gorodenkoff

Editor’s note: Seeking Alpha is proud to welcome Futurist Stocks as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

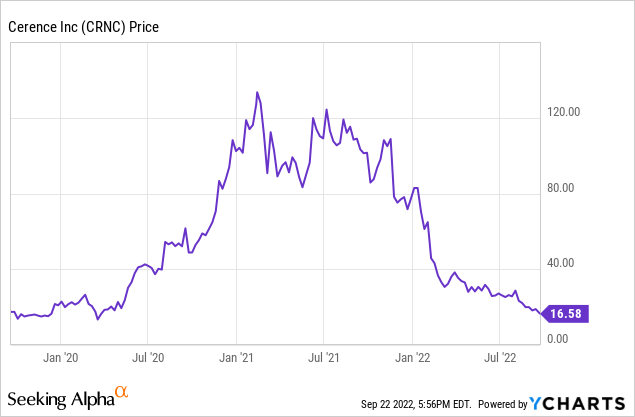

Cerence (NASDAQ:CRNC) is a small-cap tech company in the niche automotive AI assistant sector. Like so many of its ilk, the stock has suffered immense losses since 2021 heights and currently languishes at almost 90% down from all-time highs, currently trading at $16.58. Unlike so many of its ilk, Cerence is actually profitable, boasts a healthy balance sheet, and a relatively low forward P/E ratio of 14.51. However, because of the myriad long-term risks currently facing the stock, I recommend a hold. This is a wholly unique stock with notable advantages and significant risks that need to be addressed thoroughly.

Cerence develops and provides AI personal assistants for several large automakers, counting BMW (OTCPK:BMWYY), General Motors (GM), and Ford (F) among their customers. The core conversational AI is based on natural language processing (NLP), a branch of AI that has developed rapidly over just the last few years. For a sense of the time frames involved here, GPT-3 – a widely lauded NLP model developed by OpenAI – released in mid-2020, making Cerence itself just less than a year older. This underscores the dynamic and quickly changing nature of the sector, one with a varied array of potential competition, ranging from tech giants like Apple (AAPL) and Google (GOOGL) to small caps like SoundHound (SOUN).

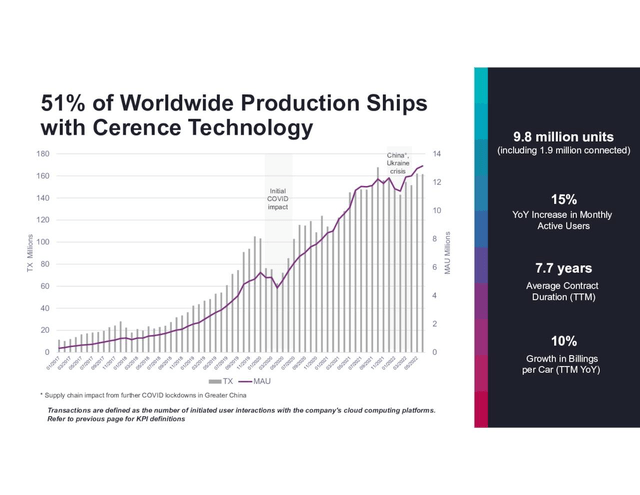

However, Cerence has targeted a niche that is not currently occupied by any other company. They are positioned as a kind of full stack provider of automotive AI services from conversational AI to advanced voice recognition and even personalized UI/UX design. This approach has enabled them to achieve a 51% share of worldwide auto production using their technology. I think that this is one of the stock’s central advantages, along with the stock being priced fairly by the market.

Financials and 2022 Q3

Cerence’s balance sheet is relatively healthy, especially for an AI small cap in the current market. With $129 million in cash and cash equivalents, the company has a buffer to the current macroeconomic environment. The company currently trades at a forward P/E of 14.51 which seems attractive in this sector, where the median forward P/E is 17.22. The company has a forward EV/EBITDA of 10.02, which is somewhat lower than the broader sector – indicating it is not overvalued (an EV/EBITDA under 10 would indicate it is undervalued).

It is worth reiterating, though, that since Cerence is the leader in a very specific niche, these indicators have limited comparisons. The P/B ratio has actually fallen to 0.71, which means the market is currently pricing the company at less than the liquidation value. For reference, competitor SoundHound has a P/B over 120. This could be interpreted as an indicator Cerence is undervalued, as a value below 1 often does. However, it could also be a sign that the market thinks Cerence is doing very poorly in terms of returns on its assets and is bearish on the company.

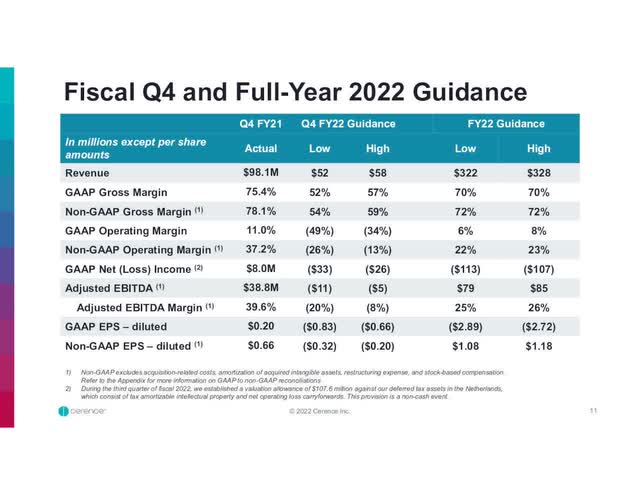

Q3 results were mixed and the stock suffered for it, with revenue missing consensus by $2.7 million, but EPS beating by 1 cent. CEO Stefan Ortmanns cited a combination of continued FX headwinds and pressure on car production as the reason for the lowered revenue figures. This is troubling for the stock, as I do not see any of these pressures stemming from macroeconomic conditions changing anytime soon.

Here’s Ortmanns on the revenue slowdown:

Working against us, as the quarter progressed, were slower than expected revenue from certain new products and markets. Continued FX headwinds and pressure on car production, which was down 6% from last quarter according to HIS.

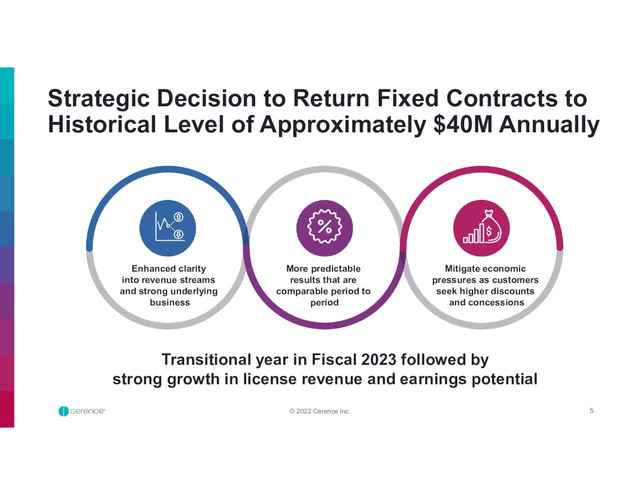

On the other hand, management reported 36% growth in professional services revenue YoY, which is promising for increasing future licensing and connected services revenue. In order to drive longer-term growth and combat macroeconomic variables, Cerence is also making a strategic shift in the types of contract they are pursuing, committing to keeping fixed contracts to a historical level of $40 million per year. This resulted in a Q4 guidance that slashed FY revenue to $322-$328 million, a large departure from the consensus of $370 million. Cerence’s strategy around their contract revenue model represents a risk I will address later.

Of the nine Wall Street analysts covering the stock, six recommend to hold, with one buy and two strong buys. These ratings have shifted sentiment significantly negative since Q3 results, prior to which half of the analysts had a buy rating or better on the stock.

Risks

The bear case for Cerence is strengthened by the sheer breadth of risks the company faces, unfortunately mainly long term and systemic in nature. The primary one, in my view, is potential competition from mega-cap tech companies. Cerence’s moat seems very unsteady and mainly geared around simply being the only company in this particular niche. The company does have over 1,000 patents, so an argument might be made around their technology being protected. But I don’t think any of it is something another company couldn’t easily recreate.

With AI development generally, I think big tech has massive advantages over smaller companies like Cerence because AI research is expensive, and access to vast amounts of data is required. The comparison of R&D budgets is particularly unfavorable: Cerence’s trailing annual R&D spend is $110 million, while Google’s is around $35 billion. Of course, only some of this will be AI-related research. But the point stands that Big Tech has resources that Cerence does not.

The macroeconomic environment also poses a significant risk to Cerence’s outlook. Auto production is a highly cyclical industry that a recession will inevitably disrupt. On top of that, the strong position of the dollar currently undermines Cerence’s dollar-dominated contracts, leading customers to request higher discounts to protect against the currency risk. Management is attempting to lessen the impact of this by limiting the volume of fixed contracts they accept, but it’s possible they lose customers or damage existing relationships by doing so, as they have a pool of existing customers who prefer these.

While a recession will weaken demand for the auto OEMs Cerence serves, supply chain issues threaten the supply of chipsets needed in these vehicles to run Cerence AI. A dropping supply of newly produced cars combined with a lower percentage of those cars equipped with adequate microchips means shrinking revenue on two fronts for Cerence.

Conclusion

Cerence stock appears undervalued at first glance, but upon closer examination faces extremely challenging macroeconomic and competitive challenges that justify its current valuation. Many, if not all, companies right now grapple with macroeconomic issues, but the long-term threat of mega-cap competition in the sector with huge R&D budgets makes the stock uniquely unattractive. A mixed Q3 report combined with Q4 guidance being slashed has acted as a catalyst to pull the stock further down.

However, in my view, this is not the main problem. AI generally is a very high-cost technology to develop, and small caps in this space are inherently disadvantaged. Automotive AI services is definitely a nascent industry with huge growth potential, but I am not convinced Cerence will be the one to realize those gains. Therefore, I have a hold recommendation on this stock.

Be the first to comment