Galeanu Mihai/iStock via Getty Images

Introduction

It’s time to talk about the world’s largest nitrogen fertilizer production. Deerfield, Illinois-based CF Industries (NYSE:CF) is up 20% year to date after losing a quarter of its market cap since its April peak. The stock got sold off as the fertilizer trade got crowded. The Ukraine war and energy risks were priced in, providing new investors with an unfavorable risk/reward. Now, this is changing. I believe that too much good news has been priced in. For example, agriculture supply is expected to remain tight on a long-term basis. This is now hitting new headwinds like prolonged export tightness issues in Ukraine, energy-related geopolitical issues in Europe, as well as longer-term elevated natural gas prices in the United States and beyond. In this article, I’ll cover all of this and discuss why CF Industries is too cheap at current levels.

So, bear with me!

The Fertilizer Bull Market

Agriculture is a fascinating topic and something we discuss quite a bit on Seeking Alpha. It’s also a very complex topic that’s influenced by a lot of factors.

In the case of CF Industries, we’re dealing with a $17.7 billion market cap fertilizer producer. Founded in 1946 as Central Farmers Fertilizer Company, the company was owned by a number of regional agriculture cooperatives for 59 years.

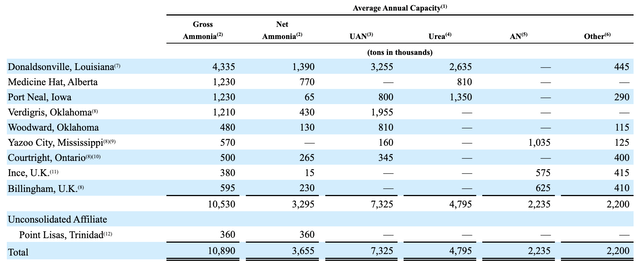

Since 2005, the company is NYSE-listed. Moreover, the company has a global footprint with a focus on North America. It owns five nitrogen facilities in the United States, two Canadian nitrogen facilities, two facilities in the United Kingdom, and a 50% interest in Point Lisas Nitrogen, an ammonia production joint venture in Trinidad and Tobago. In Louisiana, the company operates the world’s largest nitrogen complex consisting of six ammonia plants, give urea plants, and storage for 140,000 tons of ammonia – among other fertilizers.

CF Industries (10-K)

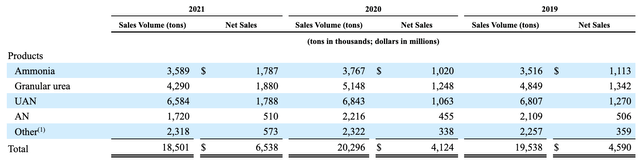

The table below shows the company’s reportable segments, which are basically various fertilizer products. In 2021, the company produced 6.5 million tons of UAN, which is a solution of urea and ammonium nitrate.

CF Industries (10-K)

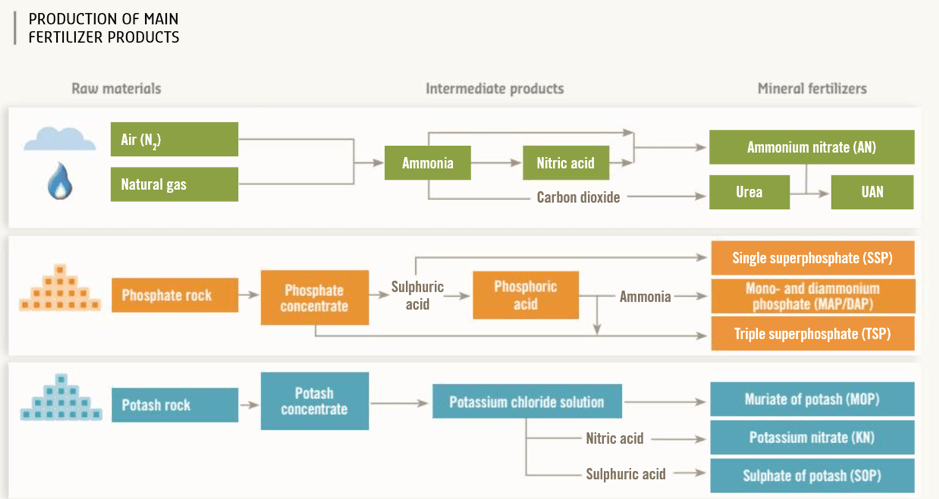

With this in mind, one of the most important raw materials for the production of nitrogen fertilizers is natural gas. Please be aware that I am not a chemist, so I may mess up some minor details, but as the overview below shows, natural gas produces both ammonia and nitric acid, which can be turned into ammonium nitrate, urea, and UAN fertilizers. An important by-product is carbon dioxide, which is often used in other supply chains like animal processing plants to stun animals before slaughter.

Fertilizer Europe

According to CF Industries:

Natural gas is the principal raw material and primary fuel source used in the ammonia production process at our nitrogen manufacturing facilities. In 2021, natural gas accounted for approximately 40% of our total production costs for nitrogen products. Our nitrogen manufacturing facilities have access to abundant, competitively-priced natural gas through a reliable network of pipelines that are connected to major natural gas trading hubs.

Natural gas prices are one of the reasons to be bullish on CF Industries. The other day, I told someone in a discussion that it’s one of my favorite ways to play natural gas price differentials between i.e., Europe and the United States.

For example, I believe that natural gas, in general, will trade at prices that are well above average on a long-term basis due to long-term accelerating liquid natural gas (“LNG”) demand as well as production issues in the United States – as discussed in this article, it’s still good news for CF Industries because other regions are worse off.

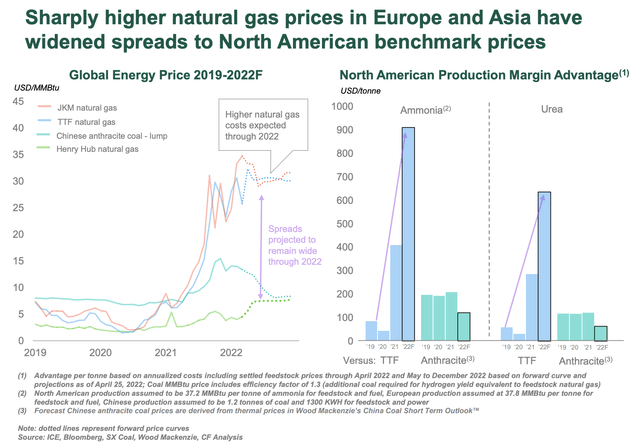

For example, as the company showed in 1Q22, energy price differentials have gone through the roof as both Japanese/Korean (JKM natural gas) and European (TTF futures) have rallied at a pace not witnessed at any point in recent history. Europe suffered from lower Russian exports and subdued domestic production while the Asians started to compete for valuable global LNG supply.

CF Industries

Back in 1Q22, the North American production margin advantage rose from less than $100 per ton to roughly $900 per ton for Ammonia.

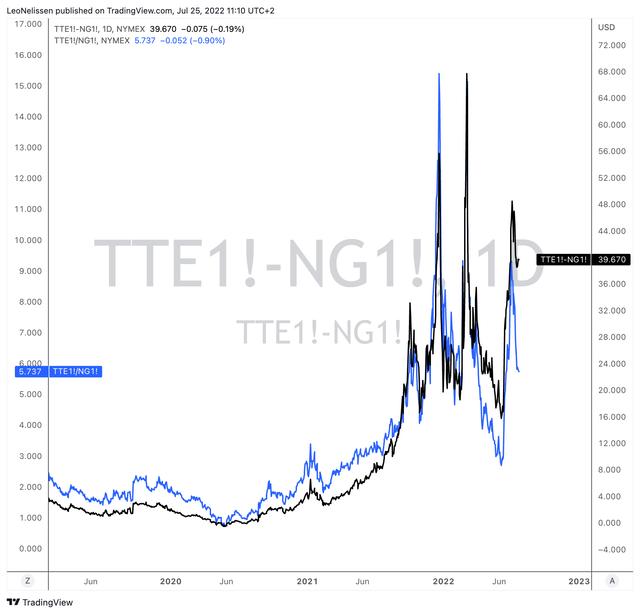

The (updated) chart below shows the difference in $ per MMBtu between US-based Henry Hub natural gas and European TTF (I used TTE because it’s in $ per MMBtu). The blue line shows the ratio between the two. As we can see, the difference is now almost $40 per MMBtu, that’s almost 6x more expensive than US Henry Hub…

TradingView (Black = TTE/NG Spread, Blue = TTE/NG Ratio)

Earlier this month, the Wall Street Journal wrote an article highlighting the steep declines in fertilizer stocks.

Wall Street Journal

While a lot has happened since then, I like one particular part that I believe is very important to keep in mind:

Some analysts and investors say there are still reasons to be bullish on fertilizer stocks. War in Europe is still raging, and the output of both combatants remains in doubt. Natural-gas prices are still sky-high in Europe, keeping pressure on fertilizer manufacturing costs and giving a leg up to companies that are less affected. The number of acres planted for cash crops has been on the rise, indicating demand from farmers eager to grow as much as possible at lower but still profitable crop prices.

Supplies of grains and fertilizer are low around the world and energy prices are high, which should keep food and fertilizer prices inflated through 2023, said Tracey Allen, commodity strategist at JPMorgan Chase & Co.

On July 22, Ukraine and Russia signed a Black Sea export deal to reopen Black Sea ports for grain exports.

The Reuters article explained that, “Senior U.N. officials, briefing reporters on Friday, said the deal was expected to be fully operational in a few weeks and would restore grain shipments from the three reopened ports to pre-war levels of 5 million tonnes a month.

Now, there are two problems. Problem one is that Russia bombed the largest port of Ukraine, Odesa before the ink of the agreement was dry.

Problem two is that regardless of Russia bombing Ukraine, too much good news was priced in.

Prior to the bombing JPMorgan noted that the deal is not an indication of normalization of Ukrainian export flows, which would require a peace deal. After all, I do not believe that Russia is going to give up its agriculture leverage. By blocking exports, it can cause food shortages in i.e., Africa, which would put tremendous pressure on the EU through new refugees – among other things.

Hence, the bank wrote that:

With some 10 million tonnes of wheat and 5 million tonnes of corn exports resulting from this initiative, and serious weather risks ahead, the global grain markets appear immensely oversold.

Adding to that, and with regard to fertilizer volumes, we’re in a situation where farmers need yield-enhancing technologies due to very tight supply as I wrote in a recent Seeking Alpha article.

Because of tight supply and (related) declining agriculture land per capita, the OECD commented:

Investments in raising yields and improved farm management are foreseen to drive growth in global crop production. Assuming continuing progress in plant breeding and a transition to more intensive production systems, yield growth is projected to account for 80% of global crop production growth, cropland expansion for 15%, and increasing cropping intensity for 5%.

In other words, while some governments like the Dutch and the Canadians are looking to restrict nitrogen fertilizers (on a long-term basis), I have no doubt that CF’s position in the global food supply chain is more important than ever.

Moreover, on July 18, the US International Trade Commission determined that urea ammonium nitrate imports from Russia and Trinidad and Tobago did not harm the US industry.

“This outcome will perpetuate an unlevel playing field for a domestic industry that has invested billions of dollars in the U.S. to ensure American farmers have a reliable source of UAN fertilizer,” CF Industries President and CEO Tony Will said.

Last month, the U.S. Department of Commerce’s final affirmative AD/CVD determinations found that imports from Russia were dumped and unfairly subsidized at rates as high as 132.6% and from Trinidad and Tobago as high as 113.5%.

If the ITC had found U.S. fertilizer producers were being injured by the imports, the duties would have been locked in for five years.

Analysts at RBC Capital said the “surprise” ITC ruling is “negative for North American nitrogen producers, primarily CF Industries.”

I believe that this surprise ruling is nothing but an effort to ease fertilizer costs on farmers, even if it would benefit Russia.

The good news is that this has been priced in.

CF Stock’s Attractive Valuation

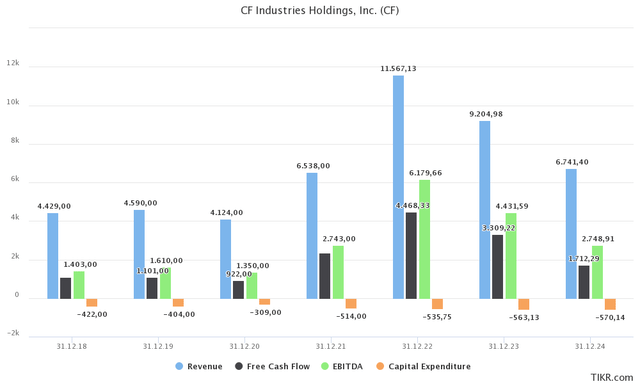

CF is in a good spot to boost its EBITDA to an all-time high this year. Analysts are looking for roughly $6.2 billion in EBITDA based on $11.6 billion in revenues. This implies a 53% EBITDA margin, roughly 20 points above pre-war levels.

TIKR.com

Moreover, high free cash flow expectations are so high that the company can technically become net cash positive this year (more cash than gross debt). This opens up new opportunities to reward shareholders via dividend hikes and buybacks.

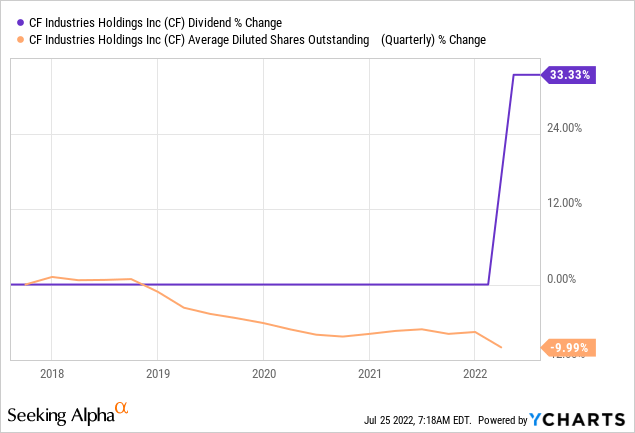

On April 27, the company announced a 33.3% dividend hike to $0.40 per share per quarter. This implies a 1.9% dividend yield.

Just like very conservative (read: slow) long-term dividend growth, the company is extremely conservative when it comes to buybacks, even as free cash flow accelerates.

Over the past 5 years, dividends have been hiked by a total of 33.3% (the hike this year) while shares outstanding have been reduced by 10%.

That may be frustrating, but it’s a good strategy given its very volatile business environment. The company does not mind holding additional cash as it protects the company against (some) downside. In other words, when the stock enters another commodity bear market, it has much lower debt levels, which protects investors.

The quote below is from the company’s 1Q22 earnings call. It’s somewhat long, but I wanted to put it in as it highlights the strategy behind somewhat slow shareholder distributions:

I think it puts us in a very enviable position. And as Chris said, we are focused on a ratable basis now between the dividend and the ratable portion of the share repurchase program, returning over $1 billion a year to shareholders. And that still gives us a lot of capacity to go in strong when we see drops in the share price and discontinuities like that.

When a couple of weeks ago, there was a rumor of ceasefire, we dropped $15 in one day, and then we ended up catching some of that back through the course of the day. But we have a highly volatile stock, and we want to be able to absolutely capitalize when there is drops in the share price that are not connected to the fundamentals of the financial performance of the business.

And our belief is that, that is actually going to be in the best interest of our shareholders. And if that means we carry a little bit of extra cash on the balance sheet from time to time, so be it. I think when they see us like we did in the fourth quarter, taking out as many shares as we did at the average price of $60-some, that’s a pretty attractive move.

Now with that said, how do we value a company that is expected to report blowout numbers in 2022 followed by very good numbers in 2023 and “good” numbers in 2024.

First of all, it assumes that agriculture prices normalize. I disagree with that. I believe that the company will beat the numbers for 2024 that are displayed in the graph above.

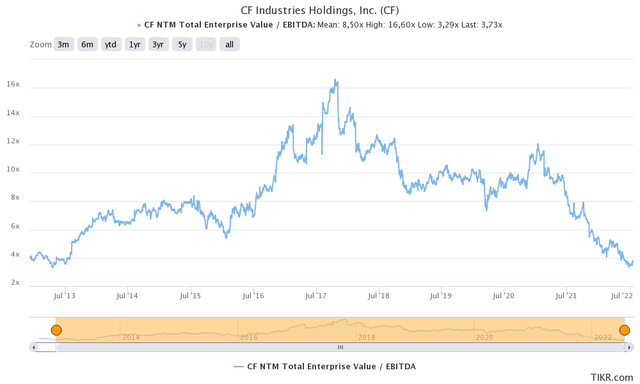

Using an enterprise value/EBITDA valuation, we’re dealing with an $18.9 billion enterprise value. This is based on the $17.7 billion market cap, $1.8 billion in expected 2023 net cash, $2.8 billion in minority interest (tied to its Trinidad assets), and $170 million in pension-related liabilities.

This is 4.3x expected 2023 EBITDA of $4.4 billion.

Looking at the company’s historic EV/EBITDA (next twelve months EBITDA) valuation range, we’re dealing with a very favorable valuation, which is lower than any valuation since the summer of 2013.

TIKR.com

Moreover, I believe a wild card situation could occur this winter. If Putin wants to, he can reduce Nord Stream 1 natural gas flows to Germany far below the current 40%.

Note that 40% flows are already not enough to prevent European companies from massively reducing output. If flows fall, I believe that energy differentials will shift even further. Hence, benefiting CF.

Takeaway

The agriculture trade has become even more headline-driven than it already was prior to the Ukraine war. CF Industries has become one of the world’s most profitable agriculture stocks thanks to its massive footprint in nitrogen-based fertilizers, its strategic location in the United States – despite having two plants in the United Kingdom – and its ability to benefit from very favorable natural gas price differentials.

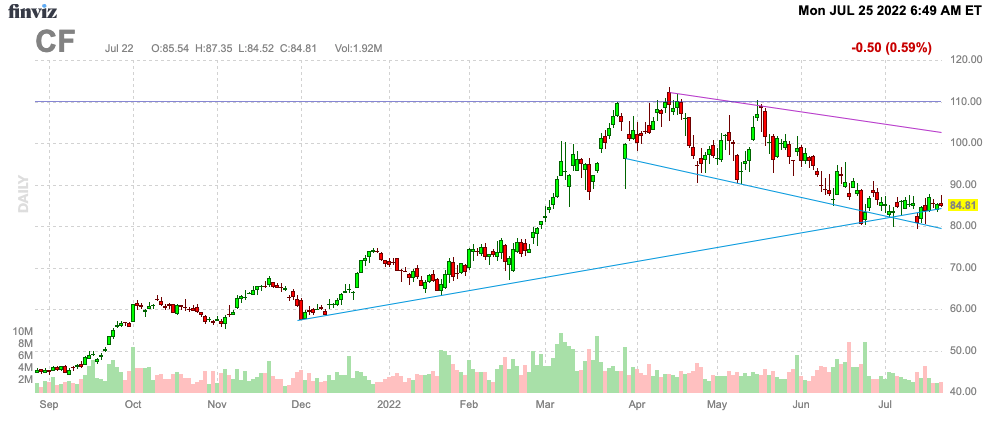

FINVIZ

Since April, the stock has lost a quarter of its value as the risk/reward wasn’t that good anymore. Investors and traders started to sell anything agriculture related. Now, I believe that too much good news has been priced in.

Agriculture supply is set to remain very tight, Ukrainian exports will not come back as expected, and favorable energy price differentials are looking to last on a longer-term basis.

On top of that, CF is using its free cash flow to repair its balance sheet while using stock price weakness (whenever it occurs) to accelerate buybacks.

With all of this in mind, I believe CF Industries is undervalued.

However, this is very important to me: please do not trade volatile agricultural stocks like CF if you’re not a trader or an inexperienced trader – or a long-term investor with a low tolerance for risk. It’s a headline-driven market that comes with more volatility than usual. And while I believe that CF will continue its long-term bull run, it most certainly will continue to come with steep (temporary) drawdowns.

If you’re looking for a long-term agriculture investment with dividends, buybacks, and less volatility, maybe you’re like this article I wrote recently – to give you an alternative.

With all of this in mind, I think we’re dealing with a very favorable risk/reward that could push CF to $120 before the end of 2023.

(Dis)agree? Let me know in the comments!

Be the first to comment