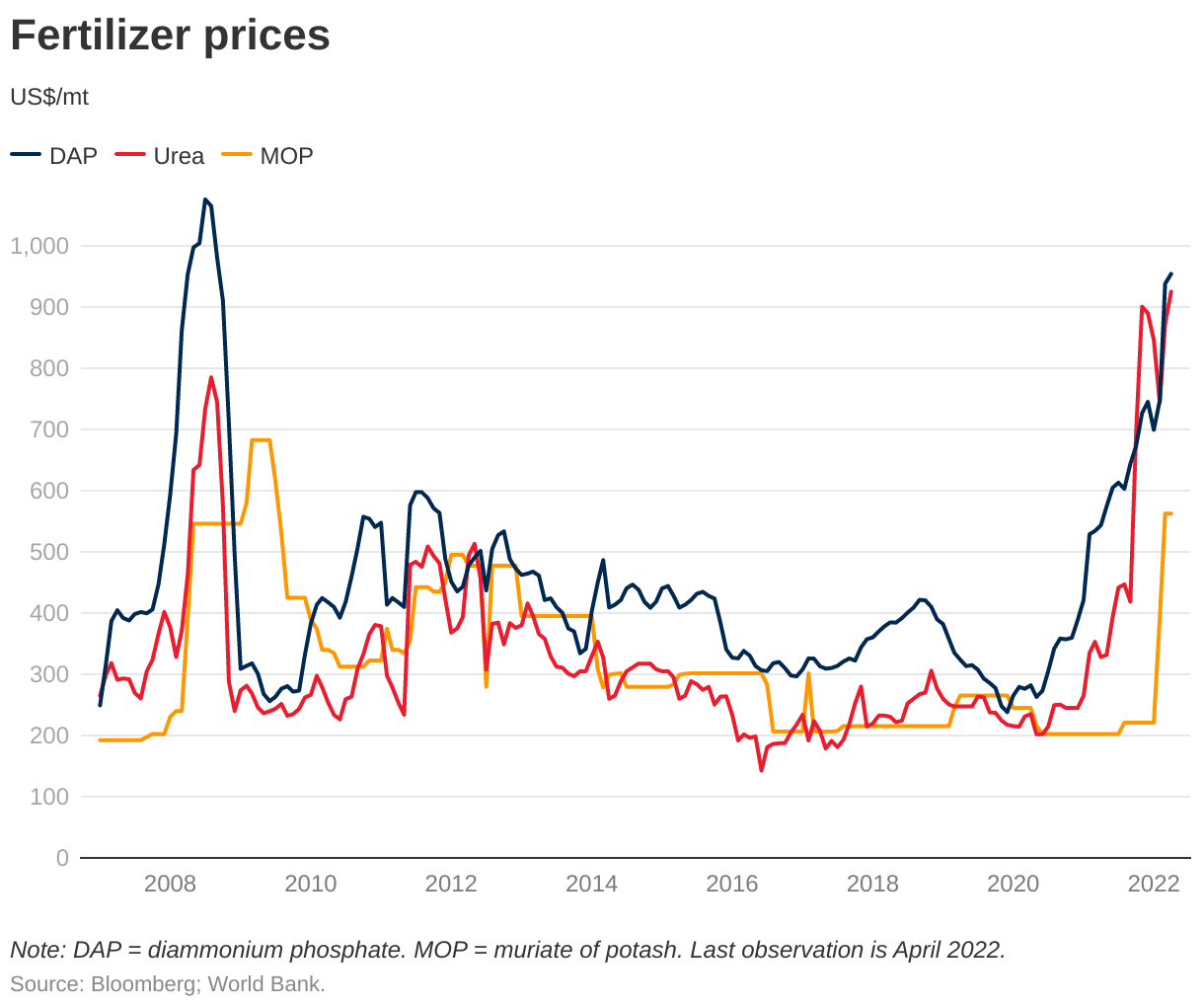

The prices of nitrogen fertilizers such as DAP (diammonium phosphate), MOP (muriate of potash) and Urea have relentlessly edged higher over the past 18 months due to a combination of factors. They are currently the highest they’ve been in close to 15 years.

Nitrogen fertilizer prices at multiyear highs (World Bank)

The main factor driving the price of fertilizer up is surging input costs, specifically natural gas, which is a significant cost component in the manufacturing of nitrogen fertilizers. Natural gas is a chemical feedstock in the production of ammonia (an important base material for fertilizer). It’s also a fuel used to produce nitrogen products. The well documented increase in natural gas prices over the past two years has led to a corresponding sharp spike in fertilizer prices over this period.

Other factors contributing to high fertilizer prices include fertilizer supply disruptions caused by sanctions in Belarus and Russia (two main fertilizer producers) and export restrictions in China (another key producer). This supply shortage has kept prices elevated. Geopolitical risks also abound, including the Russian invasion of Ukraine and its impact on supply and renewed Western Chinese tensions that could further restrict and disrupt supply.

The World Bank recently published expert analysis on its blog elaborating how the factors outlined in the last two paragraphs will work together to keep global fertilizer prices elevated. In the May 2022 piece, the authors argue that fertilizer prices “will remain higher for longer.” The Foreign Agriculture Service, a government agency within the US Department of Agriculture, in a June 2022 report on the global fertilizer markets notes that prices “may remain elevated throughout 2022 and beyond.” CF on its part expects prices to remain elevated for the next two years, according to Bloomberg.

We are of the view that the experts and CF are right – fertilizer prices will remain elevated for the next twelve months or more. In such an environment, fertilizer stocks like CF could continue trending higher and we recommend buying it. Here are some reasons why it seems to be the better buy compared with peers that will also benefit from continued high fertilizer prices.

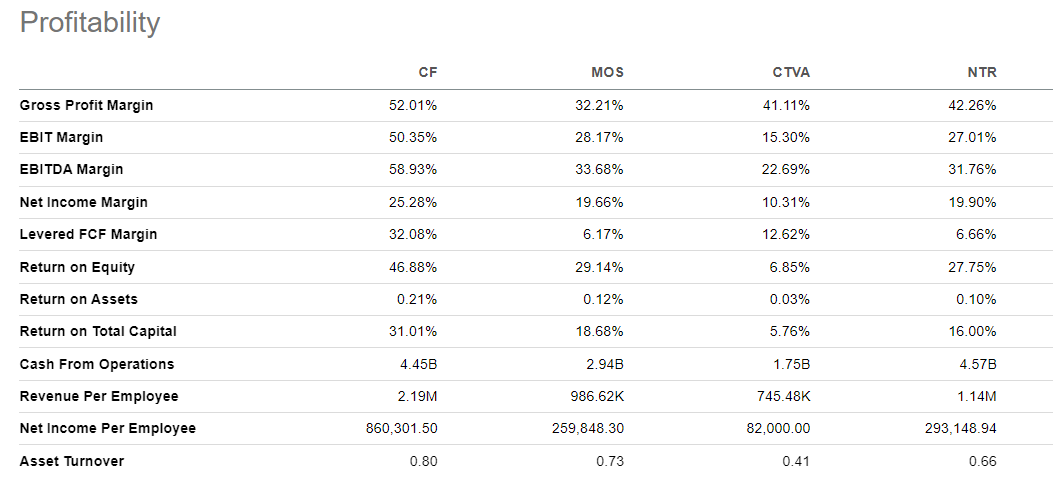

CF scores highest in profitability

Compared with MOS, NTR and CTVA, CF is a smaller company by topline and number of employees. However, it is the most efficient and scores the highest in terms of profitability

|

CF |

MOS |

NTR |

CTVA |

|

|

Revenue (‘TTM’) |

$10.16 billion |

$16.55 billion |

$34.61 billion |

$16.70 billion |

|

Employees |

2,985 |

12,525 |

23,500 |

21,000 |

Data source: Seeking Alpha

Despite being smaller, CF is the most efficient when compared to peers. It’s the only one in its peer set with gross margins higher than 50% and net income margin above 20%. The company is therefore able to generate more cash for shareholders for every dollar earned in revenue. This puts it at an advantage over larger peers.

CF Industries profitability vs peers (Seeking Alpha)

CF has used its strong cash balances to offset long term debt. As at June 30, 2022 it had long-term debt of $2.96 billion, a 14% reduction from $3.46 billion six months earlier on Dec 31, 2021, its most recent form 10-Q shows. Retained earnings have nearly doubled from $20.88 billion on Dec 31 2021 to $37.29 billion on June 30 2022.

CF’s strong margins, which give it an advantage over peers, are likely to remain higher than competition due to the fact that it has geographic advantages. Following closure of some UK plants, more than 80% of CF’s production happens in the US. This presents unique advantages over peers with huge exposure to Europe.

The cost of natural gas in Europe is much higher than the US and this means that CF enjoys comparatively lower costs, giving it both pricing power and relatively higher margins. U.K. natural gas prices are ~7x above U.S. levels, so European ammonia producers face much higher input cost pressure, which means CF (mostly US based) should benefit, according to Barclays analyst Benjamin Theurer, who in an August 2022 note increased his CF price target from $103 to $120.

CF better positioned to reward shareholders

If fertilizer prices stay elevated, CF is also better positioned to reward shareholders more generously compared with its peers. Dividends for CF, MOS, NTR and CTVA are not enticing at all – nothing above 2%. However, buybacks can create value given how much cash fertilizer companies have accumulated on their balance sheet in the past 18 months.

Compared to peers, CF is best positioned to create value through buybacks by virtue of the size of its cash pile, its potential to generate cash at above-normal rates (as long as fertilizer prices stay elevated), the fact that it has reduced long-term debt (hence low cash outflows by way of capital costs), and the fact that it has a comparatively lower share count.

|

CF |

MOS |

NTR |

CTVA |

|

|

Cash |

$2.37 billion |

$839.1 million |

$711 million |

$2.66 billion |

|

Long-term debt |

$2.96 billion |

$3.35 billion |

$7.06 billion |

$1.28 billion |

|

Shares outstanding |

199.26 million |

345.27 million |

538.93 million |

718.60 million |

Data Source: Seeking Alpha

CF is the clear value creator in its peer set as far as shareholders are concerned. This is especially impressive considering its peers are 4 to 7 times bigger in terms of headcount and 60% to 300% bigger in terms of revenue for the trailing twelve months. It therefore comes as no surprise that CF has outperformed its peers as shown below.

CF Industries stock performance vs peers (Seeking Alpha)

In the recent past, CF has not been aggressive with buybacks, meaning there’s opportunity to the upside if it in future decides to step up the pace of buybacks. An argument can also be made that sitting on cash is, paradoxically, a good thing for companies in cyclical sectors like CF. When the trend inevitably changes and valuations drop, by 20% – 50%, you want to have lots of cash as a management team, as that provides greater latitude to buy more stock and reducing the share count at a faster pace, or even snap up distressed assets in the industry or do full scale acquisition at bargain prices.

Closing remarks and risks

With fertilizer prices expected to remain high for the foreseeable future, we believe CF’s outperformance over peers will continue. It’s the best buy in its peer-set.

Future earnings potential and stock price are correlated for all stocks but this correlation is especially strong for cyclical stocks. The main factor driving earnings for CF is the price of fertilizer. This therefore makes it the single most important risk investors need to keep an eye on.

Even though the projections for continued high fertilizer prices are backed by convincing arguments, projections and reality don’t always align. It’s important for investors in CF to bear this risk in mind and take defensive action in case the risk materializes.

Be the first to comment