zimmytws/iStock via Getty Images

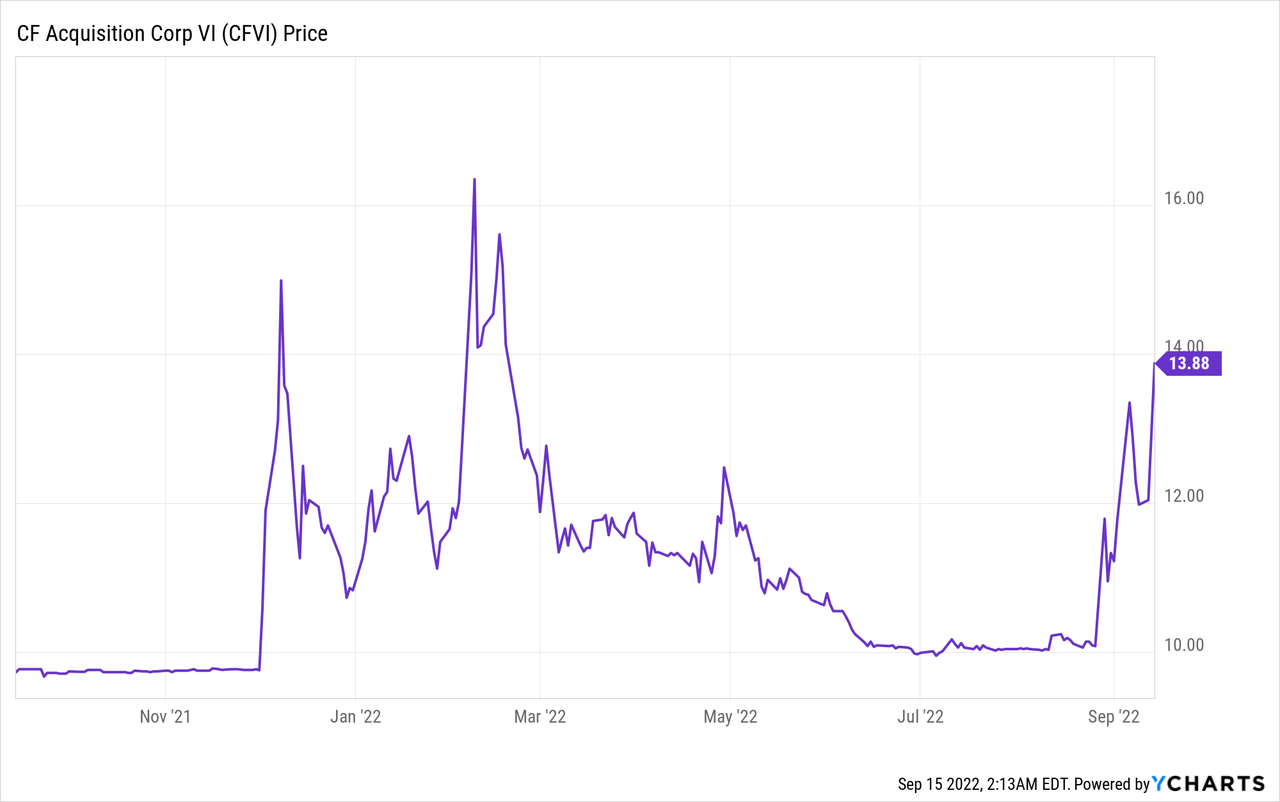

CF Acquisition Corp. VI (NASDAQ:CFVI) stock has risen sharply lately because of good news, while the rest of the market has been very weak. Today, it was announced at the shareholders’ meeting that the merger with Rumble was approved. On September 13, there was an SEC filing with some very positive Rumble user numbers, and last week there was a mutually agree to scheduling order for Rumble’s lawsuit against Alphabet Inc. (GOOG, GOOGL) (“Google”). The merged company will be called Rumble (RUM) and we continue to rate it a buy.

Shareholder Meeting Results

As expected, CFVI shareholders voted in favor of the merger with Rumble. The actual results of the votes will be filed within four days in an 8-K SEC filing. Remember, a “non-vote” was the same as a vote against. The merger should be effective on September 16. On Monday, CFVI shares will start trading under the ticker symbol “RUM.” Current CFVI shareholders do not have to take any action, but shareholders should be aware that some brokers may still use CFVI on their accounts for a few days as they make appropriate adjustments. This should not be a taxable event/transaction for U.S. holders. Canadian holders, however, have more complex tax issues, so consult with your tax professional.

At this time, we do not have the number of CFVI shares that were redeemed by shareholders, if any. Because the stock has been trading far above $10, I doubt that there were many shares redeemed. Shareholders had until September 13 to make that decision. Those who elected to redeem will get about $10 cash under this redemption provision. At least now, holders of the CFVI warrants (CFVIW) do not have to worry that their warrants might become worthless if there were no mergers because warrant holders do not have any redemption rights.

New Positive Rumble Numbers

There were some very positive data disclosed in an SEC filing on September 13. According to Rumble CEO Chris Pavlovski, Rumble hit 78 million active users in August, which is up sharply from 44 million average users in 2Q 2022.

Increased users are great, but these users need to be monetized. Quoting Pavlovski is the best way to describe how Rumble plans to do that:

One of the buckets is going to be programmatic advertising, kind of typical to what you see on YouTube and on these other platforms. On the other bucket, what I think is going to be unique to Rumble and is going to create an advantage for Rumble is that creators and brands are now going to have the ability to work together to create sponsorships and live reads with their content. I believe this bucket is going to be the largest bucket of revenue for Rumble in the future. The other bucket is going to be subscriptions and tipping. That goes really well with what you see on Locals, where creators are driving subscriptions for their loyal fans. We see that actually being the second largest pile of revenue in the future for Rumble. So, at the very top, in terms of revenue generating, we really believe that sponsorships are going to be the biggest, followed by subscriptions and tipping, and then followed by programmatic. Those two top portions will be our competitive advantage at Rumble.”

Currently, Rumble is beta testing their new ad business model. Investors need to understand that Rumble’s income statements going forward for the immediate future will look terrible. It takes a lot of time and expenses to monetize their business model. They are getting $383 million net cash via the merger ($100 million from new PIPE financing and $300 million from the CFVI trust account) to help pay these expected high expenses needed to grow. Investors may also expect to see very negative media comments about these financial results by those who do not want Rumble to be successful. They do not have the competition, especially from a neutral/conservative leaning platform.

Update on Litigation Against Google

As I about wrote in my article last month about the litigation of Rumble versus Google (text of 21-cv-00229-HSG), there was a status conference on August 30. The parties have agreed to a scheduling order (text of the order).

Most readers who are familiar with this type of litigation understand that there invariably is a very lengthy period of time before an actual trial starts. According to the order, the parties have suggested the trial start on November 4, 2024. There are other key dates, in my opinion, that are important to this case. The discovery period already began on September 9 and the deadline to complete fact discovery is December 15, 2023, but this is “subject to any additional discovery allowed by Court in response to Motion to Compel.” I expect many motions to compel Google to provide requested information/data to be filed by Rumble. Google is unlikely to be very responsive to give Rumble their algorithms. To Google, this is akin to forcing Coca-Cola to give up the recipe for Coke, in my opinion. Another key date is the deadline to complete expert discovery by May 17, 2024.

I actually do not expect this case to ever go to trial. If Judge Gilliam eventually compels Google to give certain very sensitive internal data/algorithms to Rumble, I would expect some negotiated settlement that gives a much more favorable search engine results for Rumble’s internet platform. This could have a huge positive impact on Rumble and a modestly negative impact on Google’s YouTube website. The fact that Judge Gilliam did not dismiss this case last July (text of dismissal motion) indicates to me that he is open to compelling Google to provide certain information, because the judge knew that to continue this case would require extensive sensitive discovery.

(I will post updates to this critical litigation as they develop in the comment area and/or future articles. The media seems to be ignoring this litigation, but I am not.)

Potential for Massive Shareholder Dilution

Current CFVI shareholders need to understand that under the terms of the merger there is going to be the potential for massive dilution. There could be an additional 105 million shares given to current Rumble shareholders (not current CFVI retail shareholders). They get 50% of the 105 million if going forward RUM trades above $15 for 20 days within a 30-day-period and another 50% of 105 million shares if RUM trades above $17.50 for 20 days within a 30-day-period. These shares are given, or, as they term them, “earned” – they do not raise additional cash. Given the current stock price, it is fairly likely that these 105 million shares will flow to current Rumble shareholders.

To be prudent, I am going to use the maximum total number RUM shares of 377,220,1668 (less any CFVI shares deemed) when calculating equity capitalization and various per share calculations. So, at $14 per share, even though the earnout shares would not be given at that level yet, the total equity RUM capitalization would be $5.28 billion.

It is critical to remember that some RUM holders (not current CFVI public retail holders) have restrictions placed on when they can sell their RUM shares. The holders of 700,000 private units have to wait 30 days after the merger to sell. The PIPE investors will have to wait until RUM files a registration with the SEC for those shares and the SEC declares the registration effective. They are expected to file this registration within the next 30 days. The current RUM holders have to wait until the earlier of one year after the merger, or, if during a 30-day trading period there are at least 20 days when RUM closes above $15 per share, commencing 150 days after the merger. This means that the earliest these current RUM holders can start selling is about March 15, 2023. (When it gets closer to that time, I will do an exact day count.)

Conclusion

It is interesting to see that this SPAC merger deal is finally completed and CFVI shareholders have made money from the original IPO price. Many other SPAC deals have fallen apart or are trading far below their IPO price, such as BuzzFeed (BZFD).

I think that RUM may trade above “fair value” partially because there are so many people hoping for the success of a free speech platform. Because it is almost impossible at this point to estimate revenue and earnings going forward, I am unable to assign a fair enterprise value for Rumble. Based on positive operations expectations and potential for a positive settlement with Google regarding the lawsuit, I rate Rumble (RUM) a buy.

Be the first to comment